Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello ialam,

If you're adding an employee HSA contribution (a deduction item). Please follow the steps below:

QuickBooks will automatically calculate the HSA deduction on the employee's payroll. Also, these deductions will be reported in the box 12 of W-2 forms. But, this is excluded from federal wages (SS & Medicare) and most state wages.

For more details, please check out this article: Set up Health Savings Account (HSA) Plans.

Otherwise, you'll need to add it as an additional pay item. This will be reported in the employee's total wages. To learn more about it, please see this article: S-Corp Owners Health Insurance.

We'll be glad to help if you need anything else.

Thank you for your response. As per IRS, HSA Contribution for >2% shareholder of S-Corp must be included in federal/state wages and reported in W-2 box 1 but not in box 3 &5. As a result, this contribution will be taxable for federal/state income tax but exempted from Payroll taxes (SS/FICA/Medicare).

Also, HSA contribution for >2% shareholder of S-Corp should be reported in box 14 in W-2 and NOT in box 12.

In QBO, I do not see any 'Pay Type' that can help us to record HSA contribution for >2% shareholder of S-Corp correctly to meet IRS requirements.

Any help will be greatly appreciated.

Good day, @ialam.

Thanks for reaching out to us. Let me help provide some additional information about Health Savings Account (HSA) contribution.

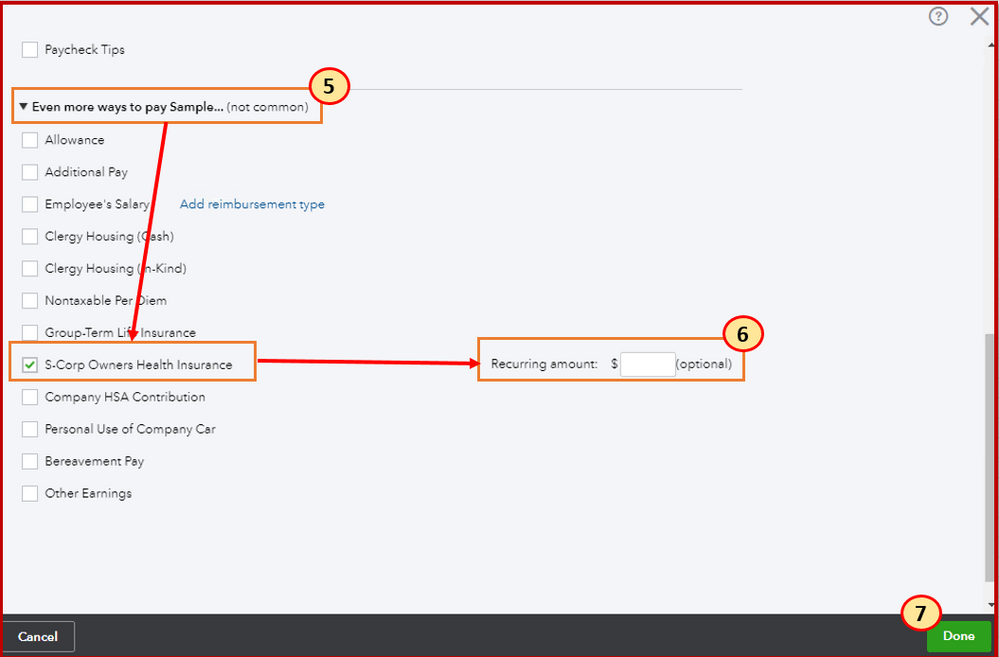

For shareholder-employees who own 2% or more of an S Corporation, do not select Company HSA contribution. Your contributions are taxable at the federal level and in some states. In this case, you'll need to set up S Corp item instead of HSA Contribution.

