Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello @sheilaweigel17-g,

Thanks for reaching out to the Community. I’d be happy to help clarify why credit card payments initially go into Undeposited Funds.

The Undeposited Funds account is a default holding account for company payments to collect before depositing them to your bank account so that your deposit records correctly. Here’s an article with more detailed info: Deposit payments into Undeposited Funds

I’m happy to help if you have any more questions about Undeposited Funds, or anything else. Just drop a comment below and I’ll be around.

It makes sense to put checks and cash from customers into Undeposited Funds until a bank deposit is made, but I don't understand why credit card payments (made through QB) go into Undeposited Funds. Can you explain further, please?

Thank you!

Sheila

Thanks for posting here again, @sheilaweigel17-g,

If you're using QuickBooks Payments, the system will auto-assign the customer payments into the Undeposited Funds account. The U/F account is the default holding account for merchant services (QuickBooks Payments) transactions.

You'll need to create a bank deposit to put the funds in the register and zero out the UF balance.

Here's how:

For your reference, see the following link for the steps:

Kindly post here again if you need further assistance with anything in QuickBooks. I'll be right here to help you with your customer payments. Have a good one!

I can see that the payments customers make online using their credit cards to into an Undeposited Funds account until they clear and apparently QBO bundles them together to make a bank deposit. I have not done anything in the past to take them out of Undeposited Funds and move them to our main bank account. We do not write out a deposit slip and 'take it to the bank' for online payments. This is where the confusion comes in. (Your instructions imply that we make out a deposit slip, bundling these payments together). QBO does this automatically, correct?

I understand about putting hardcopy checks and cash into Undeposited Funds until we actually make a bank deposit. That makes sense.

If I am not understanding this correctly, please let me know.

Thank you.

Sheila Weigel

Yes, you're right that QuickBooks automatically record payments from the QuickBooks Payments service, sheilaweigel17-g.

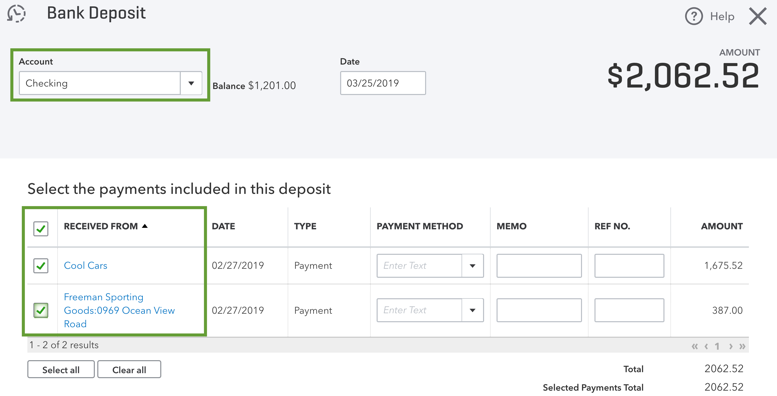

All you need to do in QuickBooks Online is combine or approve one payment at a time through the Bank Deposit page. Then, post it to the right bank account on your register.

And, if your bank account is connected for online banking, you can categorize and match them with the ones you've already deposited. The system will still record one entry on your register.

Once done recording those deposits to your bank register, you can check the Undeposited Funds account. Doing this will help clear out any payments waiting to be deposited.

Let me show you how:

You can visit again this page for additional information: Deposit payments into the Undeposited Funds account in QuickBooks Online.

Let me know if you have follow-up questions about those payments showing up on the Undeposited Funds account. I'll be around to help you.

This is still a mess. The undeposited funds in QBO is a trainwreck that it seems there is no EASY way to fix. Knowing that I have their Intuit Merchant and I receive a payment, the second it is registered it should AUTOMATICALLY clear from the Undeposited Funds. It is insane that you have total control of these functions yet it is up to the user to spend hours trying to figure out how to resolve. Even when the bank is reconciled the funds in the Undeposited Funds show that they are reconciled, YET they are still reflected as Undeposited Funds. You should allow the user the ability to turn off this automatic function if you cannot automatically resolve it when the bank is made whole, or offer a EASY BUTTON to clear it to the bank.

I, too, have this problem and did not know about "recording the deposit" after I had entered all the credit card payments. Therefore, my undeposited funds account is HUGE and not zeroed out. I will start recording the deposits after I process the credit cards (through Intuit!) but our accountant does not want us to carry the balance in my undeposited funds account. How do I fix past deposits so I can clear out our undeposited funds account? Do I need to recreate each deposit?

Hi there, @jillaccesstestprep.

