Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have an eCheck that was processed through quickbook payments when the customer entered the wrong account number. Quickbooks deposited the funds in my account then deducted them later with a fee, but my invoice still shows paid. With a normal payment I can click on process bounced check, but with a Quickbooks eCheck that option is not available. How do I show the invoice unpaid, reverse the deposit to reconcile my account, and show the customer the payment was rejected/declined?

Hi there, pworthyservices.

Aside from using the Record Bounced Check option, there's another option to track bounced checks in QuickBooks Desktop. Here's how:

Once done, switch the payment for the invoice to the reversing journal entry.

Let me know if you need anything else. The Community is always here to help.

"Aside from using the Record Bounced Check option" - I would prefer to do this, but it is not available for echecks.

The issue I am having is that the customer is not seeing this as a bounced check. Quickbooks deposited the money in my account, and still shows response as approved, yet QB removed it from my bank and charged me a fee and lists the status disputed/disposed??

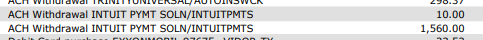

[Moderator note: edited customer screen below to protect privacy.]

Hi there, pworthyservices.

It could be that your customer initiated a chargeback request that's why the payment has been removed from your account was removed and it shows as disputed. This transaction is a sale disputed by the cardholder or card issuer. We can record this transaction using a refund so that you'll be able to reconcile your account. I'll guide you how:

Check out this article guide you in handling chargebacks and retrieval requests for QuickBooks Payments.

If I can of any additional assistance, please don't hesitate to leave a comment below. Feel free to tag my name.

I have run into the same problem. This is a programming issue that needs to be corrected. Please enable the bounced check option for e-checks!! Occasionally, but not often I will have a customer with insufficient funds and the check bounces. I need the same process to occur for e-checks as it does for normal bounced checks. The amount is deducted from the bank account register, along with any fees which I can enter. I can also create an invoice to charge the customer the return fee and Quickbooks automatically activates the invoice as unpaid again. I am well aware how to manually delete the deposit, delete the payment, change the payment to a regular check, then re-add the payment to the deposit, then use the bounced check button and finally have it enter a journal entry, and charge the customer and create an account and item list to deal with all of these things, but the point is we have programming for a reason! Please FIX this and enable the bounced check button for e-checks.

I followed all the steps in #2 but when I resend the invoice to the client to process payment on a second time, it's only allowing her to pay the returned check fee and saying there is a "credit" on the invoice, which is untrue.

Thanks for joining the thread, @franLBK.

There might be a data issue in your company file that's causing this behavior. This might be the reason why it's only allowing her to pay the returned check fee instead of the full amount.

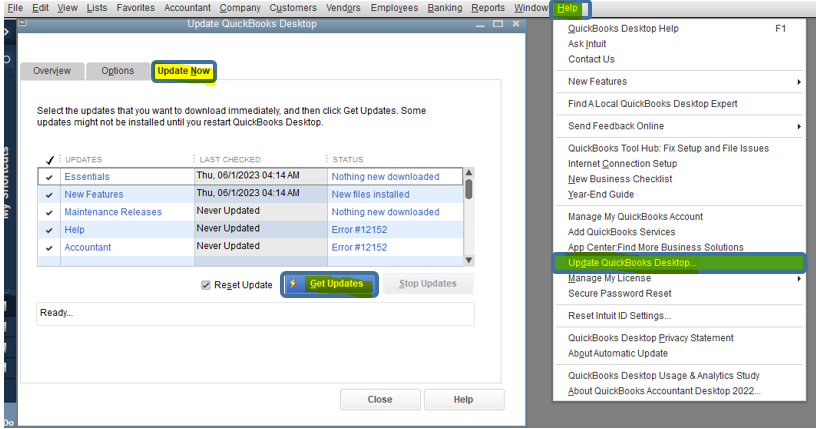

Let's clear this out by updating QuickBooks Desktop to its latest release. Here's how:

Once done, try sending the invoice again. If you're still getting the same result, run the Verify and Rebuild Data tools. These will help us identify the most commonly known data issues within a company file and fix it.

If the issue persists, contact our phone support. They have the tools that could check your account and trace the cause of the problem.

Here's how you can reach out to them:

Please check out our support hours to ensure that we address your concerns on time.

You can also run several reports to tell where your company stands. These offer critical information about your business and finances.

