Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have walked through the steps to create a payroll item for the National Paid Leave for Coronavirus Quarantine. However, whenever I go to pull that item into an actual payroll check, it is not listed. It is listed in the overall Payroll items list, but not listed when I try to create a paycheck using that as the "item". Can anyone help me figure this out? I assume I need to use that as the payroll item on the paycheck in order for the correct credit to be issued on the 941.

Solved! Go to Solution.

I'm here to provide additional steps to include the National Paid Leave for Coronavirus Quarantine item on the paycheck, charlamarla.

You're on the right track. All you need to do is add the payroll item when you run a payroll. Let me show you how:

You can also refer to this page: How to track paid leave and sick time for the coronavirus for instructions and detailed steps.

Don't hesitate to leave a comment below if you need anything else concerning payroll. I'm always right here to help.

I'm here to provide additional steps to include the National Paid Leave for Coronavirus Quarantine item on the paycheck, charlamarla.

You're on the right track. All you need to do is add the payroll item when you run a payroll. Let me show you how:

You can also refer to this page: How to track paid leave and sick time for the coronavirus for instructions and detailed steps.

Don't hesitate to leave a comment below if you need anything else concerning payroll. I'm always right here to help.

That was the step I was missing. Thanks so much!

We are having the same problem as charlamarla. The steps you describe make sense, but we can't select the payroll item "national paid leave credit" in Step 5 to add to the Other Payroll Items box. Tried removing all items from the Earnings box as suggested in Step 4 but that didn't work, and not really understanding why we would need to do that. Is there something we have to "turn on" to make this possible? Thank you.

We are having the same problem as charlamarla. The steps you describe make sense, but we can't select the payroll item "national paid leave credit" in Step 5 to add to the Other Payroll Items box. Tried removing all items from the Earnings box as suggested in Step 4 but that didn't work, and not really understanding why we would need to do that. Is there something we have to "turn on" to make this possible? Thank you. |

Hi, charlamarla. Can you describe the step you were missing? I think we are having the same problem you described in your request, but can't figure out what that missing step might be. We feel like we've performed all the steps described by Intuit help. Thanks.

Hey, @Lesalbis.

Thanks for reaching back out to the Community and clarifying that Step 5 isn't working for you.

The best and easiest way to get this payroll item setup is by contacting our Customer Support Team. They can use their screen share tool to walk you through the steps again to help you out. Here's how:

Here's an article that can help you and your business in the future: How to track paid leave and sick time for the coronavirus.

Once you get in touch with our Support Team, you'll get this problem resolved in no time. If you run into any trouble along the way, just let me know. I want to make sure all of your concerns are addressed. Take care!

2020 is done; however, I still have the National Paid Leave - Health showing on my Pay Liability screen and in the outstanding liabilities on my Balance Sheet. What do I have to do to fix this?

Can someone walk me through the steps?

Thank you,

Cheryl

Hello there, CAC3.

Thanks for reaching out to the Community about your payroll liabilities concern. Let’s review the posting account for your payroll items. Then, make sure they’re posted to a liability account to fix the issue.

