Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowWhat would be the best way to handle a person that was an hourly employee before promotion that after promotion will be converted to a salary person?

Thoughts:

(1) Can these two types appear on one payroll cycle? If not, then I assume I would have to run an unscheduled payroll for pre-promotion, then an adjusted payroll prorated at salary post promotion.

What I have seen previous practice was to create a different spelling of the person, but I know this will cause an issue with W2s at YE. So, I know that is not ideal.

This is what I'm currently thinking. Run an unscheduled payroll at the hourly rate. Process. Then go to the employee profile change settings to salary and continue payroll from thereon at the salary prorated rate.

Bonus Related Question:

Also, is it possible to merge duplicate employees one was configured to hourly rate and one was configured at salary rate? Example: John Merry Doe (Employee ID 1001) J. Merry Doe (Employee ID 1002).

Solved! Go to Solution.

RE: 1) Can these two types appear on one payroll cycle?

Yes. That is easy to do.

RE: What I have seen previous practice was to create a different spelling of the person, but I know this will cause an issue with W2s at YE.

It causes many more issues than that, in several cases. This is not a good idea.

RE: is it possible to merge duplicate employees one was configured to hourly rate and one was configured at salary rate?

No, it is not possible to merge two employees when they have both been paid. You can merge an employee who has no payroll into another that does.

Here's what do to:

If the employee's promotion is effective mid-pay-period, then for the paycheck for that period:

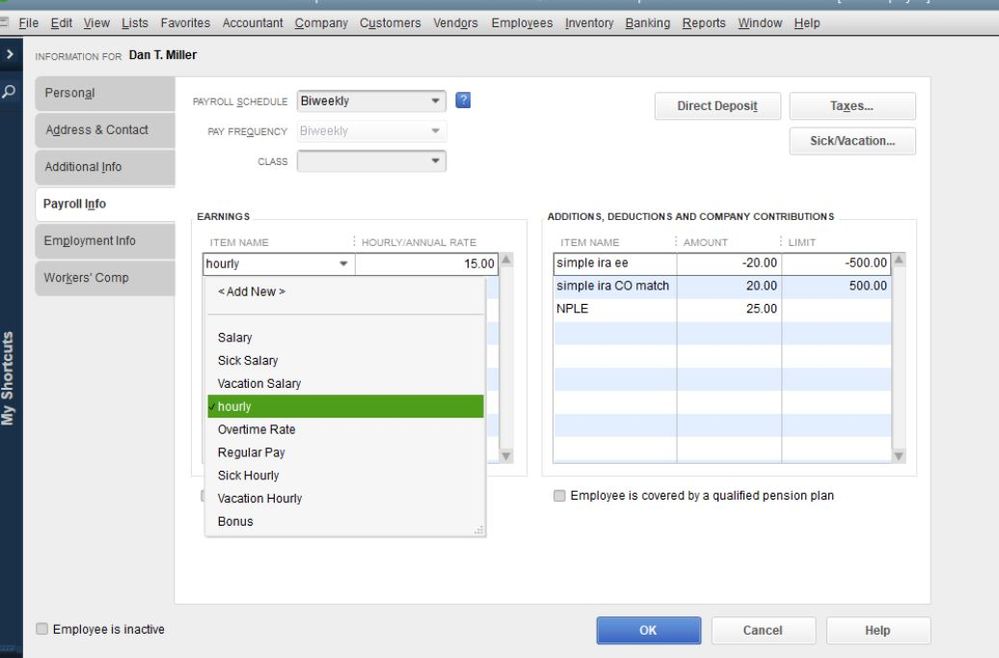

1 - As you're creating payroll click the employee's name to open the paycheck preview.

2 - Pay the employee for their hourly hours as normal, for the part of the period they were hourly.

3 - Add the salary item you want to use to the earnings table. For the pro-rated salary amount, manually calculate the salary/day based on the period salary. For example, if you pay every other week and the salary for that period is $2000, then the daily salary is calculated like: $2000/10 days work or $200 per day. If the employee worked 4 days of the period on salary, then the salary amount is $800.

4 - Complete the payroll as normal.

Then:

5 - Edit the employee, and then remove the hourly items and add the salary item, entering the annual salary there (using the example above, enter $52,000.)

6 - On your next payroll, make sure the paycheck includes only the salary (some settings might make QB pull in the prior paycheck's earnings table details.)

Thanks for sharing what you'd like to achieve, @User_20200731.

We're unable to use hourly and salary rates in one payroll cycle. Though, we can create an item manually and add it to the employee's paycheck.

Here's how:

Then, we can now add the item to the paycheck. I'll guide you how:

Once done, let's change the rate of your employee to salary. Moving forward, this rate will show on your employee's info.

Also, to merge duplicate employees, you can make it identical to the one you're merging it with and click OK. Then select Yes to confirm.

Additionally, I've included an article that'll guide you in viewing what you've paid out. This way, you'll keep track of your payroll totals: Create a payroll summary report.

