Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowLet me help you sort this out, @Anonymous.

May I ask what error prompt did you received while trying to enter your NE State Identification number?

Here are the instances why you're unable to enter your State ID number in QuickBooks Online.

That should do it! Feel free to click the Reply button if you have follow-up questions about setting up your State Payroll tax. I’m always here to help.

I'm having the same problem trying to enter my Nebraska State ID Number. It wants it in a xx-xxxxxxx format, but my number (looking on the certificate) is only 8 digits and no dashes. Help please!

Thank you for posting here in the Community, @jodisd1.

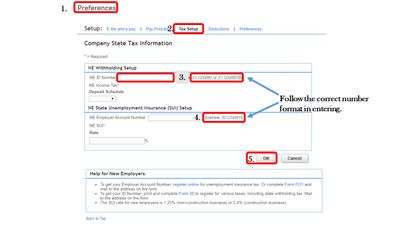

To ensure that you have the correct NE Withholding number, I highly suggest reaching out to your State agency for verification. It should be with a format of xx-xxxxxxx for the NE Withholding and xxxxxxxxxx for the NE Employer Account Number. You can follow the steps provided by, IamjuViel to verify your account numbers.

Also, I'd attached here a helpful article that you can read through to know more about what's changing with the federal W-4.

Feel free to leave a reply below if you have other concerns with QuickBooks. I'll appreciate the opportunity to help. Stay safe and take care always.

I’m trying to set up my taxes as well for payroll. I’m in Texas and when I tried to register, I was told I was not liable to pay state taxes. Therefore I was not goven a number. I’ve typed in my FEIN where it asks but I still haven’t been able to set it up.

I am also having all these problems. Anybody come up with an answer?

Hi there, aztek_llc.

Welcome and Thank you for posting here in QuickBooks Community.

When you enter the state identification number for payroll or taxes, make sure to input the correct one. That said, it could be that you entered the wrong number. This is because State unemployment and State withholding have different account numbers. The format that the QuickBooks system follows is all from the state. That said, numbers should be with a format of xx-xxxxxxx for the NE Withholding and xxxxxxxxxx for the NE Employer Account Number.

I still suggest contacting your state agency to make sure that you have the correct set of account numbers and verify from them.

Once verified, you can click this article to see detailed steps on how to add or edit your state account number: Changing a state account number.

Please refer to this to see different information about the new changes to the Federal W-4 and how to enter and print a W-4 for employees: What’s changing with the Federal W-4?.

Please let me know if you hit any bumps along the way so I can assist you further. Always take care and have a nice day!

I had the same issue and called the NE Dept of Revenue. They said to add the 21- to the beginning of the number and then a leading zero to my 8 digit number, that worked.

Example -

Your Ne tax ID - 12345678

Enter into QB as - 21-[removed]

What was the 8 digit number. Reason I ask is cause to run my payroll for the first time

Thanks for joining the thread and choosing QuickBooks as your payroll tool, @DPS3. I’m here to share some insights about the 8 digit code and lend a hand with running payroll.

The 8-digit account number is your unique state tax identification number or EIN. This is given to a company or organization by the state in which it conducts business. This is also mostly utilized for SUI and other state-related taxes.

Please also know that federal related-taxes requires 9-digit EIN. This should be issued to you by the IRS. That said, numbers should be with a format of xx-xxxxxxx for the Withholding and xxxxxxxxxx for the Employer-Account Number.

This is used for tax filing and employee hiring. That’s why you need to enter this so you’ll be able to run payroll. If you don't have one, contact the IRS or your state agency to get the needed information.

As a workaround, you can enter zeros as your temporary EIN. Just make sure to update this information once you received it.

You might want to read about the Payroll Tax Compliance Links to find more details on tax forms, withholdings, unemployment and other tax, e-file and pay information, general state and agency information, and employer registration.

For payroll questions when paying employees, you can have this article as your reference:

Need more help in setting your state taxes in QuickBooks Online? This article will help you with the process: Set up local taxes in Online Payroll.

If you're looking for a guide to help you epay and efile your taxes in the future, feel free to bookmark this article: Set up e-file and e-pay in Online Payroll.

Please let me know if you hit any bumps along the way when running payroll. I’ll be here to assist your further. Have a great day!

The Nebraska withholding tax number is only 8 digits, but you need 9. They advised adding a '0' to the front of the number when I called Nebraska. I believe QuickBooks should reach out to Nebraska Tax to resolve the issue instead of asking us to do it and getting nowhere between NE Tax and QuickBooks.

This is not the impression we want you to experience, myqandil.

Yes, you are right. Your unique state tax identification number, or EIN, is represented by the 8-digit account number. However, federal taxes necessitate a 9-digit EIN. We'll need to enter zeros as your temporary EIN instead. Once you receive it, make sure to update this information in QuickBooks Online.

We see consumer feedback as an opportunity to improve our products' numerous features. I'd suggest providing direct feedback to our engineers. They may look into this suggestion and incorporate it into future updates. Here's how:

Furthermore, you can visit his page to stay up to date on the latest software improvements and enhancements with QBO: Customer Feedback for QuickBooks Online.

To learn more about adding or changing your state account number in QuickBooks Online Payroll after you’ve started running payroll, check out this article: Add or change your payroll state account number.

Feel free to visit these articles for more details about submitting tax returns:

I'll be around if you have any other questions about the withholding forms and payroll processes in QuickBooks. I'd be here to provide guides and the steps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here