You can review your transactions from the Undeposited Funds account and open it. Make sure to deposit to the bank account respectively.

When making a deposit slip, you have to select the payments created. You can choose one or more payments and group them into a single deposit. This should match the transaction amounts on both your bank statement and in QuickBooks.

For your guide, you can use the How to Use the Undeposited Funds Account to Receive Payments article. Go to the Grouped Payments section.

You can also check out this article that will guide you when you need to review your accounts in QuickBooks to make them match in your real-life bank and credit card statements: Reconcile workflow in QuickBooks.

Keep me posted if you're able to clear your account. I'm still here to help you further if you have follow-up questions. Wishing you and your business continued success!

Thank you for responding. I read the article you referenced and already use undeposited funds (hence my problem). The article does say: "This workflow is especially important for QuickBooks users who don't process transactions through QuickBooks Payments and import payment data from external processing services." I must say it is a little annoying that I have to go to the deposit page and click on each transaction since we DO process our credit cards through QB Payments.

I will do that moving forward, but the problem I am trying to solve now is clearing out my undeposited funds accounts with hundreds, probably thousands of entries over the years. How can I clear it out? Will I have to edit each and every deposit I have made for years?

Thank you for your help.

Hello, jillaccesstestprep.

Yes, you'll need to open the transactions individually to move them to the correct account. Please refer to this article for more detailed information: How to Use the Undeposited Funds Account to Receive Payments in QuickBooks Online.

Once done, you can categorize and match them with the ones you've already deposited.

Also, you can contact our support team. Agents have specialized tools, like the ability to screen-share, to take a closer look at your account, and might have other options to clear out the undeposited funds.

This article provides these steps on how to Contact the QuickBooks Online Customer Support Team.

You're always welcome to post your questions, comments, or concerns here in the Community. I'll be here to help in any way that I can. Stay safe!

This is our scenario - we don't use QB online and invoices are not created in QB but in our AMS.

So when payments are received for a certain month but not recognized until the next statement I don't know how to use Undeposited Fund option. I hope this makes sense.

Greetings, @12eaRth34.

Thanks for joining in on this thread. Congrats on making your first post here in the Community as well.

If the invoices/transactions are created in your AMS, then I recommend contacting them on why it is being imported into QuickBooks this way.

Don't hesitate to reach back out if you have any other questions. I'm only a post away. Take care!

Im not sure if my problem is the same as the one listed but I have found no answers in the thread. So despite using a bank deposit to account for the payments made to quickbooks cash account, the customers which I have already deposited are still showing up on my bank deposits screen. How do I get them to go away with just deleting the entire transaction?

Hello there, marblemaid.

I'd like to share some insights about bank deposits in QuickBooks Online.

Normally, QuickBooks Payments takes care of your invoice payments. If you need to combine payments processed outside of QuickBooks Payments, you can check this link for more information: Deposit payments into the Undeposited Funds account in QuickBooks Online.

If your real-life bank account is connected for online banking, you can utilize this feature to match those bank deposits with transactions you've already entered into QuickBooks. This way, QuickBooks will record it in a single entry on your register and links them together so you don't get duplicates.

To match with an existing transaction:

That should get you back on track. I've added this article to learn more about handling bank transactions online: Categorize and match online bank transactions in QuickBooks Online.

Here's a link for more common questions about payments and deposits in QuickBooks Online.

Just click the Reply button below if you still have other questions about banking. I'll make sure to check on them. Have a wonderful week!

I would like to attach a customer to the sales receipt that was automated by quickbooks but it wont let me make changes. Instead it just says "undefined". I'm starting to think using quickbooks is more trouble than it's worth. Please stop giving generic answers and have quickbooks fix their bugs.

Hi, I have many Undeposited funds from using QuickBooks cash for online payments. My problem however is that we used the funds that are already in Undeposited funds. So I just downloaded my ledger and I see so many entries for undeposited funds…my question is since I have used these funds for expenses, there is nothing else I need to do right? Hope you understand.

Hello, Brandon James.

To verify, are you not going to record these expenses downloaded in your account? If so, you have the option to exclude them.

Here's how:

Here's a sample screenshot for a visual reference:

After excluding the transactions, you can delete them in the Excluded tab. For reference, check out Step 1: Check if you should exclude the transaction section in this link: Exclude a bank transaction you downloaded into QuickBooks Online.

To help manage your new transactions, you can match and categorize them by following these steps in this article: Categorize and match online bank transactions in QuickBooks Online.

In case you have any additional questions or need help with other features in your account, please click on the Reply button. I'll get back to you the soonest. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here