Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowClient wants to have financials on a true Accrual Basis (recognize revenue when earned), not accrual per QBO definition (when invoiced) but will be filing taxes on a Cash Basis. They want to be able to see P&L presented both ways. They are a small volume/high dollar transaction business where revenue is earned over 2-3 months, but a single invoice is issued when the work is complete. So I accrue revenue each month so they have a true accrual based P&L, not accrual per QBO's funky definition.

I set them up as "Cash Basis" in the Company Settings. However, running a P&L on a cash basis isn't smart enough to exclude any transactions that aren't associated with cash received or spent. The cash basis p&l doesn't exclude JEs entered to accrue revenue.

Anyone have a workaround?

Solved! Go to Solution.

The only way to make QB use true accrual accounting is to use progress invoicing, where each month during the project you invoice for that months expenses + markup. The invoice sits open until the job is paid.

Since the client most likely wants a single invoice for the job, that poses an issue to some extent. You would create the final invoice, then issue the client a statement which would show all invoices and the total amount due. A simple explanation that your accounting program requires it be done this way is usually sufficient to placate the client.

Payment received would then show in cash basis accounting as it should, on the date of reciept.

"Client wants to have financials on a true Accrual Basis (recognize revenue when earned), not accrual per QBO definition (when invoiced) "

There is no such thing as "True" Accrual Basis, and QBO does not have it's own definition of accrual basis. If you use an item that is linked to an income type account, then date the invoice when goods or services are delivered, not when payment is requested.

You seem to be asking about Work in Process, managing both Revenue and Expense as In Progress until Invoiced (charged to customers) as Sold. They might not be asking what you are providing, but they don't know how to state what they want. You would be posting all Purchases as WIP and the charges to customers would be using an Other Current Asset service item as Unearned Revenue (linked to Liability).

Then, on occasion, you Clear Liability by charging the customer name for the Income item(s) and applying the prepayment value(s) using a Credit Memo with the prepayment item on it. And, you would enter a Bill to clear WIP costs to actual expense, reducing the WIP other asset account.

All of which violates what your client needs to have for proper tracking and reporting.

They are asking for analysis of Work In Progress, not Earned Revenue. It isn't Income; it's income when Paid for Cash Basis. It's Income when Charged, for accrual basis.

It seems what you want to do is Invoice more frequently.

The only way to make QB use true accrual accounting is to use progress invoicing, where each month during the project you invoice for that months expenses + markup. The invoice sits open until the job is paid.

Since the client most likely wants a single invoice for the job, that poses an issue to some extent. You would create the final invoice, then issue the client a statement which would show all invoices and the total amount due. A simple explanation that your accounting program requires it be done this way is usually sufficient to placate the client.

Payment received would then show in cash basis accounting as it should, on the date of reciept.

Thanks for the response @Rustler. You addressed the question posed. This was my suspicion, but I was *hoping* there's some workaround. Unfortunately, we add an element of complexity by utilizing a 3rd party T&E solution as the source for invoicing as well as payment posting, and those simply sync to QBO.

I suspect, given the nature of my client's customers, they will not want progress billings as a solution (especially given that some are flat fee rather than T&E), but I'll pose it to the client anyway. I suspect the only feasible solution is that I'll have to calc an accrual to cash basis p&l in excel each month (or quarter) as part of the reporting cycle.

Thanks again for the informed response!!!

if you want to run reports in either cash or accrual mode, you can't use journal entries, as they appear in both

I think what you're looking for is a way to track "Deferred Revenue" or "Unearned Revenue", not "Unaccrued Revenue". Take a look at these two links for details on that:

https://quickbooks.intuit.com/r/accounting-money/accounting-101-adjusting-journal-entries/

No, I was truly asking for workarounds to avoid having to do an Accrual to Cash conversion every month. My client bills when their work is complete, a multi-month timeframe. This isn't a Deferred Revenue scenario (receiving payment for work not yet earned), but thanks for chiming in!

I'm super late to this discussion - but this may help

https://www.qbalance.com/Accounting_Method_Cash_and_Accrual.htm

You can change each report to cash or accrual as needed.

Late to discussion, all my clients must do GAAP accrual-basis on books but few do cash-basis for tax.

Agree QB does not handle accrual-basis, seems to only include/exclude non-cash entries to AP/AR.

I don't use QB much, usually only for a short time until my clients move to project cost accounting system. Have not seen what you mention with recording revenue to understand if that comes from AR or not, but the workarounds suggested here sound like too much work to me since I'm used to pushing a button to accrue revenue and on the systems I use, where revenue and billing are separate transactions, but this may help:

We accrue revenue in the period earned:

DR AR Unbilled

CR Revenue

When customer billing is sent to customer:

DR AR Billed

CR AR Unbilled

When customer payment is received:

DR Cash

CR AR

Not sure if this will help you but wanted to try. I also see QB as funky.

FYI my clients don't care about seeing cash-basis monthly (I find most outgrow once they make money), so if the client prefers cash-basis for taxes, that conversion is just done one time at YE, outside the books. No need to try to track two sets of books for one company.

@qbteachmt wrote:

What do you mean by "Charged" here?

"It isn't Income; it's income when Paid for Cash Basis. It's Income when Charged, for accrual basis."

