Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood day, @ayexpressllc14-g.

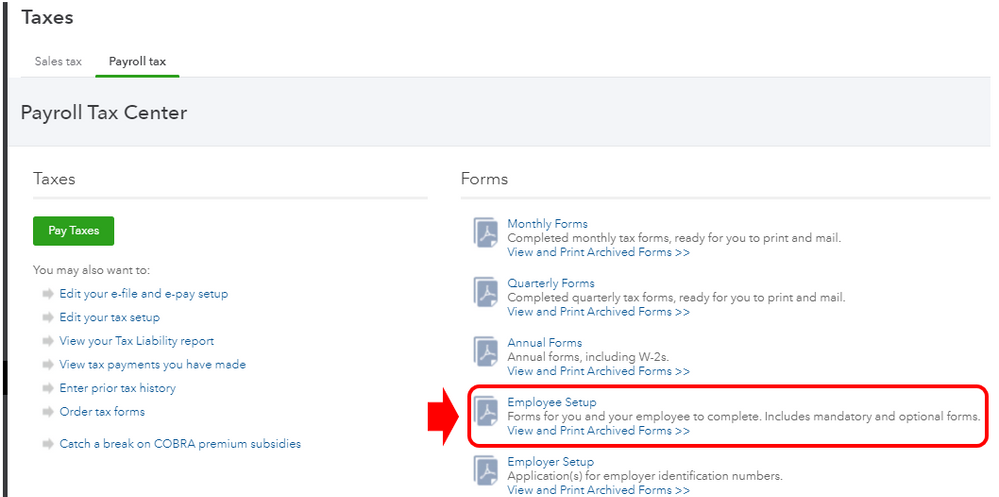

If you’re trying to access the direct deposit authorization form for your employees, just visit the Payroll tax section in QuickBooks Online (QBO). This way, your employees can start to fill out and sign.

Here’s how:

Also, you can directly use this information to print an authorization form for direct deposit. Then refer to this guide to enter the employee's bank account information in QBO: Set up direct deposit for employees.

Once everything is set up, you can visit these resources to learn more on how to process payroll and to make sure your employees get paid on time when there’s a holiday:

If you mean something else or have other concerns about the direct deposit form, you can message me anytime. I'll be here. Always take care!

It would be helpful if the DD form included the employee email address.

Since I manage payroll remotely for multiple companies, it is sometimes challenging to get email addresses for new employees.

Providing the best experience with sending direct deposits is what we aim for, @cbcavnar.

I know how beneficial it is to your business to add an employee's email address to the direct deposit form. However, this option is unavailable in QuickBooks Online (QBO). With this said, I'd recommend sending this request straight to our product engineers through feedback. Sharing features and options that you would like implemented is how our engineers look for new product updates. Here's how:

We can invite your employees to see their pay stubs and W-2s online. You can also invite your new employees to add some personal info for them to have access to their pay stubs and W-2s any time they need them. Each time you run payroll, they’ll get an email letting them know their pay stubs are available to view and print. They can also view and print their own W-2s at tax time. Here's how:

To learn more about this one, check out this article: Invite employees to see pay stubs and W-2s online. Feel free to browse this link here if you need help with other tasks in running payroll. It'll route you to our general payroll topics with articles.

Drop a comment below if you have follow-up questions or concerns about processing payroll transactions. I'm more than happy to assist you. Take care and have a wonderful day ahead.

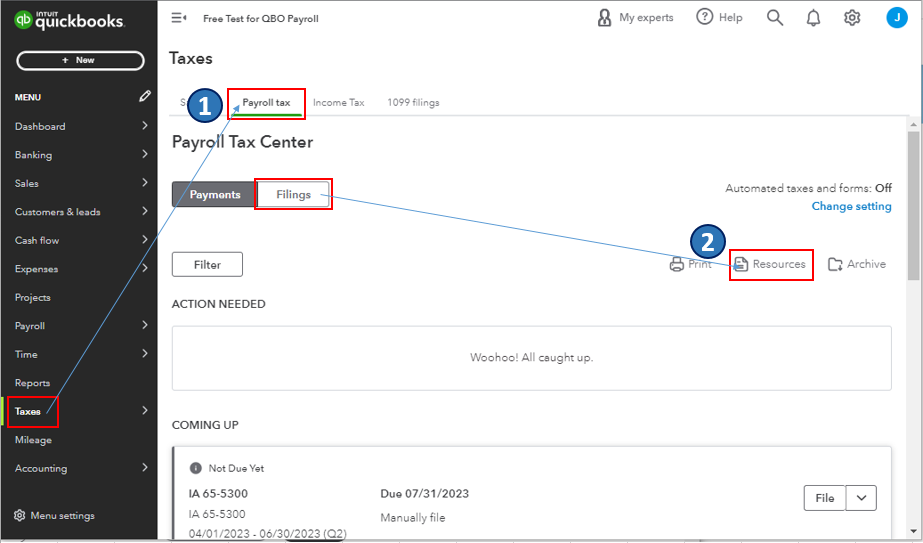

There was an update to the system. The pathway is: Taxes -> Payroll Tax -> Filings -> Employee Setup.

Can we use the direct deposit for reimbursement checks or does this only work for payroll checks?

Does QB Payroll have an option for new employees to authorize direct deposits through the self-boarding process when they enter their banking information, or is the employer still required to print the form and have the new employee complete and sign the paper document

Hey there @SLM77, thanks for joining the conversation.

Yes, QuickBooks Online (QBO) Payroll now gives you increased flexibility with employee self-onboarding by allowing you to enter some of their information, and then invite them to add the rest. You can still print a direct deposit authorization form if you want.

But if you want your employees to enter their own personal, tax, and banking info, make sure Employee self-setup is on. QuickBooks will automatically email them an invite to QuickBooks Workforce. I'll show you how.

