Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Has anyone filed 4th quarter 941 with Employee Retention Credit catch up for previous quarters? Trying to figure out how to put previous quarters' wages on the 941 on QuickBooks Desktop.

It's good to have you here in the Community, RA22.

The forms in QuickBooks Desktop is already updated for 2020. Creating a form for the last quarter of 2019 is already unavailable.

You can download the 20190version of the form on the IRS website. Then, manually file the form. You can visit this Prior Year Products section on the IRS website.

Additionally, here are some helpful references that you can check out about the payroll tax forms, like how to ensure compliance with federal tax regulations, as well as some payroll news and updates:

Feel free to click the Reply button if you have any other questions. This way, we'll be able to help you out.

Please let me clarify by stating I am looking for a place on the 4th quarter Form 941 to input the Employee Retention Credit for quarters 1-3. The new law signed on December 27, 2020 should allow for this.

Good morning, @RA22! Hope you had a great weekend and a happy new year!

There should be a place for you to choose the quarter/year prior to creating the 941 form. Let's try these steps:

Here's the full article: Learn how to prepare and print Form 941, Schedule B, and Form 940.

.

Can you verify if those steps are available to you? If not, please reply to this post so we can continue to troubleshoot. We're all eager to help you. :)

@RA22and now I am asking how to claim the Employee Retention Credit on the 4th quarter form 941 for prior quarters wages paid. Didn't claim the credit in the 1st through 3rd quarter as prior to passage of the Consolidated Appropriation Act of 2021, those who got a PPP loan did not qualify for this credit. The act changed this and IRS has provided guidance that you can claim the prior period credits on the 4th quarter form 941, here is the link for that: https://www.irs.gov/forms-pubs/didnt-get-requested-ppp-loan-forgiveness-you-can-claim-the-employee-r...

Our question is how do we do that in QuickBooks Desktop Payroll?

We know how to select form 941 for different quarters that is not the question?

Let me route you to the right support, @TaxMan2.

For liability and legal reasons, the concern above requires users to contact the PPP team. They will be the ones to guide you with how to claim the credits.

Here's how you can reach them:

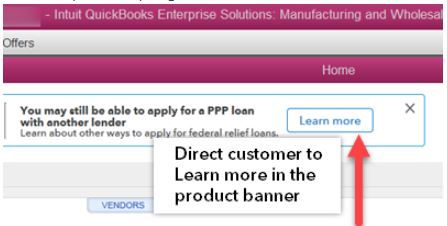

If you don't have access to the PPP Center, you can use this link: https://help.quickbooks.intuit.com/prechats/offerings/Paycheck-Protection-Program/23465/view.

Then, to be updated for the latest information about PPP, please head to the Microsite at this link.

For additional reference, I've attached a link you can use about the Employee Retention Credit: How to set up and track the Employee Retention Credit under the CARES Act.

You can tag me in the comment section if you have any other concerns. I'll be around to extend a helping hand.

It is obvious you do not have a solution for this, so why don't you just tell people that instead of giving them the run around?

Your PPP Team is not giving the solution to how to claim the credits on the 4th quarter form 941, for prior wages paid when the credit was not available to PPP borrowers?

Running out of time, returns due February 1st, very disappointed in your response to this problem!

So frustrating asking for help when they have NO CLUE what you are asking! I just read your thread and was laughing. I also just hung up with QB desktop support (with roosters crowing in the Philippines) because she was completely unaware. I have now 'manually' filed a 941-X for Q4 2020 claiming the ERC. It takes a lot of effort & time to learn how to do it. But it is definitely worth it. TIP: Print out Worksheet 1 from the IRS instructions for the 941. My problem now is that Quickbooks doesn't seem to want to let me claim the ERC for Q1 2021 on the 941. I can't even override to manually input my amounts. So will probably have to go thru the same process with the manual 941-X for Q1 2021. I did go to HELP (F1) and typed in "Employee Retention Credit 941" and it gave me a lot of information which, in fact, told me I should have set everything up differently from January 1 in order for QB to track. I didn't, and have since run too many payrolls so definitely doing the 941-X for Q1 2021. Good luck!

you're right Jakbooks. The Q1 941 will not allow me to override the erc wages field to retroactively calculate the ERC. So, I tried to do a PR liability adjustment. That's not allowed either. The payroll item cares employee retention credit employee will not populate on the liability adjuster my screen . I've been searching for a solution to no avail. The only instructions coming from Intuit are how to set it up at the beginning and run a payroll. Just like you I need to adjust Q1 for ERC wages. This is not a unique situation. Intuit should have programmed this by now . I've been a proadvisor for years. Lately I'm telling clients to seriously consider a competitor.