The Community always has your back, so please let me know if you have any other questions. I'll be more than happy to help. Keep safe.

I had this same problem and followed your instructions to manually enter the bounced check and reverse the payment. Now the original deposit from QB Merchant Services is still showing in my checking account. How do I remove the Merchant Service Deposit?

Thanks for chiming in on this thread, ronnaranjo.

I'd like to direct you to the right support for this situation.

After you make the changes related to the rejected payments, please contact our Merchant Services Team. They can help you remove the deposit.

You can click on the Chat with us link in this article: Contact Payments or Point of Sale Support.

I'm also adding this link for more details about the process: Fix rejected ACH payments or fees in QuickBooks Payments.

Please don't hesitate to reach out to me if you have any additional questions or concerns, I'll be here for you until the issue is resolved.

I have the same problem; client tried to pay my QuickBooks invoice via echeck online through intuit payment solutions. They simply transposed some numbers in error.

QuickBooks notified me of payment; waited a few days; funded the transaction; another day or so later - reversed the transaction, sucked the money plus $10 out of my account and sent me an e-mail.

i contacted client.

Client tried to go back in to take care of it; it won't let her pay the invoice - it says it has already been paid. So, the client wrote me a regular check, which i deposited.

But, now I can't get the "Automatically posted" rejected payment off her account. This makes it appear like she has a big credit balance - but she doesn't.

I read the details from others back through summer 2020. WHY IS THIS STILL AN ISSUE I HAVE TO STRUGGLE WITH??!!??!!

Hi GunTower19930!

Currently, the Record Bounced Check option is for the Check only, and not the e-Check payment method. Let me help you on how we can fix the rejected e-Check

We can manually record the rejected e-Check. What we'll need are an income account and a bad check charge item. Follow these steps on how to set up an income account:

Follow the steps in the Create an item section of this article on how to add a bad check charge item: Add, edit, and delete items. Make sure to select Other Charge as the type of item, leave the amount as zero, non-taxable, and select the Bounced Checks Income you created as its income account.

We can now create a journal entry. You'll need to debit the account receivable (A/R) for the same amount of the rejected e-Check and credit the bank account that received the original deposit.

Then, we need to switch the payment for the invoice to the reversing journal entry.

Once done, the original invoice should be open again and you can apply a new payment to it.

You'll want to check this link: QuickBooks Payments FAQ. This includes different articles that will help you in managing your payments with QuickBooks Payments.

Do you have additional concerns? Let us know by commenting again here and we'll assist you. Thanks!

The solution is to just enable the bounced check button for e-checks rather than have to do all this work around. Enough people are having a problem, so Inuit just fix this glitch please!

Hello - I have the same issue described on this thread. I've followed all of the instructions (created the bad check charge item and income account, recorded journal entry to accounts receivable, unapplied the merchant payment from the original invoice and applied instead to the journal entry, even deleted and re-recorded the deposit), with the same issue described here. The new invoice shows the correct balance due amount (in my case $1160, original $1150 plus the $10 returned ACH charge), but the ACH payment link on the invoice will not allow a payment amount greater than $10.

I confirmed the detail in my merchant account transaction is the same as the screenshots. In my case, it appears the customer used an incorrect routing number, so their bank didn't honor the ACH/echeck payment.

I also followed the update instructions (my file was current, but ran anyway) and the verify data (no errors exist), and the issue remains - in theory this process should work, but something in the background "remembers" the original payment and won't unapply it.

I think we need another workaround.

I ended up just leaving the payment applied to the original invoice, creating a new invoice (same invoice # with NSF after it), adding the return fee, and sending that link to the client.

Thank you, this was a much easier option than jumping through all the numerous hoops that didn't solve the problem.

I know how to handle rejected e-checks but my issue is that we used to receive the notification emails that included the reason code for why the transaction was rejected but about 2 months ago we stopped receiving the emails. We have called support numerous time and they are not helpful bc they have no idea what email message we are referring to.

Any ideas who to contact about not receiving the emails or how we can fix this? It's hard to tell a customer their payment was rejected by their bank when we don't know why it was!

Jumping in to ensure that you receive the email for the rejections codes once again, LWiles.

