Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello!

I have just implemented epay for payroll tax liabilities starting with my 5/15/20 payroll. Previous to this, the CPA handling the books for this group made deposits for taxes through EFTPS and then recorded journal entries to keep the payroll tax liabilities straight. My balance sheet is correct as of right now; all four employee's prior year and YTD numbers are correct. However, now that I've indicated I want to e-pay these things, I'm getting "overdue" liabilities red arrows for all my payroll tax liability payments for 2019 and 2020 up until today. My question is, how can I make these lines go away? The taxes have already been paid and accurately recorded (albeit via journal entry).

Thanks in advance for any help!

Solved! Go to Solution.

Thank you for contacting us, gharris198.

You'll want to enter those prior tax payments since you've already paid the. This will help remove those liabilities for 2019 and 2020.

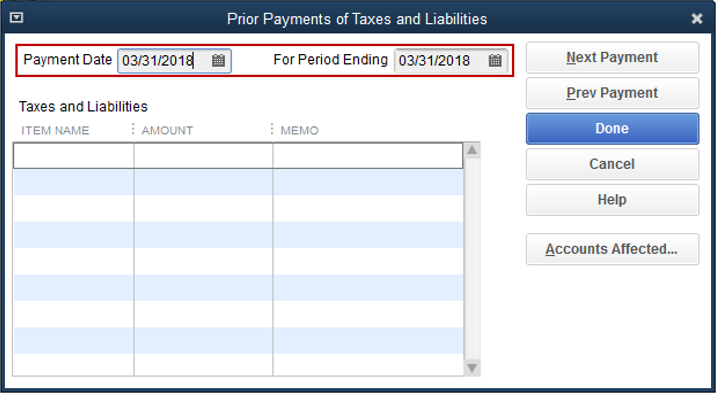

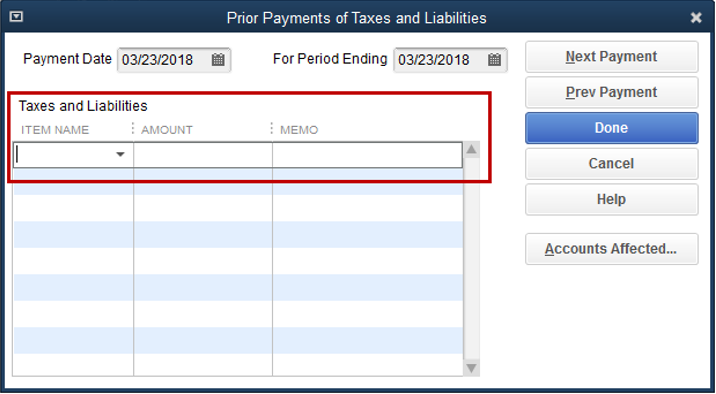

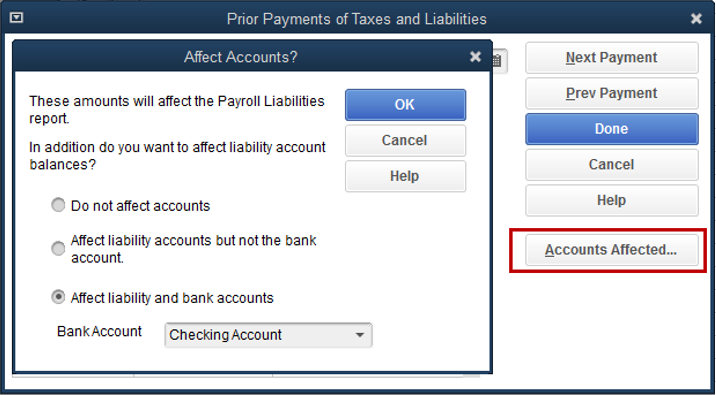

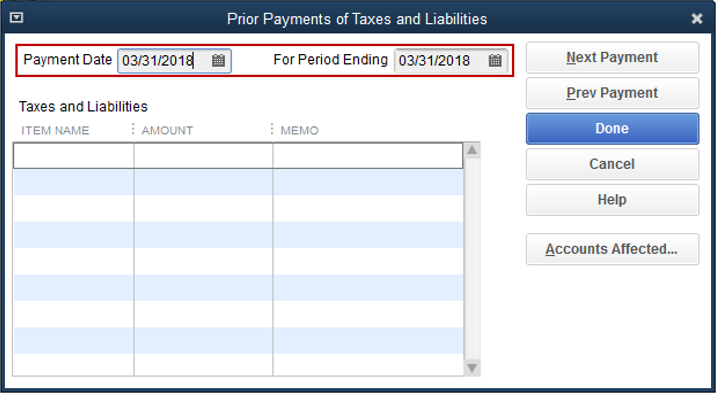

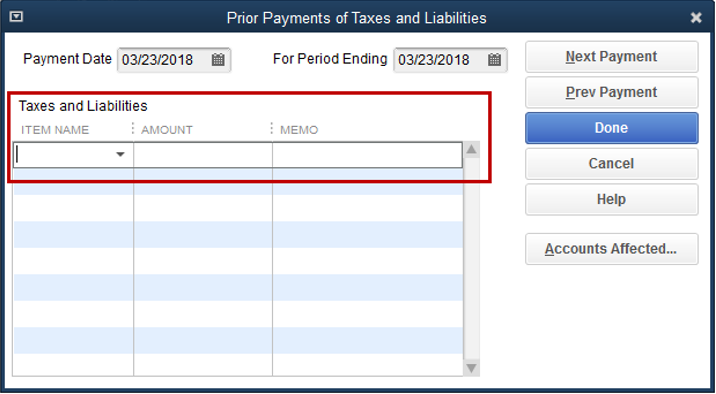

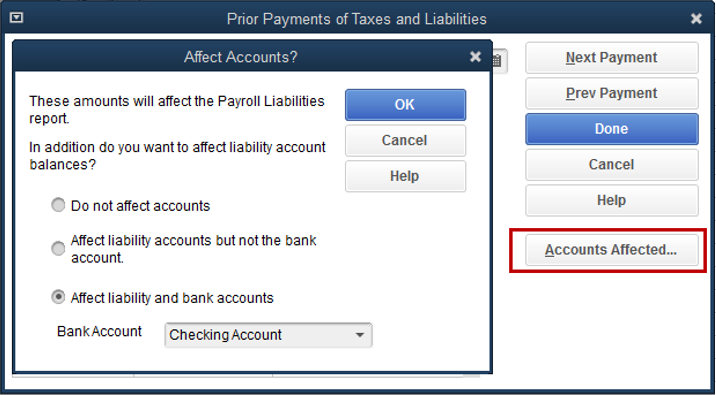

To do so, I'm glad to provide you the steps on how to accomplish this:

After that, you can start creating new paychecks. Then, pay and file your tax liabilities.

Let me know if there's anything else you need anything else by commenting below. I'm always right here to help.

Thank you for contacting us, gharris198.

You'll want to enter those prior tax payments since you've already paid the. This will help remove those liabilities for 2019 and 2020.

To do so, I'm glad to provide you the steps on how to accomplish this:

After that, you can start creating new paychecks. Then, pay and file your tax liabilities.

Let me know if there's anything else you need anything else by commenting below. I'm always right here to help.

Thank you. Just one follow-up. In my QB "Pay Liabilities" tab, one of the taxes shown is "Federal 941/944/943." But when I try to enter the prior payments as you describe, I don't see that description, only "Federal Withholding" and the various FICA-related items. I expect I will need to break all of this out to make the total go away, or will it not matter since I am not wanting to affect accounts?

Thanks for actively responding, @gharris198. I understand that you'll want to ensure you're recording your previous tax payments correctly.

To clarify, payments for prior quarters are entered as a lump sum, while for the current quarter are entered as per payroll.

Hence, for your taxes paid from the first quarter (January to March) should be entered as a lump sum amount using the Federal Withholding for Federal 941/944/943.

