Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I currently have 10 clients operating Desktop Standard Payroll under my license. How does this change affect Clients operating under my QB ProAdviser license? Specifically:

1. Will my 10 clients still be able to operate QB Legacy Enhanced payroll under my subscription? Or has this been discontinued too and they now have to buy separate subscriptions?

2. If my clients can still operate under my subscription, who will get billed for the monthly Direct Deposit fees (which vary from client to client and month to monty)?

Mike Stone

Let me share some details about the payroll subscription changes in QuickBooks Desktop (QBDT), Mike.

QuickBooks Desktop Payroll Basic and Standard (Legacy) are no longer offered for the upcoming subscription. If you're currently on one of these products, you'll be moved to QuickBooks Desktop Payroll Enhanced (Symphony).

Furthermore, Direct Deposit fees will be billed depending on who's on the billing profile of the payroll plan.

You can read these articles for more details about QuickBooks Desktop Payroll:

Please don't hesitate to reply to this post if you have further questions about the QuickBooks Desktop Payroll subscription. We're always around to help.

I have a question on moving to the Enhanced Program. It shows a one time fee of $400 and then $6/month/employee. What is that $6 for? And if we only have one employee, do we just get charged the $6 even though we have payroll for up to 3 employees? We are a super small non-profit so changes like this are a bigger charge than you probably think.

I have a question about the pricing on the Enhanced Payroll. It shows there is a $400 annual fee and then $6/month/employee. What is the $6 for? And if we only have one employee, do we just get charged the $6/month even though we have payroll for up to 3 employees?

Welcome to the thread, AshleyJ.

The +$6/employee per month charge for a QuickBooks subscription refers to the additional cost for each active employee added to your subscription. This means that for every active employee you add to your QuickBooks account, you will be charged an extra $6 per month on top of your base subscription fee.

If you're interested in learning more about the Plans and pricing for QuickBooks Payroll, you can visit this link: https://quickbooks.intuit.com/payroll/desktop/. This will give you a more detailed breakdown of the different options and what they include.

Additionally, if you're wrapping up your payroll for the year and need some guidance on preparing your tax forms, you may find this article helpful: Year-end checklist for QuickBooks Desktop Payroll.

If you have any questions or concerns about your billing subscription, please don't hesitate to let me know by commenting below. I'm here to help and will do my best to provide you with the information you need. Have a great day!

Is the $6 fee per employee only for direct deposit employees? Or what is this fee for?

Welcome to the Community, @Pacshorecorp.

I'm here to provide you with details regarding the Intuit QuickBooks payroll monthly per employee usage fee for QuickBooks Desktop with Basic payroll.

Yes, the monthly $6.00 per employee charge for a QuickBooks subscription refers to the additional cost for each active employee added to your subscription. The recent price increase in QuickBooks Desktop (QBDT) Payroll is an effort to provide you with a better user experience.

However, it's important to note that this additional cost comes with the advantage of accessing some extra features:

You will receive a notification in QuickBooks and an email approximately 30 days before your annual renewal date. This notification will inform you about the upcoming changes to your subscription. To continue the subscription, you will need to give your consent to the change. Your subscription fees will be updated automatically the next time you're billed.

To learn more about product and price changes, refer to this article: Understand changes to QuickBooks Desktop Payroll Basic and Standard.

You can get more details about the following resources. You'll find lists of payroll pricing and a chart to compare their features as well as steps to check your statements:

If you have any questions or concerns about your billing subscription, please don't hesitate to let me know by commenting below. I'm always here to help. Have a wonderful day!

How many employees do you have?

Only one.

Which QB Desktop year version do you have?

I have the same issue. 1 part time employee, not worth the new fees. Can I add a payrollenhanced license key and use it as is for another year?

I have the same issue. 2023 quickbooks pro with payroll enhanced. 1 part time employee. Can I add a payroll enhanced license key and stay with what I have for another year?

You can use QB Desktop 2023 Pro Plus + Enhanced Payroll until 2026. Can you access CAMPS and find your license code there?

I'm here to help, teri5.

Affirmative, you can add a payroll enhance license key. All you need to do is to have a payroll subscription in QBDT. After that need to Contact payroll support in QBDT for the agent to generate a service key for you.

If you haven't received your service key, please check your spam or junk folder. Alternatively, you can use our automated Service Key Retrieval tool. Simply sign in with your Intuit Account login details.

Here's how:

After accessing the program successfully, do you need help in reviewing your financials and other entries? Check out this article series to help you utilize the Reports feature well: Understand reports.

Please feel free to reply to this post if you have any further questions regarding your QuickBooks Desktop Payroll subscription. We are always here to assist you.

Intuit's QB Payroll is NOT for small business owners like me. I am an accountant with only 6 clients for payroll and have been using QB's Desktop Payroll for many years. Last year they started charging me over $1K and at that time I was so busy that I did not have time to investigate payroll services from other companies. Now I have more time to find other payroll companies offering similar services at much less charges.

Now to finish up my 2024 payroll, I found out that I cannot access QB Payroll after QB's latest update which occurred this weekend.

The error message is "The file you specify cannot be opened - "The Window Error was 'The File exists'???

Has anyone encountered this error message that has prevented accessing QB Payroll?

Hello there. Thank you for providing detailed information regarding the payroll error message you have encountered. I am here to assist you in resolving this issue.

If you encounter an error such as, "The file you specified cannot be opened and The file exists." while updating payroll, paying taxes, or opening state or federal forms, the solution is to run the application as an administrator on your PC. Please follow the steps outlined below:

If the issue persists, I recommend updating the Windows Permissions by following these instructions:

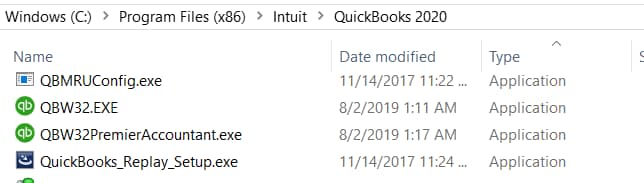

Processor Type

File Path for QBW32.EXE

You can proceed to step 4 in this article: Fix payroll errors: The file you specified cannot be opened and The file exists.

Additionally, you may find it helpful to visit this article to learn how to view payroll tax payments and forms in QuickBooks Payroll: View your previously filed tax forms and payments

I am always here to provide further assistance with your payroll or any QuickBooks-related issues. Please do not hesitate to reach out if you need more help. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here