Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowSo I run into a situation where we order a wrong part from the vendor and request an refund from them for the amount of $5,000. Since we have a few order that are pending from that vendor as well (about $3,000 in total),

they subtract that amount from refund and gave us $2,000 back. My question is how do i record all of this in quickbook? I have never do a refund from vendor before, let alone getting it subtract by the new order. Do i create a Refund account and then do a PO with that Refund account and transfer the rest of the balance back to my bank account? Any guiding with image is much appreciated.

Good to see you here in the Community forum, Mphan1402.

I'm here to share information with you on how to record your transaction on QuickBooks Desktop.

To start, you'll need to record a Deposit of the vendor check. Here's how:

Then, record a Bill Credit for the returned items:

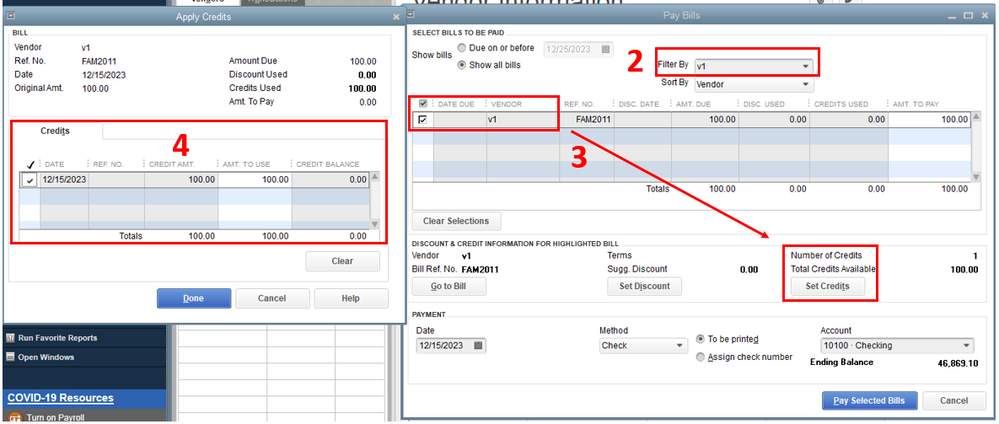

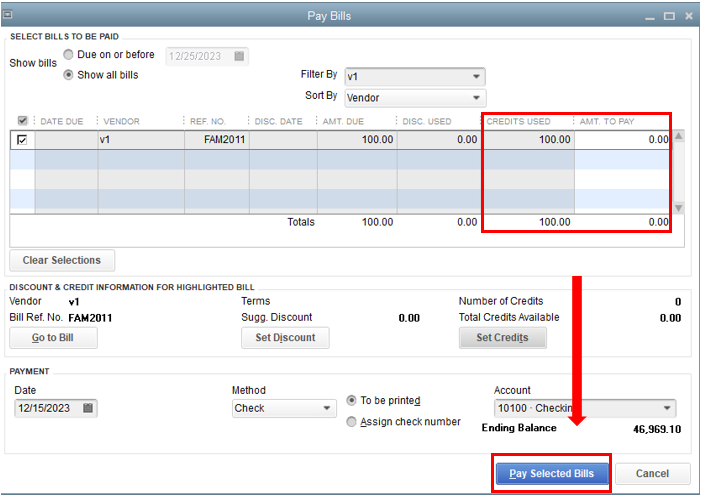

After that, link the deposit to the Bill Credit. Let me show you how:

For more details about this process, see this article: Record a vendor refund in QuickBooks Desktop.

Let me know if you have questions. I’ll be here to help. Have a good one!

Thank you for the Reply, but i will need a little more Detail on how much should i put in the Deposit form and the Credit from Vendor form. Like i mention above, if the vendor would just simply refund me the full $5,000, that would have been much easier. But instead, they choose to deduct the refund amount by applying $3,000 of the refund toward the other Purchase order that we have with them, and only credit us $2,000 back. The way i see it, i have to make a credit refund from vendor, and some how use some of that money to pay for other P.O. The problem is when i do a credit from vendor, do i put $2,000 or $5,000?

I'm here to share further details about the vendor refund, Mphan1402.

When recording the refund amount, you'll have to create a credit for the $3000 and then deposit the $2000 vendor check. For the detailed steps, I'd suggest following the steps shared by MirriamM. Otherwise, please refer to this article: Record a Vendor Refund.

To learn how to receive inventory with or without a bill in QuickBooks Desktop, please click here.

I'll be glad to help you again if you have more questions about managing refunds in QuickBooks. Have a great day!

I have a case where we returned something to a vendor so put in credit to use next time we order from them, well the vendor just credited our credit card instead so how do I get it on the credit card? I know I can just go put a credit in under my CC but then I can't put product back in inventory. Right now the only way I can "use" the credit is to pay them and put credit towards it but like i said they put it on my CC. Any suggestions?

Nice to have you joined this thread, @LRIESBERG.

I've got the steps you need on how to account for your credit. You'll need to create a Journal Entry (JE) so you can link it to the vendor credit you've created. I'll show you how.

Before we begin, I recommend contacting your accountant. They'll be able to guide you on the right account to debit and credit in recording a JE. If you're not affiliated with one, you can visit our ProAdvisor page and look for one from there.

When ready, you can follow along with these steps in creating a JE:

To apply the JE to the credit:

In addition, you'll want to adjust your inventory quantity to record back the item. You can utilize this link for the complete details: Adjust your inventory quantity or value in QuickBooks Desktop.

You can also check out these resources for guidance in case you need to refund your vendor and how to track your inventories:

Let me know in your reply if there’s anything else I can help with about your credits and payables. I’ll be here to help you.

I have QuickBooks Enterprise Desktop and this does not appear to work. Is there something I am missing? I have no outstanding bills with this vendor, so vendor is not in Pay Bills. And... it only lets you set credit for the outstanding bills amount. I received a check in the mail from the vendor due to a duplicate invoice that was paid. Both invoices had been paid. To make it worse, this spans two fiscal years.

@MirriamM wrote:Good to see you here in the Community forum, Mphan1402.

Good to see you on this thread, Breeeze.

I'd be happy to share information on how to record vendor refunds in QuickBooks Desktop (QBDT).

When recording a refund for the check that is not related to an existing bill, you'll need to ensure that you selected the appropriate Accounts Payable account when recording the deposit of the Vendor check. By doing this, you can record a bill credit for the amount of the check so you can link the deposit to the Bill credit.

To do this, I recommend following the detailed steps found in this article: Record a vendor refund in QuickBooks Desktop. Then go to Scenario 3.

Additionally, to further guide you in managing your vendor credits and other expense transactions in QBDT, I'd recommend checking out this article: Accounts Payable workflows in QuickBooks Desktop.

Let me know in the comments below if you have any other questions. I'm always around to help. Take care and have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here