Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhich of the following is correct?

Solved! Go to Solution.

Thanks for reaching out to the Community, DG96.

I'm here to provide you some insights about the difference between the two transactions. In QuickBooks, you'll enter Expense transaction at the time of purchase for goods or services that have already been paid. On the other hand, if you purchase and want to pay it later, then you'll enter the transaction as Bill.

The first and second bullets are correct. The third bullet, you can create recurring for "both" expense and bill transactions. Fourth, expense and bills contain "Item Details". Lastly, you can add Attachments to expense and bill transactions.

I've added some links you can refer to learn more information:

Please let me know if you have any other concerns. I'm always here to help.

Thanks for reaching out to the Community, DG96.

I'm here to provide you some insights about the difference between the two transactions. In QuickBooks, you'll enter Expense transaction at the time of purchase for goods or services that have already been paid. On the other hand, if you purchase and want to pay it later, then you'll enter the transaction as Bill.

The first and second bullets are correct. The third bullet, you can create recurring for "both" expense and bill transactions. Fourth, expense and bills contain "Item Details". Lastly, you can add Attachments to expense and bill transactions.

I've added some links you can refer to learn more information:

Please let me know if you have any other concerns. I'm always here to help.

If I have a subcontractor invoice me at the beginning of the month, and I pay them towards the middle or end of the month, would I enter the invoice as a bill or expense at the beginning of the month?

Look no further, @Michaelak.

If you'll pay the invoice sent by your subcontractors in the middle or end of the month. You'll record this as a Bill. As per my colleague, @GlinetteC discussed above, Expense transactions are those paid at the time of purchase. On the other hand, Bill transactions are those purchases that you'll pay at a later date.

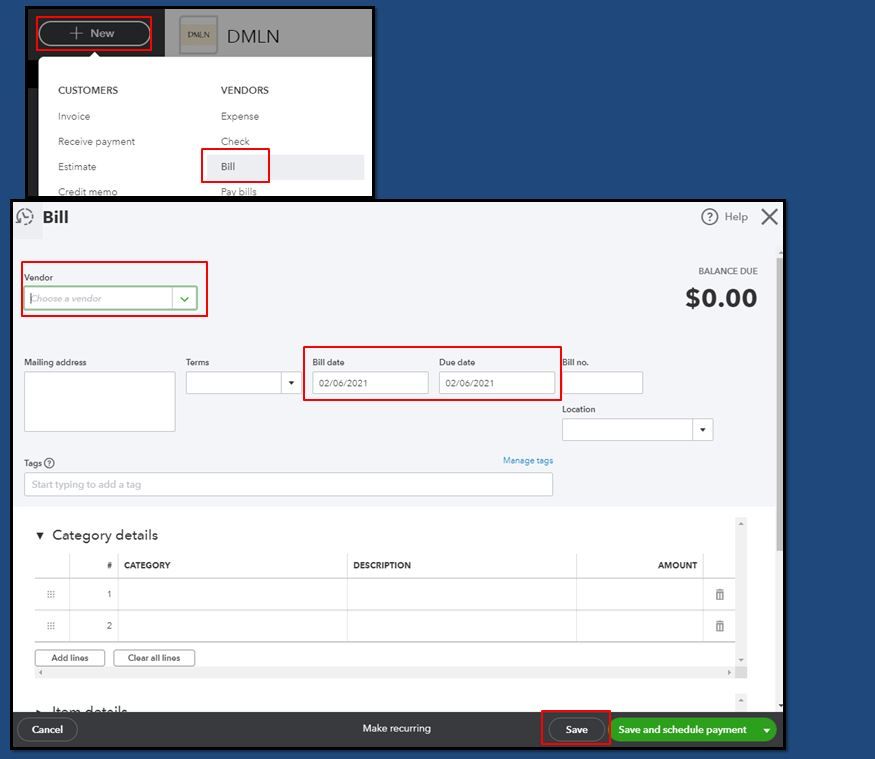

Follow along below to create a Bill right away:

Then, to record payments on the bill you've created, please head to Enter bills and record bill payments page for the detailed instructions.

