Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do we change our e-mail address that QuickBooks uses to notify us of Federal Tax "QuickBooks E-pay Confirmations" and also Intuit "Direxrt Deposit Service Communications" ?

We are transitioning to new accounting department personel taking over handling payroll duties and we need these QuickBooks Payroll Service confirmations and notices to go to the correct e-mail address.

Solved! Go to Solution.

Good day, @SCUTI,

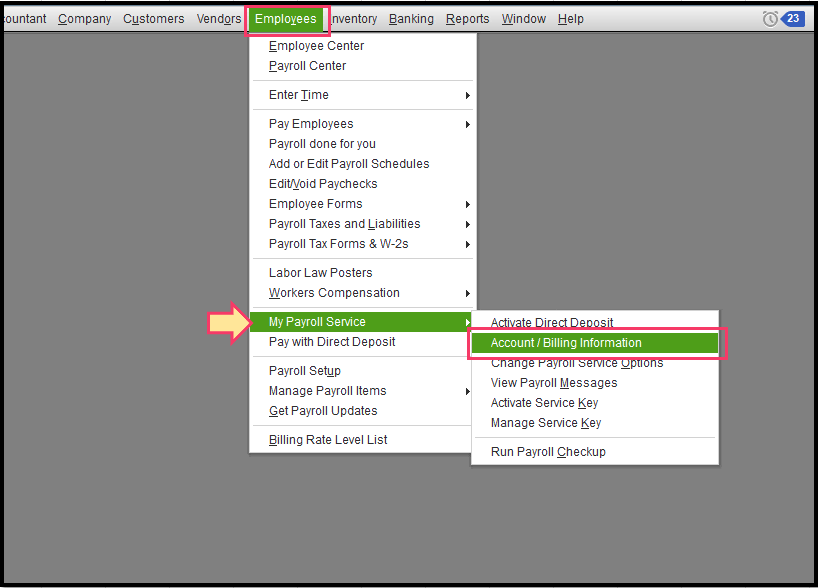

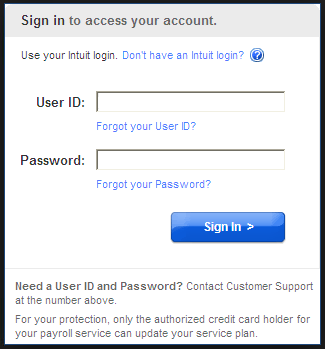

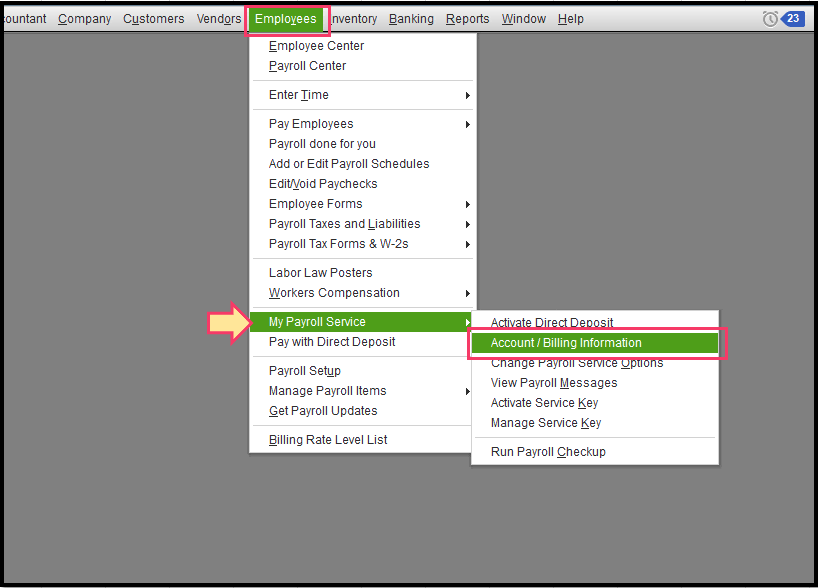

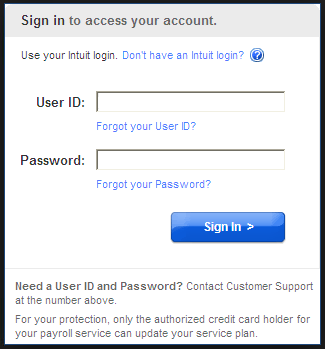

Let's log in to the QuickBooks Payroll Maintenance page so you can change the email address for your payroll notification.

Here are the steps on how to accomplish this:

You can go through this article for additional information with payroll information: Update Payroll Admin information in QuickBooks.

