Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowHello there, tropicalfunkstud.

In QuickBooks Online, after setting up the automated sales tax, taxes are automatically calculated based on the following:

In some states, when you sell or ship to a different address, sellers are required to charge sales tax based on business location. To view and make changes on the tax information, you can click the See this math link under Sales tax.

Here's a sample screenshot of what it looks like:

I've also got some articles here that includes a lot of information about sales tax in QuickBooks Online:

Please leave a comment if you need more help with this. I'm just a few clicks away to help you some more. Stay safe!

As a florist in Washington State, I am exempt from charging different sales tax rates depending on where the product is being shipped to. Florists are allowed to charge sales tax based on where the product was produced -- so the shipping tax rate is the same regardless of destination. How do I change my settings so the sales tax is charged on Shipping? Currently in my system, sales tax is not being charge on the Shipping line.

Thanks for joining the thread and sharing details about your concern, @ABradfield.

Let me share some insights about adding shipping sales tax when creating invoices in QuickBooks Online (QBO).

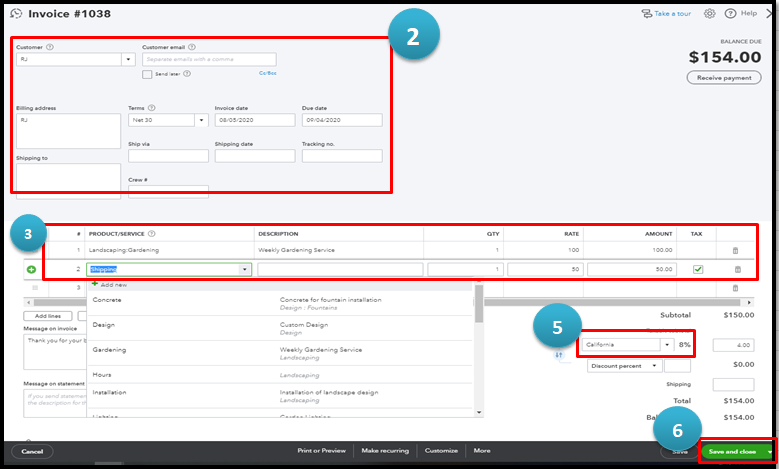

Yes, you're correct. The Shipping field on an invoice won't be taxed since you'll have to manually add the exact amount to it. I've got a workaround you may perform to get around this.

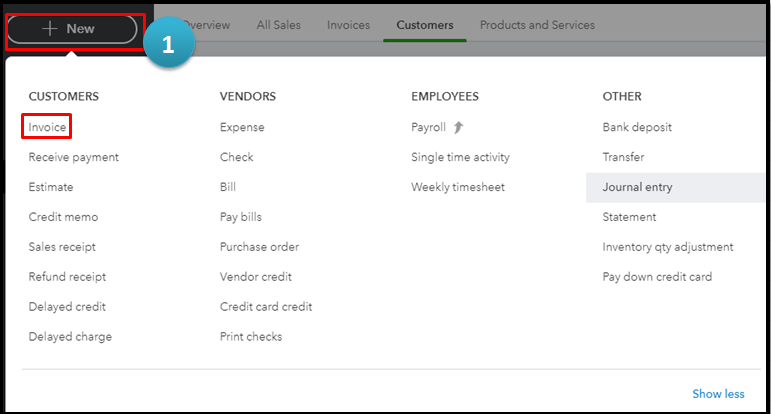

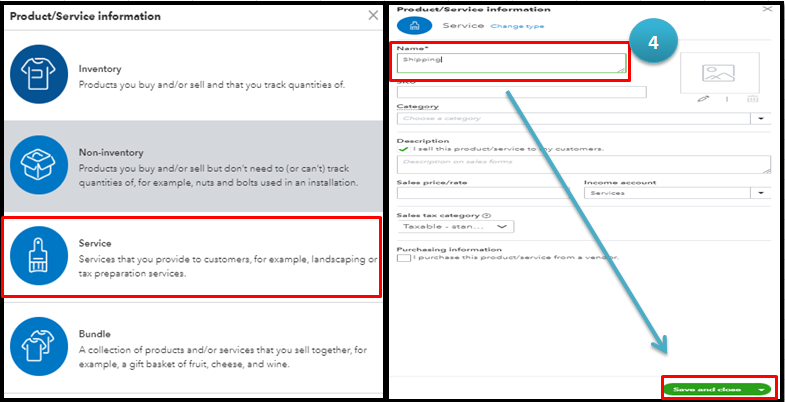

You can add the shipping fee as a service item in the Product/Service section. Then, ensure to put a checkmark on the Tax column and choose a sales tax rate to make it taxable. Here's how:

I'll be adding this handy resource as your guide on how to modify the sales tax in QBO: Edit Sales tax.

