Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowYou'll want to delete and re-create the check to show it as Bill-Pmt-Check, BenTam.

Just double-click the check to delete. Make sure the transaction has a bill.

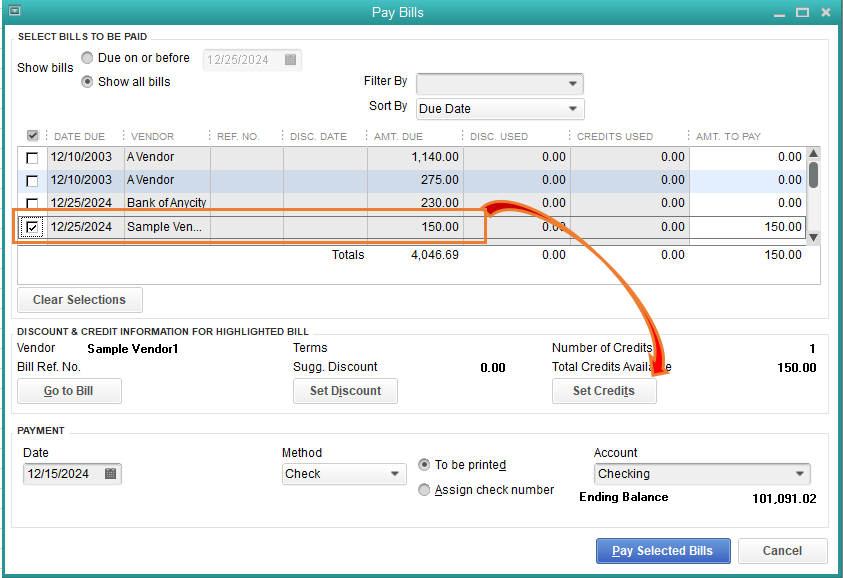

To pay the bill, click the Pay Bills icon on your Home Page. You can also go to Vendors, and then Pay Bills to do so.

Once done, you can check the Transaction List by Vendors report again.

You might also want to check out this article for your reference: Pay bills in QuickBooks Desktop.

I'm here if you have more questions. Please don't hesitate to reach out. Thanks.

I've found the way now: "right click on the page".

I made a mistake that right-clicking on the check and select "pay bill" will create a new "Pmt-Check" entry.

Thus, I repeat my question 'does anyone know how to convert a "check" to a "payment"'.

TIA

You'll want to delete and re-create the check to show it as Bill-Pmt-Check, BenTam.

Just double-click the check to delete. Make sure the transaction has a bill.

To pay the bill, click the Pay Bills icon on your Home Page. You can also go to Vendors, and then Pay Bills to do so.

Once done, you can check the Transaction List by Vendors report again.

You might also want to check out this article for your reference: Pay bills in QuickBooks Desktop.

I'm here if you have more questions. Please don't hesitate to reach out. Thanks.

What if the check has already been reconciled?

We appreciate you for coming back, Charlotte2771.

If the transaction is already reconciled, you can still delete and recreate the check to show it as a Bill Payment Check. Then, do a mini reconciliation or special reconciliation to re-reconcile the transaction.

You can follow the steps and details in the Reconcile previously deleted and re-entered checking or credit card transactions article. Then, choose Method 1 or Method 2 that is appropriate in your situation.

If you don't want to delete the reconciled check, you can re-open it. Then, add a description in the Memo field that it is a Bill Payment one.

Please reply to this thread if you need anything else with managing vendor transactions in QuickBooks. I'm here to help.

Hi RCV

Thanks for your reply!

It's really easy. Go to the check and change the account to Accounts Payable and the Vendor Name on Customer:Job to the vendor who sent the Bill. This will convert the check to a Bill-Payment Check without changes on RECONCILIATION. Then, go back to the bill, click on Pay Bill and the check will appear as a Credit for that bill with the same amount. Apply it to the bill and ALL SET.

Well, As far as I know - you can not convert the 'Check to Billpmnt" But you can link the check with bill.

By using the built-in QB tool : Company > Accounting Tools > Fix & Apply payments.

Regards,

Wajahat Muhammad Khan,

[removed]

[email address removed]

Thank you for this simple shortcut! The only solution that didn't take multiple steps. Yeah for you!!

What if the check has already been reconciled AND included on an invoice to a customer?

