Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have Quickbooks Online. I invoiced a customer and he paid via Quickbooks online payment, and then he sent a check as well--not realizing he paid the same invoice twice. The check was deposited into the bank before realizing that it was a double payment. I need to:

1) Record the deposit into my bank so that I can reconcile, and

2) Record the credit in the customer's account so that he can use the credit for future invoices.

I don't want to issue a refund, and there is no open invoice at this time to apply the payment to. I haven't come across any scenarios exactly like mine. Can someone please walk me through the steps and explain the purpose of each?

Thanks in advance!

Solved! Go to Solution.

Hello,

This is actually very simple.

Record the check from the customer under the Receive Payment window. Since there is no open invoice it will give you a message saying it will save the payment as a credit for the customer.

This credit will be available next time you receive a payment on an open invoice.

Hello,

This is actually very simple.

Record the check from the customer under the Receive Payment window. Since there is no open invoice it will give you a message saying it will save the payment as a credit for the customer.

This credit will be available next time you receive a payment on an open invoice.

Thank you so much! I knew I was thinking too much about it! Exactly what I needed.

I also had a customer pay twice. Actually, the check was printed with the same number and the bank rejected the second one. So I created a credit with the second check payment on the customer's account. I was able to match up my deposit records that way. But now my customer shows a credit which is no longer available because the bank returned the duplicate check. I don't know whether to create a credit, a refund, a journal entry, an invoice...My accounting know-how is not advanced enough to handle this! Help!

Hello, @Awebbs12.

Thanks for taking the time to follow along with the thread. I hope you're enjoying the day so far.

For this one, I recommend reaching out to your certified accountant. Your accountant will know the best way to handle the second check based on your business needs. If you don't have an accountant, don't sweat. You can find one here in our Resource Center.

Please let me know if you have any questions or concerns. Take care!

Hi! I'm following this procedure to record a double payment, but it says, "If you want to record this payment without an invoice, use a sales receipt" Do I also need to create a sales receipt for this, or do I record it without?

Thank you.

Hi, @In Awe.

Thanks for following the thread and getting more guidance to record a double payment.

Do you want to record the other payment as a customer credit and link it to the invoice in the future? If so, you'll have to enter the amount and save it as credit using the Receive payment feature. Once you create an invoice in the future, you can use this credit to pay it, and it will show as an Unapplied payment on the Receive payment window.

Please see my screenshots for visual reference:

However, if you won't have to link the other payment with an invoice in the future, you can create a sales receipt.

Feel free to check this article for more details: Recording invoice payments in QuickBooks Online.

Additionally, do check our Income and expenses page and learn some best practices in managing your income in QBO.

You can always come back to me whenever you have other questions about recording transactions. I'm always here to help. Stay safe and well.

Thank you. When receiving payment, I'm wondering about the notification that tells you to enter a sales receipt because it's not linked to an invoice. Do I need to do that as well or bypass the alert? Thank you.

Thank you for coming back to the Community, In Awe.

I’m here to guide you in the right direction on how to handle the receive payment message.

QuickBooks Online (QBO) wants to make sure your customer’s payment is properly recorded. That’s why you’re prompted to create a sales receipt or Save as a credit since we’re unable to bypass the alert message.

As mentioned by @Jovychris_A, enter a sales receipt if you’ll not link the other payment with an invoice in the future. This reference will guide you through the process: Create and send sales receipts in QuickBooks Online.

Additionally, the links below provide information on when to give a credit memo, delayed credit to customers, and manage customer refunds.

Keep me posted if you have additional questions about receiving payments. I’ll be glad to answer them for you. Enjoy the rest of the day.