You may personalize your invoices and other sales forms to make it more appealing and professional looking. Check out this article for the detailed instructions: Customize invoices and sales forms.

Also, you can batch email or print your invoices and sales forms to make your task easy and efficient: How to send and print multiple invoices and other sales forms.

Then, once you receive payments from your customers, you'll want to enter them in QBO to organize your records: Record invoice payments.

Click the Reply button if you need more help about managing your sales tax or anything else related to QuickBooks. Take care and have a nice day.

We have the same issue as the OP but it doesn't seem like this was addressed in the reply/answer. We have to collect sales tax on the entire amount including shipping but can't find a way to set that. When we click the "see the math" it shows no match only the sales tax % for the jurisdiction. How can we specify sales tax on shipping?

Thanks for getting involved with this thread, mac2it.

Total sales tax rates are the sum of states rates, plus local rates, which may include city, county, and/or district rates. You don't have to keep track of each rate you need to charge, because QuickBooks does it all based on your location of sale or ship to address listed on the invoice or receipt.

When following ReyJohn_D's steps to create a service item for your shipping fee, I'd recommend making sure it's set up properly to be taxed. When creating the item, in step five, you can turn on your Tax option, then speify a rate.

If you've already created the item, you can find it on your Products and services screen, then edit it to make it taxable.

I've also included a detailed resource about working with sales taxes which may come in handy moving forward: Learn how QuickBooks calculates sales tax

Please feel welcome to send a reply if there's any additional questions. Have an awesome day!

Actually it seems like you have to make sure you choose "based on location" and not a custom rate if you have used those previoulsy and have since updated to qbo sales tax. If you do this then it will add the sales tax onto the shipping if you put shipping in the shipping field.

It appears that QBO's sales tax calculations are not built correctly. QBO doesn't apply sales tax to the Shipping field, which will cause incorrect sales tax calculations in its Automated Sales Tax calculations. Please fix this ASAP.

Thank you for joining this thread and bringing this to our attention, @JWHCC. I'm here to clarify this matter and provide a workaround to ensure that your taxes are calculated properly.

The Shipping field under the Sales Tax section is used manually to track shipping expenses. At the moment, only the products and services items can be taxable.

If you want to make the shipping fee taxable, we can create a taxable Service for the shipping and add it to the products and services line items.

Here's how:

With these steps, we don't need to enter the shipping manually into the Shipping field.

On the other hand, you can manually calculate the shipping tax, add it to its exact amount, and enter it into the shipping field, if you don't like creating a product and services for it. Please remember to provide a Note to customer that the shipping tax is already included.

You can explore the resources below. This can help you make your invoices, estimates, and sales receipts personalized. Also to know how much sales tax you owe.

I would love to introduce you to the QuickBooks Live Expert Assisted team. They're a group of experienced experts ready to help you smooth out your financial operations.

If you need more assistance or further clarification you can drop it to this thread. The Community team and I are here to address all your concerns. Have a great day!

An undocumented workaround isn't an appropriate solution to something as critical as sales tax compliance. I'd highly recommend making this more obvious on your Sales Tax feature guides, as this brings a lot of risk for entities who rely on your "automated" sales tax calculation. You can't claim it's automated if it misses components.

Please fix your software.

I completely agree. When we train our employees to enter quotes and orders, each caveat creates inconsistency and risk.

Agree. Very risky.

You need to fix this because customer do not want shipping as a line item cause they match line for line to their POs

I have a case where you automatic by location is not correct and when you do custom it no longer adds tax to shipping but this customer is very big and they will not budge on how they want their invoice

Was solved. Don’t know how to delete my question.

I appreciate you sharing your feedback and concerns regarding the ability to apply sales tax to the shipping field in QuickBooks Online (QBO), Tonya31.

We completely understand the importance of this feature, especially in situations where invoices need to align perfectly with the purchase orders, and where accurate sales tax calculations, including shipping, are essential for your business operations. This functionality would add significant value and streamline your invoicing process.

Since this specific feature is currently unavailable, I recommend sending feedback to our product developers. This way, they can further review which parts of the program need improvement and consider adding them to future updates.

Here's how:

You may visit our Customer Feedback page to get updates about the status of your request.

Drop me a reply if you have further questions about the Purchase order in QuickBooks or any other sales forms. I'd be glad to lend a hand, Bradley.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here