Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello everyone,

I just came across this while looking at my payroll liabilities balance report. This time last year, we were setting up Quickbooks Desktop as my new business grew and I hired an employee (my daughter). Long story short, we were going to do health insurance (company paid) and it was deducted out of her very first paycheck. But then from the end of January 2020 through March 2020 (my company worked with an accountant from March 2020 through summer 2020 and she had gotten it worked out so for the remainder of the year it was not deducting health insurance from paychecks so I have no balance from April 2020 - Dec. 2020), it was no longer being taken out of her paychecks because we went a different route and weren't going to do the health insurance (company paid). So I have a balance of course on the reports for Jan 2020 - March 2020, and I was wondering if adjusting them would be ok and it wouldn't mess anything up seeing as this was all 2020, and we are now into a new year.

Thank you for your help in advance! I really appreciate it! And I have learned a lot from this community without a doubt!

Solved! Go to Solution.

Let me help you go over to your account and have your balance for Jan-March 2020 corrected, JustinB75.

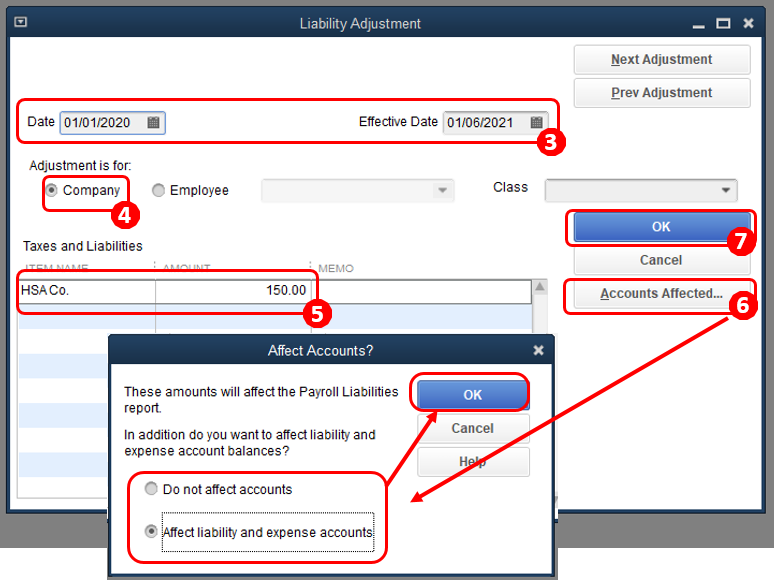

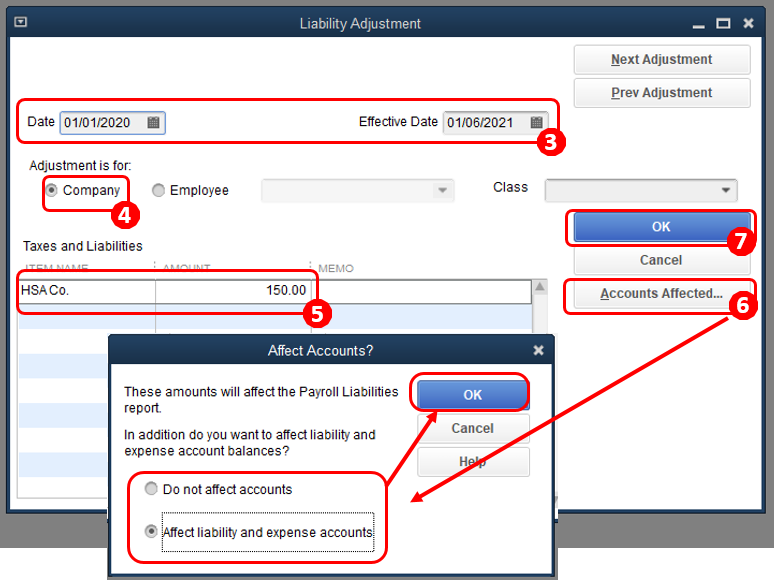

You can create a liability adjustment to correct the amount and ensure you don't have any balances left for the year 2020.

