Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen a customer sends payment for an invoice via QuickBooks, the transaction is recorded twice in the system. The first one is Payment Received; The Second Time is when money is deposited in my bank account.

This second transaction cannot be matched to the invoice because the first one is already matched. So I have a big sum that I can't categorize. Previously, I complained about this, and someone from the QB team told me to exclude it. I did, and now I can't reconcile my bank account because those double transactions are missing.

This is such a mess, and I can't believe a company as large as Intuit can't fix this year-old bug.

Thank you for providing us with detailed information and a screenshot regarding your concern, lensdigital.

We appreciate it and it helps us better understand what happened to the payments and deposits. Let's go over some troubleshooting steps to keep your sales records in order so that you can easily reconcile your bank account.

Before we begin, let me share some insights on how QuickBooks Payments handles payments. When you use this feature, it automatically processes and moves transactions into your accounts, eliminating the need for the Undeposited Funds account.

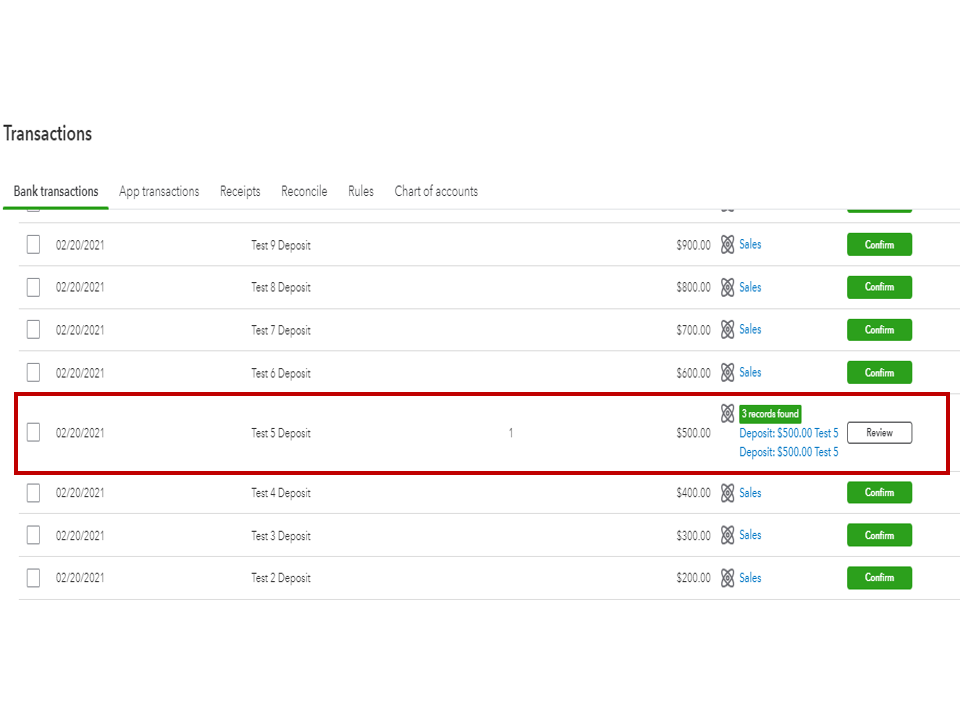

Based on your scenario, it appears that deposits have been added to the bank feeds, which creates brand-new transactions that are transferred to the Categorized tab. We'll need to undo these entries to move them back to the For review tab.

Here's how:

Perform the same process for the remaining deposits you wish to unmatch. See this article for more in-depth information: Unmatch downloaded bank transactions or move them to another account. It includes instructions on how to switch downloaded entries to another account as well as a screenshot for visual reference.