Also, please update the payroll tax table every time you pay your employees, or at least every 45 days. This is to ensure your payroll has accurate information.

By following the solution above, you're now able to update the email address. Keep in touch if there's anything I can help you with concerning payroll. I'm always around whenever you need help.

Hello there, SCUTI.

Allow me to chime in and provide more information about changing the email address for payroll related notifications in QuickBooks Desktop.

The steps provided by my colleague, MaryLandT, is for the direct deposit notification. It seems that you'd also like to change the email address for E-file and E-pay notifications.

To change the notification for E-file, please follow these steps:

I've attached some screenshots below to help you with the process.

For E-pay, you can change the email address when processing your payments and QuickBooks will use this information moving forward.

To learn more about managing the Company Information, you can check it on our Help section. Just click on Help and choose QuickBooks Desktop Help. Then, enter a keyword in the Search bar.

You can also manage your QuickBooks products and subscriptions by logging into the Customer Account Management Portal Site (CAMPS).

That should do it. Please let me know if you have any other concerns. I'll be around to keep helping.

Good day, @SCUTI,

Let's log in to the QuickBooks Payroll Maintenance page so you can change the email address for your payroll notification.

Here are the steps on how to accomplish this:

You can go through this article for additional information with payroll information: Update Payroll Admin information in QuickBooks.

Also, please update the payroll tax table every time you pay your employees, or at least every 45 days. This is to ensure your payroll has accurate information.

By following the solution above, you're now able to update the email address. Keep in touch if there's anything I can help you with concerning payroll. I'm always around whenever you need help.

MaryLandT -- Thank you. Actually, I figured this out since I posted my inquiry, so you just confirmed it. This is one of those things that is done so infrequently that one forgets how to go about it. Thanks again for your help.

Hello there, SCUTI.

Allow me to chime in and provide more information about changing the email address for payroll related notifications in QuickBooks Desktop.

The steps provided by my colleague, MaryLandT, is for the direct deposit notification. It seems that you'd also like to change the email address for E-file and E-pay notifications.

To change the notification for E-file, please follow these steps:

I've attached some screenshots below to help you with the process.

For E-pay, you can change the email address when processing your payments and QuickBooks will use this information moving forward.

To learn more about managing the Company Information, you can check it on our Help section. Just click on Help and choose QuickBooks Desktop Help. Then, enter a keyword in the Search bar.

You can also manage your QuickBooks products and subscriptions by logging into the Customer Account Management Portal Site (CAMPS).

That should do it. Please let me know if you have any other concerns. I'll be around to keep helping.

JaneD,

Yes, you are correct we also want E-file and E-pay e-mail notifications to change. I followed your procedure and saw the correct e-mail was there already. Don't recall when or how ir was changed. We'll note who gets an e-mail notification on the next Federal tax payment and when we e-file 1st Quarter 941's. Thank you.

I was recently forced to sunset my microsoft 2013 desktop e-mail and go to Yahoo web-based e-mail exclusively.

I use my quickbooks extensively to e-mail clients for my many free-lance jobs. But that e-mail was always tied to the Microsoft 2013 desktop e-mail.

Currently, I'm unable to use QB to e-mail clients an invoice, but really renders the product useless to me. Could someone help me with making the switch. The ability to e-mail clients invoices is the No. 1 reason I have been a decade-long QB customer and fan. Thanks. Art Stricklin

Welcome to the Community, Bbearsn1.

I understand how important it is for you to be able to send invoices through email. Let me share with you some insights about emailing invoices on QuickBooks Desktop (QBDT).

To have the best experience with QBDT, you need to have the QuickBooks Pro or Premier 2019 and Enterprise 19.0 or later versions.

Also, check the system the requirements for this version.

You also need to set up webmail to work with QuickBooks.

Here's how:

Before you get started

Set up webmail

Additionally, you can also check on how to upgrade to newer versions of QuickBooks Desktop Pro Plus, Premier Plus, or Enterprise.

Feel free to reach back out to me if I can be of more help about emailing invoices. I'll make sure to get back to you as soon as I can.

Hi

I have followed these steps and the confirmation of efile acceptance is still going to the wrong email. I have looked all over Quickbooks Desktop to see where it is pulling this email from and I can't see it.

Hi brucars,

I see that my colleagues, MaryLandT and JaneD, have shared good information about changing the email address for payroll communications. Thanks for trying their steps.

It’s important to me that you can update your email, so let me route you to the team that can help you further. You'll want to contact our QB Desktop Payroll Support via chat or callback request. They are available on weekdays from 6 AM to 6 PM PT.

Feel free to keep me posted on this. I'll be here in case you have other questions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here