- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- Re: I need a live person

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

36 Comments 36

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

We'd love to be of help real-time, skelleysr.

Due to COVID-19, we've reduced our support hours to 6 AM-6 PM PT Monday-Friday. Also, 6:00 AM-3:00 PM Saturday. We have limited staffs but we want to let you know we're always here to help.

If you can provide information on how we can help, I'll be sure to help you on that.

As for contacting QuickBooks Self-Employed, please follow these steps:

- Click Assistant from the top menu.

- Enter Talk to a human.

- Select from Start a chat or Get a callback.

You can always leave a reply below if you need further assistance.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

I am new ti qb self employed. i processed four invoices this week. I understand there is a delay on the first few invloices. However, i received an email earlier on 4.2.20 that the money was funding, the transaction report tells me that four of the invoice transactions were funded and the money os not in my account!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

@GlobeTradeGroup Thank you for joining community.

I can help you find the funds. To start, have you checked the correct bank account? Sometimes customers with more than one bank account will look for funds in the wrong bank account.

Have you checked your email for communication from our Payments team? There are times when we encounter problems trying to credit/debit bank accounts. When we are unable to deposit funds, customers will be emailed to inform them to contact their bank to resolve any problems.

If you still can't find your payments, please contact support. Our agents can look further into your account to determine where your funds are.

This link will take you to the QuickBooks support page, where you can select your service and the proper contact channel: Contact Support

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

I WANT TO STOP A DIRECT DEPOSIT PAYMENT OF 99,000.00 WHICH WAS MADE YESTERDAY THROUGH INTUIT ONLINE PAYROLL

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Hi there, @rashid123.

You still have the option to cancel the direct deposit that you made. In doing this, make sure that it is before 5 PM PT and two banking days prior to the paycheck date.

For example, if you've scheduled an employee's paycheque for direct deposit on Friday, you can delete it until 5 PM PT Wednesday. If you wait until 5:15 pm Wednesday, it's too late: the money has been transferred.

To shed more light regarding cancelling a direct deposit in QuickBooks, please see this link: Learn about the deadlines for cancelling direct deposit paychecks.

However, if you don't have the option to delete the paychecks, I'd suggest reaching out to our Customer Care Team. They have tools that can check your account and guide you with the process.

Here's how you can contact them:

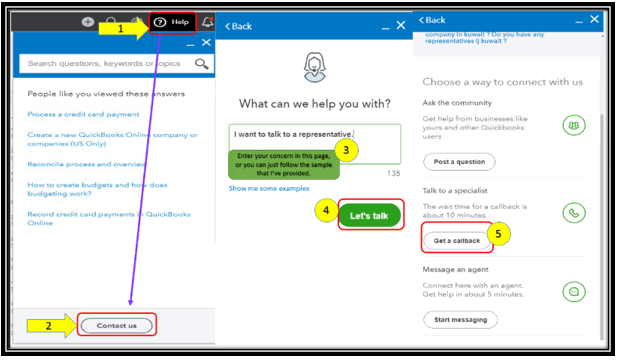

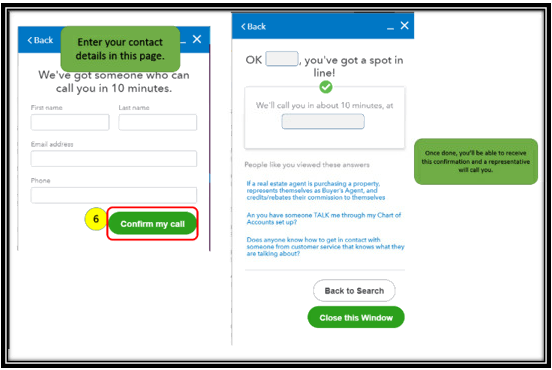

- Click on Help at the top menu bar.

- Hit on the Contact Us button.

- Enter a brief description of the issue in the What can we help you with? box.

- Press on Let's talk.

- Select on Get a callback.