Most of the time, Intuit notifications and emails are not received due to the following reasons:

You'll want to check your Spam or Junk folder and see if the notifications were sent there. If you can't see them, add the following Intuit’s email addresses to your contact list:

Aside from that, you may also need to contact your IT person or domain provider for assistance to temporarily turn off Sender ID filtering or get help on what’s causing you not to receive the email.

Additional details about this are discussed here: Unable to Receive Intuit Email from QuickBooks Payments.

Allow me to add these articles as well in case you need more payments-related references:

Post more questions in the forum if you still need more help from us. We're open 24/7 to make sure everything is sorted out.

Frustrated with my options, I did something even simpler: I left the payment applied to the original invoice, contacted the client via my email (forwarding the Intuit NSF email) and requested a check. I deposited the check without recording in Quickbooks, but did record the $10 fee. Recording two paid invoices does not seem like good accounting practice to me.

What if the bank rejected it because it was an unknown transaction and then said to put the echeck back through?? How do you put it back through without all the darn steps to remove the payment and do it all over?

Thanks for following along with the thread, @TDean2.

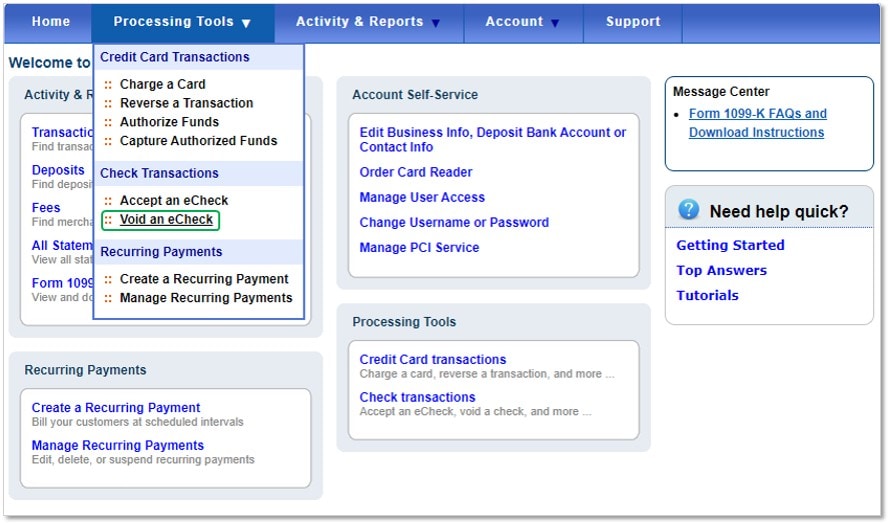

When we have a rejected echeck in QuickBooks Desktop, you'll need to void it, then recreate a new one using all the same details of the first check. At this time, there isn't a way to resend the same one. I've included some steps below to void the current echeck.

Here's how:

Once you've voided the echeck, you can Create a new one to send.

For additional details about this process, check out Void an echeck in QuickBooks Desktop.

Please don't hesitate to let me know if you have any questions or concerns. Have a good one!

I accidentally stumbled upon an easy fix - open the payment and change it to a Check (instead of E-check) then save and close. Re-open it and the option for Record Bounced Check is now available.

They must have saw this EASY fix and made it now so we now cannot do this - now the option to change the payment type is grayed out and not an option - so annoying! WE NEED AN EASY FIX - like let us use the bounced check option!!

I hear your sentiments. Helping you fix the problem with changing the payment method and enabling the Record Bounced Check option in QuickBooks Desktop is indeed my priority, DPHarris1.

The Record Bounced Check option in QuickBooks Desktop is typically grayed out for customer payments when the payment method used for the transaction is not eligible for bouncing. Credit cards, cash, or another type of non-bouncing payments do not have the possibility of being returned or bouncing.

Thus, updating the payment method to a Check can help you get through it. Did you get an error message when trying to update the payment method? If yes, it would be best to provide the exact error message. That way I can provide you an exact information and accurate solution to your concern.

If you didn't receive an error, we can go ahead and isolate why you're unable to change the payment method. Start updating QBDT to the latest release. It gives you a better experience, including bug fixes and improvements that could resolve issues like this.

Once done, you can perform verify and rebuild in QuickBooks Desktop: Verify and Rebuild Data in QuickBooks Desktop.

Afterward, open the customer payment and change the payment method again.

Let me know how it goes. You can go back to this thread if you have more questions. I'll be around to help you in any way that I can. Take care and stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here