Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, qbcelerapro.

You will need to delete the paychecks if they aren't processed yet. Please open this article and follow the steps on how to delete them: Edit, delete, or void employee paychecks.

If you're using Direct Deposit, you will need to delete the transactions before 5 PM, two banking days before the check date. Otherwise, we will not be able to stop the transactions from posting to the employee's accounts. Check out this article for more details: Reverse a direct deposit in QuickBooks Payroll.

Once deleted, you can go back and reprocess the payroll. Let me know if you need anything else.

I processed payroll through an old company file.

When I processed payroll for the following week in the active company file, QB imported the payroll that I had processed in the old payroll file.

Now there is a scheduled payroll in the payroll center for the dates I processed in the old company file.

Can I delete it?

Hi @Jfkastq,

I'll share insight on your query about deleting a scheduled payroll in your QuickBooks Online (QBO) company. Be advised, this option becomes available if there's no employee assigned to the schedule you wish to delete.

Follow these steps:

See this article for additional details on managing your payroll schedules: Set up and manage payroll schedules. This lists schedule types available for QBO Payroll, including a short description for each.

Since you've already run payroll for your employees, you can check out this article: Add pay history to QuickBooks Online Payroll. This is so you can import your payroll data, then run the payroll on the next scheduled pay date.

I'd also suggest running your payroll on a single QBO company so you won't have any issues tracking payroll taxes, keeping your books accurate.

Don't hesitate to leave a comment below in case you have other questions. I'll be sure to get back to you.

Thank you for the reply.

I am using quickbooks DESKTOP so there is no gear icon. I see no way to cancel the scheduled payroll.

Also, QB imported the liability check as well and it cannot be deleted.

Oy!

Hello, @Jfkastq.

Allow me to provide the steps to delete the scheduled payroll for QuickBooks Desktop.

First, you'll want to remove any employees on the payroll schedule you want to delete. You can do this by following these steps:

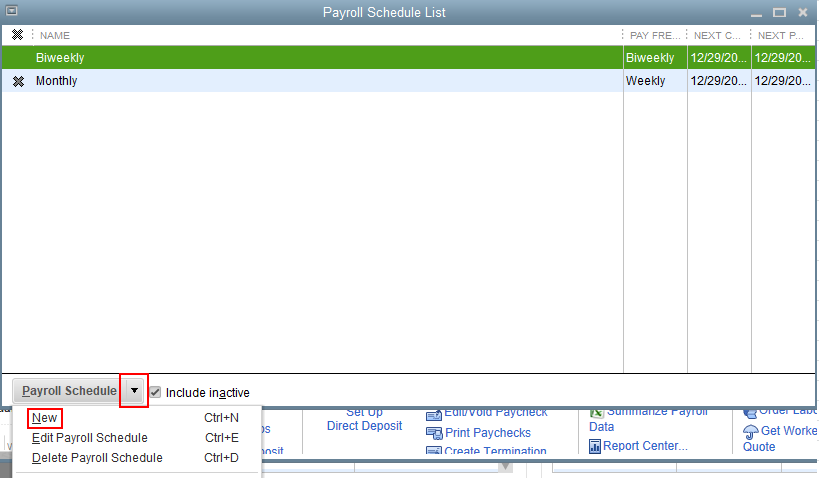

After you remove all the employee's from this payroll schedule, you can delete the payroll schedule. Here's how:

Now your schedule is deleted, and you can get back to business. You can also reference this article if you need more information: Set up and manage payroll schedules.

Feel free to hit the reply button if you have any other questions. Take care!

Thanks for the quick answer but I'm not understanding.

go the employees MENU (alt-y), then go to Payroll Center OK?

There is no employee showing unless I click on the employee TAB.

OK, did....up comes Edit Employee. Is that right?

Under payroll schedule is only Weekly.

I'm stuck here.

Also, you say make sure you're not in the schedule you want to delete but that's the only I have. Payroll is tomorrow and it will still be the same one in there.

Thanks for letting us know about your confusion, @Jfkastq.

You're correct. It's the Employees tab where you can edit an employee's payroll schedule. Since you only have one payroll schedule, you can create another schedule so you'll be able to delete the scheduled payroll.

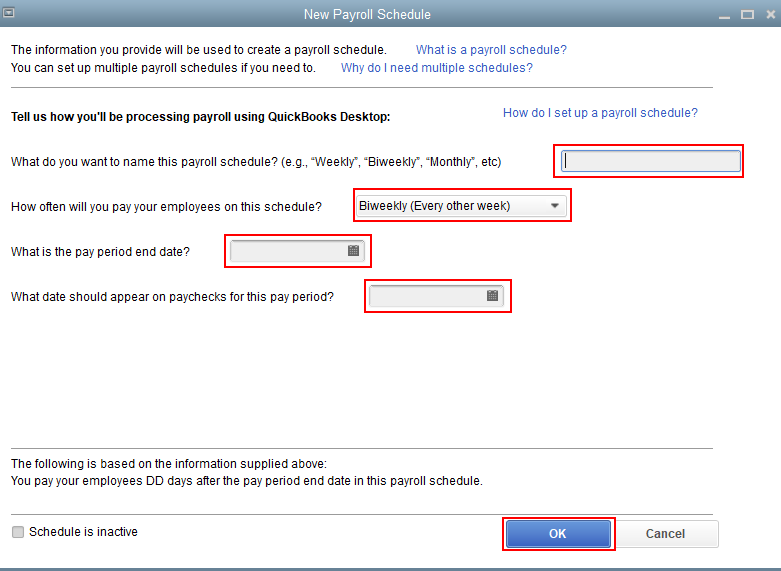

Here's how to create a payroll schedule:

I'm adding this article for more details: Set up and manage payroll schedules.

