Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have set up in the employee's sick leave accrue at .03333 for every hr worked with a max of 40 hrs. For the past few weeks it keeps accruing past 40 hrs. Why is this and how do I get it to stop without me going back in and changing it back?

Hey there, @tracy26.

Let’s resolve the issue with the employee’s sick leave accruing the past 40 hours. When calculating sick time, there are two calculation methods which are per hour or per paycheck.

To calculate basted on hours worked, you’ll take the number of hours they will accrue in a year and divide by 2080. If you want it to be based on per paycheck, you’ll need to take the total number of hours they will accrue in the year and divide it by the number of checks in the year.

For further information about adding and changing sick accruals on an employee profile, follow this article below:

Reach back out if you have other questions.

From your screenshot it does look like QB accrued past the max balance of 40 hours you have set up, which it shouldn't do.

Still, it's kind of strange that your balance is so high at all, given that you have the option to reset at the start of the year set. What happened there? Did it not reset?

When you want to put a limits on how much Sick or Vacation time can accrue, you put the figure in the "Maximum number of Hours" field. That being said, for the NYS Sick Leave, you need to continue to accrue hours even after 40. They can only use 40 hrs in a calendar year, but they can still accrue hours to have available at the beginning of the next year.

My concern is how QB has the accrual options (Beginning of Year, Every Paycheck & Every Hour on Paycheck) . Accrued hours based on Every Hour, will accrue on all hours. This includes when you use Vacation or Sick Time items, which should not be included. It should only be on hours worked. If you have payroll items for Holiday, Bereavement, Jury Duty, Sick or Vacation time, it will a calculate on all those payroll items and inflate the Sick Time that is accruing on the employee.

There needs to be a way to specify which payroll items should be used/included when indicating the "Every Hour on Paycheck" option to ensure Sick Leave is accruing correctly.

Hope this helps you Tracy26. Hope QB updates this feature asap.

I have been trying to get the answer to this question and can't find it. If you set up QB to accrue Sick Time by "Every Hour on Paycheck", does it indeed accrue on sick and vacation hours paid? It should only be on Hours Worked (Regular hours). Also, does it accrue sick time on Overtime hours worked?

Hi kt291,

Yes, for Every Hour on Paycheck, accrual is based on regular hours only. It does not accrue hours based on overtime or the hours used to pay for sick and vacation leaves.

Hope this clears up everything. If you need more information about tracking sick and vacation time off, just refer to the article that Emily M shared above.

If you have other questions in mind, you can always go back to this thread.

I wish its true. Every Hour on Paycheck included sick time, vacation time. I am try to get around it. It should only calculate the hour worked.

For example: 32 hours worked + 8 hour sick time. The sick accrued should be 1.07 but QuickBooks calculated sick hour 1.33.

Please show me how to get around it.

I wish its true. But Quickbook sick hour accrued included holidays pay and sick hours. The sick time should only accrued regular hour worked.

For example: 32 work hour + 8 sick hour. The sick accrued should be 1.07 not 1.33

Please advise me if there is way to set up correctly.

Hello @shanausmus,

You're on the right track, employee's sick leave accrual is calculated based on the regular hours worked, holiday pay, and sick hours. Since you don't need to include the holiday pay and sick hours, it is recommended to manually calculate the sick leave accruals in QuickBooks Desktop Payroll.

Additionally, here's an article you can read to learn more about tracking your employee's time off: How to set up and track time off, vacation, and sick pay for your employees in QuickBooks payroll?

Need help performing any tasks related to your payroll account and company settings, click here to access and browse all articles for QuickBooks products. This reference contains most resources with steps on how you can update your data and security management, to name a few.

Don't hesitate to post again here if you have other questions or concerns with QuickBooks tasks and navigations. I'm always around happy to help. Stay safe and have a good one!

I want to jump into this old thread with a question about what the accrual period "beginning of year" means.

I want to put the max number of sick hours AVAILABLE per year in the employee profile so that sick time is being subtracted from the maximum rather than accruing. We allow employees to take sick time ahead of what has been earned, essentially. I tried putting 52 /beginning of year but nothing seems to change.

Is there a way to do this now, half way through the year?

Hello there, @KathieICF1.

In QuickBooks Desktop (QBDT), the beginning of the year in the actual period means the first month of the year.

Let's make sure that you've set up a maximum number of hours for the year in your QuickBooks preferences and employee's payroll details. By doing this, you'd received a prompt to tell you that the sick p

Here's how:

1. Go to the Edit menu.

2. Choose Preferences.

3. Select Payroll and Employees.

4. From the Company Preferences tab, click the Sick and Vacation button.

5. Under the Set accrual limit, select the appropriate option for you:

• Maximum hours at a time

• Maximum hours for the year

6. Click Ok.

Once completed, you can run a payroll checkup. This way we can review your employees' payroll information. I'll guide you how:

1. Choose Employees.

2. Select My Payroll Service.

3. Pick Run Payroll Checkup.

4. Follow the onscreen instructions.

5. Click Continue to go through the various steps.

Keep me posted if you have other questions about managing your employee's payroll information. I'm always here to help.

You wrote: "

There needs to be a way to specify which payroll items should be used/included when indicating the "Every Hour on Paycheck" option to ensure Sick Leave is accruing correctly."