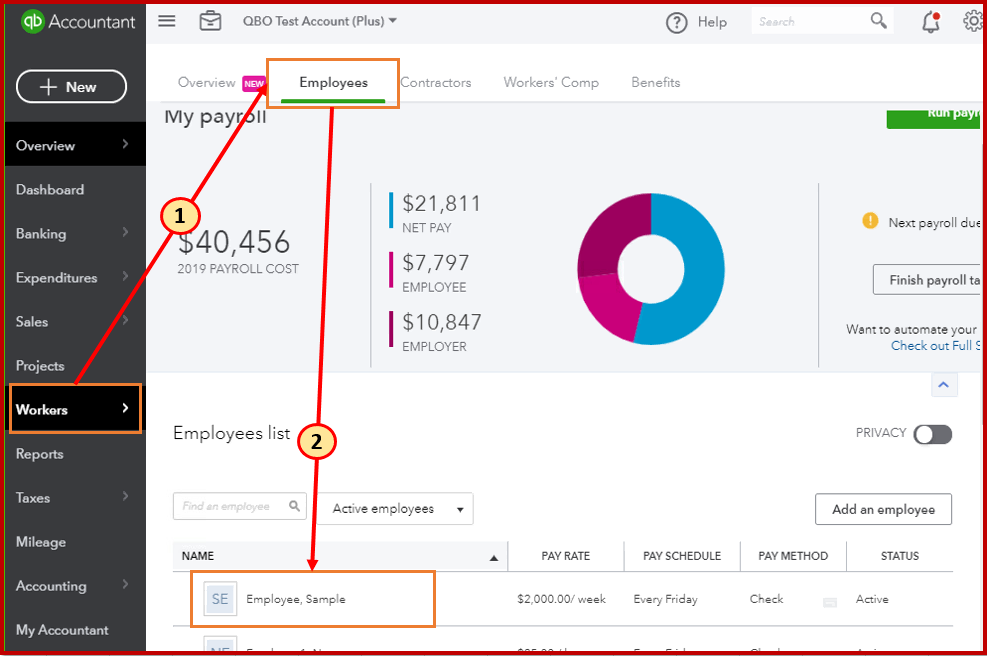

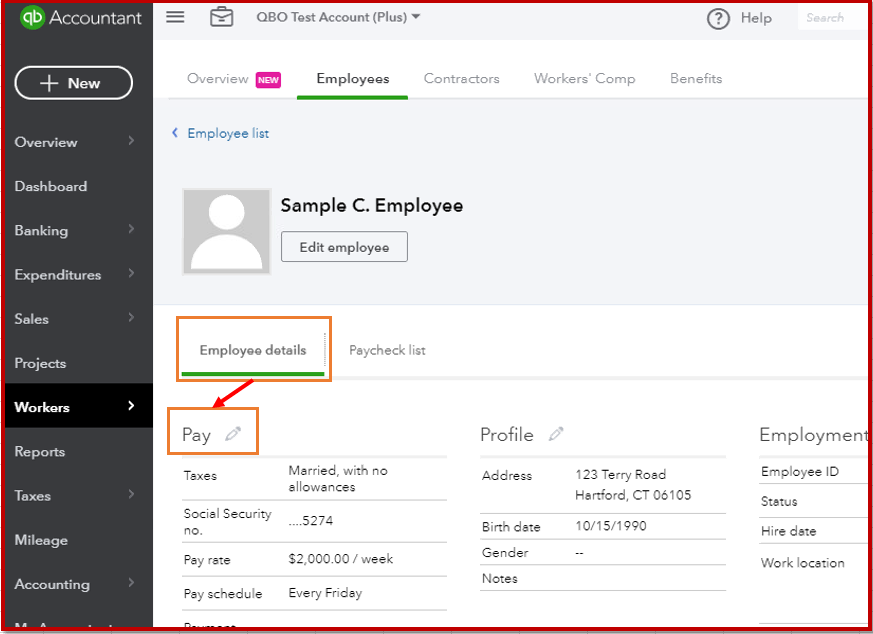

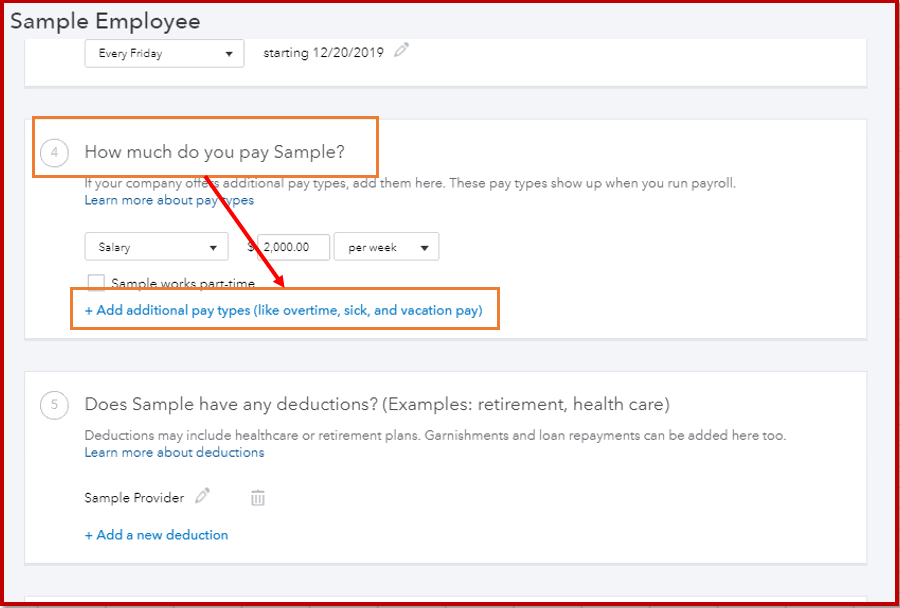

Here's how to add the S-corp owners health insurance pay type for an employee:

For additional reference, please check these articles:

If you need further assistance with the steps from our live support, here's how you can contact them:

Don't hesitate to leave a comment below if you have any other questions. Have a good one.

Thank you for your response once again.

You and I are on the same page as you did mention that "For shareholder-employees who own 2% or more of an S Corporation, do not select Company HSA contribution. Your contributions are taxable at the federal level and in some states".

However, you suggested to set up 'S Corp item instead of HSA Contribution'.Please suggest how to setup 'S Corp Item' to handle HSA contribution.

Thanks in advance!

Thank you for getting back to us here in the Community, @ialam.

Allow me to join the thread and help share additional information about setting up an S-Corp Owners Health Insurance in Quickbooks Online (QBO).

The S-Corp item mentioned by my colleague JanyRoseB, is the S-Corp Owners Health Insurance that must be added to the pay type of the employee. The steps to add the S-Corp owners health insurance pay type was also provided above.

For additional reference, you can also check this article: To add the S-corp owners health insurance pay type for an employee.

Please know that I'm always here to help you if you have any other payroll concerns, just add a post/comment below. Wishing you the best!

Thank you again.

Ok. So in this case, do you recommend adding S-Corp Owners Health Insurance Item and include HSA contribution in this Item? If yes, then I think it will work for Tax calculation but there will be just a single entry in W-2 box 14 for S-Corp Health Insurance Premium and HSA contribution.

Appreciate any further comments.

Thanks for getting back to us, ialam.

Let me guide you to the right support so you can get the help you need.

To further assist you on setting up the S-Corp Owners Health Insurance Item and HSA contribution, I recommend calling our QuickBooks Online Payroll Support Team. They have the tools to do a screen share so they can walk you through the process and ensure that the item will reported in box 14 in W-2.

