Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I am using QuickBooks Desktop 2020. In 2019, QuickBooks had an excel report that would pull the W-2 information to efile to the State of Montana. That report is no longer available. Is there another way to pull this information from QuickBooks? I am trying to export the information to import into the system we use to produce W2s and 1099s. This report worked very well but I can't use it now.

Good day, AMYACCTING.

I'm here to help ensure you'll be able to get the information you need in QuickBooks Desktop.

Updating your payroll tax table is a good start before pulling up any reports in QuickBooks Desktop. This is to ensure that your data is accurate and ready to use.

Once updated, you can pull and run the Tax Forms Worksheets report to get all the W2 information.

Here's how:

You can also pull up the Payroll Detail Review or Payroll Summary report and you have the option to export them into Excel.

The following article lists different Excel reports and ways on how to generate them in QuickBooks Desktop: Excel based payroll reports.

I'm always up to answer any additional questions you may have regarding your QuickBooks reports. Feel free to reach out to me in the comment section below. Happy Holidays!

Both reports are great but they are not in the format the I need. The Create State W-2 efile report was perfect. It had headings with the employee information under each heading. These reports do not provide that format.

The feature/report to eFile state W-2's should still be available, but it isn't when you first install and launch QuickBooks.

Before it appears, you need to get payroll updates and then restart QuickBooks. Then it should appear in the same place on the QB menu as before.

The State W2 Efile report is only available for certain states and unfortunately it does not apply to my state for 2020. If I could edit the report, I could make it work but of course there is a password on it and changes are not allowed. I was hoping to find a report that was similar to this to do what I need to do.

Hello there, AMYACCTING.

Since you'll file the W-2 form directly to a website, you can use the QuickBooks Desktop Payroll report shared by RoseMarjorieA and use it as a copy when you enter details into the system that produce W2s.

Another report that you may want to use is the Payroll Summary report. Then, manually bring the data by exporting or printing this report to get the information you need.

Let us know if you have other concerns. Take care and stay safe always.

Is QB not going to bring back support for MT state W2 filing?

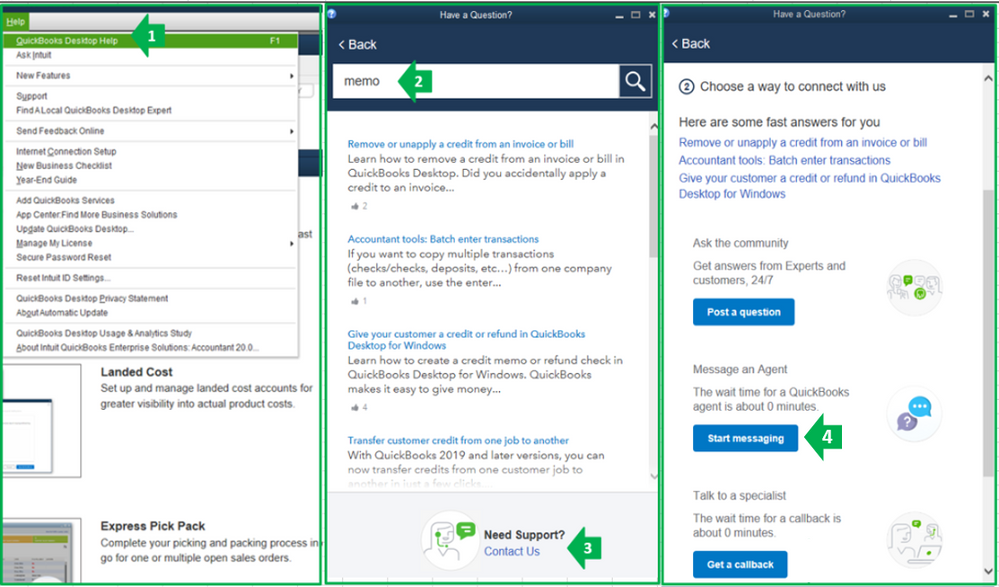

I recommend contacting our Payroll Support Team, RachelW2.

This way, they'll be able to guide through the process of the MT state W2 filing. They are also equipped with tools that can securely look into your account.

Here's how to reach put to one of our supports:

To learn how to Montana state W-2 e-file works, I suggest checking this article: Montana State W-2.

Additionally, I've included an article that will guide you in ensuring your compliance with state payroll tax regulations: Montana Payroll Tax Compliance.

