Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Our company has been withholding child support payments from one of our employees. However, since switching to QuickBooks Payroll from ADP 3 months ago, we have not remitted those payments to the state. We have just been collecting that money in a garnishment liability account.

We recently received a notification stating his child support case was terminated and that his account has already been paid in full. So, now we have about $1500 sitting in the garnishment liability account that we need to return to the employee.

How can we return this to him so that it reflects correctly on his YTD totals for garnishment on his paycheck?

I read an article on here stating that while preparing his paycheck, we should choose the same deductions account that we use for the regular garnishment and instead put a negative number in that field. I tried that but it would not let me continue. It gave me the following message:

| Looks like some of your pay items are incorrect. Please fix the highlighted areas before you continue. |

Is there any way to do this?

Thanks for any help.

Solved! Go to Solution.

Thank you for getting back to us and clarifying your concern, @CarlaF.

I want to make sure you can record a refund to your employee's wage garnishment correctly to show the total amount of YTD on his paycheck. I'd like to redirect you to the best support group available to get this addressed right away.

Since QuickBooks Online (QBO) doesn't allow you to enter the negative amount on a paycheck, you'll have to write a check to reduce the employee's wage garnishment. However, considering that writing a check to refund the garnished wages didn't reduce the YTD amount, I suggest contacting our QuickBooks Payroll Team. One of our live agents can help correct the garnished wages on an employee's paycheck. To reach them, please follow the steps below:

You can also check out this article for another way of reaching out to our support team and its support hours: Contact Payroll Support.

You might also want to learn more about the basics of payroll processing in QBO. Here's an article you can read for more details: Payroll tips for small business owners.

Our doors are always open to help you again if you have any other concerns or follow-up questions processing payroll. Have a great day ahead.

Allow me to help and share some information regarding refunding an employee's wage garnishment in QuickBooks Online, CarlaF.

QuickBooks Online doesn't allow you to enter a negative amount for a deduction pay type. This is the reason why you're getting the "Looks like some of your pay items are incorrect. Please fix the highlighted areas before you continue." error.

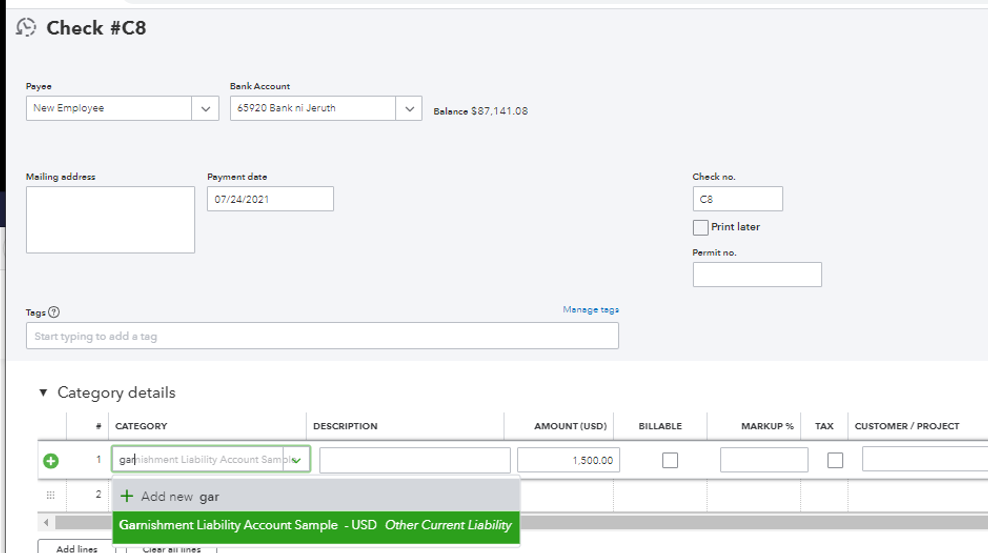

To refund your employee, you can write a check and choose the garnishment liability account where the money is sitting. Here's how to create a check:

To help you manage your payroll preferences and other payroll accounts, check out the following articles: This will provide you steps on how to change your posting accounts for payroll transactions as well as a sample breakdown of a paycheck.

