Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowMy company's BCBS and Aflac come out of their paychecks pretaxed. There is no pretaxed option for this so I need to create a new one. I believe I used the Other option as the tax tracking type and the BCBS and Aflac amount would then show up in box 14 on the W2. BUT then it is not taken out of the taxable wage on line 2 of the 941 tax form. Then I changed the tax type to Premium Only/125 so it will be included in wages on 940 and will come out of line 2, 5a and 5c on the 941 but it is NOT on the W2 then. How do I get these to come out of the 940 and 941 correctly AND show up in Box 14 on the W2?

Solved! Go to Solution.

Hello there, @AbbyHCU.

I got some clarifications to share regarding the posting of your health insurance in the system.

Cafeteria Section 125 Plans do not appear on any box of the W-2. The IRS does not require this information. Some payroll services will put this on Box 14; Intuit has chosen not to do this.

The information that will show up on box 14 of the W2 in QuickBooks Desktop are the following:

To give you more details how the system populates the W2 form's data, please see this link: Learn how QuickBooks Desktop payroll populates the boxes on the IRS Form W-2.

Moreover, for more insights about the Section 125 Health Insurance (Cafeteria Plan) set up in QBDT, you can always read through this reference: Set up a Section 125 Health Insurance (Cafeteria) plan payroll item in QuickBooks Desktop.

Should you need anything else about this or with QuickBooks Desktop, just let me know by leaving a comment below. Take care!

Thanks for sharing the details of your issue with us, Abby.

I can share with you some details about the Premium Only/125 Health Insurance in QuickBooks Desktop (QBDT).

Section 125 Plans doesn't appear on any box of the W-2 forms as IRS does not require this. Thus, intuit chosen not to. For more details and guidelines about this, you can refer to this article: Set up a Section 125 Health Insurance (Cafeteria Plan).

Moreover, I'm adding these resources that you can read for future reference in filing your payroll forms:

Know that you’re always welcome to post a reply in this thread if you have any other concerns about payroll forms in QuickBooks. I’ll be around to listen and back you up. Have a good one and keep safe.

This was not helpful. I know which tax tracking type I need. The Premium Only/125 is the correct option but with that option it does not show up on the W2. I need for it to show up on the W2.

Hello there, @AbbyHCU.

I got some clarifications to share regarding the posting of your health insurance in the system.

Cafeteria Section 125 Plans do not appear on any box of the W-2. The IRS does not require this information. Some payroll services will put this on Box 14; Intuit has chosen not to do this.

The information that will show up on box 14 of the W2 in QuickBooks Desktop are the following:

To give you more details how the system populates the W2 form's data, please see this link: Learn how QuickBooks Desktop payroll populates the boxes on the IRS Form W-2.

Moreover, for more insights about the Section 125 Health Insurance (Cafeteria Plan) set up in QBDT, you can always read through this reference: Set up a Section 125 Health Insurance (Cafeteria) plan payroll item in QuickBooks Desktop.

Should you need anything else about this or with QuickBooks Desktop, just let me know by leaving a comment below. Take care!

Thank you! I was really hoping there would be a way to automatically get it in that box but we may have to add it in manually. Thank you for the response!

I was really hoping there would be a way to get in information in box 14 but we may just have to manually enter it in. Thanks for the response!

Thanks for following up with the Community, AbbyHCU.

I'm happy to hear BettyJaneB was able to help with your inquiry about box 14 and how QuickBooks works with W-2 forms.

You'll additionally be able to find many detailed resources about using QuickBooks in our help article archives.

Please feel more than welcome in sending a reply or making a post if there's ever any questions. Have a wonderful day!

No offense. NONE of the below is either helpful, or accurate. Prior to three or so years ago, when your Assisted Payroll Help Desk vanished, every year was a breeze when folks who actually knew what they were doing would manually walk me through placing my Sub-S health insurance premiums in Box 14. NOW, NO ONE AT ASSISTED PAYROLL HAS A CLUE!!! And, to add insult to injury, these so-called "help" articles are anything BUT helpful. Last year ONE Individual...ONE...rescued me on 12/21/2020 (Dylan R. - who has since left Intuit) and in literally FIVE MINUTES walked me through the steps to manually report my health insurance premiums in MY BOX 14 W-2, as the owner of a Sub-S corp. I NEED SOMEONE NOW TO WALK ME THROUGH IT.

I will write down the steps this time and never bother y'all again - promise!!! PLEASE HELP-agggghhhhh!!!:-(

Hello @jsfreud,

I appreciate you for reaching out to us here in the Community. I know how important to show the correct figures when filing your W-2s in QuickBooks Desktop.