Why would you need an accrual to cash conversion monthly?

Sounds like you are doing accrual-basis accounting, own it.

You can still do taxes on a cash basis if that is the big concern.

Most who do accrual accounting and cash-basis taxes just do one conversion at YE in Excel, not in QB.

When you move over to QB online form Desktop version. How can we view the accrual entries for revenue for a customer?

Welcome to this thread, neetab.

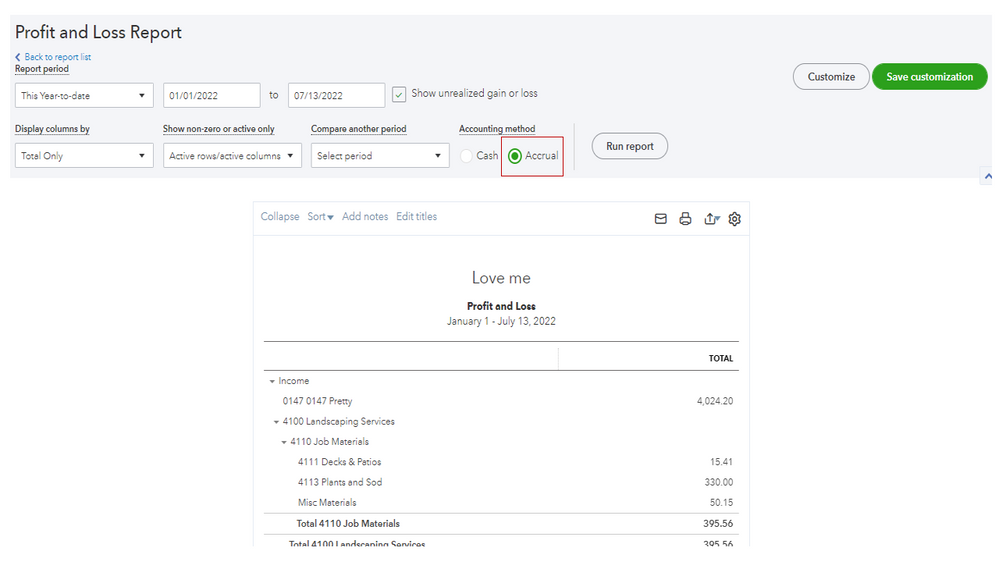

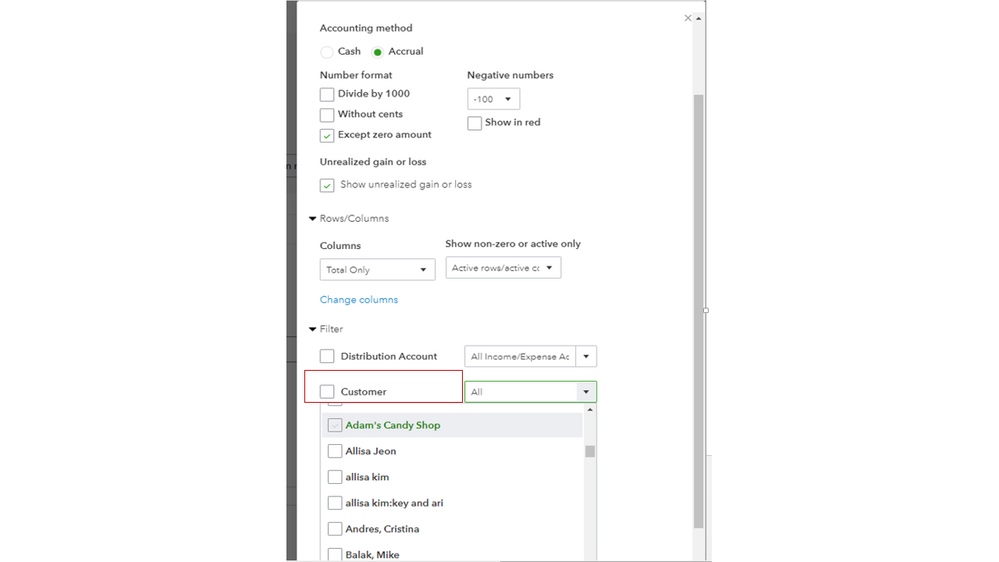

Allow me to chime in and help you find the accrual entries for your customer in QuickBooks Online (QBO). Let’s run the Profit and Loss report and customize it to see the data you need.

When you move from the desktop version to QBO, compare your financial reports to make sure your information was copied successfully. You’ll have to open the Profit and Loss or Balance Sheet statements. Then, set the accounting method to accrual basis to check the data.

You can go over this resource for additional information: What to do after you move from QuickBooks Desktop for Windows or Mac to QuickBooks Online.

When you’re ready, follow these steps to build the report:

This reference will walk you through the process of how to tailor the information on your statements: Customize reports in QuickBooks Online. You’ll learn about automating a custom report, exporting your statement to Excel, and so on.

To get around any accounting activities easily, you can browse our online resources. They contain topics about inventory, taxes, payroll, banking, etc. to help with your future tasks.

Thank you for giving me the opportunity to help, neetab. Should you have other QuickBooks concerns or additional questions about your customer’s transactions, let me know in the comment section below. I’ll get back to answer them for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here