Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThere are many third party providers, who will help you create ACH/NACHA file to support Vendor Direct Deposits, Process customer payments. You may need to have a ACH account with your bank to process the NACHA file. It is an alternative option - https://apps.intuit.com/app/apps/appdetails?shortName=app-b7rhf97pmg&locale=en-US

If Bill.com is not meeting your needs, you can also use Tipalti which is integrated deeply with QB Online.

https://appcenter.intuit.com/app/apps/appdetails?shortName=tipalti_qbo&

Hi There

We are with Bill.com. I have been trying for hours to figure how to edit a vendor's bank transfer account number. Please help!!

Let me help you in updating your vendor's bank account information, @Anonymous.

For us to update the vendor's account number, we need to change the payment method from Online Bill Pay to paper checks. Then, toggle it back within QuickBooks Online. Once reverted, the system will ask you to re-enter their bank account information or sending them a new request.

Here's how:

If you're still unable to update this information, I recommend reaching out to our Support Specialists. This way, they can take a closer to your account and provide you another detailed option to update the account.

You can reach them through these steps:

You can also check out our support hours to make sure we address your concerns on time.

You'll also want to read this article to learn more about Online Bill Pay. This will provide you answers to frequently asked questions about it.

Please keep in touch with me here should you need any further assistance regarding updating the bank account info. The Community always has your back.

How do I get started with Online bill pay via Bill.com and Quickbooks Online?