To learn more about the process, check out this article: Add your new employee to QuickBooks Payroll.

The employee will receive an email inviting them to enter their Address, Social Security Number, W-4, and other information along with their banking details (for direct deposit) by setting up an Intuit/QuickBooks Workforce account. This also gives them the option to view their pay stubs and W-2s online in the future.

For your reference, you can read this article to see the list of payroll reports you can use to view data about your company and employees: Run payroll reports in QuickBooks Online Payroll.

If there's anything else you want to know or concerns you require assistance with, let me know in the comment below. I'll be around to lend some help. Take care and have a good one!

this has changed in Quickbooks online, has it not? I am not finding the menu to which you refer.

Hello, sazzafraz.

Thank you for reaching out to the Community. I'd be happy to assist you, but I need some details regarding this issue. Could you provide further details on the menu or steps you are referring to? I'd be pleased to help you with the exact solution you require.

Any additional info or a screenshot of the interface will be greatly appreciated. Looking forward to your reply. Have a good one!

This thread is about the direct deposit form. There is no menu that takes you to one. The previous posts are outdated because they don't exist. Where can updated info be found?

Hi there, @Cyndyn.

Let me get the help you need to get a direct deposit authorization form so your employees can fill it out.

For more details on managing your employee's direct deposit in payroll, see this article: Set up direct deposit for employees.

To guide you on how to process payroll for your employees in the future, check out this article: Create and run your payroll.

Please let me know if you have further questions or concerns. Have a great day!

This "employee setup" does not exist on any of my clients in the filings. I have seen snapshots of this online and mine is blank in that spot. We don't set up employees there and use the payroll / Employees / Add an Employee. So not sure what you are point out. Maybe a snap shot?

Hello there, @Cyndyn.

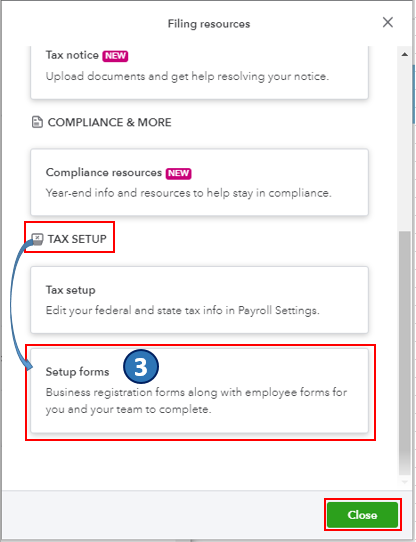

For this QuickBooks Online Payroll (QBOP) update, we'll follow a different path in getting your employee direct deposit authorization form. Let's go to the Filing resources window to complete this task and set up your employees' direct deposits in payroll.

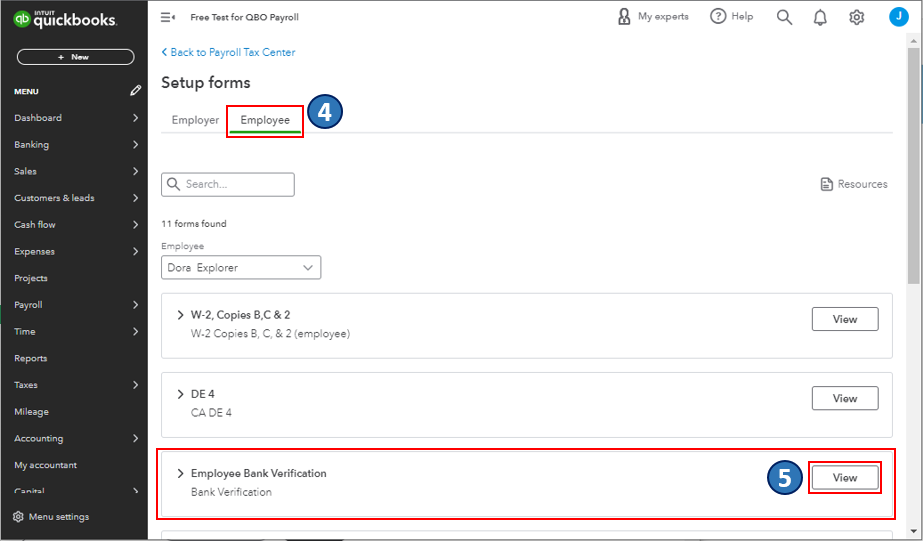

Employees or contractors who will be paid by direct deposit should complete the employee direct deposit authorization form. To get this, here's how:

Once you're done, continue setting up and managing employees' direct deposit in payroll. You can refer to this article for the complete guide: Set up direct deposit for employees.

Also, there are a variety of payroll reports you can use to view information about your business finances and employees. For the complete list of reports and how you can access them, please see this article: Run payroll reports.

If you have other payroll concerns or questions about managing employees in QBOP, don't hesitate to drop a comment below. I'm always ready to help. Take care, and I wish you continued success, @Cyndyn.

THANK YOU!! I have been searching for Direct Deposit form for 30 minutes!! How stupid of me!!!!

It's EMPLOYEE BANK VERIFICATION form.....

Hello, Ivan.

I appreciate you taking the time to share your experience here in the Community. It’s great to hear that you were able to figure out the correct form with the help of my colleague. We all know how challenging it can be to search for the right documents, especially when time is of the essence.

Your feedback is incredibly important to us, as it helps us understand how we can improve and better support our users like you. We truly value the trust you place in us, and we are committed to providing you with the assistance you need.

If you have any other questions or if there are any other concerns related to QuickBooks Online Payroll, please feel free to reach out. We are here to help and look forward to serving you in the future. Thank you once again for being a part of our community.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here