Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have 2 credit cards. 1 for exclusively for Work, and 1 that is for mostly work but sometimes has larger personal things on it too.

I pay off the Work card in installments each month, I am no longer using it to purchase anything, just paying off the balance.

The Mostly Work card I pay off in full each month.

My question is: How should I be categorizing these payments in the Banking Section of my Quickbooks Online?

Solved! Go to Solution.

Credit Card balances are Debt. The Balance you owe gets increased by entering Expense charges that you used that card for, already. The credit card purchases are individually entered, for the date you used that card to buy something. That is how your balance owed Increases.

The balance goes down by the payments you make. A payment against a Card Balance is paying against that credit card type of liability account in your file, the same as ane debt payment is not expense but Liability payment.

In other words, paying VISA or AMEX is a debt payment, it isn't the purchase of something. You didn't buy anything from them. They are Lender = the card provider for micro-loans.

Credit Card balances are Debt. The Balance you owe gets increased by entering Expense charges that you used that card for, already. The credit card purchases are individually entered, for the date you used that card to buy something. That is how your balance owed Increases.

The balance goes down by the payments you make. A payment against a Card Balance is paying against that credit card type of liability account in your file, the same as ane debt payment is not expense but Liability payment.

In other words, paying VISA or AMEX is a debt payment, it isn't the purchase of something. You didn't buy anything from them. They are Lender = the card provider for micro-loans.

That is a great, in depth, and helpful reply, thank you!

So in Quickbooks Online, should I just link my credit card through Banking and enter each expense? Or should I just enter the total payment to the credit card as a debt payment? Or do I do both?

"should I just link my credit card through Banking and enter each expense?"

Linked or not, the entry of an expense paid by Credit Card is similar to one paid from Checking (as paper or debit card); the difference is the Source of Funds. You didn't use your own money; you Charged it on that card.

"Or should I just enter the total payment to the credit card as a debt payment?"

The Payment is a Transfer, between checking and the credit card account. That way, they Both Go Down.

"Or do I do both?"

The first is the spending of someone else's funds by using their credit card they provided to you.

The second is your Cash Flow as an expediture but not as an expense account entry.

Wow, that was an awesome answer! Everything finally makes sense! Thank you :-)

I'm still lost. So I have my bank account. I also have my credit card. Quick books pulls my Credit card balance from the website and I imports the "transactions". However, when I add these Transactions and start coding to them to the correct account on the Banking screen for review, they make the "QUICKBOOKS" total go up. So therefore the actual credit card balance, and the quick-book balance doesn't match. How do I keep these transactions added to the correct accounts like "Cost of Goods" sold, without making the balance go up?

Hello there, @Anonymous.

I’m here to help categorize the transactions and make sure that QuickBooks balance matches with what’s on the credit card website.

Before we begin, may I ask if the credit card is connected to QuickBooks? If so, importing the same transactions you've already downloaded causes the balance in the account to go up.

Choose which method suits your business best. Either you download the transactions directly within QBO and edit the category to COGS or import and add them to the register with the correct account. Performing both processes at the same time can cause duplicates and incorrect balances.

You can also match the downloaded or existing to the imported transactions to maintain the correct credit card balance. I recommend checking out the following articles for more information:

That should answer your concern for today.

Post again in the Community if you have any follow-up questions, I’m always here to help. Have a good one!

When a purchase transaction is posted in the credit card account, the credir card negative balance is increasing, which is fine. Now, when a payment is made to the credit card,I'm creating a "transfer" from my checking account to the credit account. Cash decreases in the checking account, which is correct, but the "transfer" is actually increasing the negative balane in the credit card account too, which doesn't seem right. The negative balance should decrease. As a result, the negative balance has become very high. What am I doing wrong? How should I fix my books?

Hi pngsvc,

The positive amount in the credit card account is a liability, while the negative amount is an over payment.

To fix this, you can transfer the amount back into your checking account. Using the credit card account to pay the expense transaction can be an option, too.

You might want to check out this helpful article for your reference: Transfer funds between accounts.

Let me know if there's anything else you need. We're always here to help.

