Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowCanceling an invoice is easy as 1 2 3, @nealc1405-gmail-.

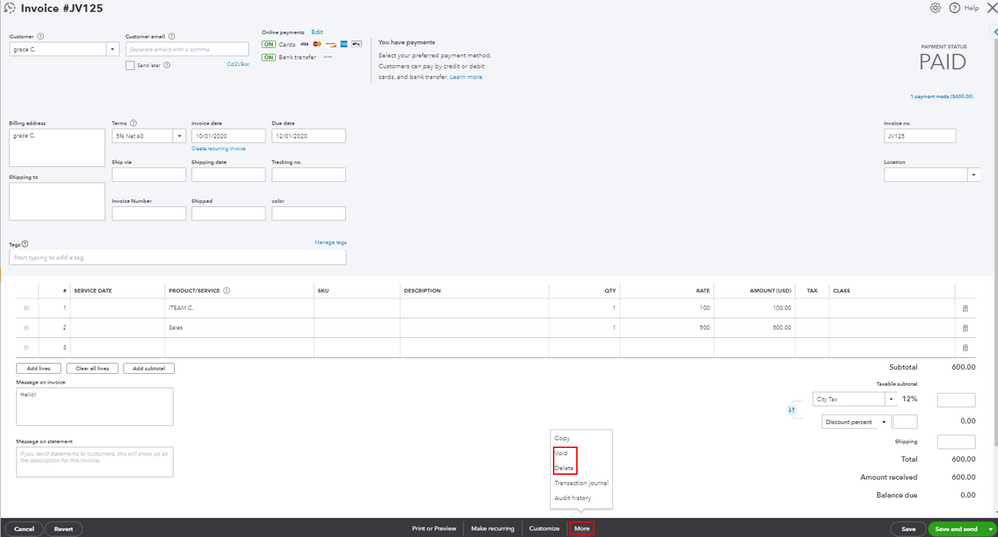

When you enter an invoice with incorrect information and want to cancel it, you can simply delete or void it to completely erase it from your books. Here's how:

I'm adding this article for more guidance: Void or delete transactions in QuickBooks Online.

Just in case you want to recreate the invoice, feel free to check out this article for the detailed steps and information: Create invoices in QuickBooks Online.

Should you need any assistance managing your QuickBooks transactions, I'm available here to help any time!

Good day, @nealc1405-gmail-.

I'm back to ensure you were able to cancel the invoice by deleting it. If you need further assistance with this, you're welcome to post again or leave a reply below. We're always here to help.

Thanks for coming to the Community, wishing you and your business continues success.

I have to Cancel or Void certain old never-to-be-paid Invoices where I've already paid the Sales Tax to NY State on a Sales Tax Item associated with each particular County. I need those paid Sales Tax amounts to be credited now to the proper counties. Over the last 21 years of using QB Premier Desktop on a Cash Basis, I have discovered Sales Tax had always been paid on an Accrual Basis, noting that I see it can be also changed to a cash basis, but it wasn't/isn't on a cash basis currently. I'm having difficulty finding an A/R report with the jurisdiction/county Sales Tax Item shown. When I Void an invoice, does it leave it there completely intact, to see in its entirety in the future, for reference purposes? And does Voiding it put a notation of the Void date on it? I'd also like to know what it does to my books' Sales Tax records --- thinking it'll bring a negative balance forward in general, but credit the paid Sales Tax on a per county basis, when I reconcile and Pay the Sales Tax, yes/no?.

Thanks for posting here, @chart,

When you void a transaction in QuickBooks the system offsets the amount on the transaction to zero out the balances. However, voiding a sales entry will not affect the sales taxes paid prior.

The system will retain the payment and apply the credit to the next taxable period. If you want to keep track of any changes to the entries in QuickBooks, you can open an Audit Trail report for it. Simply go to Reports > Accountant & Taxes > Audit Trail.

Regarding the report, you can look for Sales by Customer Detail report and customize it to only show invoices along with the taxable sales.

I'm also adding this article to learn more about the reports in QuickBooks: Understand reports

Please know that your insights about our reports is important for us to improve our products. If you have any questions feel free to reach out back again, and I'll be right here to help. Have a nice day!

Thanks for your help and expertise.

How do I "Void" an Invoice in QB 2020 Premier Desktop, as opposed to deleting it (Control D). Also, please confirm that "Voiding" a past Invoice posts the respective Sales Tax Credit to the next open Sales Tax filing period. I know how to "Delete" an invoice, but I wouldn't want to do that, as those sales details, unpaid or not, are an important record of what was done, info I wouldn't want to loose.

Thanks for getting back to us, @chart.

As mentioned by my colleague above, QuickBooks will retain the payment and apply the credit to the next taxable period. That means, voiding old transactions automatically apply the credits to the open Sales Tax filing period. Keep in mind that it doesn’t affect the prior paid sales taxes.