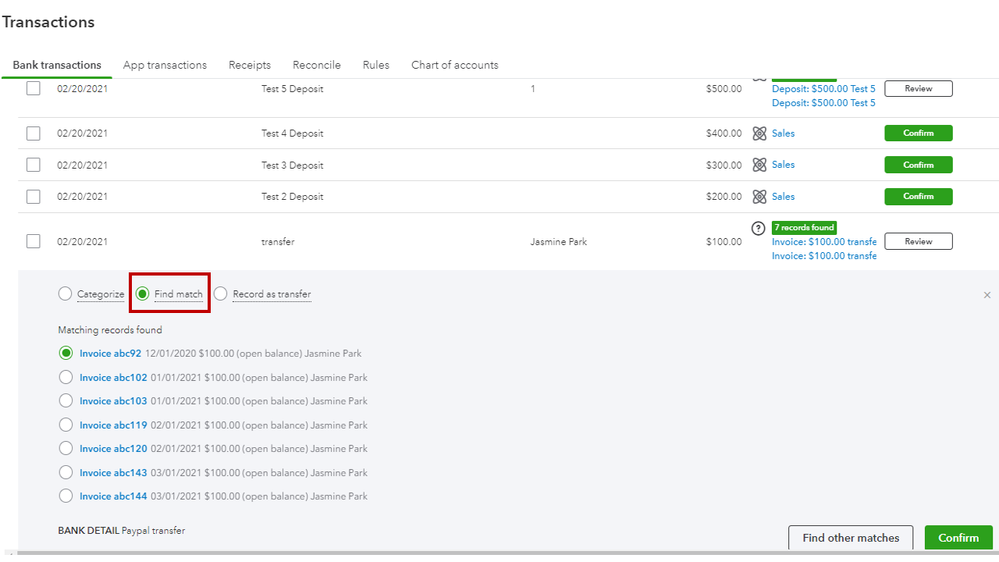

Next, link the deposits to the payments one at a time to prevent duplicates. Let's navigate to the Banking page and match them.

This reference covers all the details on how to prevent duplicates for your downloaded data and instructions to put them into the correct accounts: Match online bank transactions in QuickBooks Online.

After performing these steps, you can start reconciling the account. To learn more about linking a deposit to an invoice, and automatically matching payments to the appropriate entries, feel free to review these links:

@lensdigital. Properly categorizing transactions and avoiding duplicates takes some work, but is crucial for accurate books. Reach out to me again if you have additional questions about matching payments or deposits. I'd be delighted to assist you further. Have a good one.

"When a customer sends payment for an invoice via QuickBooks, the transaction is recorded twice in the system. The first one is Payment Received; The Second Time is when money is deposited in my bank account. This second transaction cannot be matched to the invoice because the first one is already matched. So I have a big sum that I can't categorize."

Are you referring to matching your downloaded bank transactions? The screenshot you attached doesn't look unusual. That is what it looks like when you create an invoice (entry #1), receive payment to Undeposited Funds (entry #2), and then make a deposit to your bank account (entry #3). The only entry that should be able to be matched to your bank feed is entry #3 (the deposit) because it is the only transaction that hits your bank account. If you're able to match both the payment received and the deposit, it's because you're depositing the payment received directly to your bank account, not to undeposited funds, and then creating a separate deposit. Any chance that what's happening? You want to make sure you are receiving payments to Undeposited Funds, then adding the Undeposited Funds to the deposit.

Just to add, QB automatically matches payment received to the invoice and then few days later I get this transaction that I can only exclude. And if I Exlude it I won't be able to reconcile this account

Thanks for getting back to us and providing another screenshot, lensdigital.

The answer provided by Rainflurry is correct. However, let me guide you to another way to categorize your transaction correctly.

First, review your downloaded transaction in QB Payment and compare it with your bank statement to have a basis if it matches your transactions. If both are matches, you don't need to exclude it; rather, we'll match it to your invoices if it's a bulk payment/deposit.

If ever you excluded the transactions to the For review tab, here's how to undo the transaction so that it will return to your For review page.

Afterwards, we undo the transaction. You can match it to your invoices, or we can do it manually to find a match by following these steps.

Additionally, if the QB Payments and your bank statement transactions don't match and your QB Payments are really showing duplicate entries, you can exclude your transaction. Here's how:

Once you have completed these steps, you may proceed with reconciling your account.

After you reconcile our accounts, we can close your books to prevent changes to your past transactions.

If you have any additional concerns besides categorization, please post them here in the community. I'll be around to lend a hand.

"Just to add, QB automatically matches payment received to the invoice and then few days later I get this transaction that I can only exclude. And if I Exlude it I won't be able to reconcile this account"

Are you saying that you have tried to exclude the transaction and your reconciliation doesn't show any deposit related to the payment received?? Or, do you just assume it won't reconcile?

When QB matches the bank transaction to the invoice, QB creates the invoice payment entry that reduces A/R and increases your bank account with a deposit. Do you see this deposit in your bank account register in QB? If you do, there is no reason why you can't exclude the additional transaction because the payment entry already posted the deposit to your bank account and will show on your reconciliation.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here