Also, QBO offers some reports to help you monitor your paid and unpaid bills. To get started, just go to the Reports menu and scroll down to the What you owe section.

Let me know if you have further questions in recording transactions with your subcontractors. I'm always here to give answers and clarifications. Have a great day ahead.

Hello! It sounds like I should enter property tax bills as bills. But then is there any solution to how to attach documentation or a copy of the invoice to it? TIA.

I'll make sure you can attach documentation or the invoice copy of your property tax bills on your Bill transactions in QuickBooks Online (QBO), @ERB-Pittsburgh.

You can add a copy of your property tax invoice as an attachment to your bill. This way, you'll be more organized with your record-keeping. Then, helps you in keeping your books accurate.

To attach a document to the bill, follow these steps:

You can also attach a document to your customer and vendor profiles. Then, directly upload a file to the Attachments list without attaching them to a transaction or profile. To learn more about this, you can refer to this article: Attachments in QuickBooks Online.

Once bills are entered, you'll have to record payments towards them in QBO depending on how they're paid. Please check out this article for the complete details: Enter bills and record bill payments in QuickBooks Online (Record payments towards bills section).

Then, I'd recommend monitoring your business expenses by pulling up transaction reports (i.e., Expenses by Vendor, Transactions List by Vendor or Purchases by Vendor). To do this, go to the Expenses and vendors section from the Reports menu's Standard tab.

Also, I'm adding this article to further guide you in entering your expenses, paying bills, writing checks, and managing suppliers using QBO: Help Articles for Expenses and Vendors. It also includes topics about purchase orders, vendor credits, and managing inventories, to name a few.

Let me know if you have other concerns about managing business expenses and attaching documents in QBO. You can drop a comment below, and I'll gladly help. Keep safe always, @ERB-Pittsburgh.

Hello, just want to confirm, so if the invoice has been received by the vendor and will not be paid yet, so this will be tagged as "bill" in the projects section, right? but, if this invoice has been paid already, this will be added to "expense", right? what about if I want to pay the invoice that was initially inputted as "bill"? what should I do?

Also, will the client see if I want to add these expenses/bill in the project section? I don't want this to be seen by them as, of course, there is a mark-up, what should I do? Is ticking on and off the "billable" in the the category details section will do this?

Thanks for joining this thread, @ushuaia_22. I'll clarify a few things about how the bill works in QuickBooks Online (QBO).

In QBO, you'll enter an Expense transaction at the time of purchase for goods or services that have already been paid for or for items paid-on-the-spot. On the other hand, if you purchase something and want to pay for it later, you can use Bill to track what you owe.

For more information about the difference between an expense and a bill, see this article: Learn the difference between bills, checks, and expenses in QuickBooks Online.

If you want to pay the bills in the future, you can simply use the Pay bills feature in QBO. For your reference in entering the bills and processing the payments, visit this article: Enter bills and record bill payments in QuickBooks Online.

Also, the billable expense option is used when you incur expenses on your customer’s behalf when you perform work for them. It can only be used to reimburse them when they receive their invoice.

Let me know if you have other concerns about managing business expenses and bills in QBO. You can drop a comment below, and I'll gladly help. Take care!

I would like to know if these expenses and bills that are being created can be seen by the clients??? Can you also add quotes/estimates from vendors in quickbooks?

Good afternoon, ushuaia_22!

Hope your day is going well so far! I'll share insights about bills and expenses in QBO.

The bill and expense transactions are not visible to your clients, and if you make them billable, only the item information will appear on their invoices. You can try making billable bills or expenses and creating an invoice out of them. Then, click Print Preview on the invoice transaction to see the things that are visible to your client.

As for your other question, estimates or quotes are only available for clients or customers. If want to inform your vendor about the things you want to buy ahead of time, you can send them a Purchase Order instead.

On the other hand, if you've created an estimate for a client for a certain item that you also need to buy from a vendor, you can directly copy the estimate to a purchase order.

Please don't hesitate to reach back out if you have other questions in mind. Take care!