I would feel the same thing if this happens to me after seeking assistance. Allow me to chime in and help you manually report your health insurance premiums.

You can report health insurance you offer or reimburse your employees on their W-2s. Since our payroll services don’t automatically reflect employer-sponsored health insurance on W-2s, I suggest performing the manual process.

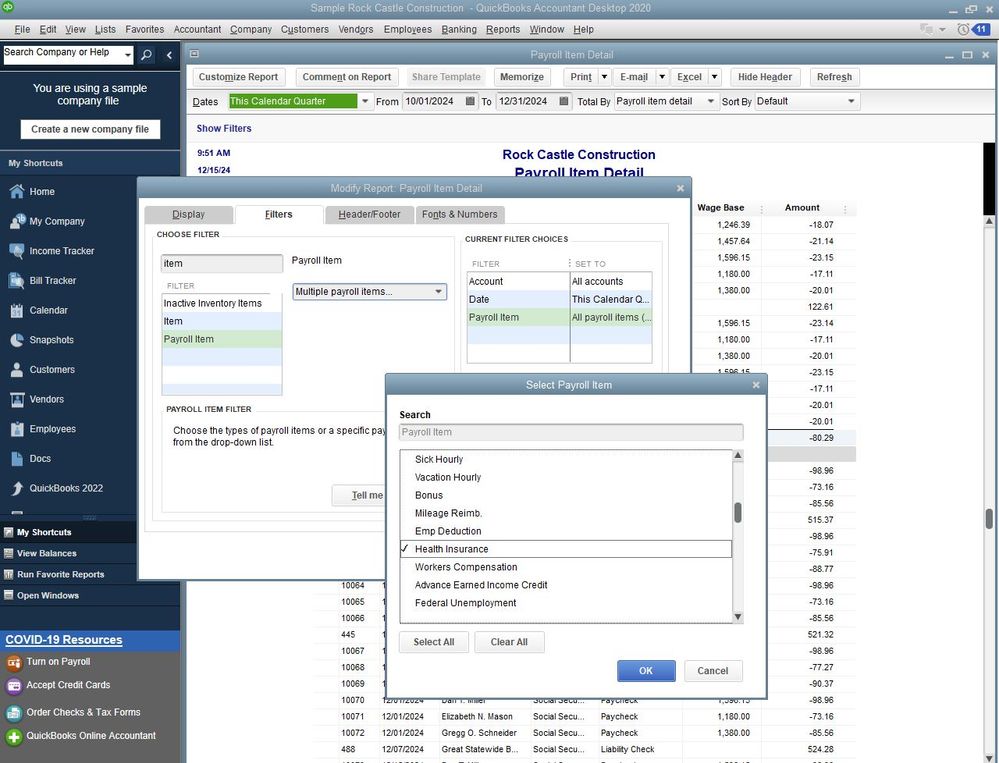

The first thing you need to know should be the amount you need to include in the form. If you're unsure of it, you can run payroll reports available in the system.

I recommend using the Payroll Item Detail or Payroll Detail Review report to show the breakdown of the amounts by payroll item. Here's how:

Once you already have the necessary information, you can proceed with adding the details manually. Once W-2s are available, you can follow these steps:

Additionally, I recommend visiting the following article to learn how to report health insurance using the Enhanced or Standard payroll subscription: Report employer health insurance on W-2s.

Remember that you can always hit the Reply button anytime you have questions about the payroll forms or the payroll data in QuickBooks. Have a great day ahead.

Thx for the reply, BUT, this is NOT CLOSE to the procedure I have followed FOR YEARS to get this right!!!

There is a step whereby you add, and then subtract $.01, to make sure the amount in Box 14 is NOT picked up as income on my W-2. No where in your explanation is that shown. Quite frankly, when I see the CORRECT STEPS I will recognize those steps. What you gave to me IS NOT CLOSE!!!

Can YOU PLEASE find someone at Intuit to walk me through the CORRECT STEPS to do what should be a simple, ministerial computer input task.

I had a Case Number last year, That has now expired. Dylan R., who walked me through the steps without a hitch also left NO INSTRUCTIONS on those steps and I made the mistake of not writing those steps down.

I am begging for the right answer here.

What you gave me, however well intentioned, is just flat wrong.

Thank you.

I just learned that if you use the "other" option, it will be listed in Box 14, which is ridiculous that I had to go in and change all of the benefits to this option because QB's doesn't feel the need to help the companies who support them.

ALSO, but not listing these benefits in box 14, you have their gross wages higher than they should be meaning they are now paying more taxes when they file their returns.

