Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowSolved! Go to Solution.

Hello pam-brenner,

QuickBooks Online allows you to enter negative amounts. However, you must not have a negative Total or BALANCE DUE on the invoice. Otherwise, an error like you have mentioned will occur.

Instead, we can create a Credit Memo. This will set a negative balance on the customer's account. You can also apply this to future invoices of the customer. You can use this for reference: Create and apply credit memos or delayed credits in QuickBooks Online.

Here's also an article that is related to credit memos: Handle a customer credit or overpayment in QuickBooks Online.

Feel free to get back to us if you have additional queries. Have a great day!

Hello pam-brenner,

QuickBooks Online allows you to enter negative amounts. However, you must not have a negative Total or BALANCE DUE on the invoice. Otherwise, an error like you have mentioned will occur.

Instead, we can create a Credit Memo. This will set a negative balance on the customer's account. You can also apply this to future invoices of the customer. You can use this for reference: Create and apply credit memos or delayed credits in QuickBooks Online.

Here's also an article that is related to credit memos: Handle a customer credit or overpayment in QuickBooks Online.

Feel free to get back to us if you have additional queries. Have a great day!

Ran out of characters...essentially QBO will not let me save the invoice with a negative balance. How can I accomplish what I am trying to do?

Thank you - this makes sense. Appreciate the prompt response.

This is very frustrating to not be allowed to have a negative number in an invoice.

Hello there, @Bob7735.

I can see how essential it is to have a negative number in an invoice in QuickBooks Online (QBO). However, as mentioned by my colleague above, having a negative Total or BALANCE DUE on the invoice is not an option. For now, you can consider creating a credit memo as a workaround.

And while the feature you're looking for is unavailable, I recommend sending this request straight to our product engineers through feedback.

To send feedback, follow the below steps:

If you want to see a snapshot of your business, you can check this article for an overview of how to run basic reports: Run reports in QuickBooks Online. And if you need help customizing it, you can check this link for more details: Customize reports in QuickBooks Online.

If you have other concerns and questions about managing your QBO account, I'm always around to help. Take care, and I wish you continued success, @Bob7735.

It will not let me make a negative Credit Memo either.... any other suggestions?

Creating a negative credit memo also doesn't work. Any other suggestions?

Thank you for reaching out to us, CF_admin.

I would love to help you with your concern, but I just need further information about the specific objective or outcome you're aiming to achieve through this process. Understanding your end goal will help us explore the best options for your situation.

Could you please elaborate on why you're considering a negative invoice or credit memo? Are you trying to adjust a customer's account balance, provide a refund, or address a particular billing issue? Once I have a clearer grasp of your specific circumstances, I will be able to provide you with more accurate advice and answers.

Thank you for your cooperation, and I look forward to assisting you further. Have a great rest of the day!

One of our customers bills out on our behalf for some jobs (agency), due to that, they will pay us a lump sum that often includes multiple bills from various clients. We have each of those sub-clients set up, and invoices in our system for each.

If we are paid directly by a client, we then owe an agency fee. They will then deduct whatever that is from a future payout. Let's say $100. So I need to be a able to create an invoice for -$100 for that client, so when the payout comes through, I can match all the according invoices, and account for that -$100 instead of taking it from another client invoice.

Hope that makes sense!

It would be nice if we could create an invoice with a negative amount, @CF_admin.

I appreciate the details you've shared and admire your interests in recording this entries. Currently, we're unable to create a negative invoice. If I understand it correctly, I can see that your Customer Company Agency will charge you an agency fee if its clients pay directly to your business.

In this instance, you're correct to allocate the sub-clients under the Customer Agency (Parent customer) in QuickBooks Online. You can also consider checking the Bill parent customer box to show all invoices to the parent customer.

Please follow these steps:

The setup will be like this:

Parent Customer: Customer Company Agency

Sub-clients: *SubClient A

Sub-clients: *SubClient B

Sub-clients: *SubClient C

Sub-clients: *SubClient D

This way, all the sub-client invoices appear on the Receive payment window when you select the parent customer.

While on the other hand, when you are paid directly by a sub-client, we're unable to create an Agency Fee that will deduct from a future payout. In this case, when you receive that payment, I suggest adding a memo that indicates that it is subject to an Agency Fee from the Receive payment window.

Here's how:

You can then create a credit memo to offset invoices when receiving payouts in the future by following my colleague, JamesDuanT's advice.

