Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowThanks for checking in with us, cjn52.

There's no specific time frame on when the status change from "rejected" to "submitted to the agency". However, Intuit will submit it to the tax agency within 24-48 hours and you check the status of your filings by following these steps:

Here are the different statuses that show:

Furthermore, you can also consider learning how to e-pay taxes in QuickBooks Desktop Payroll Enhanced. Also, to ensure that the payment or form is submitted to the agency promptly, it's important to check the status of the e-payment or e-filed form after it's submitted.

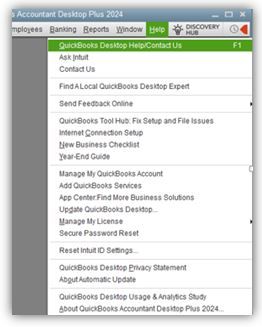

To check the progress of your status, I recommend contacting QuickBooks Desktop Payroll support. To help you pull up the resources you need. Here's how:

You can also check out this link for more contact information: Contact QuickBooks Desktop Payroll support. Ensure to review their support hours, so you'll know when agents are available. For additional reference, adding you some articles to know how to submit and check the filed forms:

Please come back and keep us posted on your progress with the status of your filings. I'm determined to get this resolved. You have a good one.

I posted this same issue last year. I never did get an "Agency accepted" status. It remains to this day with "Submitted to agency". It was 11 days later when under "Audit trail" it showed that it was agency accepted. It was frustrating at the time because it usually is immediate as you mention. It looks like this is going to most likely be the case this time around as well. It should be fine.

That doesn't quite address what I'm seeing in my QB's desktop. Under "Audit Trail" it only shows "submitted to Intuit". It hasn't even reached the status of "sent to tax agency".

That doesn't quite address the situation I have. Under "Audit Trail" it only shows "Sent to Intuit". It hasn't even reached the status of "Sent to tax agency".

Thank you for getting back to us, @cjn52.

The Submitted to Intuit status means that the e-payment or e-filed form has been submitted to Intuit. Usually, Intuit will submit it to the tax agency within 24-48 hours. However, if it's already beyond this timeframe, I suggest reaching out to our Customer Support team.

Our Customer Support team can help you check your account in a secure environment using their tools. They can also verify the status of your payroll tax payments or filings sent through QuickBooks Payroll. Follow the steps below to reach them:

You can check this article for more information about the different types of support we offer and their availability: Contact QuickBooks Desktop support.

If you need to amend previously filed federal forms 941 and 940, you can refer to this guide: File a corrected Federal Form 941 and 940 in QuickBooks Desktop Payroll.

If you need any more help with your forms, please let me know by leaving a reply below. Have a great rest of the day!

It took almost 2 weeks for the audit trail to update to accepted. I am expecting the same things this time.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here