Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowPleased to see you here, @annette.sales.

Welcome to the Community! I'd be delighted to share some steps on how you can use multiple payment methods in receiving payments in QuickBooks Online.

You can accept and record multiple ways in receiving partial payments from your customer. However, you have to apply it one at a time. Here's how:

That should do it! Don't hesitate to visit us here in the Community if you have other questions about receiving payments in QuickBooks Online. I'm always here to help.

Hi @IamjuViel

I'd like to create a sales receipt instead of an invoice for a customer who paid for goods and services which totalled $140. $100 was paid in cash. $40 by CC. Would it be a similar concept?

The reason I'm considering sales receipt is that the customer paid at time of service and no invoice was issued.

I'd be grateful for a step by step breakdown when you get a moment.

Many thanks!

Glad to have you here, @akpowell!

You'll have to create two separate sales receipts with different amounts and payment methods. I can walk you through on how to achieve this.

Once completed, create the second sales receipt for the same customer. Just make sure to select Credit Card as the payment method.

You can check this short video clip for additional insights:

Also, I've attached this article to learn more:

Always feel free to visit me here in the Community if you have other questions. I'm always here to help.

I still create an invoice and apply two payments for the time of payment so that there's only one transaction number in the sequence and not two. So, create an invoice, then apply the first payment type, and then the second. You don't have to send them an invoice but it's easier than creating two receipts, for me.

@akpowell wrote:Hi @IamjuViel

I'd like to create a sales receipt instead of an invoice for a customer who paid for goods and services which totalled $140. $100 was paid in cash. $40 by CC. Would it be a similar concept?

The reason I'm considering sales receipt is that the customer paid at time of service and no invoice was issued.

I'd be grateful for a step by step breakdown when you get a moment.

Many thanks!

Quickbooks should revisit this, it should be as simple as going to the grocery store and paying part of the transaction with cash and the rest with a card. It should always be done in one transaction for proper book keeping.

Explore the invoicing feature in this app. You may find something useful.

http://get.practiceignition.com/quickbooks

Hope it helps.

Hi @yenizfit,

Thank you for bringing this up again. I can certainly see how being able to apply multiple payments at once would be helpful in terms of bookkeeping. I will certainly pass along the feedback so our teams know this is something customers are requesting.

thanks,

Lucas

This has still not been fixed. I have a customer who would like to pay for my services with 2 different cards. I have tried to figure out how to do this and have even been on the phone with customer service for an hour. NO ONE CAN FIGURE IT OUT. Why is this such a hard demand? Do I have to create 2 invoices now? I am super frustrated with quickbooks for not making this a no brainer.

Hello there, allisenanne.

You don't have to create multiple invoices just to associate multiple payment methods. Instead, you can create partial payments of the invoice and use the correct payment methods. Here's how to do it:

Here are some links that you can use for reference:

Feel free to get back to us if you need further assistance in paying the invoices. Have a great day!

This doesn't work because I want to send the customer the invoice so that they can use their cards to pay. I want to do this BEFORE they pay.

Hello there, allisenanne.

Your customers can create partial payment using the invoice you've sent to them. Once they partially paid the invoice, they can close and reopen the same link. Then, they can pay it again using a different payment method.

Ask your customer to do the following steps:

Make sure you have connected your QuickBooks Payments account so your customer's can pay it on their end. You can use these links for reference:

We got you if you have additional questions. Have a great day!

I'm confused. I am a retail store and people pay on the spot. I use Square as my POS, and a sales receipt is automatically generated in Quickbooks when the two systems sync.

I had a customer buy several items which were all taxable, and a discount was also applied. Then he paid partially in cash and partially with a credit card. Are you suggesting that I create two new receipts - one for the cash payment and one for the credit card payment, and then delete the one that already exists? With the taxes and discounts, how do I get one receipt add up to exactly the cash value and the other one the exact credit card value? This just sounds awfully complicated, or maybe I'm over-thinking it.

You can associate multiple payment methods and don't have to create multiple invoices, @TabbyTree.

Create partial payments of the invoice and use the correct payment methods.

Here's how to do it:

Learn when and how to give a credit memo or delayed credit to customers in QuickBooks Online: Create and apply credit memos or delayed credits in QuickBooks Online.

It would be my pleasure helping you further if you have additional concerns about invoices. Take care and have a great day!

Thank you, but I am not using invoices. This is for a sales receipt.

Thanks for coming back to this thread, TabbyTree.

Since you're using sales receipts, you can create two separate transactions for the cash and credit card payment. However, we're unable to add up or combine these receipts. Before diving in, let's delete the original receipt first to avoid duplicates.

