Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I’m happy to see you today, @doctorsheahan.

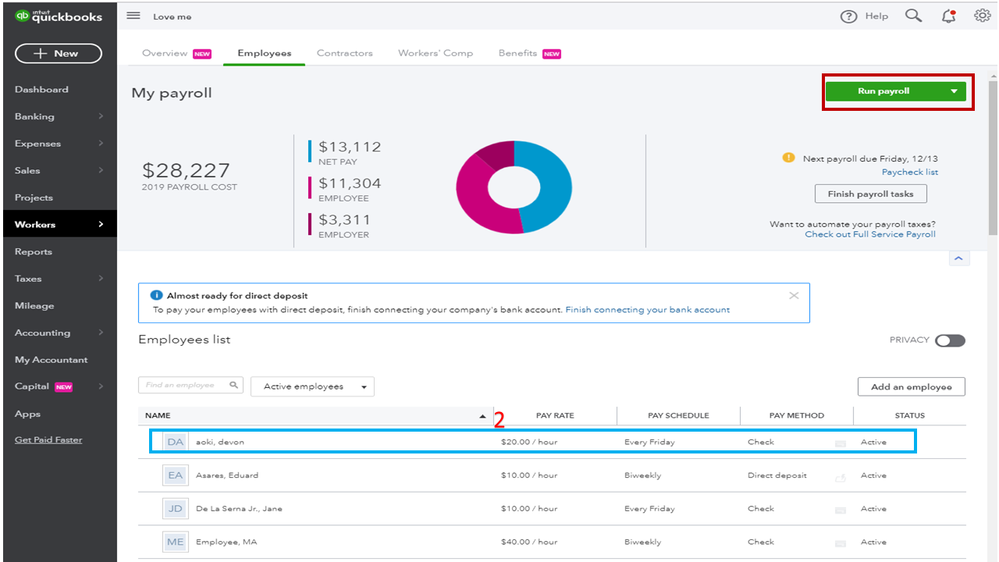

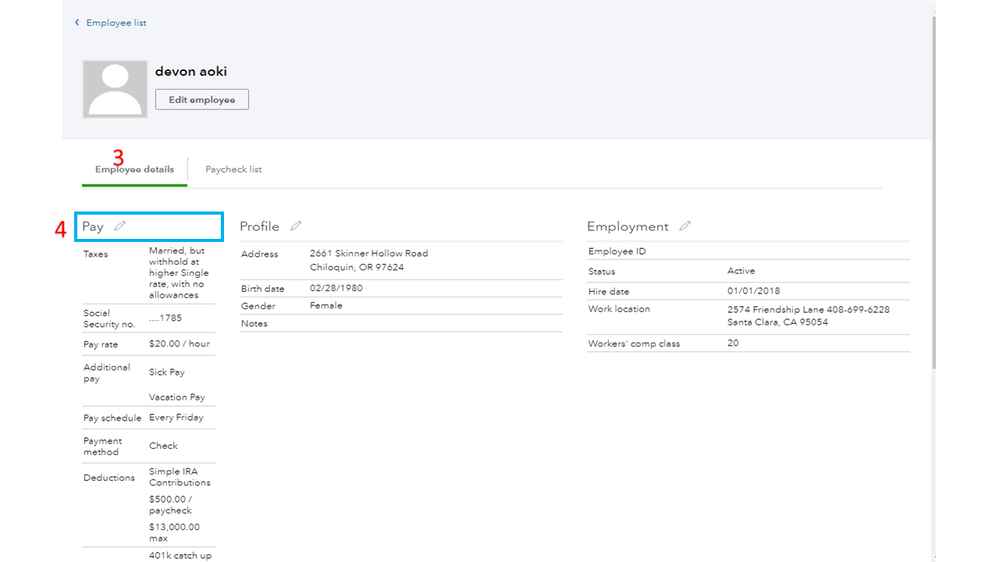

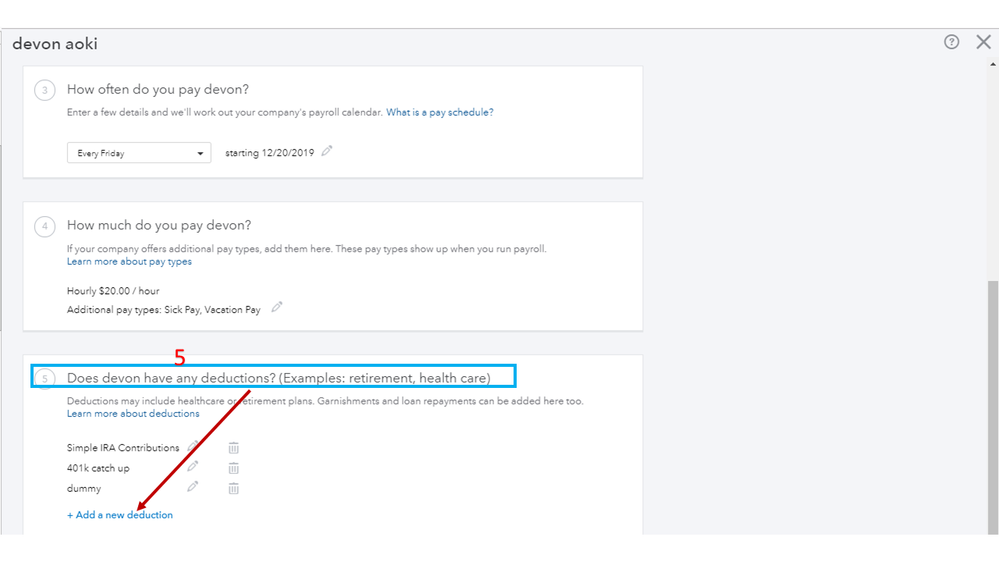

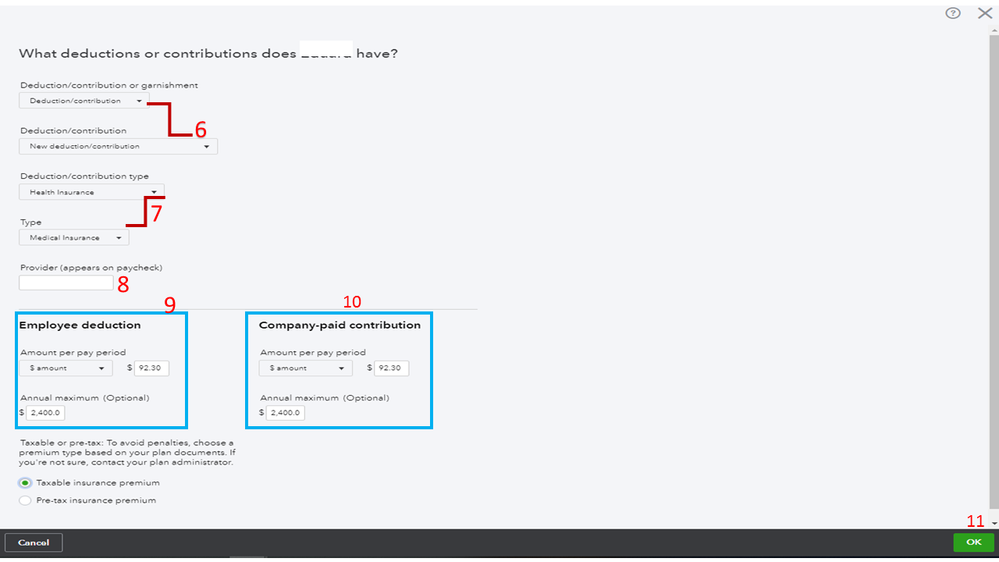

Welcome aboard to the Community. Let’s go to the employee’s profile and then manually enter the correct contribution in the Amount per pay period section.

Here’s how:

In regard to the premium, the calculation should be (200x12)/26 since it’s on a bi-weekly schedule. Simply click on this link to learn more about the number of payouts per year and proceed directly to the Pay schedule section to view the complete details.

For additional information such as contribution limits and which box on the W-2 the health insurance is reported, check out this article: Set up Health Savings Account (HSA) plans.

Post a comment below if you have additional questions while working in QuickBooks. I’ll pop-right back in to assist further. Have a great rest of the day.

This solution does not make sense.

If I do that starting in January and there are 2 pay periods I will have deducted $184.60 from the employee's pay for the actual $200 premium that is owed in January. If the employee resigns after the second paycheck then the company is out the $15.40 remaining premium for January.

How is that money accounted for?

Hello there, DanN69.

You have the option to edit the employees paycheck and enter the deduction in a lumpsum amount so you don't have any balance on the next pay period. I still suggest reaching out to a payroll advisor so they can advise the correct way on how to create final paychecks of your employee.

Once you create the employee’s final paycheck, update their employee status. This removes them from your active employee list so you don’t get billed for them anymore. You can refer to this link for more details: Update their employee status.

Feel free to leave a reply below if you have additional questions in processing payroll. Take care!

Terrible solution.

Because the system can't handle it I have to do extra work of accounting for monthly bills that do not reconcile because the employee has not paid the full amount each month. Then when we have a 3 paycheck month the employee has overpaid and I need to account for that.

Then if that wasn't enough if an employee leaves mid-year I have to do a calculation to reconcile their medical deductions MANUALLY.

With some programming and computers you would think the system could figure out when a 3 paycheck month is coming and adjust.

Have you found a solution to this problem? I have the same issue. Unfortunately, it seems that the payroll companies do not accommodate this (I checked with three of them). I agree with you, that it would be a simple programming on a back end.

Hi EwaM,

While we're unable to set up a bi-weekly schedule for monthly health insurance, I recommend sending feedback to our product development team. That way, they can consider adding such an option in future updates.

On the other hand, if you want to see some references for QBO payroll, you can go to the main support page, scroll down a bit, and click More Topics.

Let me know if you have any other concerns. Have a good one.

Terrible solution, you guys do know that you have a payroll product that you charge hefty fees for..

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here