Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

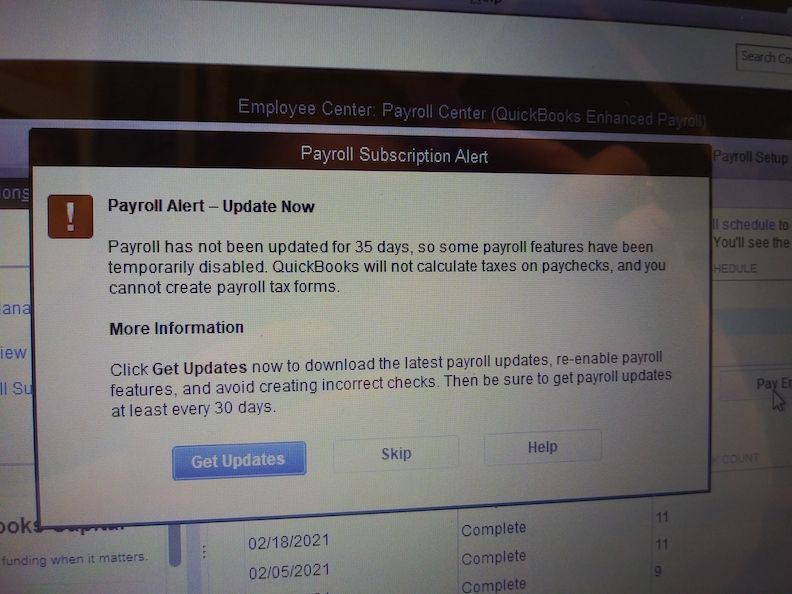

I am trying to do payroll and when I clicked on "Pay Employees" and a box pops up and asks me to do the latest payroll update, which I haven't updated in 35 days...but I just did last week. After the payroll update runs I get a message box that says "You've retrieved the latest payroll update and validated your subscription. We strongly recommend that you go online again before 3/5/2021 (PS038)". When I click ok

Hi there @4jcowgirl.

I appreciate you reaching out to the Community. I know how important getting your payroll processed is and running into a snag is no fun. Most often the type of situation you are experiencing is solved by updating QuickBooks. To do so, follow these steps:

Once you have downloaded the updates, restart QuickBooks. Once QuickBooks has been restarted, go through the Pay Employees process. Please note, you may have to click on Update Payroll once more and let it update.

I want to make sure you get those paychecks done, so I’ll keep an eye out for any additional questions. Feel free to reply. Additionally, you can stop in anytime for help with any other situations. Enjoy your day!

It did not work. It did ask me to do the payroll update again and but I get all the same messages.

It did not work. I go the same messages when I click on Pay Employees. I did all updates. Same results.

Hello again, 4jcowgirl.

Thank you for keeping us updated about the outcome when trying the steps above.

Currently, there are reports about the Payroll update message loops. Our engineers are all hands in investigating this unexpected behavior and are diligently looking for a fix as soon as possible.

In the meantime, you can click the Skip button to proceed with processing payroll.

While we're working on this, it would be best to get in touch with our Customer Care Team. This way, you'll get listed to the affected users. To contact us, here's how:

Ensure to review their support hours so, you'll know when agents are available.

I appreciate your patience while the engineers work to resolve it. As always, if you have any other concern about QuickBooks, please feel free to visit the Community again. I'm always here to help.

I have pushed the skip button and created the checks. The problem is there is nothing withheld for taxes.

Thanks for keeping an eye on this post, 4jcowgirl.

It's possible the latest update didn't go through, and that's why the system is asking you to update it again.

You can click Get Updates and follow onscreen instructions. Once done, make sure to restart QuickBooks for changes to take effect. Or follow these steps to download the latest tax table:

Aside from downloading the latest tax table, there are additional actions you need to take to ensure paychecks are compliant:

If the alert will still show up, I recommend contacting our QuickBooks Desktop Payroll Team. They can create a case to isolate this issue.

Don't hesitate to leave a comment below on how the contact goes. I'm always right here if you need additional information about this.

how did you fix the problem? I have the same problem.

Hi Edithc1,

I've checked in our system and our engineers are continually working on a fix to this Payroll Update prompt. I still recommend contacting us so we can add you to the list of affected users. Updates will be sent through email.

Aside from the contact us steps shared by me colleagues, you can alternatively use these link where you can reach out to us outside the system: https://quickbooks.intuit.com/learn-support/en-us/contact.

You'll want to use the chat links in this article as well: Contact Payroll Support.

Always know that the Community is open 24/7 to attend to your questions. You can post your concerns anytime here. Take care!

Hello, wellds.

I appreciate you for following the steps above to resolved the issues. Once you reach out to our customer support team, they will add you to the list of affected users, and you'll be notified about the latest status of this matter through email once any updates on this issue are made available.

You can follow one of my colleague's steps above on how to contact our support team. To ensure that you'll be assisted immediately, I recommend checking our support hours before performing the steps.

For your future tips, while working with QuickBooks, I also suggest opening the topics from our help articles.

Please leave a reply below if you have further questions. The Community is always here to help you. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here