How to manage payroll accounting

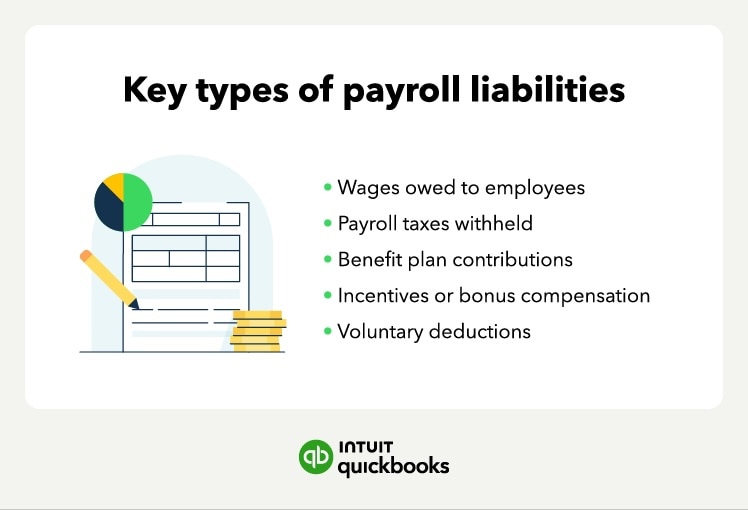

When doing payroll accounting, there are several steps you’ll need to follow. Some of the best ways to manage your payroll liabilities include:

Remember to adjust payroll liabilities

Businesses will need to post adjustments for several types of payroll transactions. For example, payroll liability accounts, like wages payable, are reduced when payroll withholdings are paid to a third party,

Use payroll software to generate a payroll-liability balance report each time you process payroll. Review the report, so you can post each adjusted journal entry. Accounting also requires account reconciliations.

Reconcile your payroll liabilities

When you reconcile payroll liabilities, you match data from various sources. The data you’ll use to match your payroll records includes:

- Employee data like pay rates and hours worked

- Payroll tax filings for income and FICA taxes

- Payroll taxes withheld from pay and submitted as tax deposits

- Bank activity for payments to workers and third parties

- Accounting records and transactions posted

To correctly post payroll liabilities, the amounts generated throughout the payroll process must match.

For example, consider payroll reconciliation for federal income tax for an employee:

- Employee’s gross pay and Form W-4 were used to calculate $150 in federal tax withholding

- The business withholds $150 and reports the amount to the IRS

- $150 must be deposited with the IRS

- $150 must be added to the worker’s federal tax withholding for the year and reported on the employee’s Form W-2

- The accounting records must record the amount withheld and paid to the IRS

You can use software to reconcile the payroll liability data and ensure you’re processing payroll correctly.

Keep proper documentation

Make sure you comply with document requirements and other laws and regulations, such as the Fair Labor Standards Act (FSLA), which establishes rules for the minimum wage, other pay rates, and overtime laws. FSLA also requires that payroll records be kept on file for at least three years.

If you employ union workers, you must comply with the pay and overtime rates required in the collective bargaining agreement with the union. Union pay records must also be kept on file.

This accounting method does not post expenses based on cash inflows and outflows, referred to as the cash basis method of accounting.

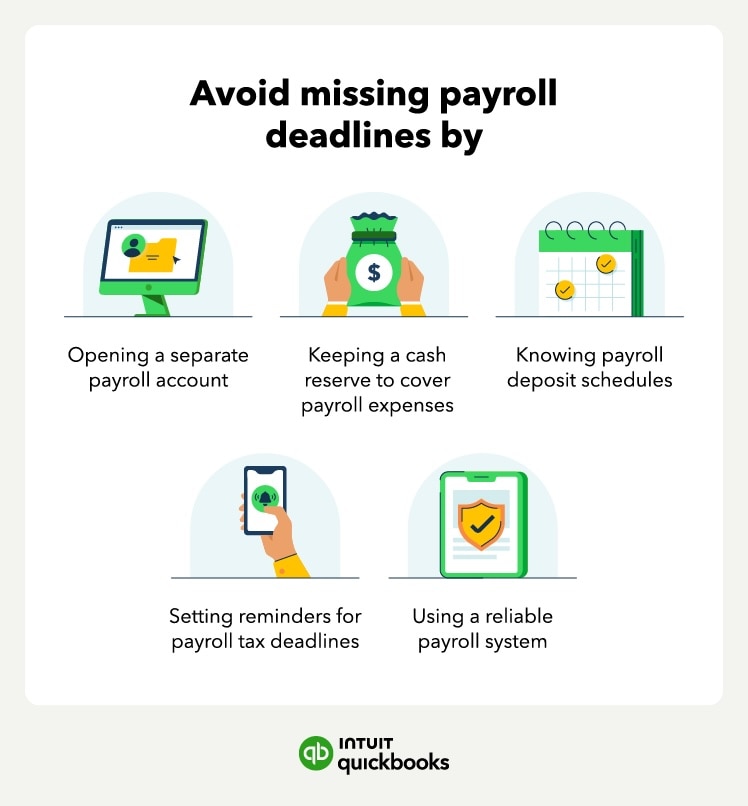

This accounting method does not post expenses based on cash inflows and outflows, referred to as the cash basis method of accounting.  The IRS and state agencies have specific deposit schedules for payroll taxes—adhere to these schedules to avoid penalties and interest.

The IRS and state agencies have specific deposit schedules for payroll taxes—adhere to these schedules to avoid penalties and interest.