Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a client who is going to begin paying PTO. It will start accruing on 10-1-20 for all employees, based on the number of hours worked. Where do I go to set up the rate at which it accrues? I set up a paid time off vacation category in Payroll Item Lists. Do I set up the accrual rate somewhere in employee setup?

Hi chantelsoutham.

I'm happy to help you set up the PTO for your client. Follow these steps below:

If you have any other questions, feel free to post below. Thank you and have a nice afternoon.

I have done the steps listed. However, where do I tell the program at what rate to accrue the PTO?

I have additional steps to ensure you can accrue this Paid Time Off (PTO), @chantelsoutham.

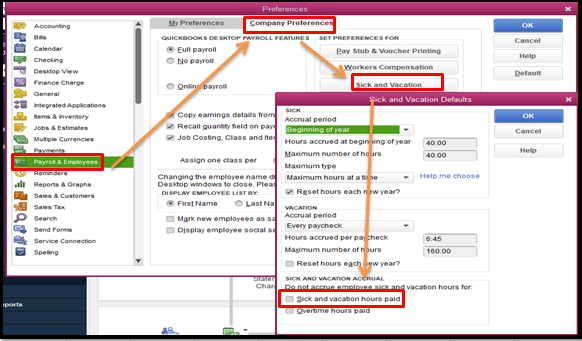

First, you'll need to ensure the Do not accrue sick/vacation pay box is unchecked on the Preferences page. This way, you can tell QuickBooks Desktop (QBDT) to accrue your PTO later on. Here's how:

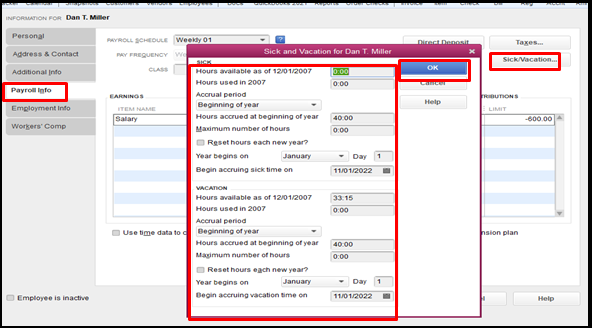

To tell QBDT at what rate to accrue the PTO, you'll just have to go to the Employees menu. Let me guide you how:

For more info, please read through this resource: Set up and track time off in payroll.

I'll be adding this article as well in case your sick and vacation time off won't accrue: What to do if time off won't accrue.

To keep track of your time offs, you can run the Paid Time Off List report. Just go to the Reports menu, choose Employees & Payroll, and then select the report from there.

Please let me know in the comment section if you have more questions. Have a good one.

Very useful information, thank you Nick. I have further questions on this - segregating the PTO. I'm attaching a screenshot to hopefully explain things.

Until now, we didn't pay for vacation time, but as of last summer we are. Our payroll setup includes PTO Sick and PTO "Vacation." I did that on the fly because I didn't have time to research it, and ended up never changing it. In the past I used the "Vacation" slot for PTO Holiday - and somehow I was able to set it to "Print as:Holiday" under the vacation item, but for the life of me I can't find where I did that. Anyway ...

I've been messing around with the accounts. In my Payroll Item List I have been using PTO Sick

and PTO Vacation (with the vacation one paying employees for Holiday). Sick leave is mandated by the State of Washington so there is a formula for that. But we don't have a set policy of holidays, we give all the usual ones but sometimes (4th of July, for instance) depending on what date the holiday is we'll pay for another day - so I can't enter an accrual for that item.

So far we've paid ONE employee for a week's vacation. I used the payroll item that says vacation (but prints as "holiday). But now, as you can see on the attached screenshot, his record has a lot of negative hours under vacation/holiday pay. Out of the -40:57 hours under vacation, 37:45 of that was his vacation pay.