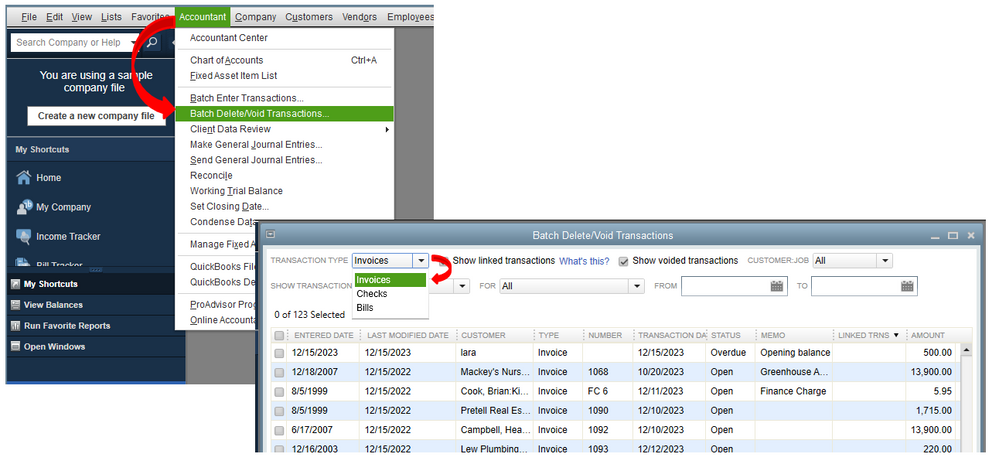

To void the said invoice in QuickBooks Desktop, make sure to switch to single-user mode first. Then you can follow these steps:

You can use the Audit Trail feature or the backup copy to keep track of the details.

In case you still need assistance personally when performing the steps, feel free to reach out to our Customer Care team.

Please do let us know if you still have concerns with managing your invoices in the program. We’ll be here to help you always.

Thanks for the response.

If I were to go that Invoice and select Control D, would there be a difference from the "Void" process you've described, like not bringing the Sales Tax credit forward?

Does "Void" (without Backup) delete the Invoice, so if I look through my invoices numerically, that numbered Invoice will be missing?

If I do a "Back Up and Void", will that process choice leave the invoice in its numeric order, perhaps marked "VOID" so it can be viewed clicking through invoices? Will it leave it fully viewable, in its original form, in the customer's transactions, so that when it's necessary to see what was done at the customer's premises, there's that Invoice's full record?

What does Back Up do, toward allowing one to see that Voided Invoice in its original form and detail? Where would iy be, if not where it was findable before the "Back Up and Void" process took place?

It's good to have you back here, chart. Let me share additional information about your concern.

Yes, there would be a difference. The difference between voiding and deleting transactions in QuickBooks Desktop is somewhat users need to consider.

Both these actions will make a difference in the way your books are organized in QBDT. By deleting an invoice, users will be permanently removing it from their company file. On the other hand, voiding an invoice cancels a particular payment or invoice. Voiding an invoice will keep the invoice number and list it in reports but changes the amounts to zero.

You may consider the steps provided by my colleague above on how to void transactions in QBDT.

I have here an article which provides different reports that cater to your business: Understand reports.

Please let me know if you have anything else to add regarding the difference in deleting/voiding invoices in QBDT. I'll be right here to help.

So that I understand the "Void" concept correctly, let's say that before Voiding a sample Invoice 4020 of 01/01/18, has a Quantity of 10 Widgets at $5.00 each, showing $50.00 in the total column, and has 5% Sales Tax of $2.50, for a grand total of $52.50. Once invoice 4020 is Voided, which items will be changed (to Zero?)?

If I need to preserve the Invoice as part of the customer record, so it shows what was done, and at what cost, including Sales Tax, could I use a Credit Memo of some type? If that was available, would there be any way to have the Sales Tax show up in the current Sales Tax Period as a credit?

If Voiding the Invoice would not preserve the details, I was thinking of going to the invoice before Voiding it and modifying each line item description to indicate the Quantity as well as the line item Total. Also I'd add a description at the bottom, with the original subtotal amount, the original Tax amount and the original Invoice total, all before Voiding it. Perhaps that would preserve all the info I'd need for any future review of the work done on the Invoice.

All ideas are welcome.

Good day, chart.

Let me join this thread so I can share more details on how to handle unpaid invoices.

I understand that you need to track the unpaid invoices especially since you paid the sales taxes already. Though you can void them, there's a better way to record it. We can write off bad debt in QuickBooks Desktop.

The first thing we need to do is to set up an expense account. You can follow these steps:

Once done, these are the steps to close out the unpaid invoices.

In regards to sales tax, it'll result in overpayment since it reduces the previous payable. You can check this link for more details: Process sales tax adjustment Also, I'd recommend consulting with your accountant for you to be guided properly about tax overpayment.

Comment again if you need anything else. Wishing you all the best!

I do not see a 'More' button in the invoice window when I open the invoice I want to delete. I am using the Mac version and am certainly a beginner. Thanks

I'm here to help delete an invoice in QuickBooks Desktop for Mac, LouiseKS.