When I click the transfer, my credit card balance increases. What have I done wrong?

Hi @qkbks_newbie,

This happens when you choose your credit card account as the source of the payment, and your bank as the recipient. It should be the other way around.

You'll want to delete the previous transfer transaction you created to keep your books accurate.

Here's how:

You can create a new transfer transaction at this point. Ensure that the Transfer Funds From drop-down menu has the bank account where the payment is coming from. The Transfer Funds To drop-down menu should be set to your credit card account. Refer to the screenshot below as an example of recording a credit card payment.

Other than creating a transfer transaction, you have other options on recording a credit card payment. Check out this article for additional details: Record credit card payments.

I'll be around in case you need further help. Leave a comment below, and I'll get back to you.

Hi Ryan,

How do I set it up the other way around...making my bank account the payment source?

I received this message when I was about to delete "This transaction was downloaded from your bank’s records. If you delete it now and change your mind later, you can add it back through the Online Banking page. Are you sure you want to delete it?"

Hello qkbks_newbie,

Based on the error message you mentioned, the transfer transaction comes from the Online Banking. We can select Yes to delete the transfer transaction.

Aside from that, we can go to the Banking page and Undo it, too. Here's how to undo a matched, added, or transferred banking transaction:

This process will remove the transfer transaction from your register. You might want to exclude the banking transaction to avoid duplicates in your register.

After that we can create a transfer transaction manually. This was also suggested by Ryan_M.

This will serve as a payment for the credit card account. We can also create a check to record a credit card payment: Record credit card payments.

Screenshots were already provided by Ryan_M and can also be viewed through the related associated articles.

We'll get back to you if you require more assistance in navigating QuickBooks Online. Have a great day!

Hello,

I’m still a little confused on how to categorize credit card debits/credits that are posted to both credit card and bank accounts.

I have 3 scenarios that I need clarifications on if possible:

Thank you so much for you tim

The credit card payments downloaded for my bank reconciliation. The individual purchases for expenses, such as gas, newspapers, did not download. So how do I get them into my QBO account to complete the reconciliation to have my QBO account match my bank? Do I do manual entries. I tried doing the period download, i.e. 4/10 to 5/9.

Hello, TCL2.

Thank you for posting in the Community. I am here to help you sort this out. Once you connect a bank account to online banking, QuickBooks automatically download your transaction data each night, you can refer to this article for detailed information: Manually download online bank transactions in QuickBooks Online.

Though, we can perform some basic troubleshooting. You can start by manually updating your bank to sync the latest transactions.

Here's how:

Also, if you want to manually add bank transactions, you can use the WebConnect feature. You'll need to download the data first from your bank's website and import to QuickBooks Online.

