Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI'm keeping the books for a friend's in-home daycare company in QB 2016 Pro Desktop. I create a new invoice for each customer at the beginning of each year. For one customer, the 2016 invoice shows no balance due. However, the customer balance detail report shows her with a $166 balance at the end of 2016, and a customer statement for the current fiscal year shows a $166 balance forward dated 12/31/2016. This appears to contradict the $0 balance due on last year's invoice.

Additionally, I recollect that the customer did have a $166 balance due at the end of last year and that I wrote it off to a "bad debt" account, but there is no corresponding entry in "bad debt." I'd appreciate any help finding where that $166 is hiding in the company accounts.

Thank you,

Terry

Solved! Go to Solution.

It sounds like you may not have applied that transaction for bad debt to the open balance. So even though the account overall has a zero balance it's not applied so it showing in the statements. You need to go to receive customer payment and apply that credit that's hanging to clear it.

It sounds like you may not have applied that transaction for bad debt to the open balance. So even though the account overall has a zero balance it's not applied so it showing in the statements. You need to go to receive customer payment and apply that credit that's hanging to clear it.

Run an open balance report on your customer so you can see what shows as open.

Quick Books created a customer statement credit that doesn't exist. The customer's account balance is zero but now every month the statement shows a credit of 229.50. This started a few months ago and that payment was back in 2015 and had been applied correctly in 2015. If I go to the customer's receive payments window it shows the credit at the bottom but the apply credit at the top is not active so there is no way to apply it. How do I fix this?

I've got you covered today, Arose2.

Let's check for possible data damage in your company file. This can be the reason why there's a customer statement credit of 229.50 shows on your statement. Isolated issues like this can be fixed by downloading the QuickBooks Tool Hub. This tool is designed to automatically diagnose and fix common issues within the software.

Below are the instructions on how to do it:

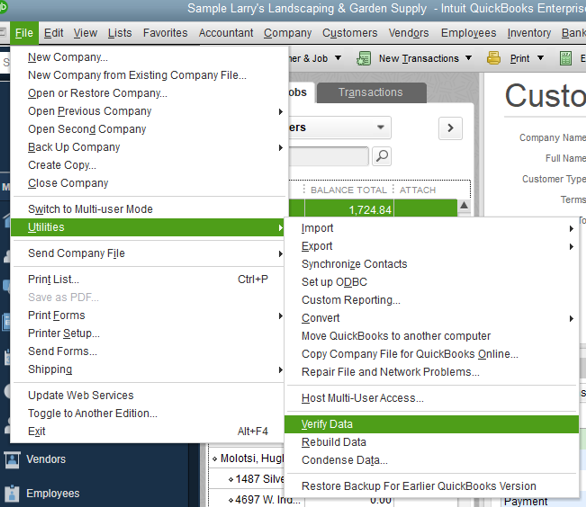

If this doesn't work, we can try using the Rebuild Data tool in QuickBooks Desktop. This tool is used to fix any possible data damage within your company file. Let me show you the steps on how to perform this below:

Keep me posted for additional questions regarding this topic or any other concerns about QuickBooks. I'd be more than happy to help. Wishing you the best of luck.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here