You can press the Command + D on your keyboard. Or go to the Edit menu while opening the invoice, then select Delete.

If you're using QuickBooks Online on a Mac PC, here's how to delete a transaction:

You can also read this article for more information: Void or Delete an Invoice or Other Transactions.

I'm adding these links you can browse to help navigate QuickBooks for Mac:

Stay in touch with me if there's anything else I can help you with deleting an invoice. I'm always glad to help.

Hello QB Community! I need some after hours help so TIA...!

Yesterday I created an invoice for a client that had multiple "time entries" that were all billable. I sent the invoice as I usually do and then they did not want to pay the invoice as it was presented (lovely). Now they wanted the single invoice split into multiple invoices for "internal billing" reasons.

This led me to VOID the invoice and start over...so I thought.

Now it shows "closed" in the status window and I can't figure out how to change the status to "open" so I can generate new invoices for the now un-billed time that was previously included on the now VOIDED invoice.

Any direction on how to get the status back to "open" would be greatly appreciated.

Thank you!

Hey there, @losfelizgroup.

Thank you for following the thread and sharing your concerns.

In QuickBooks, if an invoice is voided, it can only be recorded back by recreating it. That said, I recommend recreating it so we can get it out of the closed status.

Before recreating the in the invoice, make sure to write down all the details of it (Date, Customer, Items, Etc.).

Once you've written down all the important details, you’re ready to manually re-enter the invoice. For further details, please see this resource: How to create an invoice.

After you've recreated the invoice, check out the steps in these articles on how to mark the invoice as paid:

Feel free to take a look at these articles for additional guidance:

If you have any additional questions or concerns about this process, please let me know.

Take care and have a great day!

My problem is where do you find the invoices? I continue to delete the invoice on my customers accounts but it comes back. Why?

For some reason I have not fully delete it, I suspect.

Good morning, @Dehaus.

Thanks for chiming in on this thread. Also, congrats on making your first post here in the Community. Allow me to point you in the direction to get this resolved.

Since the invoice is coming back after deleting/voiding it, then I recommend contacting our Customer Support Team so they can further assist you with this problem. They'll be able to use more advanced tools to view the cause of this issue. Here's how:

It's that easy!

Keep us updated on how the phone call goes. We're always here to have your back. Take care!

when I Void and Delete Invoice it does not clear the TAX behind it, why?

Hello there, @HussainAlshaikh.

Let me share some insights about how voiding/deleting an invoice affect the Tax in QuickBooks Online (QBO).

To clear things out, are you trying to void or delete an unpaid invoice? If so, it'll not clear out or affect the Taxes.

However, if this is a paid invoice and you've already made a tax payment with this transaction, you can create an overpayment for sales tax liability since the paid invoice was deleted/voided.

You can use this link for the complete steps and details about recording an overpayment: Manage Sales Tax Payments. When doing this process, you can also consult your accountant for further guidance.

Also, you can always run the Sales Tax Liability report. It provides a detailed about the taxes you owe and why you owe them. Also, it helps you ensure everything is accurate before you file your return to the tax agency. Just go to the Reports or Taxes menu to complete this task.

Please let me know if you have more concerns with this matter. I'll be around to help you further. Take care and stay safe always, HussainAlshaikh.

@SarahannC , i think your mouse is broken.. you posted the same thing 3x

I had an invoice with a received payment attached to it. I have coded the invoice as I want to record it as a sales receipt instead. How now I now delete the unapplied payment? Thanks

go to refunds and credits use the current date not to affect the prior year. use the same invoice number but add a letter to it. for example 100A. enter the invoice exactly as the original was, save it and then when it asks to apply it to an invoice apply to the original invoice #100. This way it is only affecting the current year and not the prior year.

IF I VOID A CUSTOMER INVOICE FROM 2023

IT WILL BE WITH THE DATE OF 2024

I DONT WANT TO CHANGE 2023

I appreciate you for joining this thread, Zeldy. Let me help you void invoice transactions in QuickBooks Desktop (QBDT).

If you void a customer invoice transaction from 2023 in QuickBooks, this will keep a record of the original transaction date. This process won't impact your account balances or reports.

Since you're referring to voiding the invoice in another fiscal year, we can follow these quick steps to remove them:

If the books for the last fiscal year were already closed, doing these steps will affect your financial reports. After following the steps above, you can get accurate reporting data when running financial reports on an accrual basis. Also, you follow the recommendations shared by my colleague, @SarahannC, if you've made tax payments from 2023.

I'd also recommend reaching out to your accountant before taking these steps. That way, we can ensure that your books are accurate.

Additionally, you can visit this article to learn how to reconcile your accounts so they match your bank and credit card statements: Reconcile an account in QuickBooks Desktop.

If you meant something else or have follow-up questions about voiding transactions, please share them with us. We'll be here to assist you further. Keep safe, Zeldy.

I just want to be sure that when I void the invoice the date is going to be the date that i void it and not the date of the original invoice

Thanks

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here