Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHelping you record a duplicate payment is my priority, steve237.

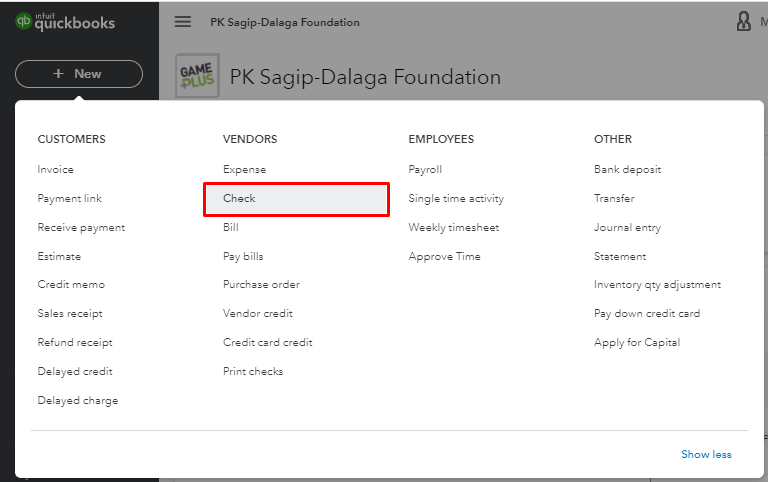

We can create another check for the duplicate payment and ensure to use it on your future bills for the said vendor. Here's how:

You might want to read through this article: How to enter outstanding balances for customers and vendors. This will provide you tips on how to manage your vendor balances in QuickBooks Online.

I'm always here should you have any follow-up questions or concerns. Wishing you and your business continued success!

Hi, steve237.

Hope you're doing great. I wanted to see how everything is going about the duplicate payment. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I'd be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Hi Rose. If both of the checks were cashed and you want to record one as a credit for that vendor, is the next step to manually add a credit to that vendor?

Hi CBROWN2022!

Thanks for joining this post. Let me help you in recording the duplicate vendor payment.

You can follow these steps on how to record a vendor credit in QuickBooks Online:

When it's time to apply to a bill, make sure to record the bills first. Then, from the + New button, select Pay bills or Pay bill. Select a bill for your vendor from the list and you'll see the available credit with this vendor in the Credit Applied field.

Lastly, I added this link if you need to link your online banking to QuickBooks Online so it automatically downloads your transactions: Connect bank and credit card accounts to QuickBooks Online.

Keep on posting here if you have more concerns. Take care!

The company I work for paid a credit card online AND by check and both cashed the bank. I need to record both payments so I can reconcile the bank and have a credit on the vendor account. What is best way to do that so credit will be available to apply to future bill?

Also, I can not use the credit card payment feature because it will not allow you to choose a business upon entering it so it becomes an unclassified transaction when I run a Balance sheet by Business.

Thanks for joining this thread, Richard. I’m here to help you record those payments in QuickBooks.

Since you can’t utilize the credit card payment feature, you can pick the Pay bills and Check options to record those payments.

Here’s how:

Check out this guide for more info: Enter bills and record bill payments. It also includes steps for the check.

You can read this reference to learn more about managing credits in the program: Handle vendor credits and refunds in QuickBooks Online.

If you have sales or expense transactions that occur regularly, you can create templates for them. Just visit this reference for complete instructions: Create recurring transactions in QuickBooks Online.

Please don’t hesitate to tap the Reply button below if you have any other questions or concerns in managing your vendor transactions. We’ll be here to help. Always take care!

I don't think you understand. The credit card has already been paid by a check and now the exact same amount was also paid again by an online credit card payment. I know how to do the standard bill pay, the bill is no longer available to pay because it does not have an open balance.

I need to know the best way to show this payment. 1. I need it to show as a credit to this vendor and so it can be applied to the next billing statement 2. I need it to show up for the bank recon for my cash account in Jan 2022.

Hello ARICHARDSON!

Let me show you how to track this double payment in QuickBooks Online.

You can create a check to record the first payment. Let me show you how:

Once done, here's how to record the duplicate one.

This process will automatically create credits that you can apply to future transactions. I included these links to know more on how to use credit card accounts and record refunds:

Shoot me a reply if you need anything else. Take care!

That worked for the cash account. The Vendor :Cap One had a credit on it to use BUT when i tried to reconcile the credit card statement to the credit card liability GL, the 2nd payment does not show up,

I tried changing the AP GL to the Credit Card liability GL, it shows up so I can reconcile the credit card, but it shows up as a positive on the Vendor: Cap One, not a negative (credit).

How do I do it so I can reconcile cash, reconcile the CC Vendor to the statement AND have a credit to use later?

Thanks for coming back to the Community, ARICHARDSON.

I appreciate for letting us know the result of the steps you’ve performed to record the duplicate payment. Let me point you in the right direction on how to get the credit to show up properly on the vendor’s record.

We’ll have to review how the entries were recorded in QuickBooks Online (QBO). This is to help identify why the second payment is missing and the credit displayed is a positive amount.

Thus, I suggest consulting with your accountant for further assistance. They can guide you on how to handle this type of scenario, including the accounts used to track the transactions.

I’ve included some links below for future reference. These articles will guide you on how to reconcile your bank and credit card statements. You’ll see the topics about managing expenses and other vendor-related transactions.

Drop a comment below if you have other concerns or questions on how to handle duplicate payments. I’ll be right here to answer them for you. Have a great rest of the day.

I am the accountant. I need to know how to do it in QBO.

This credit card is fed through the bank, BUT is paid by ck, usually. For some reason, they decided to pay it by ck AND an online payment.

How do I record it so it shows up in the bank recon, as a credit on the vendor acct AND in the CC liability to recon the credit card? That is a QBO question.

Thank you for visiting us here in the Community, @ARICHARDSON. I can share some information about your credit card payment concern.

This feature is currently unavailable in QuickBooks Online (QBO). However, by providing us with feedback, this will help us enhance our product.

Here’s how:

Your recommendation will be sent straight to our developers, who will take it into account when developing future QuickBooks features.

In addition, I’ve got you this link that will provide you with details step-by-step about reconciling an account in QuickBooks Online.

I'd appreciate it if you could let me know how you're doing. For you, I'll make sure everything is in order.

Make a duplicate PDF of the CC statement and record it as if the vendor actually sent a duplicate bill, to reconcile your bank feed. Then record a vendor credit for the amount of the duplicate bill. It will be applied towards future statements as you pay them.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here