Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have 5 employees and one of them we realize is not having her federal taxes taken out of her check. All the info is entered correctly. She has filed married filing jointly. But as far back as June, no federal takes have come out of her paychecks. Any ideas as to why?

I'm here to make sure the employee's federal taxes will deduct from his/her paycheck, @grandpasfeed.

Do you know if these employees are meeting the wage bases set by the IRS? You can click on this link to learn the wage base limit: Topic No. 751 Social Security and Medicare Withholding Rates.

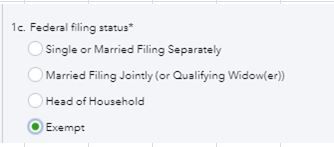

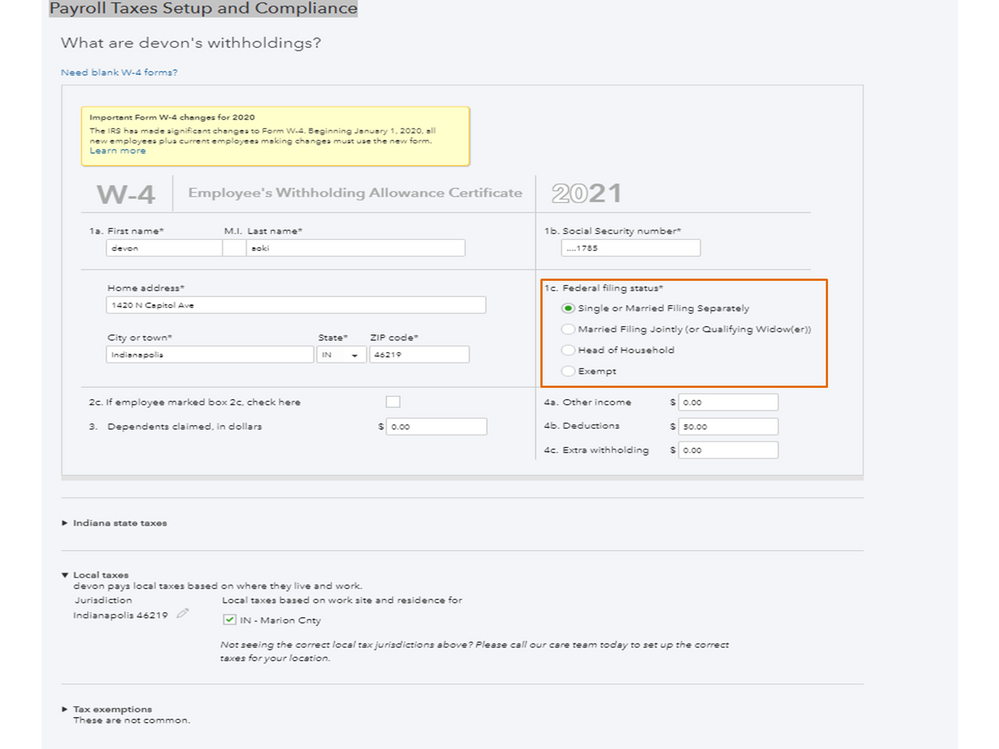

It is also possible that their W-4 status has been set to 'Do Not Withhold' by mistake. Here's how to check if an employee was set to Do Not Withhold (Exempt):

For more information about the process, check out this article: 0.00 or no income tax withheld from paycheck.

Once you've verified that the set up is correct, I suggest checking the Payroll Tax and Wage Summary report. It shows detailed information about how QuickBooks calculates tax amounts on employee paychecks and the wage base limit for each employee's tax.

Let me guide how:

For the detailed guide, you can use this article: Payroll tax wage bases and limits.

Please let me know if you need further assistance with payroll. I'm always around to help. Have a good one.

I checked all the info you gave me and everything is in place like it should. Not sure what the deal is, but thanks for the info.

It's our pleasure to help, @grandpasfeed.

Since all the information is correct and there's still no federal taxes coming from your employees' paychecks, I suggest reaching out to our Customer Support. They can check your account in a secure environment, isolate the issue you're having and help you resolve it.

You can reach our Customer Support for QuickBooks Online (QBO) by going to the Help icon at the top right of the account. Follow the steps below:

Here's the contact the QuickBooks Online Customer Support team article for more information. You can also check on the following article to know the different types of support we offer and its availability: Support hours and types.

You can always get back to me if you have questions or other concerns by leaving a comment below. I'm always here to assist. Have a great rest of the day.

I have 11 employees that federal withholding is not coming out. Is this a QB problem?

Thanks for following this thread, CarlamDecker.

I want to ensure the federal withholding is deducted from your employees’ paychecks. This is to ensure your taxes and forms have the correct information.

When the federal withholding is not calculating, check your workers’ profiles and make sure they’re set up properly. QuickBooks Online calculates the federal withholding based on these factors:

Here’s how:

For additional resources, here’s an article that provides detailed information on why a paycheck shows $0.00 or no income tax withheld. It includes detailed instructions on how to review your workers’ filing status: Self-help guide.

Stay in touch if you have additional questions or concerns about QuickBooks. I’ll be right here to answer them for you. Have a good one.

Hello I all so are having this same problem I am currently working at family dollar as a Assistant Manager and I have been here a year and I was not able to file because nothing was being taken out. I have tried everything and nothing is working

Thank you for joining in on the thread, SambrinaB.

I know that having the correct calculation for taxes is very important for filing your returns.

I see that my colleagues have already shared articles and stated the reasons why taxes will not calculate, and I believe you've checked your employee's setup as well. For these reasons, let me route you to our Payroll Support so they can start with a screen sharing session to find the root cause of the issue.

If you have other concerns with payroll, feel free to reach back out. I'll be here to assist you again. Take care!

Please help me - I believe the forms are done correctly, yet quickbooks won't allow the deduction from the paycheck and the IRS won't accept my payment because we didn't pay Federal Income tax. I spent all day on the phone with one of your employees and still no success.

Hi Deirdre55,

QuickBooks will calculate the federal tax on a paycheck if the employee has the correct setup and if the salary is not too low. I believe this is shared in my colleagues' responses above. They also included an article with more details about this scenario.

On the other hand, being on the phone for a long time is not easy for a business person. However, our phone agents are the best people to talk to about this matter because they can use more tools to see your setup and payroll records. For this reason, I recommend contacting them again to investigate this further as the initial help from here did not resolve the issue.

Feel free to go back to this thread if you have any other concerns about tax calculations on paychecks. We're just around to help.

i do not know how to set up dependents properly based on the newer w-4 form, my older employee's use the older version which asks for dependents newer version asks for how many kids under 17 x $2000.00 and some i have it set up wrong and its not taking any federal taxes out. What numbers do i put in the boxes based on employee,s disered dependents to claim? can you wake me through it?

Hello there, @Argonaut1.

I'll share insights about some important info in filling out a W-4 for you and your employees so you can keep your tax calculations accurate in QuickBooks Online Payroll (QBOP).

Yes, there are two versions of the federal W-4 form, the 2020 and later and before 2020. All of your employees should fill out a W-4 per IRS guidelines which should be based on their desired number of dependents to claim. If they need help understanding the W-4 or need guidance for their tax situation, they should speak with a tax advisor or financial planner. Intuit and employers legally can’t provide W-4 advice.

Once you have your employee’s new or updated W-4, enter it in QBOP. This way, their federal income tax calculates accordingly. For the complete guide, please see this article: Enter federal Form W-4 in QuickBooks Payroll.

Please feel free to leave a comment below if you have other payroll and W-4 concerns or questions about managing employee transactions in QBOP. I'm always ready to help. Take care, @Argonaut1.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here