Once done, you can now change the Payroll Schedule of your employee. This way, you'll be able to delete the scheduled payroll in the Payroll Center. You can follow the detailed steps shared by my peer above.

Also, what my peer trying to explain above, is to delete the payroll schedule associated with the employee before you change it to another.

Just in case you want to run unscheduled payroll, feel free to check out this article for the detailed steps and information: How do I create a paycheck for an employee?

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day and stay safe.

Thank you for the teamwork! I would like to add a semi-related question to this thread

When I did the payroll on the older QBW file I added an employee from memory but the EDIT fields are not the same. Specifically, I left out a middle initial so when QB imported the payroll it added an employee. Now I have John Smith and John E. Smith.

Not a big deal but I would like to merge them if possible. Same SSN etc...everything is the same except for the middle initial.

Thanks!

I appreciate you getting back to us here in the Community, @Jfkastq.

Let me chime in and provide some information about your payroll concern in QuickBooks Desktop.

Currently, merging employees within the system is possible. The process allows you to combine them by renaming the duplicate with the exact name of the original employee you want to retain.

However, before performing the process, I suggest creating a backup copy. This way, you'll be able to restore the data if you want to undo the actions.

In case you need the steps, I suggest you visit the Back up your QuickBooks Desktop company file article.

Once done, you can now proceed with merging them. I've attached the detailed steps and screenshots for your visual guide:

For additional reference, I've attached an article you can use to learn more about merging accounts, customers, and vendors: Merge Accounts, Customers, and Vendors.

Let me know in the comment section below if you have any other questions. Have a great day ahead.

thank you.

I know how to merge but QB won't let me.

Employees with payroll transactions cannot be merged.

Can't change the payroll check either. I was thinking I would change the name and then delete the unwanted name. Can't do....

Hi there, @Jfkastq.

Thanks for following up on this thread. At this time, QuickBooks Desktop doesn't offer a feature that merges employees with payroll transactions. I'm going to submit feedback to our Product Development Team to review and consider making this a feature soon.

For now, you can refer to this article for future product updates for QuickBooks Desktop: QuickBooks Blog.

If you have any more questions or concerns, please don't hesitate to comment below. I'm always here to help. Have a good one!

Hey there!

I failed to create a monthly check. When I realized my error, I hit Start Unscheduled Payroll, which worked! But when I was ready to begin the regular weekly checks on that same day, I did not come out of the unscheduled payroll and then start in the start scheduled payroll tab. Of course it was after the checks were printed that I realized my error. Now almost a week later, the status of last week's weekly payroll schedule is overdue.

All of the employees have been paid correctly which is the main objective, but the little red bubble is still there letting me know I have made an error!

Suggestions?

Thanks!

We can edit the Payroll Schedule to future dated pay period, George117.

I'm here to ensure that we get rid of the red bubble error stating that the payroll period is due.

The Payroll Schedule lets you know when to run your payroll, which dates your employee's paycheck is due. We calculate your upcoming payroll schedule so that you can pay your employees on time. To avoid creating duplicate paychecks, you can edit the payroll schedule and enter the correct future pay period.

Let me show you how to edit that:

The error now disappears. The next scheduled payroll will be based on the new period dates you just entered.

You can also run payroll reports to make sure that the payroll you ran is in the correct period. Check out this article for more details on how to pull that up: Customize payroll and employee reports.

Always know that the Community is around to help you with your concerns. You take care always and have a great day!

I just started QB payroll and Initially there was a scheduled payroll for pay period 9/27-10/03 that we ended up not processing and I need to cancel it as it is still pending

How do I cancel?

Hey there, @805Jackie.

Great having you here with us in the Community. Thanks for joining the thread.

We can certainly delete the pending payroll right from QuickBooks as long as it's not been processed yet. I've included some steps to delete the pending payroll below.

However, depending on your processing time, the debit from your bank for taxes and direct deposit might not be stopped.

In the event your deadline to cancel has passed, this worker will receive their funds in the associated bank account. You can void their payment and collect your money back from the employee. Additionally, you may qualify to submit a request for direct deposit reversal.

Please let me know if you have any questions or concerns. I'll always be around to lend a hand. Take care!

If changing the pay date is your goal, then I've got you covered, Moiria.

Editing the date of a processed check is done by our Payroll Correction Team. That being said, you'll want to give us a quick call so we can pull up your account in a safe environment and modify the paycheck for you. Here's how to connect with us:

On the other hand, you'll have to void or delete the paycheck and then recreate it with the correct paycheck date. If you process payroll through Direct Deposit, you can still cancel it before 5:00 p.m. Pacific Standard Time and 2 banking days before the paycheck date you accidentally entered. Also, if you manually processed the check, you can delete and recreate it anytime.

For more details in managing and processing payroll, you can refer to these resources:

In case you'll need assistance with changing your pay date, don't hesitate to get back on this thread. We're always here to help you. Stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here