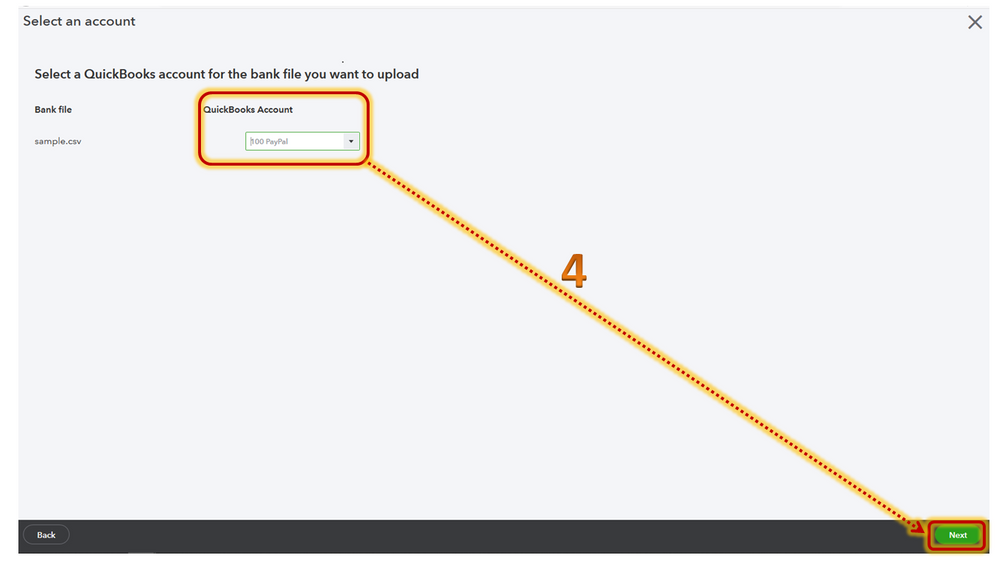

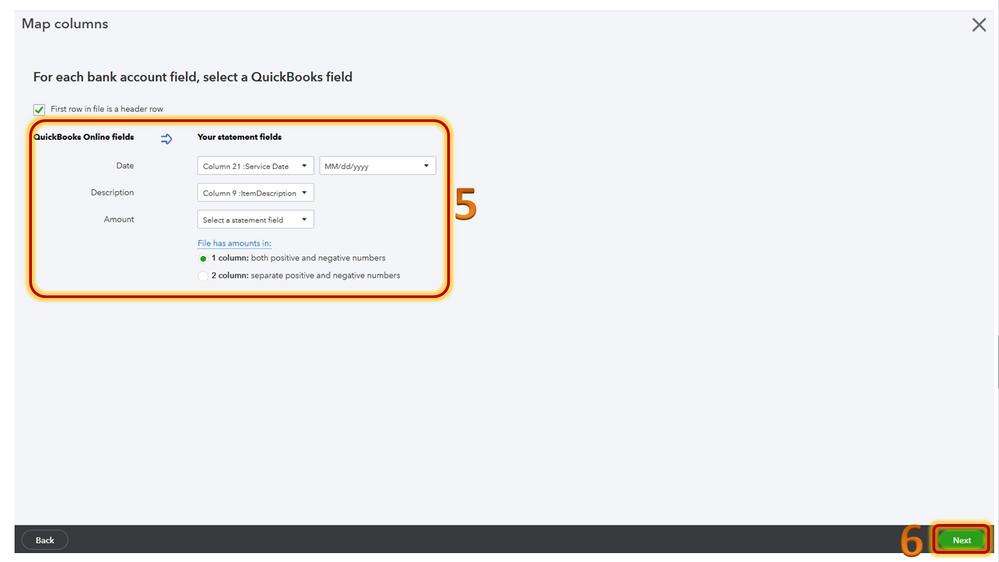

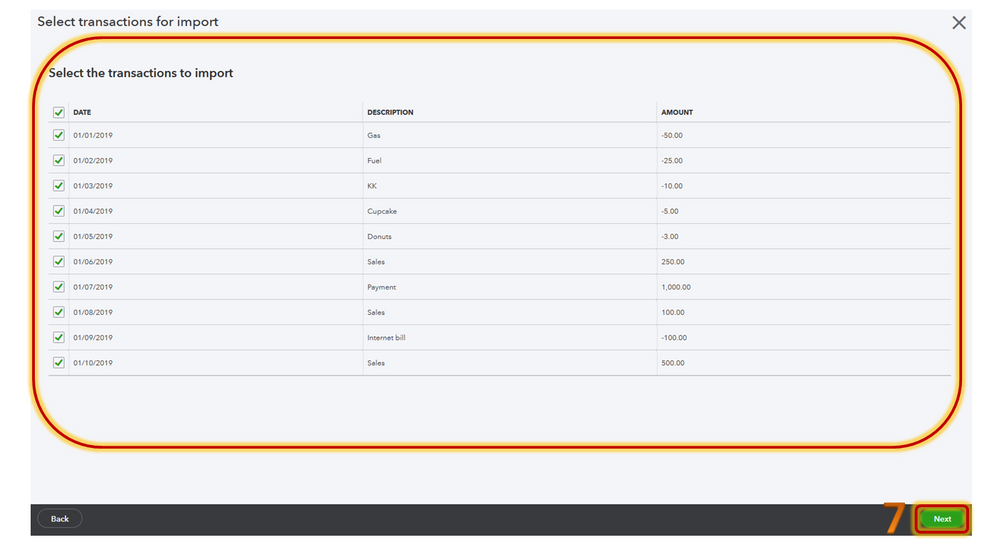

After that, log in to your QuickBooks Online account. Once done, we can add transaction by importing it using CSV files. Though, to successfully add transactions using CSV files, we need to follow the bank formats. Let me show you how to import transaction:

Once the import is finished, you are directed to the Banking menu or Transactions menu where your imported transactions are displayed on the For Review tab. You can review, add, or match each transaction.