Once done, it's time to create the two sales receipts. Just make sure to select the appropriate payment method so you can easily identify the transactions.

If you really want to combine and associate multiple payment methods to a single transaction, you'll want to consider using an invoice instead of a sales receipt. Feel free to follow the steps and instructions provided by my colleague, Joseph_A.

With QuickBooks Online, you can also personalize the sales receipts and invoices so your customer will recognize your brand.

Do you have any other questions in mind? You can leave them below and I'll get back to you as soon as I can. Have a great rest of the day.

Thanks for this! I called your support phone number and was told there was absolutely no way to do this. Might want to provide a bit more training :)

I am hoping she was wrong about the other thing I asked about it (I take pre-orders on inventory that has not yet landed. Need a way to have customers pay as pre-orde rbut not take from inventory that has yet to arrive)

I appreciate you for sharing your experience, @LynnB1.

Part of our task is to make sure we can assist our customers properly in a manner that your experience is marked as outstanding. That being said, let me share some information on how you can track your customer's pre-payments in QuickBooks.

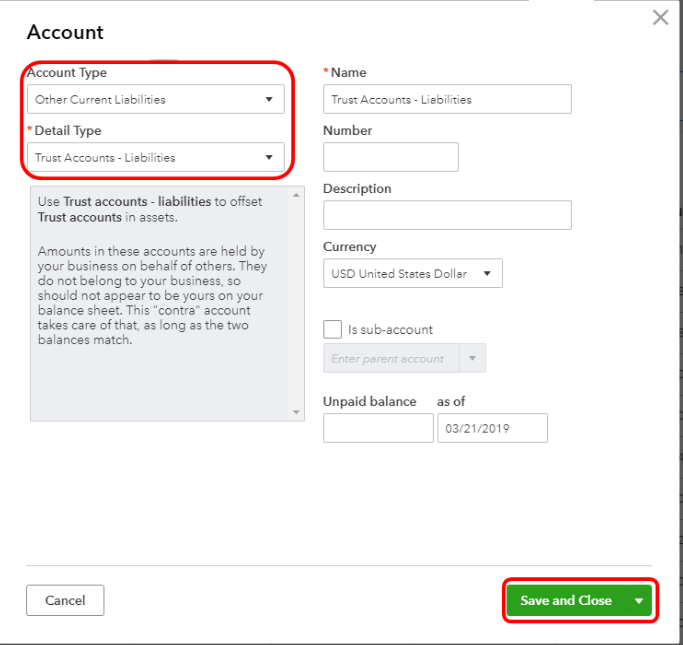

First, you'd want to create a liability account to track the prepayment amount. Let me show you how:

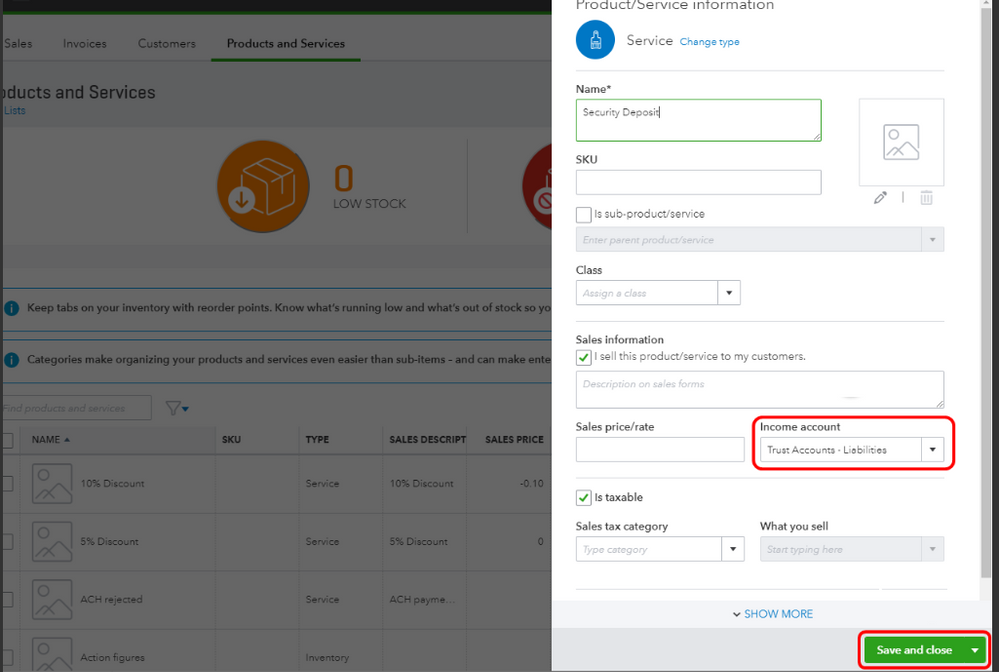

Then, create a retainer item you can use to receive the deposit or retainer from your customer. Here's how:

Once completed, you can start with invoicing the customer for the initial payment. Just a heads up, the amount of the invoice is not income. It will show as a liability on the balance sheet since the transaction is not yet complete to earn the revenue. Once you start creating the actual invoice, make sure to enter the Customer Deposit. You can read through this article for more detailed instructions: Record customer's deposit.