Did you find a more descriptive answer? I'm still looking and trying to find the best way to do this also..

Yes, other does change it. you'd think qb would maybe give that answer rather than some long "look here". that doesn't help.

Thanks for joining this conversation, @jillamena.

To further assist you with this, I'd recommend reaching out to our Payroll support team. They have the necessary tools to pull up your account in a secure place. You can also request a screen-sharing session so they can check your setup. For your reference in reporting health insurance on W2, please visit this article: Report employer health insurance on W-2s. Here's how to contact our phone support team:

Our support operating hours are from Monday to Friday 6 AM to 6 PM PT.

Additionally, you can browse through this page for additional information on how the system populates the W2 form: Understand why the wage amounts are different on your employee's W-2.

Also, to know more about the W2 form, check out this article: Get answers to your W-2 questions. It includes a list of frequently asked questions about the form with links to address the different payroll services.

Leave a reply below if you have any other payroll forms concerns. I'll be always around to help. Keep safe.

I also have a Payroll Item Deduction that uses the "Other" tax tracking selection. It is an employee 414(h) deduction that reduces Federal Income Wages (Box 1 wages) and State Wages (Box 16) but does not reduce Social Security or Medicare. However, when I create the W-2s for the year, QuickBooks Desktop is not processing it correctly. Box 1 wages are the same as Box 3 and Box 5, and only Box 16 wages shows the reduced amount. This is causing the gross pay to be to high in Box 1.

How do I correct this? Is it advisable to simply override the Box 1 amount? The payroll seems to be correct, just the W-2s have the problem. It seems that this would be something that would be generated correctly through Quickbooks. I have run the Verify/Rebuild utility tool.

Thanks for joining this thread, @Terry S. I've come to give information about your concern.

In QuickBooks Desktop (QBDT), Box 1 is the total amounts of various tax tracking types, such as Compensation and 401k deductions, along with many other defined deductions. You can run a Tax Form Worksheet to further check the details instead of the actual W2 form where you see only summaries. That said, when comparing the W-2 form with the tax form worksheet, you have to use the number on the line Total Box 1 and not Taxed Wages, since it does not appear on the W2. I'll guide you how:

Also, an item with tax tracking type set to Other will affect Box 1, regardless of its tax settings.

You may also want to check this article for more information on how W2 data is populated: Understand why the wage amounts are different on your employee's W-2. This includes factors that affect the amounts in Boxes 1, 3 and 5.

In QBDT, running payroll reports is easy. This will help you get brief details of your employee information, company finances and payroll tax data.

I'm just a post away if you need additional assistance with your W2 forms. Have a good one.

OMG - "Other" did the trick!! WHOA! Thank you! (ps. How dumb is that)

Great to see you here, @Alyssa.

I'm glad you can view health insurance on W2. Thanks to my colleague above for assisting you in this matter. Please know that you can always come here, no limit.

I'm always happy to listen if you still need further concerns in QuickBooks.

How can I manually edit Box 14 so I can put in code for health insur 2% shareholder

I appreciate you joining the thread today, butwin414. I can help you include the code for health insurance 2% shareholder on the W2 form.

You can create a payroll item from your employee's profile to post the insurance accordingly. Ensure that the information and the tax tracking type are accurately entered and aligned with the guidelines provided by the IRS for Box 14 entries.

Here's how:

You may also review the resources from this article for more options on setting up and tracking S-corp in QBDT: Set up an S-corp medical payroll item for your corporate officers.

Then, use that item to accurately post the amounts to your W2 form when running payroll. You can make adjustments to your prior payroll if necessary.

Once all set, get ready to print or file your forms. I'm adding these materials as your references:

Please know that our doors are open 24/7 for assistance. If you have follow-up questions while preparing your W2 forms in our system, notify me in the comment section below. I'm always here to help.

Hi - I need to do the same thing but am using Quickbooks Online Payroll.

Can you post instructions on how it is done? This will fix it for next year, but more importantly how can I add it to this year's Box 14?

Welcome to the Community, @Jilly.

I understand that you are using QuickBooks Online Payroll and want to set up health insurance to appear on your employee's W-2 Box 14. Here is a step-by-step guide to help you achieve that:

Please note that you can only set up the S-corp item for shareholders that have the same medical plan offered to all other employees.

Please note that you can only set up the S-corp item for shareholders that have the same medical plan offered to all other employees. Set up an S-corp medical payroll item for your corporate officers

Once you set up your S-corp medical insurance item, you can run your payroll with an S-corp medical insurance item on it.

If you have any further questions about setting up health insurance in QBOP, please don't hesitate to contact us anytime. Best regards.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here