Then, enter your April tax payment separately as it belongs to the second quarter.

For future reference, learn about how to set reminders for your upcoming payroll tax and liability payments through this link: Set up and pay scheduled or custom (unscheduled) liabilities.

Let me know if you have more concerns about anything else. We're always delighted to assist.

Mark the post that answers your question by clicking on "Accept as solution".

I have followed these instructions and these are still showing up in liabilities to be paid. Please help.

Thanks for joining the Community, ErinMill.

There's a few reasons why taxes you've already paid will show up as due liabilities:

The steps provided by my colleagues are how to address a scenario if payments were never recorded in QuickBooks.

To fix this problem, you'll need to identify why it began occurring. Once you've found its cause, you can follow the specific steps for your situation in our Scheduled liabilities payroll show as overdue or in red article.

If there's any other questions, please feel more than welcome to reach out anytime. That's what I'm here for. Enjoy the rest of your day!

These are liabilities that have already been paid this year. We started using QB 7/1. I have made the adjustments and they still show up as been due. Read the whole article next time.

Still waiting for response. Please help.

Good Morning, @ErinMill.

Thanks for reaching back out to the Community. If you're still having issues with these liabilities after trying the recommendations from my colleague, then I suggest contacting our Customer Support Team. They'll be able to do a screen share to review your account to see why this keeps happening.

Here's how:

If you run into any trouble along the way, just let me know. I want to make sure you're able to get back to running your business. Take care!

I have balances for two pay periods, how would I clear these?

Hi, aquinones. I appreciate you joining in this thread. Let me help you clear your balances for two pay periods.

Clearing your two pay periods is quick and easy. You can follow the steps provided by MaryLandT above or you can follow the detailed steps and instructions in this article: Adjust payroll liabilities in QuickBooks Desktop. On the same link, you'll find a write-up about how to correct your year-to-date additions and deductions in QuickBooks.

Also, you can go through this write-up: Payroll Liability and/or Balance Sheet Report shows incorrect amounts for payroll liabilities. This will help you determine the common reasons why your balances are off and tips on how to resolve them.

Please let me know how it goes by leaving a comment below. I want to make sure your balances are cleared and accurate. I'll be around to keep helping. Have a most pleasant day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here