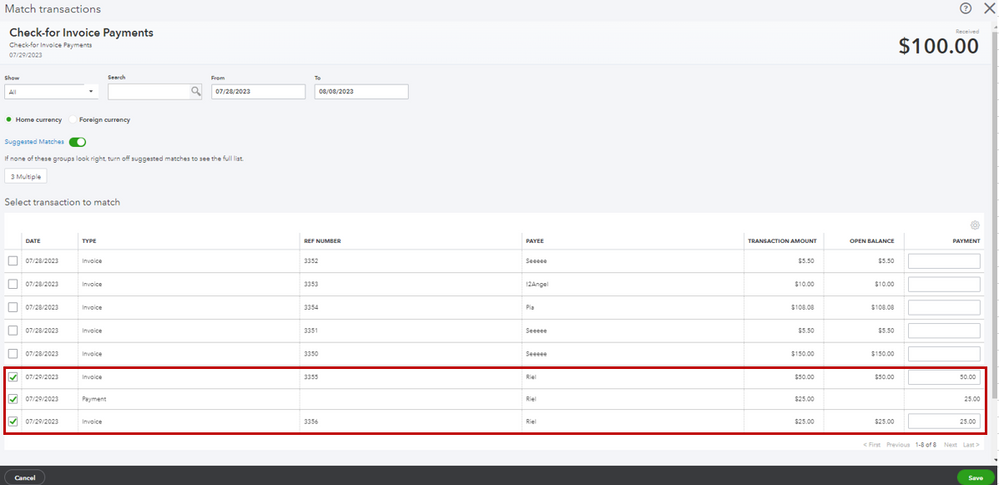

I received a check with a number of invoices and one was previously paid (duplicate payment), how do I apply the payment against the open invoices and keep the duplicate payment on the customer account for future invoices? I normally apply cash through the match option on the bank feed.

Thank you for joining the conversation, Robles. Allow me to assist you in categorizing your transactions and allocating the check you receive toward your outstanding invoices.

To start, you need to match the check to your existing transactions. It includes the open invoices and the payments. You can follow these steps:

You may also refer to this article for additional tips on reviewing your downloaded bank and credit card transactions in our system: Categorize online bank transactions in QuickBooks Online.

Once you've finished the task, create a credit memo to keep track of the overpayment, and then apply that amount to your upcoming invoices.

Here's how:

When ready to apply the credit memo to your customer's future invoices, utilize this article as your guide: Create and apply credit memos or delayed credits in QuickBooks Online. This material will serve as a helpful resource for navigating the necessary steps in this process.

If you require further assistance regarding your transactions, please feel free to leave a comment below. It would be my pleasure to assist you once again. Keep safe!

Hi!

I run an auto glass business and our customer is a corporate body shop. I invoiced them for a job in May, and got paid the first time in June. Everything is fine at this point.

I was paid a second time in July. Oops.

In August, they deducted the amount twice, then paid the amount a third time. If you're keeping score, we're even from an income perspective, but it's a mess in my quickbooks. I have "unapplied credits" and I don't know how to reconcile this.

This is an ongoing issue and this was just one example. I have tried talking to the customer, but she insists this is "how they do it" and is not going to change their way of doing things, so I need to adapt. What do I need to do to adapt? This is otherwise a good account to have since they reliably pay on time.

Do I need to write a journal entry each time this happens? Sales receipts and returns?

Thanks for joining this thread, sgeorgefl.

I want to make sure this gets resolved and your QuickBooks Online account becomes more organized as a result.

In this instance I recommend consulting with your accountant to be sure of the next steps. They'll be able to tell you for sure which entry would be appropriate based on your business setup and the situation with your customer.

If you don't currently have an accountant you can find one in your area specifically trained in QuickBooks by searching here: Find a ProAdvisor

Please feel free to reach back out here if you need assistance with the entry afterward. I'll be here to help in any way that I can.

What if the payment was received one month and then the next month the customer wants you to refund the double payment. I cannot figure out how to do this and get the credit off the customer's account. If I try and go through credit memo/refunds it leaves the credit on the customer's account. It doesn't show up as an actual credit memo just a credit on their account.

Thanks for sharing detailed information about refunding your customer for a double payment of their invoices, @dawndyoung. Allow me to step in and help you record this in QuickBooks Online (QBO).

If a customer requests a refund for a double payment, I can show you how to record refunds to ensure your books are up-to-date. Here's how:

Next, let's link the refund to the customer's credit or overpayment:

For more information, please refer to this article: Record a customer refund in QuickBooks Online.

In QBO, we can run financial reports as a summary of information from different aspects of your business. They focus on your company's sales, expenses, and other relevant details.

Please get in touch with us here if there's anything else you need about refunds and double payments, I'm determined to ensure your success. Cheers to a safe and productive week ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here