Going one step further here - we use accrual accounting. I'm constantly spending a ton of time reviewing and fixing the service periods - i.e., when the expense was incurred vs. when it was paid or an invoice was received.

Hypothetical scenario:

- We have a rental (or a contractor doing work), etc... for Jan 11 - Jan 25

- Invoice received 2/1 w/ Net 10 terms (so, due 2/11)

If i just enter the invoice date as 2/1, this will appear as a Feb expense in the P&L but it is a Jan expense. Is there a field that can be added or would a custom field help here?

Thanks for following along with the thread and sharing your concerns, @Anonymous.

How's your day going so far? I hope all is well.

The data of the bill is going to be the date the expense hits. You could adjust the invoice date to whichever date you see fit. However, please keep in mind that it's always best to consult with your accounting professional on the specifics before entering the transaction. Your accountant can let you know the best route to take when it comes to special scenarios, such as this one.

If you don't have an accountant, don't sweat it. You can find one here in our Resource Center.

Please don't hesitate to let me know if there is anything else I can assist you with. Take care!

I am working with a client who started making entries in QB Online a couple of weeks before I was fully authorized. They process "check requests." In other words, at this time they complete a check request for their vendors and then handwrite checks vs having them printed through QB. An issue we are working to streamline.

Anyway, the first half of January, the entries were made as expenses, not bills, so they show as Type: Expenditures. I'm unable to see a Vendor Balance Detail because those weren't entered as Bills. Would it be best practice to go back to those expenditures and delete them and re-enter as Bills? I have all the information as far as check number, invoice date, etc. The checks have come through the bank, so they are paid. Will I need to go back into those Bills and mark them paid?

Thank you.

I appreciate you for chiming into this thread, @tlm84. I'd be delighted to share some information about properly recording vendor transactions in QuickBooks Online (QBO).

We're unable to suggest what specific transactions you should record into your clients' books as long as you have correctly tracked their vendor transactions on time. However, to keep track of Vendor balances, entering bills is essential for knowing how much you owe vendors. You'll want to refer to this article for details on what transaction type you can record, depending on how it will be used: Learn the difference between bills, checks, and expenses in QuickBooks Online.

You're correct that expenses and check transactions will not appear in the Vendor Balance Detail report. This is because the report only reflects payments coded to expense accounts and not true vendor totals.

To get your vendor totals for all of the money-out transactions, I suggest running the Transaction List by Vendor report instead. You'll only have to select the correct Report period to show what transactions have been created associated with your vendors. You can switch to the classic view if necessary.

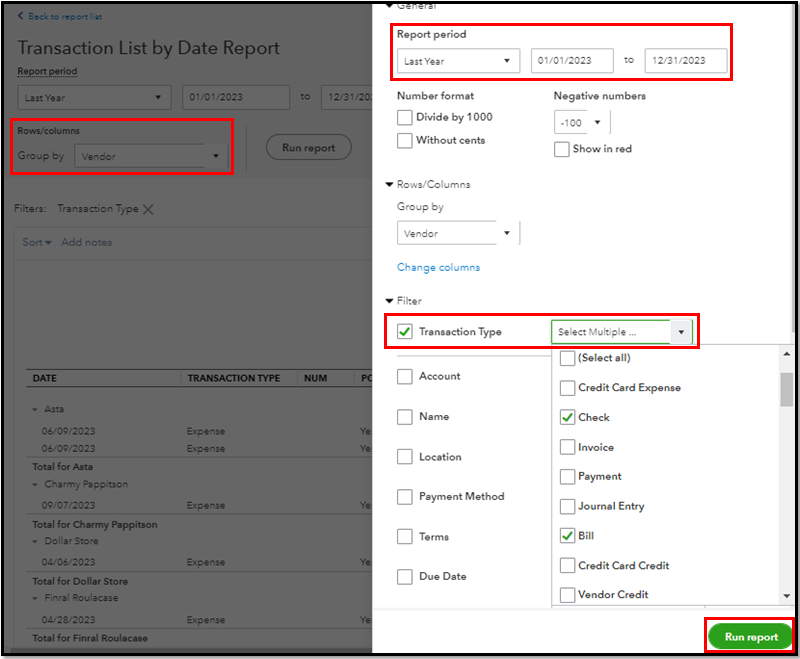

Furthermore, you can also run the Transaction List by Date report to reflect all payments to your vendors. Here's how:

Additionally, you can check out this article for additional guidance on handling your business expenses: Enter and manage bills and bill payments in QuickBooks Online. Simply navigate to the Record payments towards bills section for relevant steps in paying your bills in QBO.