You can contact them by following the steps I provided on my first post.

You're always welcome to post again if you have any other questions. Wishing you and your business continued success.

I am in the same boat. Did you get this resolved?

Hi there, Were you able to resolve this issue? I am on the same boat and would like to know where to add the HSA contributions to > 2% shareholders.

Appreciate your help in advance.

Let me clarify things out, vvicky72.

As mentioned in this thread, you won't select the company HSA contribution for shareholder-employees who own 2% or more of an S corporation. This benefit is taxable at the federal level and in some states.

You need to set up the S-Corp pay type on your employee and enter the amount from there. This will be reported on the W-2: Box 1 and $ amount in box 14 with “S CORP OWNER”.

Let me show you how:

After that, you can then run payroll that includes the S-Corp contributions.

I've added this article for additional information: Set up and record S-Corp health insurance. it provides three ways to do enter this pay type in QuickBooks Online.

Don't hesitate to get in touch with me here anytime you need a helping hand. I always have your back.

Thank you very much for your reply. I already use the "Scorp owners health insurance" for Insurance premiums paid by the scorp. How can I use the same section to show HSA contributions as well ?

Hi there, @vvicky72.

Thank you for coming back to us in the Community.

Since you don't have an option to click the +Add as mentioned on the steps provided by @MaryLandT, click on the Pencil icon on the 4th section, How much do you pay.

There, you can now use the same section to show HSA contributions as well.

Please follow the steps provided by my colleague.

Should you have questions, leave a message for assistance. I'm always here to help you. Take care, and enjoy your day!

Thanks again for Replying. The HSA contribution section you have highlighted is only for providing "Fringe benefits" to employees who are NOT 2% shareholders of the company. 2% shareholders are supposed to pay Fed/State taxes on the HSA contribution (considered as wages). As far as taxation goes its similar to the "Scorp owners health insurance". As a 2% shareholder of my scorp I don't know where to add that HSA contribution.

Thanks.

Allow me to chime in for a moment, @vvicky72.

