Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I've got you covered, @roberts1908.

Let's make sure that the box for the Track payments for 1099 option is checked. This way, you can ensure that your independent contractors will be added to the tax filing module. To do so, follow these easy steps:

For more info, see this article: How to Add Independent Contractors and Track Them for 1099s in QuickBooks Online. Once confirmed, print 1099 NEC again.

If the issue persists, I suggest reaching out to our technical support team to further investigate the root cause of the issue. They use specific tools to pull up your account and they can also do screen sharing to check your contractor's set-up.

I've also added this helpful article to know more about payment categories for the 1099-NEC in QuickBooks.

If you need further assistance about this, feel free to get back here. I'm always around to provide you steps and resolutions to achieve your goal. Have a blissful new year and take care.

That didn’t work. The NEC still isn’t picking up the company name. The info is correct on the 1099 summary report, but not the actual 1099.

Thank you for getting back to us and sharing the results of the steps provided by my peer above, @roberts1908.

Please know that the 1099-NEC form only considers one recipient's name. Thus, when you entered the vendor's name on their profile, the system will automatically read it as your company name.

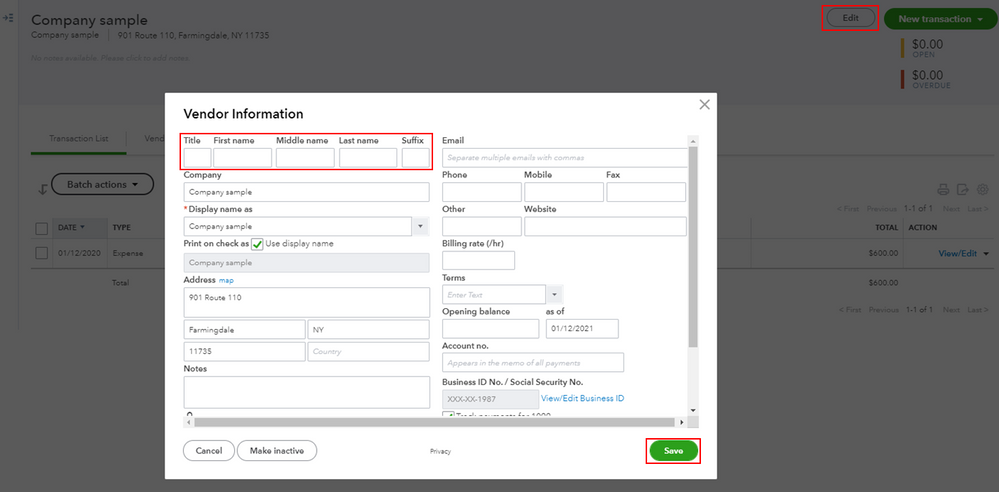

At this time, you can consider removing the vendor name on your vendors' profile to show the company name on the 1099-NEC form. Then, reenter it again once you're done preparing and filing the form. Here's how:

Once done, prepare your 1099-NEC again and verify if the company name is already showing. After preparing the form, you can reenter the vendor's name on their profile.

However, if the issue persists, I highly recommend contacting our QuickBooks Support Team. This way, they can further investigate this matter and provide additional troubleshooting steps to get this resolved.

You might also want to read this article to know more about the boxes on Forms 1099-NEC and 1099-MISC: Understanding payment categories for the 1099-MISC and 1099-NEC.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

I am experiencing the same issue and had to remove the individual name and only show the business name. I don't understand why the online version is doing this - the QuickBooks desktop version is printing out both the business name and the individual name on the 1099-NEC. The IRS prefers to have both - they want it to match to the W9 form. Hopefully QuickBooks online will fix this soon.

I am having the same issue with the desktop version. I can only get the last name to print with the dba for some of my vendors. It won't print the first name. And sometimes the full name does not fit in the last name box.

We have hundreds of contractors who fall into this category and you are telling me we have to manually change all of them and then change them back? That is unacceptable. Having a company name on a 1099 is not a new requirement. There needs to be a better solution.

Hi there, @desktopuser5308.

Let me provide some knowledge and troubleshooting steps about the vendor's name in QuickBooks Desktop.

To start, let's try to erase and re-type the vendor's name to re-trigger the process by going to the vendor's information.

If the same happens, please ensure that the Printer Setup on your QBDT account is set to \\print.corp.intuit.net. Simply go to File, then choose Printer Setup.

See the sample screenshot below for your reference.

Once confirmed and still getting the same problem, you can following the actions displayed in this article: Resolve printing issues.

If the issue persists, I'd suggest communicating with our QuickBooks Expert. They can do remote control and investigate the main cause of the problem.

Also, ensure to contact them within business hours to cater to your concern immediately.

Please browse these articles below for your future reference. This contains steps in managing the contractor's information, taxes, forms, and other relevant matters.

Don't hesitate to leave a comment below if you have other concerns. I'm happy to provide details or explanations.

Hello, @sgarrison.

I'll share some information about 1099-NEC in QuickBooks Online.

This is not the experience we want you to undergo in our system. I know how hassle it is manually changing the vendor's names in QuickBooks Online. But as of now, this is the best resolution. So the company name will show up in the 1099 form.

Nothing to worry about, I'll take note of this and send it to our higher to take action on it.

As my colleague mentioned overhead, you can communicate with our support to know extra troubleshooting steps to get this settled.

Here's how:

I've attached an article about managing vendor forms, transactions, reports, and other topics.

Let me know in the comment section if you have follow-up questions. I'm glad to assist further.

I experienced the same problem with the company name not printing on the Forms 1099-NEC. Today I spent literally 4.50 hours that I didn't have with multiple QuickBooks tech supports from Philippine to US and after all that they told me oh only one name will print! They also recommended that I remove either the person or company name, print my 1099s and then go back and add them again! What a ridicules suggestion! I have clients that have more than 50 1099 contractors. How are we supposed to do that? Intuit management and engineers if you're are reading all these complains please get to work and fix the problem as soon as possible as we the accountants and prepares running out of time! These forms are due by January 31!

I experienced the same problem with the company name not printing on the Form 1099-NEC. Today I spent literally 4.50 hours that I didn't have with multiple QuickBooks tech support from Philippine to US and after all that they told me oh only one name will print! They also recommended that I remove either the person's or company name, print my 1099s and then go back and add them again! What a ridicules suggestion! I have clients that have more than 50 1099 contractors. How are we supposed to do that? Intuit management and engineers if you're are reading all these complains please get to work and fix the problem as soon as possible as we the accountants and prepares running out of time! These forms are due by January 31!

This is not an acceptable solution. We cannot change hundreds of vendors across multiple corporations, especially in time for the IRS filing deadline. Think of the time your THOUSANDS of customers must spend to action this workaround. This is a problem your developers need to fix. We have reported it up the chain to enterprise support.

Thank you for the information but this is not an acceptable solution. We cannot change hundreds of vendors across multiple corporations, especially in time for the IRS deadline. Think of the time your THOUSANDS of customers must spend to action this workaround. This is a problem your developers need to fix. We have reported it up the chain to enterprise support.

This is not an acceptable solution. We cannot change hundreds of vendors across multiple corporations, especially in time for the IRS filing deadline. Think of the time your THOUSANDS of customers must spend to action this workaround. This is a problem your developers need to fix. We have reported it up the chain to enterprise support.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here