Or, if you match the payment to an online banking transaction, I suggest using the Resolve Difference feature. Doing so can let you allocate the difference into an Agency Fee account rather than creating a credit memo. You can do the same method if you match the sub-client invoice directly to the online banking future payout transaction.

Let me guide you on how to perform this task:

You can also create a bank deposit to link the payment and fill the Agency Fee in the Add funds to this deposit section when you choose to deposit received payments earlier to an Undeposited Funds account to record them manually to offset the sub-client/customer agency payout.

Please let me know if you have more questions about this. We're always here to help you more. Take care, and have a prosperous business year.

I have a similar issue... i made a sale on a piece of farm equipment but the customer had a trade in creating a negative balance that i owe them... invoice wont let me do that. How do i input this correctly? The customer does not have an expense because of the trade in value against their purchase in greater than the initial expense.

Hello there,

The negative balance essentially means the customer is owed something, which is often referred to as credit. Here's how you can handle this scenario correctly:

First, create an invoice for the sale of the farm equipment, just like you normally would. Enter the sale amount and the necessary details.

Then, create a credit memo to account for the trade-in. A credit memo provides credit to a customer without involving a refund. Here's how you can do it:

Now that you have a credit memo, you need to apply this credit to the invoice you created earlier. It essentially reduces the invoice amount by the value of the trade-in credit. Here's how:

By following these steps, you'll accurately represent the trade-in and the resulting negative balance in your records. The customer's balance should now reflect the trade-in credit, and they won't have an outstanding payment due unless the trade-in value is less than the sale amount. I also recommend consulting your accountant to ensure accuracy.

You may visit this article as your reference when you reconcile an account to ensure your accounts in QBO are balanced: Reconcile an account in QuickBooks Online.

If you have any further concerns about your transactions, don't hesitate to post them here. Have a great day!

IMO, the cleanest and easiest thing to do is to create a service product called 'Customer Refund' or 'Amount Due Customer'. When you set it up, choose your bank account under Income account. Then, add this service to your invoice as a negative amount for the amount you owe your customer. That will zero out the invoice, it will show as paid, and the payment made to your customer will reduce your bank account. It will also be itemized on the customer's invoice which makes more sense to the customer.

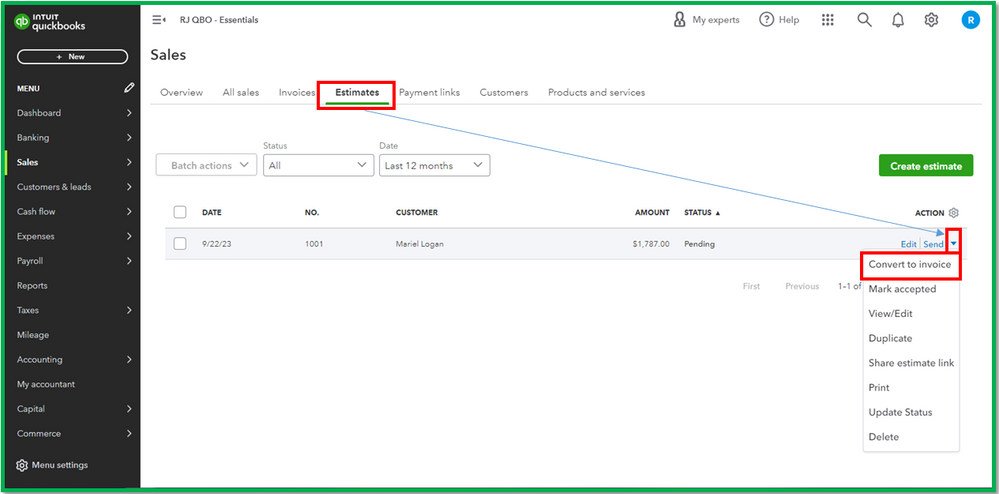

The problem is I need to convert from an estimate to an invoice. Can i go from an estimate to a credit memo?

I can guide you with converting your estimate into an invoice in QuickBooks Online, @jrobertbs.

Before we start with converting the transactions, please know that an estimate can’t go into a credit memo as the credit memo serves as another way of refunding the customers instead of sending the amount back to them.

Here’s how you can convert your estimate to an invoice:

After that, you can mark this paid once you receive the actual payment for this one. I have an article here where you can refer to keep your records accurate: Record invoice payments in QuickBooks Online.

Ping me here if you have more concerns about invoices or managing your transactions. The Community always has your back.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here