My questions:

- Today I added PTO Vacation but from the looks of it, QB payroll will only track TWO PTO items.

Is that correct? If so, since vacation should be tracked (not so much holidays), how to I disentangle the two?

- Where can I change the "Print as" back to vacation. I have no idea where I set that up.

- Is it even necessary to track paid holidays? It appears QB doesn't think so.

I'm baffled by (and terrified of) QuickBooks payroll setup and would really appreciate any guidance on it. Thank you!

I appreciate you giving more details of your concern, @AmericanRV.

Tracking and setting up time off, vacation, sick pay, and holiday for your employees are used to determine their total hours of work and their non-working hours. For more info, check this article: Set up and track time off in payroll.

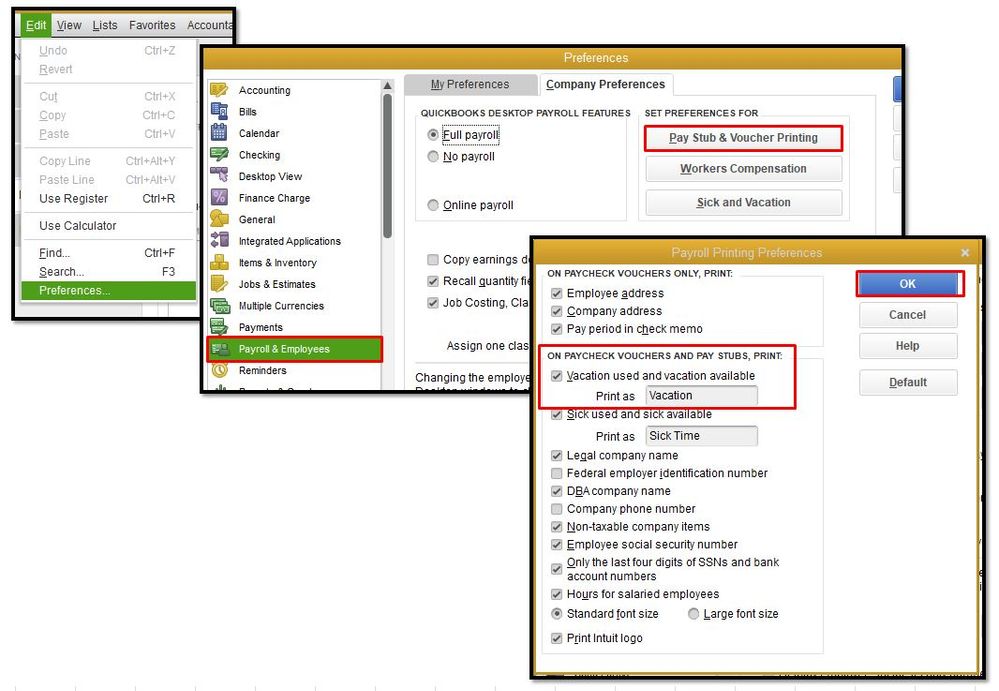

Then, changing the Print As: section back to Vacation is a breeze. Follow along below to get this done right away:

Also, to know more about tracking holiday pay for your employees, please see this link: Pay a salaried employee holiday pay in QuickBooks Desktop Payroll.

QuickBooks also has several Excel-based payroll reports so you can view your business and employee information. To get started, please open this article: Excel-based payroll reports.

If you have further questions about setting up time off in QuickBooks, feel free to leave a reply below. I'm always here to help. Have a good one.

There is no"payroll items list" in my "All Lists", so I am stumped!

Hello there, The Happy Booker. I can see the importance of utilizing this option.

