Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello Helpful People!

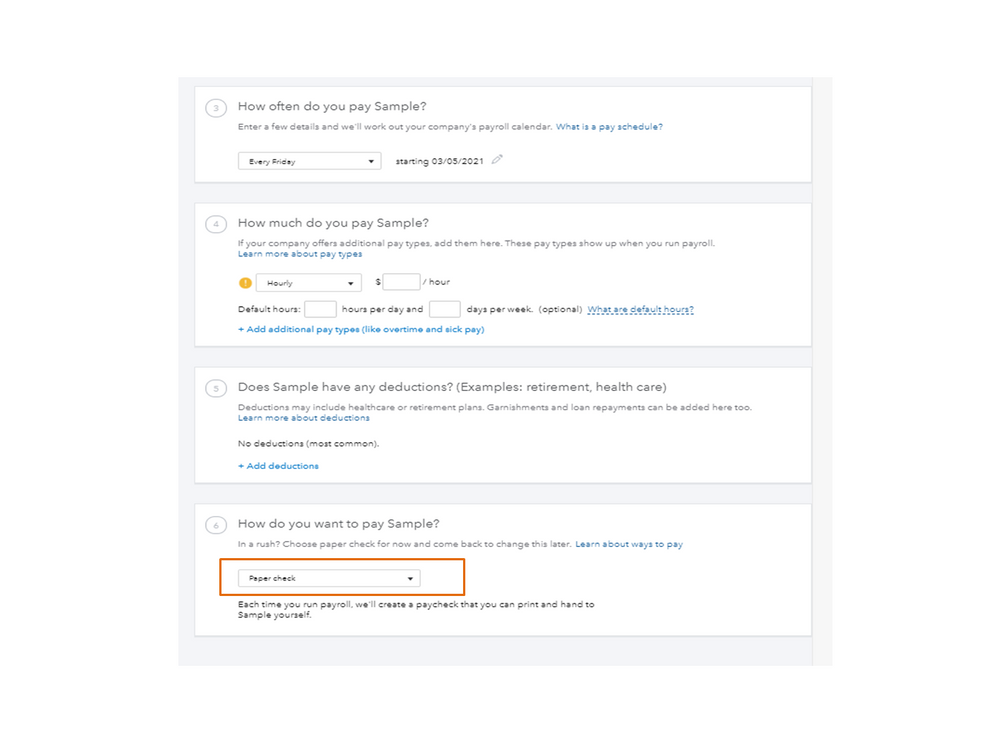

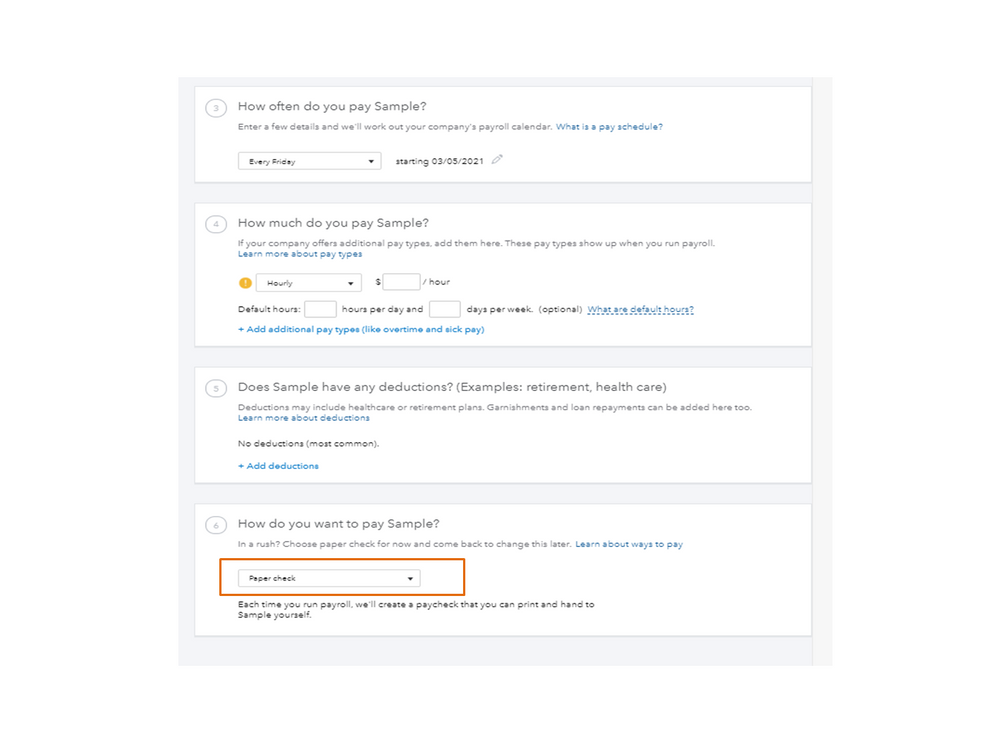

So we have multiple contractors that we pay on a monthly basis, and we recently switched to using QBO Payroll for simplifying our monthly payroll processes. So far it has worked out great, however, on this payroll period we wrote a check for one of our contractors and when we try to view that payment (or the previous payment made to them), QBO keeps giving us an error message (see attached image). I can't get it to do anything else, I can't view the details of the payments we've made to them, so we haven't sent them their check yet because we always like to send them the printout with it but now we can't seem to access it.

I've tried reloading QBO multiple times, and nothing seems to be making any difference. The error message doesn't even make sense to me because we are not paying this contractor by direct deposit, nor is it set to that. It is clearly categorized as payment by check and has not been changed. We had no problem viewing the payments last payroll when we needed to print it out so I just don't understand why suddenly it's giving us this problem. Help!

Solved! Go to Solution.

Thanks for being detailed about your concern, Admin4Holliday.

I’ll help make sure you’ll get past the error when viewing the vendor’s payments. Let’s go to the Employees page and make sure the supplier is not added to the list.

Here’s how:

Check out this article for detailed instructions. Choose the steps that fit your situation: Moving names from one list to another.

However, if the name is set up as a vendor, I recommend you get in touch with our QBO Care Team. They have to collect some information to access your account.

Then, check where the issue is stemming from. Also, our agents will guide you on how to apply the solution once it’s available.

For additional resources, this article will guide you on how to create paper checks to pay your suppliers. It includes a video for visual reference: Pay a contractor with a paper check.

Reach out to me if you have additional questions. Please know I’m just a comment away for help. Have a great rest of your day.

Thanks for being detailed about your concern, Admin4Holliday.

I’ll help make sure you’ll get past the error when viewing the vendor’s payments. Let’s go to the Employees page and make sure the supplier is not added to the list.