Please know that you're always welcome to post a reply in this thread if you have any other questions about managing your vendor transactions. I'll be here ready to assist you. Have a great day ahead!

We recently switched insurance companies and the new company billed us for January and February on January 15th. I entered the bill as of that date. It was paid in full for both months by ACH on 2/1/24. For the month of March, we received the bill on 2/9/24 and it was paid on 3/1/24. When I run our Statement of Activities for February, it shows 3 "expenses" in our insurance expense account even though one of them is actually just a Bill for March that was received in February but hadn't been paid as of 2/29/24. This is a problem for our Executive Director because he says it isn't accurately reflecting our expenses in February if it's showing a Bill that hasn't been paid yet. He said at the end of the year it will show 13 payments to insurance instead of 12 the way QB is currently showing it. Is there a way to avoid this or a way to fix/adjust it? Hopefully I explained the situation clearly enough.

Thank you for bringing this out to the Community, @ndjohnson8.

In order for you to adjust it, Let's change the accounting method and date range to see if it makes any difference.

Here's how:

1. Click on the gear icon.

2. Select "Account and Settings".

3. Go to the "Advanced" tab.

4. Click on "Accounting".

5. Finally, select Accounting method Accrual to Cash.

After making the changes, please review the report to ensure that everything is correct. If you encounter the same problem, you can switch between the modern view and the Classic view to observe the variations. The date range will change when you make this switch.

I've added screenshot for your visual reference. The first picture is for the Modern View, and the other one is for Classic View.

I also included this article to help you managing your Bills: Enter and manage bills and bill payment in QuickBooks Online.

If you have more questions related to any QuickBooks product, please don't hesitate to contact us back. We're always available. Have a great day!

It's a good question and @ErwinQ 's response doesn't work because you're on accrual basis, hence why all three expenses are showing in February. IMO, the easiest solution is to date the vendor's bills in the month that apply to the insurance coverage. So, in your example, you would create two bills using the same bill number, one dated 1-1-24, the other dated 2-1-24, and pay them together. Then, the bill for March coverage would be dated 3-1-24. The April bill would be dated 4-1 and so on. Make the due dates accurate with the vendor bills but disregard their bill date. That will properly book the expense in the month in which the insurance coverage applies. As long as you have the correct bill numbers, the bill date won't cause any issues for your vendor.

Thank you for your reply @Rainflurry . When I saw the other response I was scratching my head because it doesn’t make sense to change our accounting method to cash in the middle of our fiscal year. I was thinking exactly the same thing you suggested though. I was hoping there was another way but as you said, doing it the 2 invoice way using the due date instead really isn’t a big deal accounting wise. Thank you for your help!

Thank you for your reply @Rainflurry. I was scratching my head reading the other reply. It doesn’t make sense to change our accounting method in the middle of our fiscal year. I was thinking the same thing you suggested. I was hoping there was another way but it makes sense since there’s no harm to use 2 invoices & the due date instead of the bill date. Thank you for your help!

I'm not sure your accounting background but the best way to handle these transactions is to create a journal entry each month that debits Insurance Expense and credits Accrued Expenses (liability) for the monthly premium. Then, when the bill arrives, list Accrued Expenses as your account (category). That will book one expense entry each month and the bill will reduce the accrued expense liability. That way, you can enter one bill (if billed for multiple months) and the date of the invoice is irrelevant on your statement of activities because the bill only hits balance sheet accounts and not your statement of activities. The multiple bill option works but if you're comfortable with journal entries, this way is the proper way to do it.

I’m the Controller for a small nonprofit. I’ve been there just under a year but have held similar positions for the past 5 years & lower level accounting positions for many years before that.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here