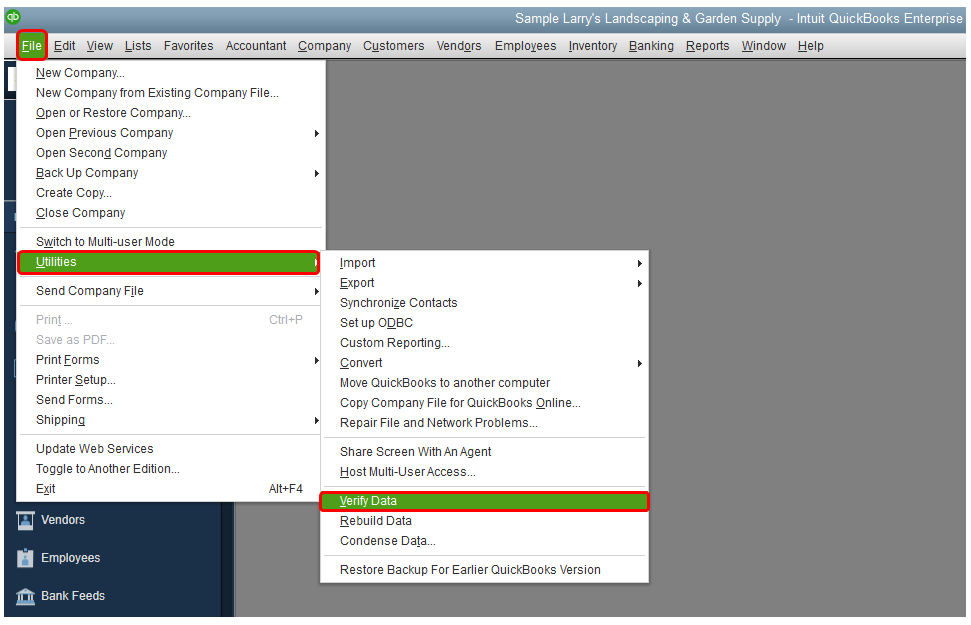

When using payroll, the Payroll Item Lists should be available under the Lists menu. We can run the verify rebuild to fix data-related issues on a company file. The steps below will guide you through the process.

. For more details about handling payroll items, check these articles:

I'm always here whenever you need help with QuickBooks Desktop. Stay safe and take care always.

So, by doing this QB will now accural PTO??? how do you tell it how much?

I'm confused on the holiday pay and vacation pay. On the tracking on each employee's pay stub it is combining the holiday pay and vacation pay. So if the employee has zero days left of vacation and then they are paid for a holiday the next pay stub shows -8 of vacation available. I originally had them under the same expense account in the payroll item list and thought that was the reason it was doing it. I then changed each item to a different expense account but it still did it the same after I did that.

I'm not sure what else to check for.

Dave

Hello there, Dave.

It's nice to see you in the Community. I can share some information and steps in setting up holiday pay and adding it to your employee's paycheck.

In QuickBooks Desktop, you'll need to track the holiday pay separately from sick or vacation pay. Let's set this up first by adding a new payroll item.

Here's how:

To track the accruals, you'll need to add this item to your employee's setting. Here's how:

Adding this item will track the YTD amount once you created paychecks with holiday pay.

To create a paycheck, you can add this together with your Regular Salary or you can create a separate paycheck for holiday pay only. Here's how:

It'll now automatically track the YTD amount on the next paycheck.

I've added this resource to further guide you in tracking time off, vacation, and sick pay for your employees in QuickBooks Desktop (QBDT) Payroll

Let me know if you have other questions about tracking holiday pay for your employees. I'll be here to help.

The link specified does not exist.

Thanks for getting involved with this thread, sescarpa.

If you're referring to the Pay a salaried employee holiday pay article linked in DivinaMercy_N's post, that article has been removed from our website. The information previously contained in it may have became outdated.

To set up and track time off, vacation, or sick pay for your employees in payroll, you'll initially need to create a time off pay policy. The first step is creating a time off payroll item.

Here's how:

Next, you can add the policy to your employee. You can find detailed steps for doing so in our Set up & track time off article.

Please feel welcome to send a reply if there's any questions. Have an awesome Friday!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here