Hello there, jazwag76,

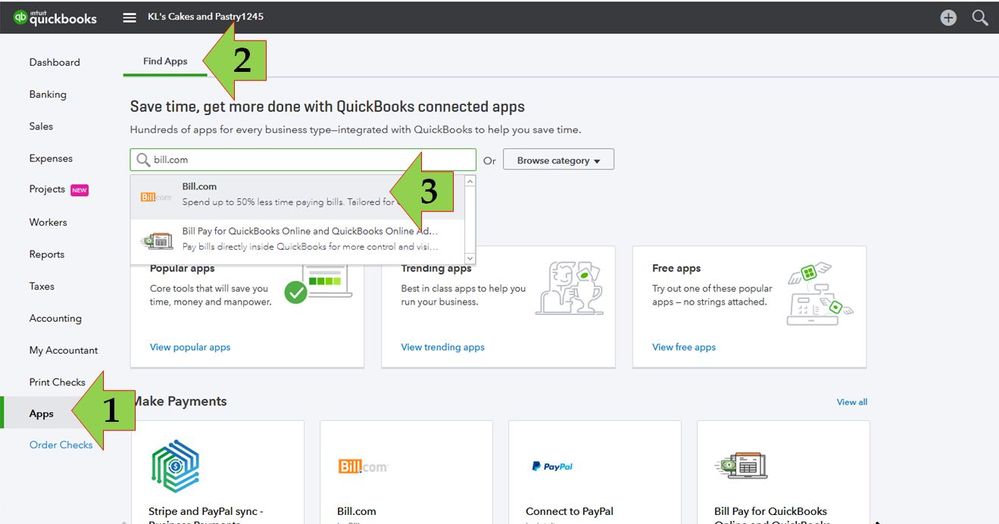

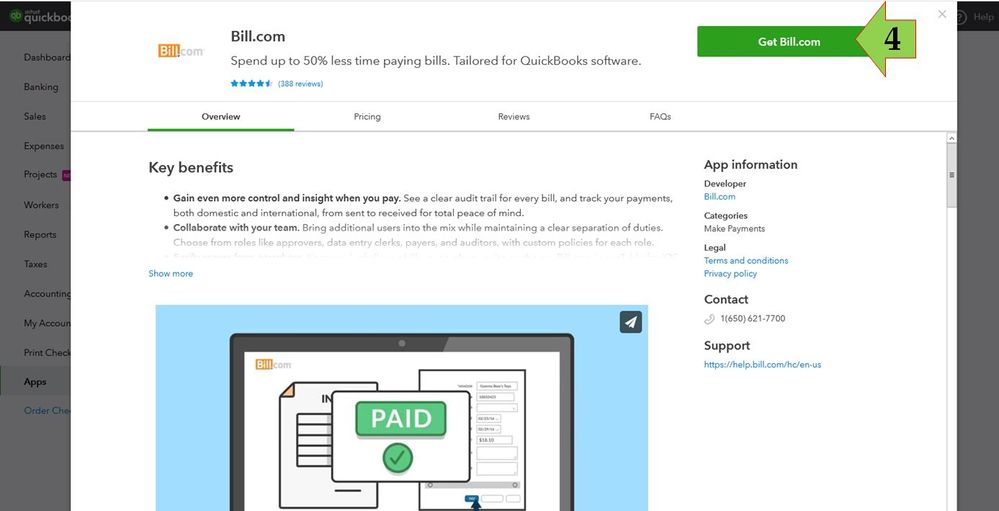

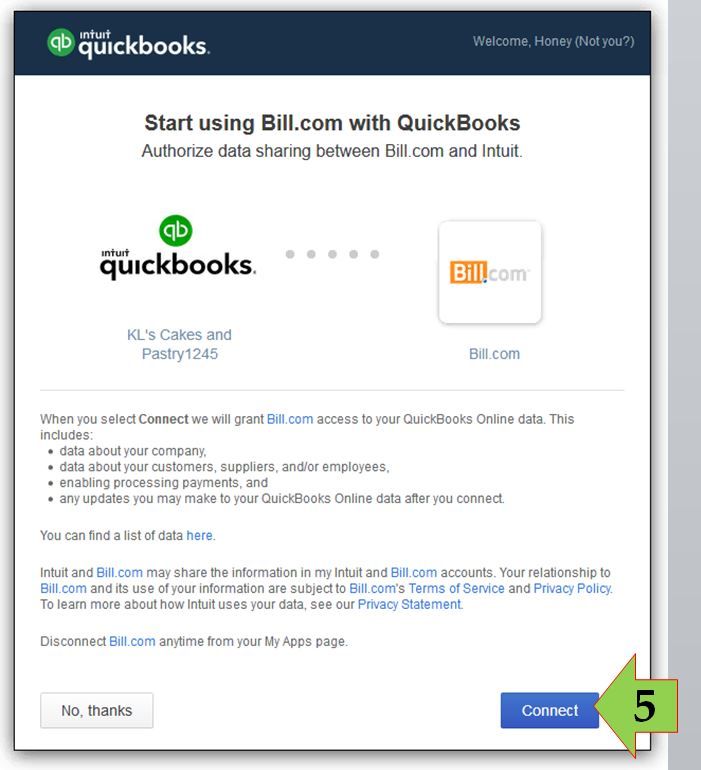

If you already have a Bill.com account, you'll have to set up the bill.com application in your QBO account to integrate its data. Here's how to do it:

You'll want to check the comparison: Comparison between Bill.com app and Online Bill Pay.

If you wan to move to Online Bill Pay, check this articles: Move from a Bill.com account to Online Bill Pay.

Let me know if you have other questions.

I could find no way to use this new service to refund a credit memo for an overpayment. I would have to set up the customer as a vendor and then add all the ACH details. That will cause problems with my accounting as a refund is not an expense but is a reduction in the revenue side under Sales.

Hello -

Do I need to use MELIO to make ACH payments in Quickbooks? Our former accountant set it up and we are charged $20 with every payment. Does not seem like it is necessary.

What is the purpose of MELIO? I believe she set it up for ex-US payments.

Now, every ACH payment we make is charged $20.

Thanks,

aMy

Hi there, wethrivv.

Welcome to the QuickBooks Community. Let me discuss how Melio works and the purpose of this program in QuickBooks. Then, ensure you'll be routed to the right person to assist you further on the charged you've encountered.

When paying bills in QuickBooks Online, you can use Melio for faster transactions. Then, Melio is a third-party online payment service provider offering free-of-charge bill payments and bank transfers. That said, paying the bill as ACH through Melio has no fee or it's free. Since you charged $20 for every transaction, I recommend contacting their Support Team. They have the tools to pull up your account which is needed in investigating the $20 charge you've received and where it's coming from.

Additionally, you also have the option to utilize Online Bill Pay (powered by Bill.com) in QBO. This lets you pay bills via bank transfer or check directly from QuickBooks Online and via bank transfer (ACH) or paper check. However, you will be charged a transaction fee for each payment you process.

Lastly, you may refer to this article to see steps on how you can run a particular report that will all payments made to vendors: Run a report with vendor totals.

Please let me know if you need clarification about Melio or if there's anything else I can do for you, wethrivv. I'll be standing by for your response. Have a great day!

Open separate Melio account for free to integrate with QBO. You will pay your bills for free by ACH or check with USPS.

Using Bill pay, I can't see the vendor credits, is there a setup required

Hello there, @kesper. Thanks for joining the thread.