Please let me know in the comment section if you have any other issues or payroll concerns. I want to make sure everything is taken care of for you. Have an amazing weekend!

Hi, CarlaF.

Hope you're doing great. I wanted to see how everything is going about refunding employee's wage garnishment. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I'd be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Thank you for responding Rose. I was able to write a check and reduce the garnishment liability account so that it shows accurately on the balance sheet.

However, my concern is that on his paychecks going forward, he will see the original amount of garnished wages in the YTD totals section. That YTD amount was not reduced when I wrote the check to refund the garnished wages. Is there a way to fix that?

Thanks for your help :)

Thank you for getting back to us and clarifying your concern, @CarlaF.

I want to make sure you can record a refund to your employee's wage garnishment correctly to show the total amount of YTD on his paycheck. I'd like to redirect you to the best support group available to get this addressed right away.

Since QuickBooks Online (QBO) doesn't allow you to enter the negative amount on a paycheck, you'll have to write a check to reduce the employee's wage garnishment. However, considering that writing a check to refund the garnished wages didn't reduce the YTD amount, I suggest contacting our QuickBooks Payroll Team. One of our live agents can help correct the garnished wages on an employee's paycheck. To reach them, please follow the steps below:

You can also check out this article for another way of reaching out to our support team and its support hours: Contact Payroll Support.

You might also want to learn more about the basics of payroll processing in QBO. Here's an article you can read for more details: Payroll tips for small business owners.

Our doors are always open to help you again if you have any other concerns or follow-up questions processing payroll. Have a great day ahead.

I RECEIVED BACK A CHECK FOR AN GARNISHMENT FOR A EMPLOYEE. THE COURT STOPPED THE GARISHMENT. SO I WENT IN AND PUT A PLUS ON HIS GARISHMENT WITH THE AMOUNT THE COURT SENT BACK WITH THE ORGINAL CHECK. SO THE EMPLOYEE HAS HIS MONEY BACK. WHAT DO I DO WITH THE ORGINAL CHECK RETURNED. IS THERE AN ENTRY I NEED TO DO?

THANK YOU,

L. CAMPBELL

Hey, @lcampbell1.

Thanks for chiming in on this thread about a check for a garnishment for an employee. Let me point you in the right direction to get this taken care of.

Since you're needing assistance with the entry, I suggest consulting with your accountant about it to be sure. They'll be able to give you the best advice for your business.

Keep me updated on what you and your accountant decide to do. I'll be waiting for your response!

I can't write a check as it says in the previous comments. I have desktop version. any help would help

Hi there, @selina84.

I want to ensure you can write a check in QuickBooks Desktop (QBDT).

To make sure we're on the same page, I'd like to verify the challenges that you encounter when writing a check. Did you received any error messages? Any additional information will get us closer to the resolution.

We're looking forward to hearing from you. Have a great day!

No error message was prompted just when writing the check and trying to reduce the amount in the liability account of wage garnishments but it won't let me make the check in the name of the employee only to the agency assigned to that liability. just don't know how to do it. If you have any insight on how to do it I will greatly appreciate it

I can see you're trying to write a check to decrease the liability, @selina84. I want to provide some tips about the process.

When you're creating a check in QuickBooks Desktop (QBDT), you won't be able to choose the employee. This limitation exists because only the vendor associated with the assigned tax will be displayed in the drop-down menu.

Nevertheless, we can make a check outside of the payroll. It doesn't affect your liability, but we can do a prior payment to reduce it if needed. I'll guide you on how to do it.

To create a check:

To enter historical payments:

To learn more about this process, read this article: Enter historical payments in QuickBooks Desktop Payroll.

Also, this guide can give you more tips on resolving overdue or red scheduled liabilities: Fix overdue or red scheduled liabilities in QuickBooks Desktop Payroll.

Please comment below if you have any other questions about managing your payroll liabilities. I'll return here as soon as possible to help you again.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here