- Key in your contact details, then tap on Confirm my call.

Know that I'm just a few clicks away if there's anything else you need. I'll ensure you're all set. Wishing you all the best in everything that you do.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

I NEED TO CHAT WITH A LIVE PERSON

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Good day, @AWS TRUCKING LLC. I understand the urgency to chat with our live support agents. I'm here to guide you on how to take a hold of them.

Here's how:

- Go to the Help menu, then select the Contact Us button.

- Enter a brief description of the issue in the What can we help you with? box.

- Select on Let's talk., then choose to Start a Chat.

Once done, key in your contact details and hit Submit. Then, wait for an available agent to join you in the chatroom.

Aside from our Chat Support, you also have us here in the Community. I'd also appreciate it if you can share little details on your concern so I can help you with it.

For future reference, you can visit our QuciBooks Articles hub to search for relevant topics that can help you with your concerns.

I'll always be here to listen and help if you have other questions. Have a great day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

How do I file W-2s with the IRS now that I missed the electronic cutoff?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

First, I just spent 30 mins trying to get to a place to contact someone for support. HUGELY unfriendly system and extremely frustrating and waste of time.

1. How do I file W-2s now that I've missed the electronic filing deadline?

2. I need to make a dummy P/R with same deductions for an employee (myself) for my PPP loan filing for 1Q when I was not using your service--started in April. How can I go about that? I have from April on but I have to report 12 mos.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

I know this wasn't an easy process for you, daddyO.

Let me share some insights about filing your W-2 form. Sending your W-2 forms to the IRS is an important payroll task at the end of the year. If you missed filing electronically, you can manually file the W2 forms.

Here's how:

1. Select Taxes, then Payroll Tax.

2. In the Forms section, select the Annual Forms links.

3. From here you can select to print both employer and employees copies of your W-2s and w-3. Employer Copies: Form W-2 (W-2 Copies A&D), Transmittal of Wage and Tax Statements (W-3), Employee Copies: Form W-2 (W-2, Copies B, & 2).

4. Choose the appropriate filling period from the dropdown.

5. Select View to open Adobe Reader in a new window.

6. Select the print icon on the Reader toolbar. Then select Print again.

Note: If you are reprinting because your employee lost or didn't get the original W-2, write REISSUED STATEMENT on the top and included a copy of the W-2 instructions.

If you're referring to setting up a dummy employee for your second question, you can follow the steps in this video on how to create one: How to set up QuickBooks Online Payroll and add an employee.

However, you can only backdate a payroll for 6 months. You can reach ask our Payroll Support Team to create an adjustment to report the last 12 months of deductions.

To connect with our Customer Care support, follow the steps how:

- Click the Help menu in the upper-right hand corner.

- Type in "Talk to a human", then press Enter.

- Look for I still need a human and click on it.

- Click Get help from a human or Contact Support Team.

- Select between Send a message, Schedule an appointment, or Get a callback.

See this article for detailed guidance: Contact the QuickBooks Online Customer Support.

You might also want to read this article to learn more about filing your W-2 forms.

Keep me posted if you have other questions about the popup ads. I'll be here to help however I can.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

I need help getting on quickbooks that i have been on for years. My Company changed my email address and i believe that is why i can't get on. Please help me because i'm not treasurer anymore and the new treasurer is trying to get on

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Hi there, JW37.

You may reach out to either the company's admin or to the new treasurer. This way, they can let you have permission to access the account.

You can share this article with them on how to add a user access: Add and manage users in QuickBooks Online.

I'll be around if there's anything that I can help. Keep safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Need help running my payroll. The system indicated that I could not run because I already paid the maryland taxes for the quarter, but our employees have not been paid for the period ending May 7, 2021. I need to create their paycheck today

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Was talking to Jessica, can I get her back?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Hello @Phil Reed,

Here in the Community, we're unable to connect you directly to our specialists from Customer Care Support. Even if you've already contacted them, I'd still recommend getting in touch with our Phone team directly from the Help menu to continue where you left off.