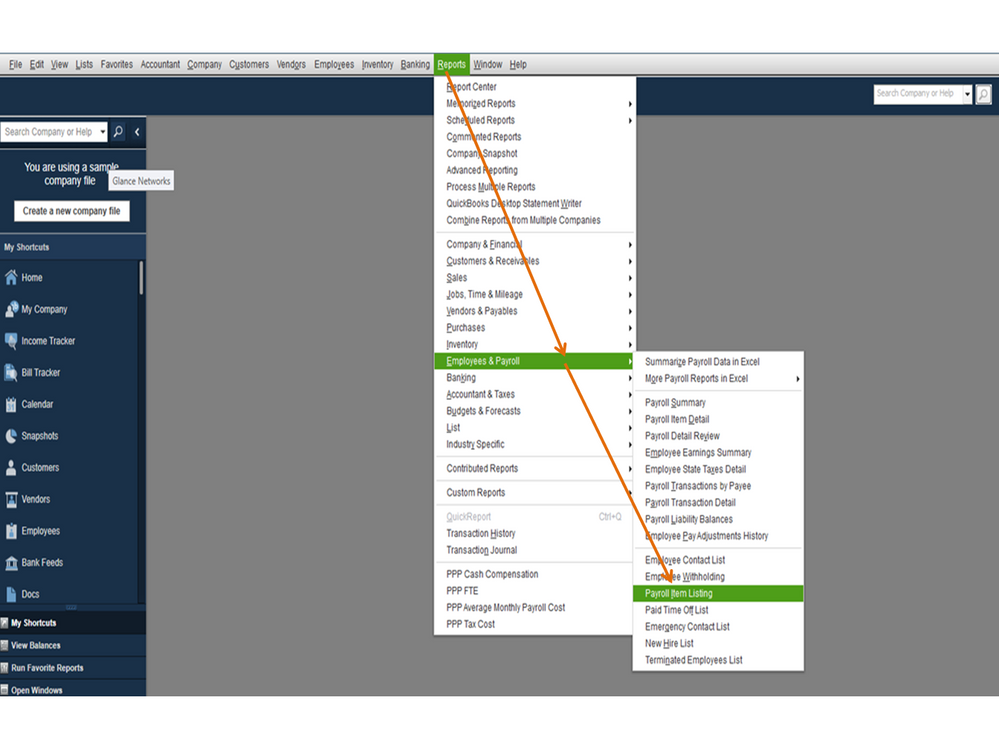

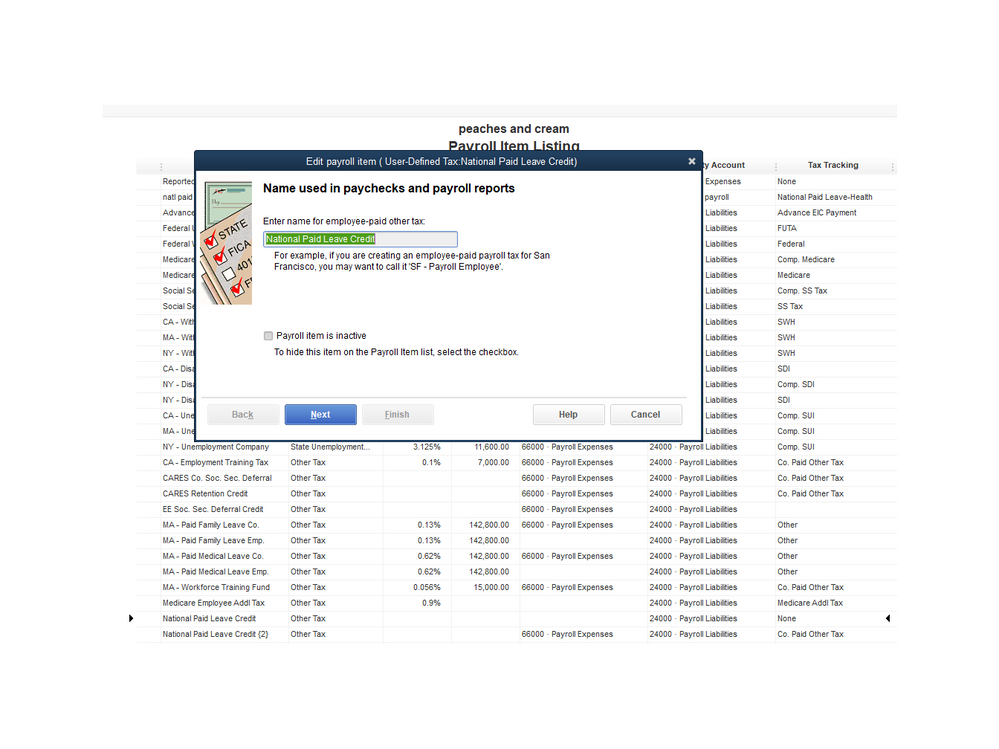

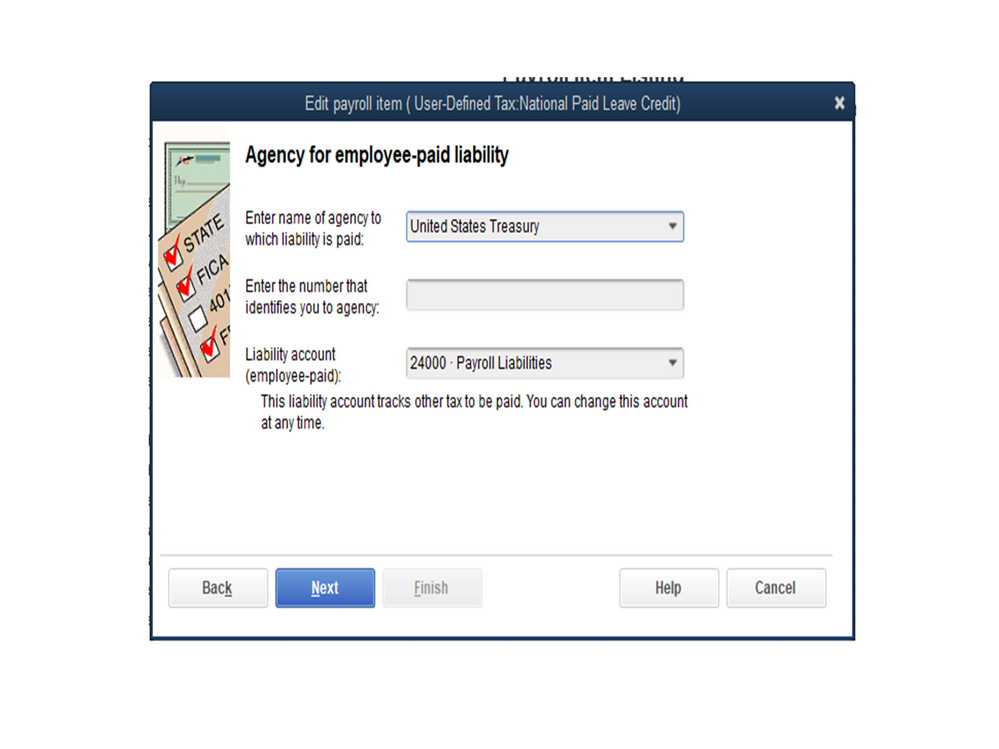

I can help and walk you through the step by step process. Here’s how:

Next, open a new Balance Sheet report and check the information. For more details about the process, check out this article: Payroll Liability and/or Balance Sheet Report shows incorrect amounts for payroll liabilities.

I’m also adding another article to help you in the future. It contains solutions when liabilities are showing as overdue in QuickBooks: Scheduled liabilities payroll show as overdue or in red.

Please let me know if I can be of further assistance. I’m always ready to lend a helping hand. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here