For other payroll concerns, I encourage sharing more details here in the Community. This way, we'll be able to help you out.

I will be calling the help desk today. QB is not supporting Montana w2 file creation. Do you know when they will provide it?

Thanks for joining the Community, Kristinjacctnt.

Let me share some insights about building the MT State W2.

The form is available in QuickBooks Desktop Payroll. You should be able to create a file and upload it. If you’re unable to make one, make sure to install the latest maintenance release and update the tax table version.

These processes will improve the functionality of the program and ensure that your payroll has the most up to date information. I can help guide you through the steps.

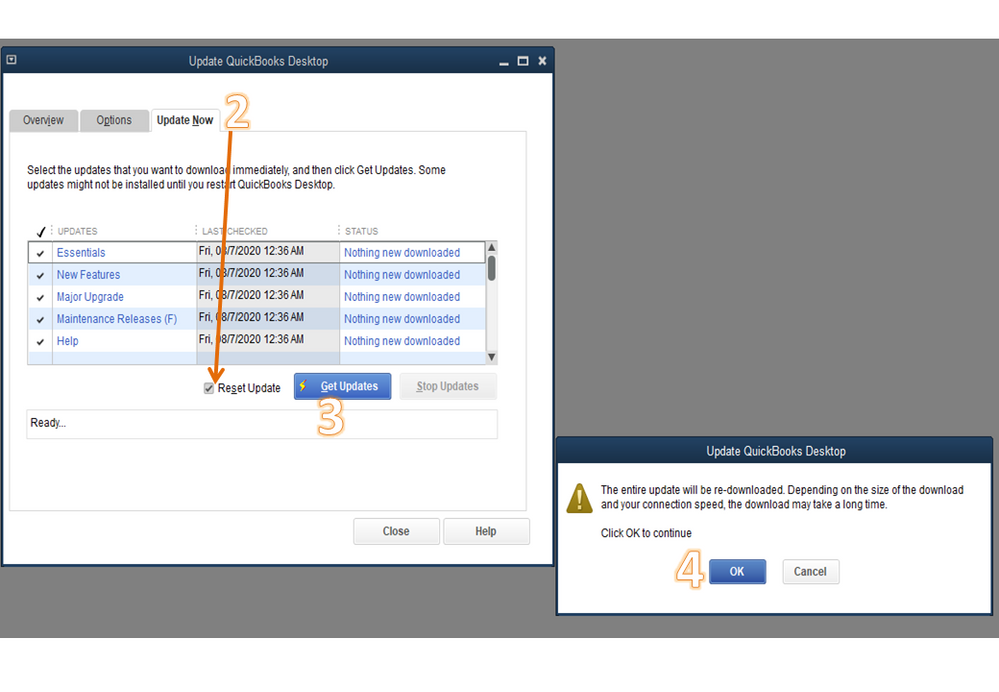

To download the maintenance release:

Next, open the company file and update the tax table version. Check out this article for the complete instructions: Get the latest payroll tax table update.

After performing all these steps, you can start creating the state W2 form. I recommend following the procedure shared by RoseMarjorieA above.

To ensure you comply with the state payroll tax regulations, let me share the Montana Payroll Tax Compliance guide. From there, you’ll find details on tax forms, withholdings, etc.

Don’t hesitate to click the Reply button if you need further assistance with QuickBooks. I’ll get back to help and make sure you’re taken care of. Enjoy the rest of the day.

I figured it out. You no longer have to create the file in excel. You can efile from the normal File Forms tab in QB where you efile your 941 and Federal W2's. It should be at the bottom, if you have done your latest payroll update. I did have to make sure my filing method for the state was efile. When you are in the File Forms tab, select Change Filing Method in Other activities at the bottom.

Did you ever get help in filing for MT? I just got a notice from the St of MT that my files were never sent even though I have a report from Quickbooks saying it was sent.

How did you resolve this if you don't mind my asking

Thanks

Hi there, Foamroof.

Since the reports say you've already filed the MT state W2 form using QuickBooks Desktop (QBDT), but you still got the notice that it wasn't sent. I recommend contacting our QuickBooks Care Team. This requires pulling up your account in a secure environment and reviewing the status of the forms you've sent for MT.

Here are the steps to contact support:

Please take note our operating hours for chat support depend on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

You might also be interested in visiting the following articles to learn more about the process of using the electronic service in QBDT:

Keep me posted for additional questions or other concerns. I'd be more than happy to help. Wishing you the best of luck.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here