I am on the phone with QB's now and it's now April 6 2021 and they still do not seem to have a fix for this. So messed up if I have to go back to the stone age and manually process the 941 and mail it out instead of efiling my 94 through QB's. Shame on QB's

I truly detest dealing with QB "customer support"... I don't even understand why it's called SUPPORT. I don't think that I have ever spoken to anyone who could straight away answer a question. The "support process" is so convoluted and drawn out and is extremely frustrating and a gigantic waste of time. They ask all these nonsense questions to drag out the time spent for the chat so that they can go contact someone to look up the answer you need. I am OVER quickbooks and am on a journey to find something better.

If you can recommend another program, that would be wonderful! I am growing more dissatisfied with quickbooks by the day!

For QuickBooks desktop you can modify a paycheck in q1 to include the CARES employee retention – employee payroll item. Once that's done, worksheet one will be visible and will allow you to override amounts to properly enter qualified wages.

I learned this through trial and error, not QB support which is a total nightmare.

I tried your instruction but it did not work for me - I even recreated the few payroll checks that I only two employees so no big deal but it's still not letting me access the worksheet

very frustrating!!

Let me route you to the best support available to address this as soon as possible. We have our dedicated Paycheck Protection Program (PPP) support team who are specially trained in handling this kind of situation.

You can contact them by navigating the PPP Center inside your product and select Live Chat.

For more information about the PPP loan in QuickBooks, see below links:

Additionally, you can visit our Microsite for the latest news and information: https://quickbooks.intuit.com/small-business/coronavirus/paycheck-protection-program/.

If you have any other questions, feel free to reach back out. I'll be right here to assist you. Have a nice day!

I used the payroll items they instructed below. Perhaps that will help.

Step 2: Set up the 3 payroll items

Once you’ve set up your QuickBooks to accept the retention credit, you now need to set up each credit.

CARES Retention Credit - Employee Addition

Go to the Employees menu, then Manage Payroll Items, then select New Payroll Item.

Select Custom Setup, then select Next.

Select Addition, then select Next.

Give your pay type a name, such as CARES Retention Emp, in the text field and select Next.

Select CARES Expense (or whatever you named the expense account in Step 1) as the expense account, then Next.

In the Tax Tracking type window, Select CARES Retention Cr.-Emp, then Next.

In the Taxes window, select Next.

In the Calculate Based on Quantity window, select Calculate Based on Quantity , and select Next.

In the Default Rate and Limit window, select Finish.

This worked for me, I only changed one paycheck. When you get to the 941 do next page until after Schedule B and then the worksheet appears and you can override those numbers and it will correctly populate the 941 form. I'm so happy....thank you!

I agree with you Online QBs support is a disaster at best. I too am not recommending QBs Online to anyone and I am actively looking for a better product elsewhere.

Quickbooks Online payroll support is a joke they haven't a clue.

I cannot find the section you reference on creating CARES Expense. Can you repost?

I can provide additional information on where to find the CARES Expense, meadowlarks.

The CARES Expense is the account on the Chart of Accounts you set up for the retention credit.

After creating this account, you need to set up the 3 payroll items listed below:

For instructions and detailed steps, check out this link: How to set up and track the Employee Retention Credit under the CARES Act. Then, click QuickBooks Desktop Payroll and follow Step 2.

I'm adding this link for additional information about the Employee Retention Credit and deferral of the employer share of Social Security taxes for 2020, as outlined in the CARES Act: How the Coronavirus Aid, Relief, and Economic Security (CARES) Act affects your payroll.

Let me know if you need anything else with setting up CARES retention credit in QuickBooks. Just leave a comment below, and I'll get back to you.

Would it be simpler, rather than having to go back and recreate payroll checks, to create a fake "bank" account called "employee retention credits" and "pay" the liabilities with that?

Then QB would still track the amount remaining without having to do it in a separate spreadsheet, and the "paid" amounts would be in the correct spot on the 941.

Am I missing something?

Thank you for doing the legwork on this issue! Problem is that there are a lot of paychecks that need modified in my case and it would probably take longer to do that than just doing a manual 941X.

MOST of what I learn is through trial & error with QB. I call support to get help. It usually takes a minimum of an hour on the phone for ANY issue I am having. And by the time I am done with the call, I have usually figured out a work around myself. And then they always want that survey filled out to say what a great job they've done. What they don't seem to know is that the stupid survey doesn't really ask much about their support. More about whether or not I would recommend Quickbooks to a friend. LOL

Product suggestion or Bug report is even more of a joke. I have submitted countless reports that seemingly go into a black hole. Quickbooks does a great job of ACTING like they care. Do they really? I think not.

Are you a BOT?! We are not talking about PPP!!! Stop!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here