Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow to fix sick pay that was paid by third party but recorded twice in our books. I will have to do a corrected @W2 for 2020. Can I please get help on how to adjust the employees income and how to file the corrected W2.

Thanks in advance for any help!

Kim

Hi there, @kimforbes.

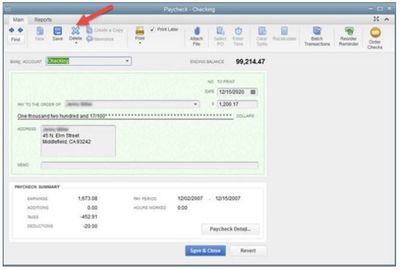

To clarify, was it overstating your employees' income? To correct them, you'll have to find the paycheck that was recorded twice. Then, delete the duplicate one. However, if you have entered the amount twice in the paycheck, then you'll have to edit it instead.

Before doing that, make sure to back up the QuickBooks company file. This way, you can restore your data if you ever run into problems.

Here's how to delete a paycheck:

To edit a paycheck:

You can refer to this article on how to create and print W-2: Fix an incorrect W-2. To give you complete details about entering the 3rd party sick pay in QuickBooks Desktop, please check out this link: Track and submit taxable third-party sick pay.

I got your back if you have any other questions. It's my pleasure to help you out. Have a good one.

Hope you’re doing great. I wanted to see how everything is going about deleting or editing the paycheck. Was it resolved? Do you need any additional help? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here