I just saw that the sick leave time is accruing on hours *taken* as sick leave.

Intuit! This needs to be changed!!

If anyone has a fix for this please respond.

Hello there, T63.

I appreciate you for sharing sentiments on how you want "Every Hour on Paycheck" to accrue in QuickBooks Desktop.

You might want to keep this article handy to learn more about tracking time off, vacation, and sick pay in QBDT: Set up and track time off in payroll.

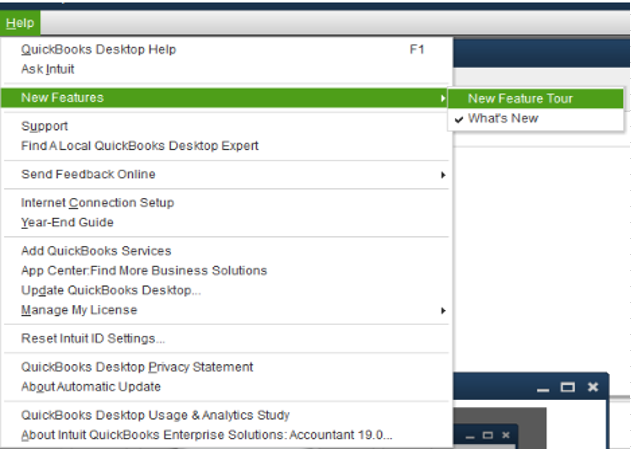

While we continue making improvements with the product, I want you to be updated with the new features added to the software by following the steps below:

Here's how:

Another way to get you in the loop about the latest news and product developments in QuickBooks Desktop is to visit our Firm of the future site. To narrow down your search, you can go to the Product & Industry News tab.

Anything else you need help with can be answered here in the Community. Just let me know and I'd be happy to assist. Have a good one.

JonpriL,

This seems like such an easy fix for qb and the below is not an acceptable answer:

"it is recommended to manually calculate the sick leave accruals in QuickBooks Desktop Payroll"

Isn't one of the main reasons that we all purchased qb is so that we don't have to manually calculate?

Thanks for getting back to us, @KeithM.

I understand that purchasing a payroll service that'll auto-calculate sick leave is imperative. Currently, the available accrual for sick leave are the following:

Depending on your setup, QuickBooks will auto-calculate and accrue base on it. Just make sure to fill in the necessary info from the sick and vacation page to have the correct leave accruals.

Here's an article for the step-by-step instruction: Set up and track time off in payroll.

About the holiday pay, you'll want to set up the accrual period to "Every paycheck." This way, it won't accrue on the hour used for the holiday.

Additionally, feel free to check out our helpful content to guide you in managing payroll-related tasks.

Please know that you're always welcome to swing by if you have other questions or concerns with setting up leave accruals. Take care and have a nice day ahead.

Thank you for the reply but I don't believe you are understanding the issue here. I have the sick pay set up correctly.

The issue myself and others are having is as follows.

Example:

My employees accrue 1 hr of sick pay for every 40 hrs that they work.

So lets say an employee was out sick all week (40 hrs) so I will pay them 40 hrs of sick pay.

The problem is that QB cannot recognize the difference in regular wages and sick wages.

In the above example my employee will accrue 1 hr of sick time by getting paid 40 hrs of sick wages. (which is not supposed to happen.)

QB needs to correct the issue so that employees are not accruing sick time when they take the sick wages.

That's absolutely correct.

Like this issue, there are a bunch of other issues with Intuit payroll like inability to use multiple payroll bank accounts which multiples my workload several times. Its a nightmare. For these issues, I am planning to switch the payroll software.

Keith - thank you for asking this question! Do you have a work around? This is insane that an option is not available to prevent sick time from accruing on sick pay.

Thank you Keith! It is insane that they do not have an option of not accruing sick time on sick wages. Do you have a work around or do you manually have to go in and adjust sick time available?

Unfortunately the only work around that I'm aware of is to manually adjust.

Edit your policy with:

My sick time is not accruing for sick or vacation hours. Directions on how to fix that have been stated a couple of times on here.

My problem is that it is not stopping once it hits the capped amount. I have 24 hours listed as the max per year, but every paycheck is going over. I have to click the "do not accrue sick/vac time" on each paycheck every week.

How does this get fixed? It has been posted on how to set it up for max hours earned, but that is not working on my checks.

Thanks for reaching out to the QuickBooks Community, @ricksilkey.

Not being able to use the payroll features in the program can be very inconvenient. We wanted to make sure this is being looked into. While the steps in this thread did not resolve the problem, I strongly recommend reaching out to our Support Team.

Our agents can review this sick leave accrual issue, and can report this concern to our engineers. To connect with our Team, follow the steps below in your QuickBooks Online account:

Another option is to chat with an experts using the links below:

If you have other payroll preferences concerns in QuickBooks, please tag me anytime. I'm always right here to help you.

Have you been able to resolve this issue? We are having the same problem and I am not finding any response that resolves it.

Hi there, @JenBokisch.

Can you share more details about your concern? I want to make sure I'll be able to provide the answer you need to resolve your issue.

Any additional details is highly appreciated. Looking forward to your response.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here