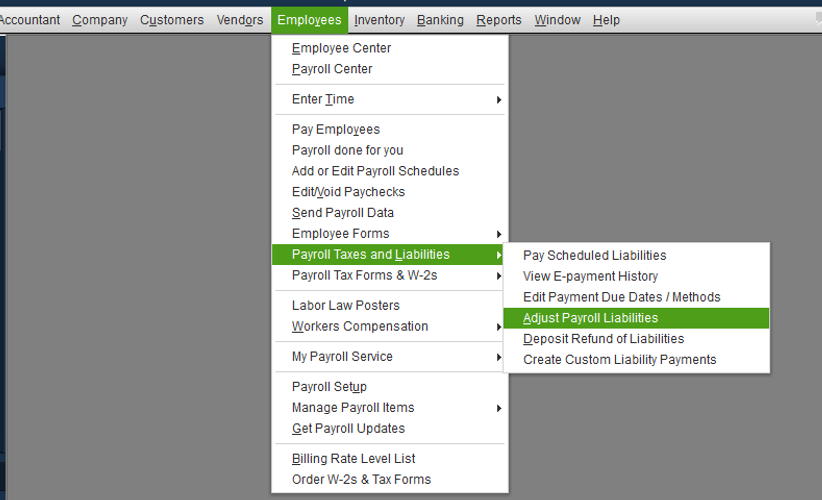

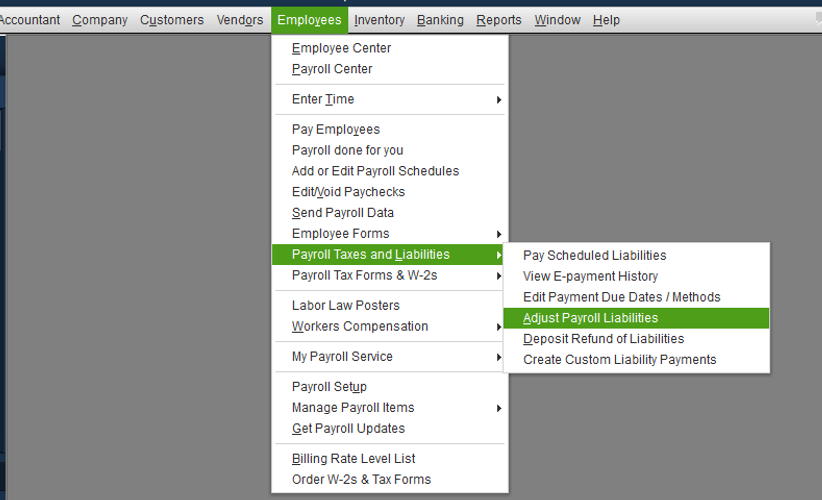

Here's how:

I'd suggest consulting an accountant to ensure your books are accurate and not messing up other data. Your accountant can provide more expert advice regarding an accounting perspective.

For more details about this process, check out this article: Adjust payroll liabilities in QuickBooks Desktop. On the same link, you'll find a write-up about how to correct your year-to-date additions and deductions in QuickBooks.

Additionally, if you need help with removing overdue liabilities, you can refer to this article for the detailed steps and instructions: Enter historical tax payments in QuickBooks Desktop Payroll.

Please let me know how it goes by leaving a comment below. If you have more questions about payroll liabilities or need anything else, don’t hesitate to ask. I’ll be here to help. Have a most pleasant day!

Let me help you go over to your account and have your balance for Jan-March 2020 corrected, JustinB75.

You can create a liability adjustment to correct the amount and ensure you don't have any balances left for the year 2020.

Here's how:

I'd suggest consulting an accountant to ensure your books are accurate and not messing up other data. Your accountant can provide more expert advice regarding an accounting perspective.

For more details about this process, check out this article: Adjust payroll liabilities in QuickBooks Desktop. On the same link, you'll find a write-up about how to correct your year-to-date additions and deductions in QuickBooks.

Additionally, if you need help with removing overdue liabilities, you can refer to this article for the detailed steps and instructions: Enter historical tax payments in QuickBooks Desktop Payroll.

Please let me know how it goes by leaving a comment below. If you have more questions about payroll liabilities or need anything else, don’t hesitate to ask. I’ll be here to help. Have a most pleasant day!

Thank you for your detailed step-by-step answer. I really do appreciate it and it was very helpful and useful.

I am not finding a way to do the payroll liability adjustment in the online product. Is there a way to do that?

Thanks for joining this thread, @9130347741107916.

I'm glad to help guide you to the right support that can help you with payroll adjustments.

Contacting our QuickBooks Payroll Team is the best way to handle your payroll liability adjustments. They have tools that can pull up your account securely and do the correction for you.

Here's how to reach them:

To ensure we address your concern on time, our representatives are only available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. You can check out our support hours and types for more details.

On the other hand, you may check our Help articles for future reference about QBO and payroll: Help articles for QuickBooks Online.

Also, these articles will guide you on how to check your e-fling status and prepare for your year-end filing of taxes and forms.

Please let me know how the call goes and if you need anything else. I’m more than happy to help. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here