Yes, you can convert the reconciled check to a payment, SRD5000.

Simply change the account to Accounts Payable and tag the name of the vendor who sent the check. Doing this will make the entry appear on the vendor transaction list as a credit. And, you can link it to a bill as a payment.

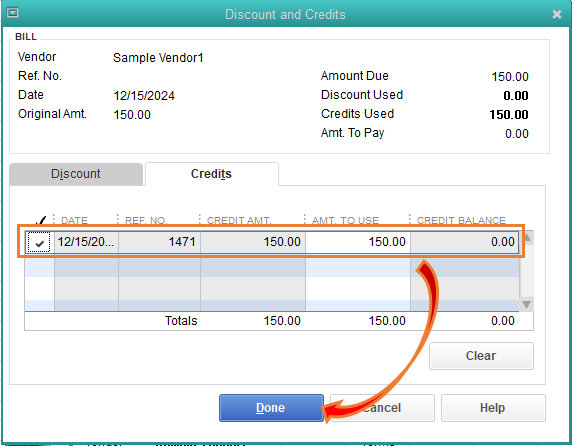

To apply the check:

I've got this link for you: Bill shows as unpaid after writing a check in QuickBooks Desktop. It has 4 solutions that will help manage created checks to pay bills.

Upon sharing this, I still suggest consulting with your account. He/She might have specific instructions since the check has been reconciled already. Any changes to your account will affect the balance on your register.

Stay in touch if there's anything else you need. I'm always right here to help.

MaryLandT, Thanks for your response. My biggest concern is what it will do to the accounts receivable for the customer that I invoiced. I'm using QBD premier contractor edition 2018.

Thanks for coming back, SRD5000.

We use the Accounts Payable A/P to record outstanding bills for your business. This tracks the money you owe your vendors. When Paying bills (as provided by my colleague), QuickBooks will add Accounts Payable to your Chart of Accounts.

If you created an invoice from the billable expense, we can enable the Track reimbursed expenses as income feature in the QuickBooks Preferences. This will show the invoice transaction posted to Account Receivable (A/R) as paid in the Profit and Loss report.

Here's how:

We also recommend consulting your accountant first before changing the posted account in the transaction. Any concerns on how these accounts affect your books are best handled by them. Also, any changes to your account in QuickBooks will affect the balance on your register.

For more details about A/P and A/R, check out these articles:

Visit our QuickBooks Help Articles for more insights about managing your business in your account.

This will take you in the right direction today, but please don't hesitate to get back to me if you have any follow-up concerns. I'm always here to help. Have a great day ahead.

Hi - were you able to resolve this issue - converting a check to a bill payment? I've been struggling trying to find an answer. I'd appreciate any assistance! TIA

Thanks for checking in with us, Cindilou.

I've check here on our and there's no reported case where customers encounter a problem when converting a check to bill payment. We can try deleting and re-creating the check to show it as Bill-Pmt-Check. Just double-click the check to delete and make sure the transaction has a bill. Then, pay the bill in QucikBooks. If the transaction is already reconciled, you can still delete and recreate the check to show it as a Bill Payment Check. Just do a mini reconciliation or special reconciliation to re-reconcile the transaction. See the Reconcile previously deleted and re-entered checking or credit card transactions article for more details.

Just in case you don't want to delete the reconciled check, re-open it and add a description in the Memo field that it is a Bill Payment one. If you need further assistance in converting check to bill payments, feel free to reach out to our Technical Support Team. From there, they'll pull up your account in a secure environment and help you with this one. You may send a message via chat, call us at a time convenient to you, or we’ll get in touch with you instead. To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. See our support hours and types for more details about this one. Here's how to reach them:

Feel free to visit our Expenses and vendors page for more insights about managing your vendor transactions.

I'd like to know how things going after trying the steps, as I want to ensure this is resolved for you. Please reply to this post and I'll get back to you. You have a good one.

Why do I not have that tool on my desktop version.

Thanks

Hi CableMaterial,

Thanks for joining in on this thread. I’m happy to share information about the tool that you’re looking for.

The tool that Wajahat Khan shared is only available to QuickBooks Desktop for Accountant. For the non-Accountant QuickBooks editions, you'll want to delete the check and pay the bill, like what RCV shared.

Let me know how the process goes. I want to make sure that your concern is addressed. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here