Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

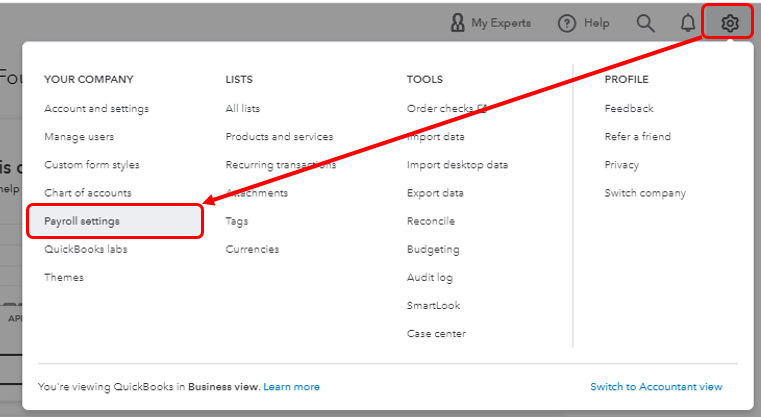

Buy nowI've got the steps you need to update your WA Workers Comp rates for the existing Class Code in QuickBooks Online, accounting328.

Here are some pointers that you can check to learn more about how QuickBooks Online handles workers comp:

Understanding Workers' Comp Report.

Washington workers' compensation setup and calculations.

However, if you're still unable to update the rates, I'd suggest getting in touch with our QuickBooks Support. They have the tools requires to edit existing class codes and rates.

Please be reminded that our Support Team is available from 6:00 AM until 6:00 PM on weekdays, and 6:00 AM till 3:00 PM on Saturdays. Here's how to contact us:

1. Click the Help (?) icon.

2. Choose Contact Us.

3. Enter a brief description of your situation in the What can we help you with? area, then click Let's talk.

4. You'll be presented with a few options for connecting with Intuit. Select Get a call.

I'll be right here to continue helping if you have any other concerns or questions about QuickBooks Online. Assistance is just a post away. Take care always.

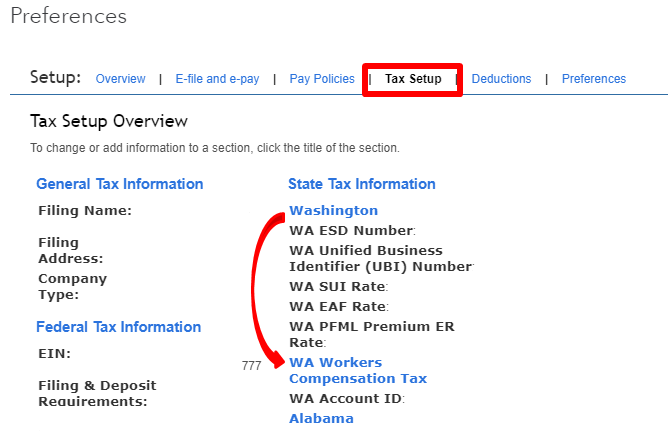

Unfortunately that information is for the older version. The payroll settings is completely different now and there is no option for WA Workers Comp on the list. The Washington tax category is only for Unemployment. Hence my problem. I spend an hour on the chat help only to be told I would have to update each employee individually. That option did not work either as there is nowhere to update rates only the effective date. If you add new class but use the same number which is assigned by the state, you can't save the rate information because that class already exists.

Thanks for the update, @accounting328.

Since the issue persists that you're still unable to update the WA Workers Compensation rate, I highly recommend contacting our Technical Support Team. They have the tools to check the unforeseen conditions of your company file and perform a screen-share for further isolation.

To contact them, follow the steps provided by my colleague RoseMarjorieA. You can also refer to this article for more information: Contact the QuickBooks Online Customer Support team.

As always please let me know how this goes or check back if you need help with QBO. Have an awesome day!

Thank you. I did. It was an extremely unsatisfying conversation. As in the fact that the cost report for PPP Loan Forgiveness is also broken. The payroll compliance department is failing in my opinion.

I'm experiencing the exact same problem and get different answers from QB payroll.

Last week, QB support said you have to call in to have QB update the rate because too many customers were apparently accidentally entering the wrong rates. However, today, the support person mentioned the "back-end" team is claiming that the rates are automatically pulled in based on the class and code. This can't be correct because that disregards each company's "experience factor" (ex. 0.9000).

Someone dropped the ball here and it's wasted a few hours of my time.

Me three...I just spent quite awhile looking all over trying to update the rate as I previously knew how under payroll preferences and could not understand why I couldn't find it for Workers Comp. I'm trying to get all of my clients (and there are several) rates updated before the first payroll run of the year. Does not look like this is going to happen now, beyond frustrating and unacceptable. The only silver lining here is I found this forum before I wasted several more hours on the phone with support...ughhh

Thanks for posting here in the Community and sharing your insights about Workers Comp, @Beancounter_98531,

Since this preference is no longer available in the Payroll Settings, you can contact our Support Team to raise this concern and get some options from our representatives.

They have the tools to check on your payroll and can provide some workaround to update the rates. I'll be leaving the contact options below for reference:

When using the messaging option, a small discussion box will open at the bottom right section of your monitor. An agent will be with you after filling in the information. See this:

See this link to know more about our support operations: Support hours and type.

Here are some of our updated links about Workers Comp in QBO:

Let me know how it goes, as I want to make sure this is taken care of for you. I'm also here if you need further help with anything in QuickBooks.

Thank goodness I found this forum before wasting any more of my time trying to update the WA worker's compensation rates for 2021. So far this upgrade has been a nightmare. I didn't ask to upgrade, Intuit decides to do it at year-end (the absolutely worst time of the year), and then the system isn't even set up correctly on your end before forcing us into your nightmare software. This will be my 3rd call for help with "back-end" problems in the short 2 weeks since we were forced to upgrade. Something that typically takes me 10 minutes is now taking hours. Sad to say that after using this product for many years, I am forced to find an alternative. I will contact customer service, wait for someone to return my call, and hope to heaven someone in this organization has figured out how to update worker comp rates before year-end!

It's like QuickBooks updates and messes with all the parts of the system that actually work and ignores all the things that ACTUALLY need fixed. I'm surprised so many people are having this problem and it STILL isn't fixed. Especially going into a new year, it's important our numbers are correct! First of all, they completely removed the Workers Comp Rate section from the settings and then they tell us the fix is to go into EACH individual employee to update the rates? What about businesses with a lot of employees?? And then there's no way to edit a current assigned rate for the employee, but there's also no way to add the same class code with a new rate. And instead of giving us some notice or instructions about the change we have to dig into the community to find half answers. I saw that someone mentioned that QuickBooks will automatically change the rates for the class code for us but that doesn't take into consideration the Experience Factor and where does QuickBooks tell us that they're taking care of it? Instead of redirecting us to old or generic/useless information.

How about you FIX THE PROBLEM that everyone is very specific about instead of thousands of people tying up many hours of their day talking with useless support staff... Each company has a different rate for L&I based on experience factors...bring back the payroll item so we can update the rates before we have to retro fix many payrolls this year!!

This issue has been broken for months. And Quickbooks has done nothing. I expect enough business owners such as myself will be looking for payroll alternatives next year.

Honestly can't believe that this is STILL NOT FIXED! SMH.

Of course this needs to be fixed, but after reading this I started a chat online and Melody S knew exactly what to do and created a task within a few seconds for me to upload my rate page. While a fix is ideal, this was great customer service in my opinion. It only took 16 minutes to complete from the start of the chat to updated rates.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here