We comply with the IRS tax regulations. Since you're part of the 2% shareholders, the setup is different. Instead of creating the item as Company HSA Contribution, I suggest adding it as an employee deduction.

However, please note that the taxability of the item will depend on how you want to report this to your federal tax forms. You can either set it up as a pretax or taxable HSA.

For additional information about the supported pay types and deductions, check out the following article. It also contains detailed information about the taxability or how the items affect taxes and forms:

Supported pay types and deductions explained.

Stay in touch whenever you have additional questions about QBO. I’m here to make sure you’re taken care of. Have a great rest of the day.

Hi @vvicky72,

I have fully read the thread about your concern and allow me to share some information.

Right now, QuickBooks Online Payroll doesn't support yet recording the Company HSA contribution with >2% shareholder-employees. I would suggest consulting your tax adviser on how can this be done manually.

While QuickBooks aims to find new ways to make sure that your product meets your needs, I'll be taking note of this. I'd also encourage you to check our QuickBooks New Features to be updated of the latest product enhancements.

Let me know if you have other concerns. I'd be glad to assist you.

This is incorrect information for an HSA contribution by an S Corporation. As stated in the thread above, an S Corp SHOULD NOT use the Company HSA contribution option. And, as yet, I still do not see where QB supports HSA contributions by S Corps so that they appear in box 1 (and box 16 for some state), but not subject to FICA.

Thanks for joining this conversation, @LAC1.

In QuickBooks Online Payroll (QBOP), the ability to record or enter the Company HSA contribution by S Corporation is still not supported yet as mentioned by my colleague @KarenEdithL above.

I can see how having this option would be helpful for you and your business. Rest assured that I'll pass along your suggestion to our Product Developers. They're always looking for ideas to consider on how to improve QuickBooks.

In the meantime, I recommend visiting our Blog site. This is where we share recent happenings and future developments, such as updates to newly added features.

Just in case, I'll add these articles for future reference:

Please let me know in the comment if you have any other issues or concerns, and I'll get back to you as quick as possible. I'm always here to help. Have a great weekend!

@FritzF It is unacceptable that in payroll, QB cannot support >2% shareholder S Corporation HSA contributions, yet it correctly handles S Corporation Owner health insurance premiums. When I call QB Support and describe the problem, the agent has no clue to what I'm referring and describing as the problem. As of this writing, I STILL do not know how to enter HSA contributions in payroll made by my S Corporation so that they accurately appear in Boxes 1 and 16, but not 3 & 5 (FICA wages).

If you have this figured out, please post. i figured out how to make the check, but then it takes county taxes out and I can't zero it. When I hit do not withold county under the employee, then the check is right but the W2 is wrong. Please help!

I too am having the problem with >2% s-corp shareholder including HSA in Box 1 and NOT Box 3 and Box 5. It seems like it should be easy for Intuit to do this because the same treatment is being done for S-Corp Medical Insurance (subject to FIT-Box 1, but NOT subject to Medicare/SS (Box 3 and 5). They just need to create the same pay type as S-corp Medical Insurance but call it something like HSA >2%. Should be SUPER EASY. I am using Quickbooks Payroll Enhanced in conjunction with Quickbooks Desktop Pro so hopefully they will be able to port the solution to this into that program as well.

I support your position here, @texasdoc.

We always appreciate customers who take the time to give us their feedback. I'll be sure to pass this along to our developers so they'll know what they need to consider in future product updates.

While this isn't an option yet for QuickBooks Online Payroll, I'd recommend reaching out to a tax adviser as mentioned by @KarenEdithL so they can guide you on how to manually record this in QuickBooks.

If there's anything I can do, please let me know. I want to help however I can. Good day!

Hello Karen,

Any resolution on this or expected timing when this will be taken care of?

The company HSA contribution for the 2% S-Corp shareholder should really mirror the settings of the S-Corp Owners Health Insurance, so I am not sure why this is not available yet.

Thank you,

Thanks for joining us here in the Community, @ds tax.

At this time, the ability to track the Company HSA contribution for the 2% S-Corp shareholder is unavailable. We don't have a specific time frame on when is this going to be implemented. Rest assured our developers will evaluate preferences received and put it under consideration.

To record your taxes accurately, its recommended to seeking assistance from your tax advisor. This way, you'll be guided on how can this be done manually.

To stay in the loop about our current news and updated including product road-maps, please visit our QuickBooks Online Blog.

If there's anything else that I can help you with, let me know. I'll make sure you're taken care of. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here