Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowQBDT pro+ 2023 Enhanced Payroll

When reviewing a worksheet for 940, the report indicates a difference of approx $14K between Total taxed wages and Total Taxable FUTA Wages. It gives 3 potential reasons for the difference, and two of those can be ruled out. The one remaining is "a payroll item that impacts FUTA had it''s taxability settings changed during the year". I am new to QB payroll, and I can't seem to locate where a payroll item gets it's taxability for FUTA established. How would I find IF a payroll item was changed sometime during the year?

Also, (separate question): In the payroll "File Forms" area there is a 941X form to be filed. I have no idea why this form is present for us to file. Is this a "default" that always appears "just in case", or is there something in a file that has filtered this to appear? There is also a 941 / Sched B form that seems correct, but I'm confused about the 941X form.???

Thanks in advance for any and all advancedl

Thank you for reaching out to the Community, @Deadwood Al

Let me help you fix your worksheet for 940 and provide information about the 94X form in QuickBooks Desktop (QBDT).

To start, you likely have a payroll item listed below that is typically exempt from Federal Unemployment, but was set up in QuickBooks to calculate it.

After understanding the reason for the error, you'll need to fix the tax tracking type or Federal Unemployment tax on the payroll item that should be exempt from FUTA.

Here's how to fix the payroll item:

For more detailed information, refer to this article: Troubleshoot Part 2 on Form 940.

On another note, the 941x is an amendment form to Federal Form 941. Here's what you can correct Form 941-X:

The due date for filing Form 941-X depends on when you discovered the error, and if you underreported or overreported the tax. For more details, see page 5 of Instructions for Form 941-X.

You can also check this article to know more about Form 941-X: File a corrected Federal Form 941 and 940.

I'll also add this article to help you run, print, and customize your payroll reports in QuickBooks Desktop Payroll: Run payroll reports.

Don't hesitate to leave a comment below if you have follow-up questions about 940,941-X or other QBDT-related concerns. I will answer them in any possible way.

We are having a similar problem with the 940 FUTA and SUTA (state unemployment calculations). Employees who exceeded both wage limits in the first or second quarter, had not liability in the third quarter, now have taxable FUTA and SUTA wages in the 4th quarter. NOTHING has changed. These are companies for which we run payroll. We have not changed ANYTHING regarding taxability of payroll items. Payroll items have not been added or deleted. This has to be a glitch in the software introduced by an update of some kind. We have thoroughly examined all of the payroll items and there is no discernible reason for this to happen. PLEASE LOOK INTO THIS AND FIX IT! We should be able to depend on these reports. At present, with the deadline looming tomorrow, we are having to override the reports and returns.

Thank you for raising your concerns about the clarity of tax liability changes in the 940 FUTA and SUTA calculations across different quarters in QuickBooks Desktop Payroll, James. I will provide some insights to help address this issue.

To correct FUTA wages for employees with inaccurate payroll items on their paychecks, make sure to create and save a backup of your company file first.

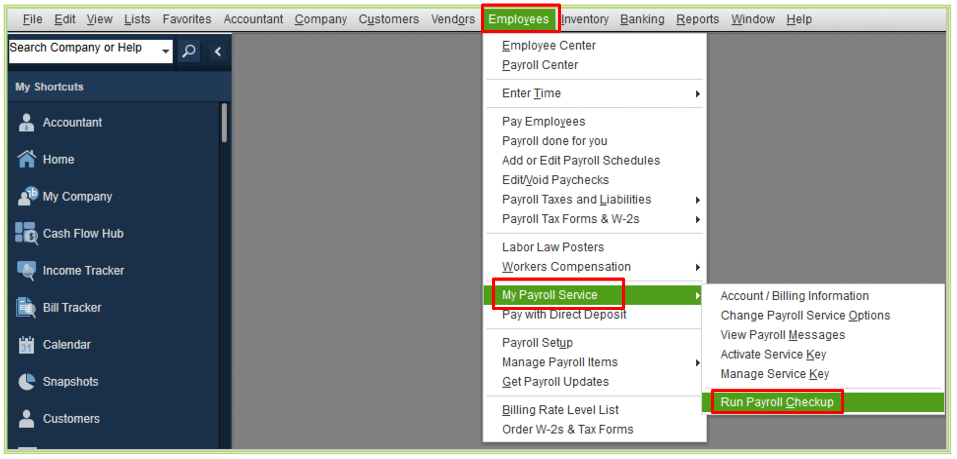

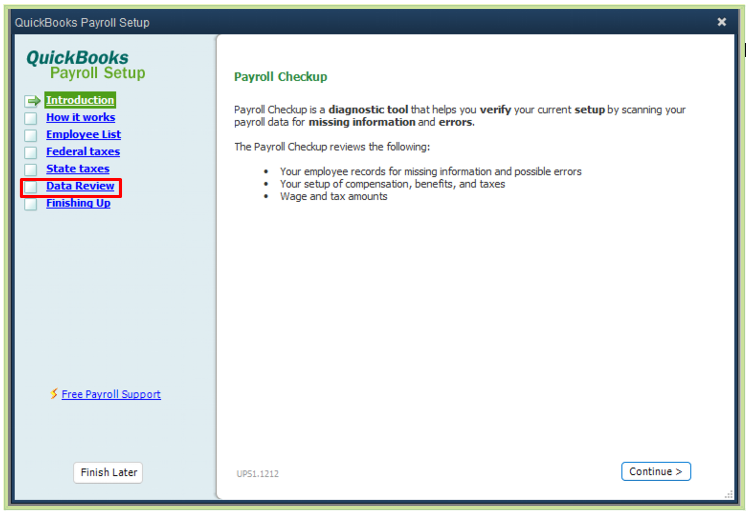

Then, we can run a Payroll Checkup, to verify your current setup by examining payroll data for any missing information or potential errors. The Payroll Checkup evaluates the following aspects:

If you need to perform a payroll checkup for a previous year, you need to adjust your computer's system date to the last day of that year:

If you encounter problems during payroll checkups, manual wage-based adjustments must be created for each employee with incorrect payroll items.

Moreover, I'm including these articles to help you learn how to run, print, and customize payroll reports. Additionally, they will guide you in creating a payroll summary report to review your payout details in QuickBooks Desktop Payroll:

You can always tap me if you have additional questions regarding 940 FUTA and SUTA (state unemployment calculations) in QuickBooks Desktop Payroll. Take the best care always and have a wonderful weekend ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here