I'll be glad to help you with this. In QuickBooks Online, a vendor credit is utilize when recording vendor refunds or vendor returns. You can manually apply for a credit that a vendor has given you in the Online Bill Pay's Credit Applied column. Please follow the steps below:

For more details, you can read this article: Applying vendor credits.

The following article will assist you in managing your expenses and paying bills, checks, and suppliers: Expenses and vendors.

If you have further questions about pay bills and vendor credits in QuickBooks Online, please leave a comment below. We're always here to help you. Keep yourself safe.

Hey, @kesper.

Thanks for reaching back out to the Community with additional question about paying bills.

You should be able to see an Credit Applied column when starting a pay a bill. Let's confirm to see if you have this column when paying a bill.

Providing us with another screenshot of the page when paying a bill will help in finding a solution.

I'll be here waiting for your response!

The Screenshot attached previously is the correct one, you can see there is no credit column when Online payment mode is on.

Hello there, @kesper. I appreciate your prompt response.

I want to ensure you're able to see the vendor credits when using Bill Pay, as well as the Credit applied column. Since it's not available on your end, I suggest contacting our QuickBooks Support Team. One of our support specialists will pull up your account in a secure environment and perform a screen-sharing session. This way, they can further investigate the root of the issue. And they can also guide you to where to see the vendor credit.

To reach them, click the ? Help button at the top-right corner and select Contact Us to talk with a live agent. Ensure to review their support hours to know when agents are available.

For additional reference, I've attached a link you can use about how to handle vendor credits in Online Bill Pay: Applying vendor credits.

Leave a comment below if you have any questions regarding vendor credits in QuickBooks. The Community and I will be around to help you.

Can I cancel a billpay made online?

Indeed, it is possible to cancel online bill payments, @Belinda_OIW.

However, before I guide you through the cancellation process, let's make sure that you are within the appropriate timeframe.

If you're sure that you're in the correct timeframe, you can now proceed to cancel. Let me guide you through the process for a seamless experience:

For detailed information, kindly visit: Overview of Bill Pay powered by Bill.com

Additionally, it might be beneficial for you to take a look at this article, which provides information on the application of vendor credits in Online Bill Pay, which is powered by Bill.com: Applying vendor credits with Bill Pay powered by Bill.com.

Keep me posted if you have additional questions about expenses, running reports, or other QuickBooks-related matters. I'm available around the clock and ready to provide assistance.

I appreciate your response.

I do not use QuickBooks online, I use desktop.

The bill was sent to me via email with a link to view and pay via Intuit but it's actually bill.com

and I do not have a bill.com account. There's is no email to contact bill.com, I tried chat with no help.

It's the same day I am in the time frame you mentioned. Do have a way to contact someone?

Thanks so much for your help.

I appreciate your response.

I do not use QuickBooks online, I use desktop.

The bill was sent to me via email with a link to view and pay via Intuit but it's actually bill.com

and I do not have a bill.com account.

Hi there

Can you send me the bill? My email is [email address removed].

I do have a client that is probably making a mistake. She was setting me up at the bank for billpay. Who knows? Thank you

Mona Porche

I appreciate you for sharing the correct product you're using, Belinda. I'm here to ensure this gets sorted out.

Beforehand, have you processed the payment? Adding additional details will help us provide steps to handle this.

If you haven't, you'll want to contact your supplier to notify them that you don't have a Bill.com account. They can provide you with alternative options for processing the payment.

In case you want to create a Bill.com account, I suggest visiting our QuickBooks Desktop Marketplace. Then, type in the app's name on the Find Applications search bar.

Regarding your concern, MP65, we're unable to send the bill you requested. We also deleted your email address for security reasons. In the meantime, I recommend contacting your client to ensure the setup is correct. This way, you'll be able to receive the payment on time. Aside from that, sharing more info about your issue can help us provide accurate steps to fix this.

You can also reach out to our QuickBooks Support Team. They have tools to guide you in paying your bills and receiving the payment. They can also ensure a seamless process. Here's how:

Lastly, paying bills is part of your usual accounts payable workflow. I suggest browsing this article to view the complete list: Record Expense Transactions.

To learn more about the accounts receivable workflows, please see this article: Get Started with Customer Transaction.

In addition, you can run and customize vendor and customer reports in QuickBooks Desktop. Doing so helps you track your sales and expenses to ensure your record is accurate.

Please know we're always available if you need assistance managing your customer and vendor transactions. Our goal is to keep the accuracy of your books.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here