For more information about import CSV Files, you can check out this article: Import bank transactions using Excel CSV files.

Also, For more details about how to manage your bank transactions, you can refer to this article: Categorize and match online bank transactions in QuickBooks Online.

I want to make sure that you'll be able to download data to your bank, please don't hesitate to let me know how it goes. If you should have additional questions, I'm just a click away. Take care!

I think what is not being answered here is what "category" do you list the credit card payment transaction under?

For example in my credit card, there is a payment monthly that was paid off and it says "Mobile Payment - Thank you $1000". Right now these are all listed as uncategorized because I don't know how to label it. What should I select?

I’ve seen this question I asked once before, and it was never accurately answered. I have a checking account linked in QuickBooks and a credit card account linked in QuickBooks. When I make a charge to my credit card it shows up in QuickBooks, I categorize it appropriately. Whenever I make a payment on that credit card, from my checking account, it shows up in QuickBooks as well and I categorize that as “pay down credit card,” and select a credit card I have linked. The problem is under my expenses it shows the expenses that came in from the credit card, they were categorized, and then also list the payment I made from my checking account to pay down the credit card as an expense as well. Payments to credit cards aren’t considered expensive so I’m not sure why it is showing up as an expense in QuickBooks. Because it’s doing that it is doubling my expenses in the expense column. I profit and loss statement and balance sheet are all accurate, but this seems like something that should be an easy fix for QuickBooks. Because credit card payments are not considered expenses, remove that from the expense column…

I'm having this same issue. My credit card and bank account are connected to quickbooks, so all of the credit card transactions that I categorize are posting to the P&L and the credit card payments I'm making with my checking account are being posted as expenses too. So the expenses in the P&L are being duplicated. I can't figure out how to fix this.

Hi there, and thank you for joining this thread, info-jointtherap.

I can see that you've posted this question twice here in the Community Forum. Please refer to this link to view the answer provided by my colleague: https://quickbooks.intuit.com/learn-support/en-us/reports-and-accounting/how-to-add-credit-card-expe....

Don't hesitate to post again if you have other QuickBooks concerns. The Community is always open to help you.

Hi Mary,

I'm unable to see the answer provided via that link. Can you help?

Hey there, @info-jointtherap.

Thanks for reaching back out to the Community. I can help you get the answer to your question.

To be sure of a few details, can you provide me with a screenshot of what it shows when you click the link to see the answer? Often at times, you may need to scroll down on the page to review the answer after the post you made.

The answer is given by my colleague GebelAlainaM. They state that QuickBooks Online gives you multiple options for recording credit card payments so you can keep track of your expenses and provide accurate financial reports. It follows with some easy instructions on how to do particular actions within your account.

I hope this helps and you're able to review the answer. If not, please give me a screenshot of what you see on your side. I'll be waiting for your response!

info-jointherap:

Did you ever get an answer to this question? I think I finally realized I am having the same problem! As our P&L statement shows that we made a -$89,000 and I just don't understand how that could be possible. So after looking at every expense, I have found that individual credit card transactions were being categorized as expenses, as they should be, but that I was also categorizing the credit card payments as an expense, essentially doubling our expenses via credit cards! I am not sure how to fix this, I think I am going to go into the expenses and manually delete all of the credit card payment transactions....

Let me know if you found out anything. Thanks!

Hello, I'm curious, did you ever resolve this? I spoke with someone at QB but they didn't seem to understand this issue at all. How do you correctly enter CC payments from your business checking account, to you business CC, without increasing net liabilities and double-counting? I must be missing something super simple...

My business has changed banking institutions and need to change account that credit card payments get deposited to.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here