Here’s how:

Check out this article for detailed instructions. Choose the steps that fit your situation: Moving names from one list to another.

However, if the name is set up as a vendor, I recommend you get in touch with our QBO Care Team. They have to collect some information to access your account.

Then, check where the issue is stemming from. Also, our agents will guide you on how to apply the solution once it’s available.

For additional resources, this article will guide you on how to create paper checks to pay your suppliers. It includes a video for visual reference: Pay a contractor with a paper check.

Reach out to me if you have additional questions. Please know I’m just a comment away for help. Have a great rest of your day.

I have now waited over 30 minutes for quickbooks to load the contractor "pay contractor" list and still waiting. OI have tried multiple browers still nothing - why promote you pay contractor in QB if it does not work??? I just go AW Snap again and browser is upto date.

Yes I have many 1099 over 300 per year but this is absolutely the worst system to work in I may as well go back to ADP -

We have to actually pay them ach through bank which is time consuming enough why I am paying for the hooty tooty quickbooks to sit and wait

Thank you for your continued patience, bourbondog. I understand that waiting over 30 minutes for the Pay Contractor lists to load can be challenging. It's great that you've tried multiple browsers to troubleshoot this situation. Let me route you to our dedicated support team.

Managing over three-hundred 1099s contractors each year is not easy, and it’s important that you have a smooth and efficient experience.

I recommend contacting our support team, they have access to tools and resources that help diagnose and resolve technical issues that aren't available to regular users. They can also provide updates on any ongoing performance issues or system changes that might affect your experience, helping you stay informed and get everything back on track.

Here's how to connect with them:

Once you’ve processed your contractors' 1099s, you might find these articles helpful for printing and correcting 1099s in QBO:

If there’s anything you’d like to discuss about paying contractors in QBO, feel free to get back to this post. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here