Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIn the vendor center for a particular vendor, when showing all transactions, some transactions show an open balance that is not part of the actual vendor balance shown in the list of vendors.

If I select to show open balance rather than all transactions, the transactions are not listed and the open balance does match the vendor list on the left.

Some (not all) of the transactions are deposits for funds received from vendor. Deposits do not normally show up in the vendor transaction list, and I am not sure why these particular ones do.

The transaction has been applied/offset by other transactions and it does not appear in pay bills, either as a bill or an available credit.

I do not believe this is actually causing any problem in balances, but I do use the open balance column in the vendor center to monitor open vendor transactions, and it is confusing to see an open balance that is not truly open.

I have verified data and my file reports no problems.

Any way to clear the reported open balance in the vendor center?

Verify data is a good way to identify errors, FlyOverLand.

Let's troubleshoot next using the QuickBooks File Doctor. Here's how:

The scan time depends on your file size. In most cases, it can take up to 5 minutes. Once the scan finishes, open QuickBooks and your company file. The scan may say it was unsuccessful even if it fixes your issue.

Check this article to learn more: Fix company file and network issues with QuickBooks File Doctor.

I'll be here if you have other questions.

Hi MLM,

I finally got a chance to do that and it did not change anything.

The File Doctor reported no problems, and left the transactions unchanged.

One thing I neglected to mention earlier is that the confusing transactions showing an open balance have a blank aging days, which is somewhat helpful in recognizing them, but I'd still prefer not to see an open balance that does not need any action.

Thanks for the suggestion.

Thanks for the additional details, @FlyOverLand.

I'll help you get rid of the open vendor balance in QuickBooks Desktop.

Based on your original post, I can see that the open balance doesn't match the vendor list on the left. The usual cause of this incorrect amount is a transaction error. To isolate this, you can run a Vendor Balance Detail report.

Here's how to do it:

If the balance is too high, you may have paid a bill using a check instead of going through the Pay Bills window. To fix this, please refer to bill shows as unpaid after writing a check article at this link.

If the balance is too low, you may have entered the wrong amount in a transaction. You can look for the bill or bill payment in the Vendor Balance Detail report and then edit it.

To learn more about this, please head to this link: Adjust the current balance for a vendor.

Also, QuickBooks Desktop will automatically create a bill for the vendor if you've entered an amount in the Opening Balance field. This can cause balance issues. To remove this, you'll have to open the bill and delete it.

Lastly, you can pull up other vendor-related reports to know and settle your payables. To achieve this, navigate through the Reports menu. Then, select one from the Vendors & Payables section.

I'm still up and running if you need help with handling vendor transactions or anything else related to QuickBooks. Take care!

Hi ReyJohn,

Thanks for the suggestion.

But, my balance is not really incorrect. As I noted in my original post, if I select SHOW 'Balance Details' the troublesome transactions are not listed and the total 'OPEN BALANCE' for the transactions matches 'BALANCE TOTAL' in the vendor list.

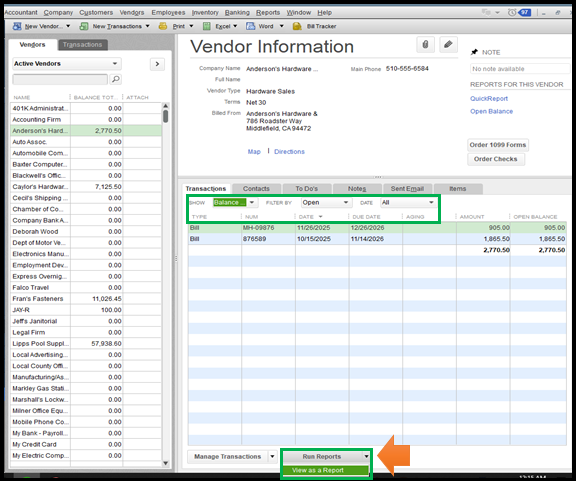

If I select SHOW 'All Transactions', then the transactions without a 'AGING' days show up and the sum of 'OPEN BALANCE' transactions exceeds the 'BALANCE TOTAL by those transactions in the list.

Maybe these attachments will help to illustrate.

Any other ideas?

Thanks

Thanks for the quick reply, @FlyOverLand.

I appreciate you for attaching a screenshot and following the steps presented above. I'll point you in the right direction so your transaction list will resolve as soon as possible.

Our Technical Support has the proper tools to examine your list and investigate the root cause of the problem. They can also create an investigation case and send it to our engineers to further review if needed.

Here's how:

Please ensure to call them within business hours to guarantee we cater to your concern punctually.

I've also attached pages that might help in writing off balances, customizing vendor reports, and other topics.

Please don't hesitate to let me know how the call goes and if you have other concerns. Keep safe!

I have same exact issue the only time it doesn’t show in open valid smell is when you have a bill and then you pay bill and write a check then they cancel each other out for the ones that I just write a check for keep an open balance, and it’s super annoying

And your bills should have another line under it somewhere depending when u pay the bill saying bill payment. A bill with a matching bill payment will show zero. My issue is I don’t want to have to enter all bills. I just want checks written out and now I find myself w a check showing open balance like ur post says. I’m thinking every this has to have an opposite that. Every left has to have a right. To balance. So bill and bill payment= balanced. Zero open. Check and just writing it out = not balanced against anything 🤷🏼

Thanks for providing a screen shot, MommyTheBommy.

I'll provide you some tips for managing your vendor transactions. Both bill and check are technically an expense. These have different meanings in QuickBooks. A bill is money that your company owes but plans to pay later. While a check is payment that your company pays for a purchase on the spot.

If you create a bill for your vendor, you can use the Pay Bills feature to pay it. This will zero the balance. If you created a check to pay the bill, you'll need to link the check to the bill to clear it's balance.

Here's how:

Then pay the bill.

On the other hand. if you don't want to general all bills and write a check to pay your vendor. Then, you can delete the bills and keep the check. This will ensure your actual vendors balance is accurate. I recommend reviewing this article for more details: Bill shows as unpaid after writing a check in QuickBooks Desktop.

Furthermore, you can choose from a wide variety of ready-made vendor reports in QuickBooks Desktop. Check out this resource to know where your business is in terms of expenses and accounts payable: Customize vendor reports.

If you need further assistance managing your vendors, let us know. We're always here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here