Thanks for dropping by the Community, LindaH69.

I’m here to help and guide you on how to enter a bill pay the driver. We’ll have to create a bill and pay it. Then, set up the job and payroll item used to track the percentage for your employee.

If you haven’t added the client, let’s go to the Vendor Center to input the information. With just a few clicks, you can accomplish this task.

- Go to the Vendors menu at the top and select the Vendor Center.

- Tap the New Vendor drop-down and choose New Vendor.

- This will open a screen where you can input your client’s information.

- Fill in the field boxes and click OK to save it.

To create a job:

- Go to the Customers menu at the top bar and choose the Customer Center.

- Pick the customer whom you want to create a project or job.

- Press New Customer & Job drop-down and select Add Job.

- On the Job screen, fill in the fields with the correct information.

- Click OK once done.

For the percentage paid to your employee, I suggest consulting a tax adviser for further assistance. They can recommend how to set up the pay type in QuickBooks. Doing so ensures you have accurate information for taxes and forms. I'm adding some links that will guide you on how to add the payroll item.

After setting up everything, enter a bill for the business’s expenses and then pay it through the Pay Bills feature.

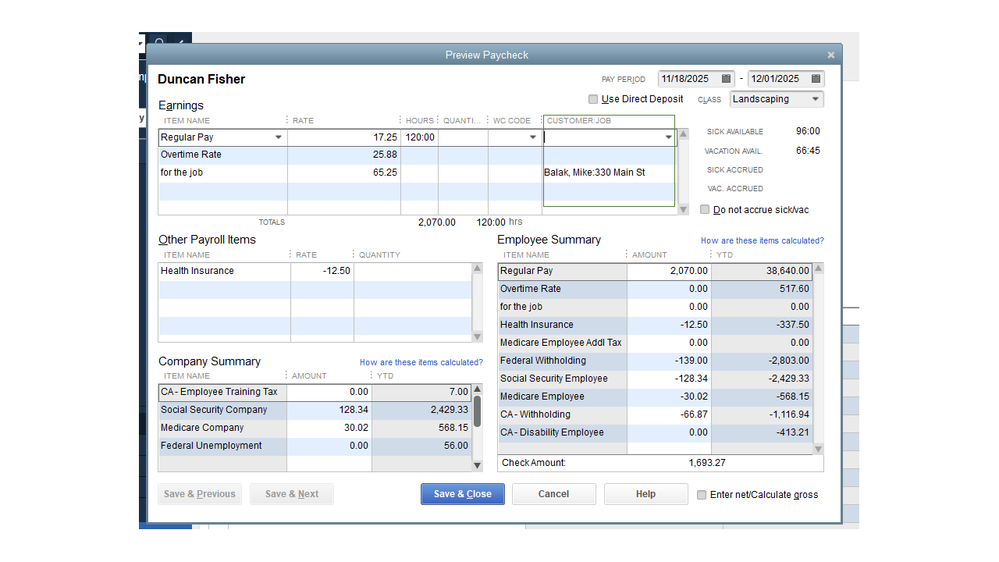

In regard to your worker, create a paycheck and manually add the percentage. Make sure to click the Customer: JOB drop-down to add the work done.

For the reports, you can run the Transaction List by Vendor and Payroll Summary to track the transactions incurred by the supplier and worker. Let me share the steps to build one.

- Press the Reports menu at the top to choose Vendors & Payables and Transaction List by Vendor.

- Click the Date drop-down to select the correct period.

- Hit Refresh to view the changes.

You can bookmark the following links for future reference. These resources provide an overview on how to personalize reports and manage payroll and vendor transactions.

If there’s anything else I can help you with, post a comment below. I’ll get back to answer them for you. Enjoy the rest of the day.