Examples include rebates, reward incentives, refunds, reimbursements, or checks issued by a vendor to cash out an existing credit.

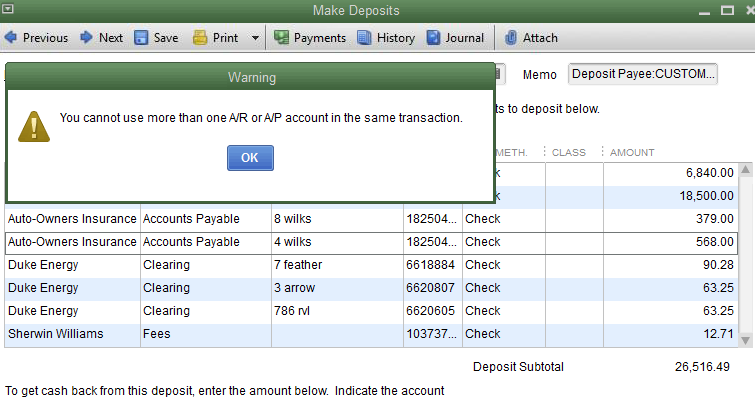

- Record a Deposit of the vendor check:

- From the Banking menu, click Make Deposits.

- If the Payments to Deposit window appears, click OK.

- In the Make Deposits window, click the Received from drop-down and choose the vendor who sent you the refund.

- In the From Account drop-down, select the appropriate Accounts Payableaccount.

- In the Amount column, enter the actual amount of the Vendor check.

- Enter the remaining information in the Deposit.

- Click Save & Close.

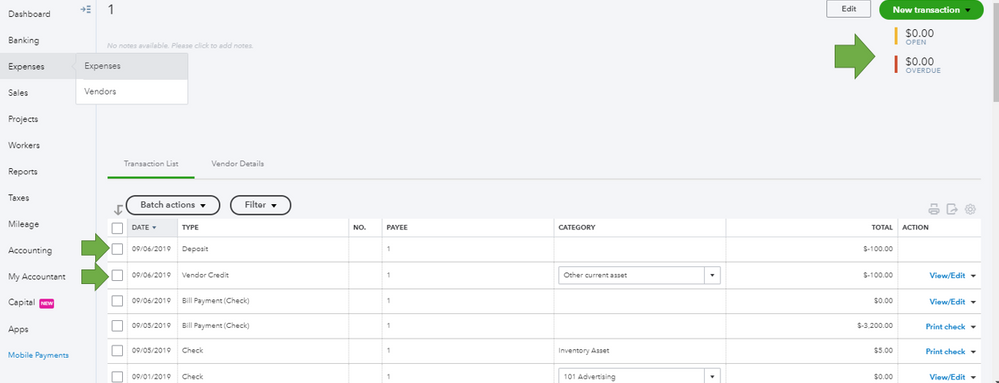

- Record a Bill Credit for the amount of the Vendor Check:

- From the Vendors menu, select Enter Bills.

- Select the Credit radio button to account for the return of goods.

- Enter the Vendor name.

- Click the Expenses Tab and enter the Accounts you would normally use for refunds.

Note: If you are not sure which account account to select, Intuit recommends contacting your accounting professional. - In the Amount column, enter the appropriate amount for each Account (the amounts may have to be prorated.)

- Click Save & Close.

- Link the Deposit to the Bill Credit:

- From the Vendors menu, select Pay Bills.

- Check the Deposit that matches the Vendor check amount.

- Click Set Credits and apply the Bill Credit you created earlier then click Done.

- Click Pay Selected Bills > Done.