Before we proceed and if you don't mind me asking, may I know what the is specific help you need? While you're able to connect with us here in the Community, I'd like to offer help as long as it doesn't require pulling up your account on file.

That said, here's how you can connect to our specialists:

- Go to Assistant.

- Enter Talk to human in the Search address.

- Type in how you wanted to accomplish your goal for today.

- Click I still need a human.

- Select Message an agent or Get a callback.

In addition, here's an article you can read to learn more about when are you able to connect with our support: Contact QuickBooks Products and Services Support.

Lastly, I've also included this reference helpful with the resources needed so you can keep the security of your account up-to-date: Account Management for QuickBooks Self-Employed.

Don't hesitate to post again here if you have other questions or concerns with QuickBooks tasks and navigations. I'm always around happy to help. Take care and stay safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

I want to add Quick Books to my new computer. The computer Quick Books on now is not responding at all

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Thank you for joining in the thread, @pmugs.

I can help you install QuickBooks on your new computer.

First, you'll have to make sure that your new computer meets the minimum system requirements. Then, you can start the installation process.

Here are the steps to install QuickBooks:

Prepare for the installation

Install QuickBooks Desktop

QuickBooks Desktop Activation.

You can also review this article for the remaining steps: Install QuickBooks Desktop.

Please feel free to read these handy articles for your reference:

- QuickBooks Desktop doesn't start or won't open

- Set up and install a multi-user network for QuickBooks Desktop

We're always available to back you and your business. Take care!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

I am filing aurterly payroll return (Form 941), but cannot find Worksheet 2 for employee retention credit.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

I need payroll assistance.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

My QuickBooks "Help" tab does not show anything when I click on any item on the menu.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Hi there, @Kenne.

I want to make sure you can reach out to one of our support agents to help generate form 941 Worksheet 2.

Since your Help button isn't working, let's try accessing your QuickBooks account using a private or a different browser. Once logged in, please follow the steps below to reach out to our support team:

- Click the Help button.

- In the QuickBooks Assistance chatbox, select Talk to a human and choose I still need a human.

- Select Contact Us.

If the Help button still isn't working, you can use our QuickBooks Online test drive to reach out to our support team. Or check out this article for another way of reaching them out and its support hours: QuickBooks Online Support.

You may want to know more about filing quarterly tax forms in QuickBooks Online. Here's an article you can read for more guidance: File quarterly tax forms.

Feel free to visit our Community forums again if you need more assistance filing forms. We're always here to help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

having trouble to pay online with some of the co. since we have 7 different company and some can pay online but others can't.

Please help ASAP!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Hi there, 4seasonsintl.

Can you tell us what happens when you pay online? We just want to make sure that we're giving you the right steps and info to resolve the issue.

Please add another reply below to share more details.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need a live person

Greetings, @Cassandragay.

I want to make sure that you'll be able to cancel your subscription successfully and get a refund if there is an invalid charge.

Canceling a subscription and processing a refund would need your personal information. This means it can't be done here in the Community. But reaching out to QuickBooks Self-Employed support is the best option to complete your request.

Follow these steps:

- Sign in to your QuickBooks Self-Employed account.

- Go to Assistant.

- Select Contact Us.

- Enter your concern, then select Let's talk.

- Choose a way to connect with us:

- Start a chat with a support expert.

- Get a callback from the next available expert.

- Ask the community to get help from businesses like yours.

I would like to add this article as your reference if you want to cancel your subscription on your end: Cancel your QuickBooks Self-Employed subscription.

I'm always here to help if you need additional assistance, just click on the Reply button below.

Need QuickBooks guidance?

Log in to access expert advice and community support instantly.

Featured

Make your QuickBooks Online invoices, estimates, and sales receipts work

fo...

This episode of Quick Help with QuickBooks will guide you through

QuickBook...

Want to master your banking and reconciliation process in QuickBooks

Online...