Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there, @jeffstmc.

We appreciate you choosing QuickBooks Online in managing your business. I can help you input your vendor history totals to include them on this year's 1099.

First, let's verify if your vendors are set up and tracked for 1099, here's how:

After that, you can manually enter their transactions with the correct dates:

Just a reminder that credit card transactions are not tracked for 1099.

That should help you prepare and file 1099s in QuickBooks Online with ease. I also have here some useful articles that you might want to check:

Keep me posted if you have other questions. I'd be happy to provide additional help. Have a wonderful day.

My fiscal year starts 09/01/18. I want to capture vendor 1099 history of payments made prior to using QBO as of 09/01 so when I print 1099s, they include totals from 01/01 - 08/31. They are not current transactions. I just don't see how to enter the past payments so 1099s are accurate for the entire year. Perhaps my first question was not clear enough. Thanks in advance for assistance.

Hello jeffstmc,

Welcome to the Community. I'm here to assist you with recording prior 1099 payments.

You can record prior 1099 payments by entering them as an expense in QuickBooks Online.

Here's how:

For more information about the process, you can visit this article: How to enter, edit, or delete expenses.

Please let me know if you need any additional assistance concerning the payments. I'll be around to help you out.

How would you resolve this same issue with Quickbooks Desktop?

Hello, @Rasty.

Welcome to the Community.

To record the prior payments in QuickBooks Desktop, you'll first need to set up the vendors to receive form 1099-MISC. Once done, you can set up an expense account for their payments. Let me guide you on how:

Here's how to set up vendor:

You can now map the accounts so you can track the payments to your form 1099.

For more detailed steps, check out this article about add the vendor and printing forms 1099 in QuickBooks Desktop: Set up a 1099 vendor and print forms.

You may check this resource page for future reference in case you want to know how to fix if vendor missing from 1099 summary report: Vendor missing from 1099 Summary Report or 1099 Efile Service.

Fill me if you have followed-up question about form 1099. I'm always here to help. Have a great weekend!

After setting up the Vendors for 1099, how do I update their accounts for the payments I made before switching to QuickBooks? For example, I paid $1000 from Jan to June for Vendor A in old software. I need to apply that $1000 to Vendor A in QuickBooks to get an accurate 1099 statement.

Hello Rasty,

We can create an expense transaction to track the payments you've made outside QuickBooks Desktop. Here's a quick guide to do this:

To get an accurate data, make sure you include these expense accounts when preparing the 1099 form.

Other related references about the 1099 form are already in this thread. Have a great day!

We are using QuickBooks Desktop.

We are using QuickBooks Desktop. We converted the our accounts from Jan-June to QuickBooks Desktop, the payments to those vendors were included in the Expense account that was converted, but the individual payments were not. By adding those payments again under the same expense account will throw off the Expense Account balance.

Welcome back to the Intuit Community, @Rasty.

