Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thank you for contacting us, honoradrew.

I'm happy to help track your personal income and expenses in QuickBooks Self-Employed (QBSE).

QBSE helps self-employed individuals track their business-related transactions. It calculates federal estimated taxes, make quarterly tax payments, and file Schedule C based on your business data.

You can connect your bank account so QuickBooks will download transactions automatically. Then, you'll have an option to categorize them depending on your needs.

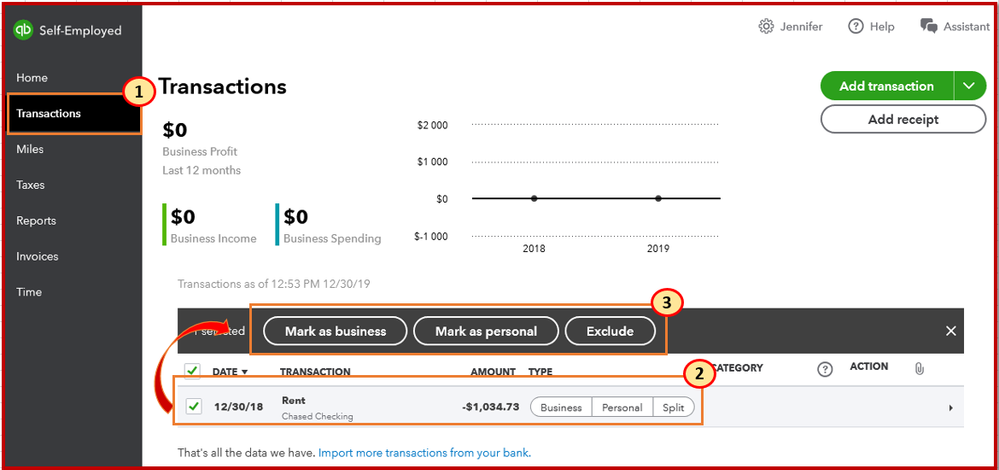

Here's how to categorize those entries:

To learn where different account appear on various reports, please refer to this page, QuickBooks Self-Employed Schedule C Categories breakdown. And, the categories will help organize your expenses more accurately.

Feel free to leave a message below if there's anything else you need about tracking transactions. I'm happy to help you out.

Thanks, but your misunderstood my question. I have done all of the above for 2019 and my problem is that I need to track the "Personal" Income and Expenses, not just the items we'll use for a Schedule C on our rental income. The QB Self-Employed may have been the wrong choice for us. It seems only focused on tracking the business expenses, and I can't see a report of personal income versus personal expenses. We were mostly interested in having a "profit and loss look" at our whole life situation, not just the house we rented out.

I used Quicken in the past, and thought QuickBooks would have more features, plus the convenience of being all online.

We are both retired and the majority of our income is from various retirement plans and some earned income. Is there a version of QB that would work better for our purpose??

Thanks,

Honora

Hello again, @honoradrew.

Thanks for elaborating. QuickBooks Self-Employed (QBSE) mainly tracks business income and expenses for estimated tax calculations and Schedule C tax filing. Currently, a report for your personal transactions is unavailable.

For the meantime, you can export your personal transactions. From there, you can customize the data based on your needs.

To export transactions, here's what you'll need to do:

To help guide you in the right direction, you can check this article: Choose the right version of QuickBooks. If you're unsure about committing to a new version of QuickBooks, you can test out the products for 30 days. Check the below useful link:

QuickBooks Online: https://quickbooks.intuit.com/online.

If you need tips in the future, visit our QuickBooks Help Articles site.

If there's anything else you need help with concerning your QuickBooks account, visit us again. Have a great day!

Can I use this self employed quick books for a LLC?

Thanks for joining this thread, @riskyray.

I'd be glad to provide information with QuickBooks Self-Employed.

Thanks for considering QuickBooks as your business tool. I can share some more information about QuickBooks Self-Employed and QuickBooks Online.

To make the most out of our products, let's determine the best subscription for your business. For you to compare QBSE and QBO, you can refer to these articles:

Please don't hesitate to hit the Reply button if you have any more questions. Have an excellent rest of your day!

Additinal reference

Once you are ready to proceed, open an account with the current discounted plan. You may get a discounted price for up to 6 months.

https:// quickbooks.grsm.io/US

https:// quickbooks.grsm.io/us-promo

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here