Lastly, I'd recommend consulting your accountant so you'd be guided to see if they have a preferred method of recording these transactions.

Let me know if you have follow-up questions about customer prepayments and I'd be glad to clear things up for you.

I am wondering how can apply one payment to two invoices and one purchase order at the same time. For example I did a wire transfer and paid two invoices and a deposit for purchase order by one transfer. How can I do this so I can match then the bank side and the payment?

Hello there, @dzanna2012.

You can write a payment check, then link it to the bills (two invoices from vendor). Then, you can treat the rest of the amounts as a credit for the purchase order (PO) deposit and apply it once the bill is already available. Let me guide you how.

Here's how to create a check that links to your bills (two vendor invoices):

I've attached a screenshot below that shows the last four steps.

After that, you can match the downloaded bank transactions to the existing entries in your QBO account. You can refer to this article for the step-by-step guide: Categorize and match online bank transactions in QuickBooks Online. It also includes steps about excluding personal or duplicate transactions.

Additionally, I'd recommend reconciling your account every month. This is to effectively monitor your expenses and the growth of your business. You can check out this article for the complete details: Reconcile an account in QuickBooks Online. It also provides instructions about editing completed reconciliations.

Please feel free to leave a comment below if you need anything else or follow-up inquiries about handling payment transactions in QBO. I'm just around to help. Keep safe always.

Still no update!!!

Trying to submit payments in batches, just like bills and invoices, but cannot do it!!!

Trying to record multiple payments to multiple invoice of multiple customers, and deposit into "Payments to Deposit" which is an "Undeposited Funds" account. Then when the funds hit, I will be able to match.

In order to do this, I need an option to submit batch payments, not go into every invoice and record a partial payment over 100s of invoices... Help!

This is essential to many businesses.

Hi there, accountantwannabe.

Thanks for checking out the Community space.

Right now, this feature is still unavailable in QuickBooks Online. Though I could certainly see how it would be valuable for you, given the use case that you described.

To help improve your QuickBooks experience, you'll want to send feedback to our Product Development Team. Your ideas and suggestions will help us determine what features to add and how we can make the product better for you. Here's how:

In addition, here's a reference that you can visit to help manage your customer transactions in the program: Sales and customers.

If you have any other concerns or questions, please don't hesitate to post them below. We're always here to help you.

Accountantwannabe,

Clarification added: I enter Daily Sales as described with INVOICES, not SALES RECIEPTS. I apologize for missing that point.

I'm not sure if this would apply to you, but I was taught to enter all my sales for the day under a single customer name, e.g., "Daily Sales". Then, all the credit card payments for the day are handles as a single amount, and all the Undeposited Funds are handled as a single amount.

Every once in a while, there's a transaction that I want to handle separately - e.g., a deposit on an order. In that case, I'll separate that transaction from the rest of the Daily Sales. Not always simple, but it simplifies things to some degree.

Why do the moderators continue to say they will suggest whatever the complaint is about. It is NEVER done. This one has been around for more than a year and nothing has been done.

Why doesn't QuickBooks realize that this happens on Sales Receipts every single day. For users to be able to create their deposits correctly it needs to be correct in the system.

I am about to have a customer quit QuickBooks because of so many things like this in the Online Version. The real world doesn't work like Intuit thinks it does.

Is it possible that the issue is more about terminology than anything? We have two ways of recording sales - one is the Sales Receipt, and one is the Invoice. I differentiate their use purely by what they can do.

For my daily store sales, I almost always have a combination of cash and credit cards - so I use Invoices for all my daily sales. Then I apply payments to the daily Invoice to reflect credit cards and cash received - so usually two different payments for each day. Even though it's called an Invoice, there's nothing about it that makes it have to be handled the way we might otherwise use Invoices.

With online sales, for which I always get one single payment, I use Sales Receipts. Again, just because of the particular nature of that kind of sale - i.e., no multiple payments to address.

After doing this for a couple years, I haven't seen any functional difference in how the two are otherwise handled in QBO. I know everyone has a slightly different environment, but it's worked all right for me like that. "Invoice" has just come to mean something different to me than it used to.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here