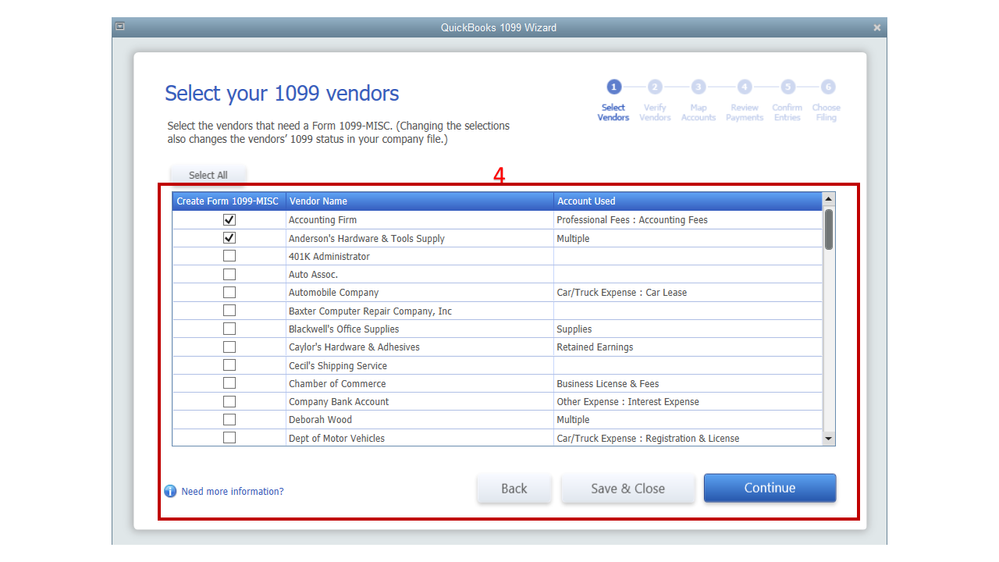

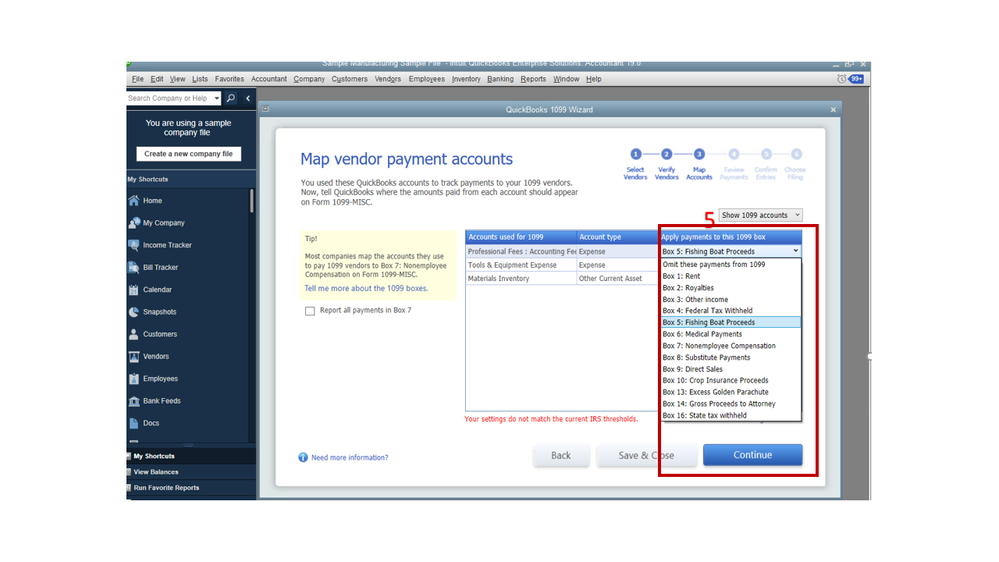

To avoid duplication of transactions, don’t enter any expenses in your company file. When preparing the 1099s, choose the correct category for the transactions.

This is to ensure they’re reported to the appropriate account. I have a few easy steps to map them.

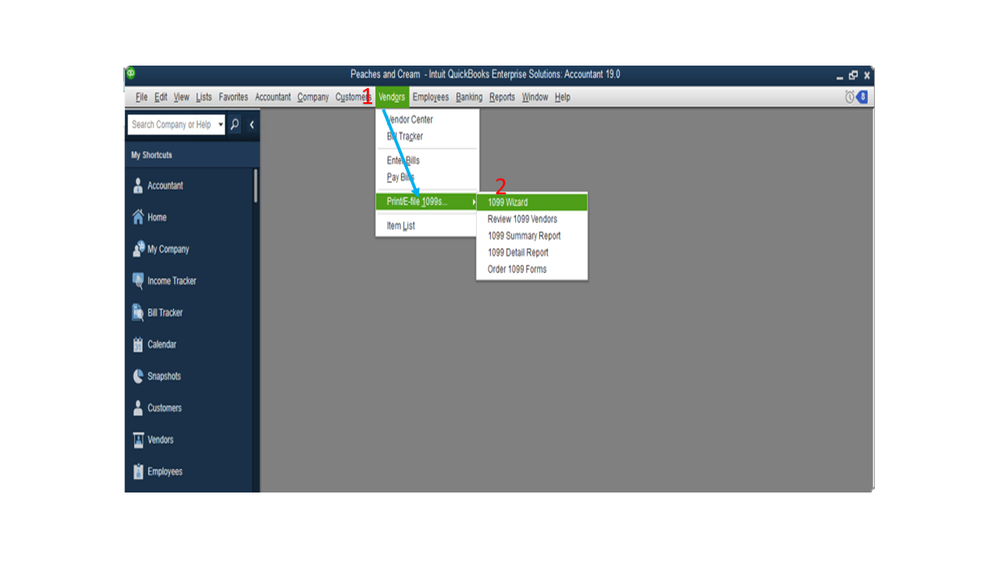

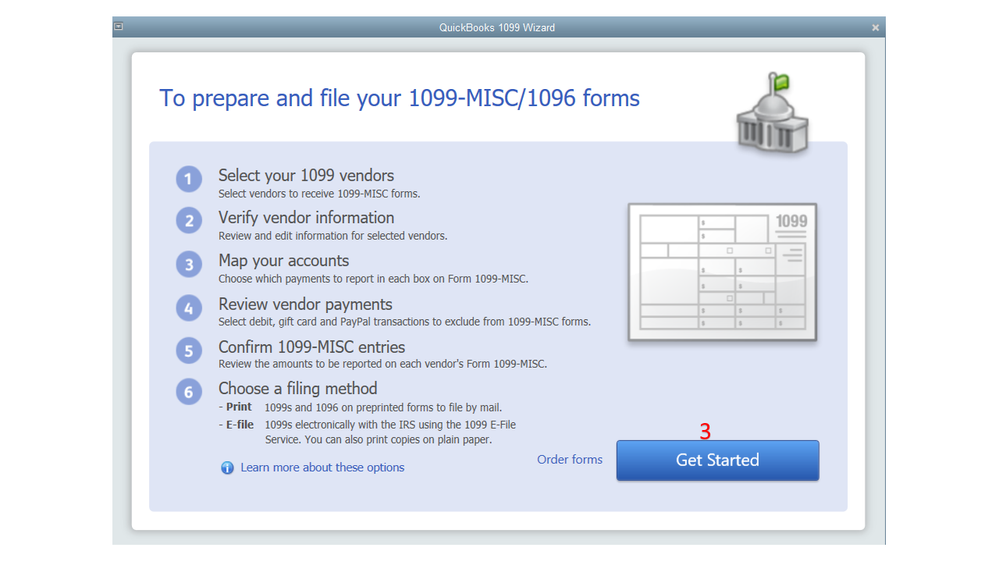

Here’s how:

From there, follow the instructions to process the form. To visually guide you, here’s an article with screenshots and detailed instructions about the process: QuickBooks 1099 Wizard.

Leave a comment below if you have any other concerns while working in QuickBooks. I want to make sure you’re taken care of. Enjoy the rest of the day.

Has anyone provided a correct response to your question about the Desktop solution for this? (ie started QB mid year but having to include the $$ on 1099... without creating a duplicate expense?)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here