It's nice to have you here in the Community, @Janet Butler!

I'll provide some helpful details to correct the negative FICA taxes or payables in your balance sheet report.

You've got two options on how to go about this. First, you can recreate those voided paychecks to correct the FICA amount.

Otherwise, you'll need to contact our payroll team for the adjustment. They'll help you correct the negative FICA balances for accurate reporting of your taxes. Before diving in, make sure to check our support hours guide so they can assist you promptly.

Here's how to get in touch with our live support:

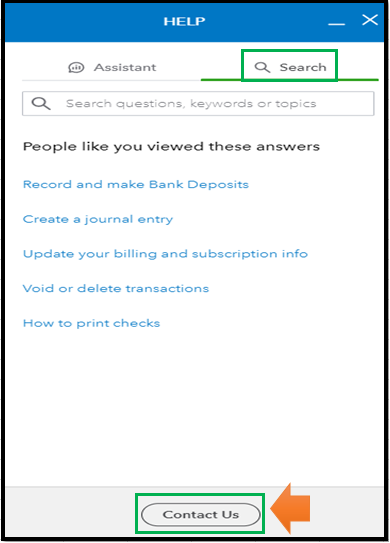

- Click the Help (?) menu at the top.

- Select the Search tab, and then click Contact Us at the bottom.

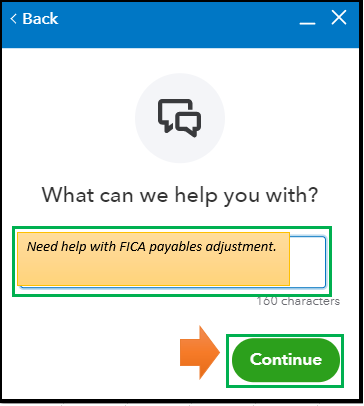

- Enter your question or concern on the box provided, like "

"Need help with FICA payables adjustment" and then choose Continue.

- Select either the Start a chat or Get a callback option.

Also, we have an extensive guide on the different payroll reports you can run to monitor your employees and business finances. Once done, you can now pay and file your payroll taxes to stay compliant and submit them on time.

Fill me in if you have other payroll concerns in QuickBooks. I'd be here to help you.