We're always here to help if you have other payroll concerns. Have a great day!

What happens if an employee voluntarily transfers from salary to hourly what would the process be to convert in that direction also, and avoid creating a duplicate employee profile?

The employer must be informed if an employee wants to be paid on an hourly rate, User_20200731.

You'll just have to edit the employee's earning information to change from salary to hourly and to avoid duplicate employee's profile.

Here's how:

In case you'll want to customize your payroll reports, here's an article for your reference: Customize Payroll And Employee Reports.

Drop a reply below if you need further assistance. I'll be here to help.

How identical does the duplicate employee A need to be to duplicate employee A.1?

What are the minimum essential items that are required to be the same to have a successful merger?

Thanks! @CharleneMaeF

Employee A

First Name: A.

Middle Name: Example

Last Name: Example

Payroll Schedule: Biweekly

Item Name = A - Hourly

Various Taxes

Class = 123

Employee A.1

First Name: ATrue

Middle: Example

Last Name: Example

Payroll Schedule: Biweekly

Item Name = A – Salary

Various Taxes – 1

Class = NULL

You're on the right track, @User_20200731!

You can create a new employee profile with the salaried payroll data so you can merge it with the existing one. No need to duplicate all the payroll information as long as the employee's legal name is a match, QuickBooks will merge it successfully.

In addition, here's an article you can read to learn more about how to merge any names: Merge Accounts, Customers, and Vendors.

Lastly, I've got you this helpful article for ideas about how you can create a payroll check: How do I create a paycheck for an employee?

Keep me updated in the comments if you have any other questions. I'll be here to lend a hand.

RE: "We're unable to use hourly and salary rates in one payroll cycle. "

Yes, of course you can. QB has always supported using both hourly and salary items on the same paycheck.

RE: 1) Can these two types appear on one payroll cycle?

Yes. That is easy to do.

RE: What I have seen previous practice was to create a different spelling of the person, but I know this will cause an issue with W2s at YE.

It causes many more issues than that, in several cases. This is not a good idea.

RE: is it possible to merge duplicate employees one was configured to hourly rate and one was configured at salary rate?

No, it is not possible to merge two employees when they have both been paid. You can merge an employee who has no payroll into another that does.

Here's what do to:

If the employee's promotion is effective mid-pay-period, then for the paycheck for that period:

1 - As you're creating payroll click the employee's name to open the paycheck preview.

2 - Pay the employee for their hourly hours as normal, for the part of the period they were hourly.

3 - Add the salary item you want to use to the earnings table. For the pro-rated salary amount, manually calculate the salary/day based on the period salary. For example, if you pay every other week and the salary for that period is $2000, then the daily salary is calculated like: $2000/10 days work or $200 per day. If the employee worked 4 days of the period on salary, then the salary amount is $800.

4 - Complete the payroll as normal.

Then:

5 - Edit the employee, and then remove the hourly items and add the salary item, entering the annual salary there (using the example above, enter $52,000.)

6 - On your next payroll, make sure the paycheck includes only the salary (some settings might make QB pull in the prior paycheck's earnings table details.)

What would be the best way to go about correct two employee profiles, after payment has been has been issued? These two employee profiles are for the same employee but payment has been issued and this spans over several months. @BigRedConsulting

This is a hard case for a few reasons:

1. You can't change the employee name on an existing paycheck.

2. You can't merge two employees that have both been paid.

3. The taxes on the paychecks may have over-run the annual limits, since they're split between two employees.

Here's what I'd do, very carefully:

In the end, you'll keep the employee that has a lot of data, and work to remove the new one incorrectly set up, which has only a few months of data.

One paycheck check at a time, starting with the oldest paycheck for the new unwanted employee, create a new paycheck for the old employee that is a duplicate:

- Make sure all the payroll items and amounts - from Gross to Net - are exactly the same on the new check as on the existing check, even if you have to overwrite the amounts manually. Technically, you don't need to do this for the company paid taxes and other company paid items, as they don't contribute to the check amount, but you can do so.

- Double check that all the amounts are the same using payroll reports for the period you're duplicating the checks. The main "Payroll Summary" report will be useful in this case. You can filter it for one day, and/or for the entire period in question.

- Once you're sure the new paychecks mirror the existing ones, then carefully delete the paychecks for the unwanted employee.

- Then delete that employee from the employee center.

So, here is some additional clarification of what I ended up doing with QuickBooks Payroll support.

As previously mentioned in the thread, you need to have the hourly and salary set up.

However, you need to reverse engineer the gross annually salary by the expected payroll gross total for the salary component (manually calculate), and then process payroll. After payroll has been processed, then update the Employee Profile to reflect the true annual salary.

Example if company is set up biweekly:

Yes, you can do salary and hourly on one payroll. But, you need to do it carefully and thought out.

Thanks @BigRedConsulting !

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here