Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI came across similar posts, such as this one: https://quickbooks.intuit.com/learn-support/en-us/reports-and-accounting/i-used-dd-to-pay-independen...

However, the account for both the DDs and the debits are all marked as an expense account (more specifically "Contract labor", a default expense account present when I first logged in).

Is there some way to merge these transactions, or to setup a rule to make them not double count in the future?

Solved! Go to Solution.

Hello there, ABair.

Thanks for reaching out to the Community about your direct deposit concern. I’m here to help and make sure the transaction will no longer show up twice in QBO.

If you’re using the online banking feature, the data we receive is dependent upon what your financial institution sends over to us. Before downloading the transactions, check the mapping first to avoid duplication.

If you have manually recorded the entries, make sure not to add them to your online banking. This is to keep them from showing up twice in your account.

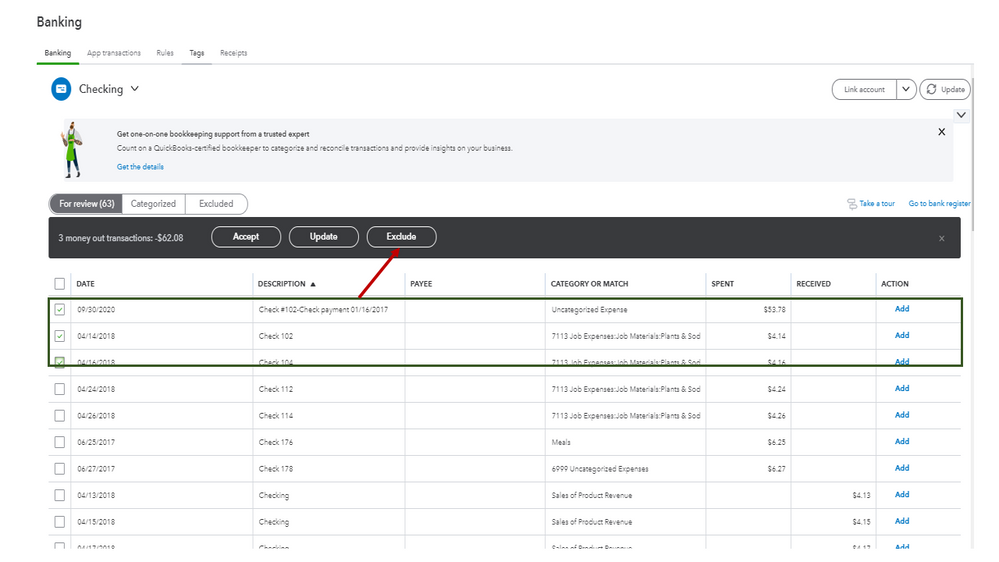

For the duplicate downloaded direct deposits, you can exclude them to keep your records in order. I’ll help make sure the process is a breeze for you.

You can read through this article to learn more about removing duplicate transactions: Exclude a bank transaction you downloaded into QuickBooks Online.

Additionally, the following write-up contains information on how to pay your vendor via direct deposit. From there, you’ll see a link about paying contractors through paper check: Pay a contractor with direct deposit.

Feel free to post a comment below if you still need help with QuickBooks. I’ll jump right back in to assist further. Have a good one.

Hello there, ABair.

Thanks for reaching out to the Community about your direct deposit concern. I’m here to help and make sure the transaction will no longer show up twice in QBO.

If you’re using the online banking feature, the data we receive is dependent upon what your financial institution sends over to us. Before downloading the transactions, check the mapping first to avoid duplication.

If you have manually recorded the entries, make sure not to add them to your online banking. This is to keep them from showing up twice in your account.

For the duplicate downloaded direct deposits, you can exclude them to keep your records in order. I’ll help make sure the process is a breeze for you.

You can read through this article to learn more about removing duplicate transactions: Exclude a bank transaction you downloaded into QuickBooks Online.

Additionally, the following write-up contains information on how to pay your vendor via direct deposit. From there, you’ll see a link about paying contractors through paper check: Pay a contractor with direct deposit.

Feel free to post a comment below if you still need help with QuickBooks. I’ll jump right back in to assist further. Have a good one.

This is exactly what I was looking for! Thank you!

When I do this, the payment does not appear under Banking at all in order to be categorized which is a problem. Is there a way to ensure that it does?

Let me add a few information, Alishah1.

QuickBooks Online is a portal. We're dependent on what your bank shares with us. Having said that, you'll want to reach out to your bank to ensure these transactions get downloaded.

Once they are, you can categorize the transactions on the Banking page.

If there's anything else that you need, feel free to let us know. We'll be around to help you. Take care!

They did download from the bank. The direct deposits made through QB are not listed. They usually have been. Last month is the first time that this happened. When I categorize the payments from the bank, it creates a duplicate payment under "other" vs. DD. Hope this makes sense.

Hey there, @alishah1.

Thanks for following up with us.

I appreciate you providing some extra details. I recommend refreshing your bank connection. You can do this by disconnecting and reconnecting the bank feed. I've included some steps below to help you out.

Before we proceed with the process, make sure to add and match all the pending transactions in the Banking page. Please take note that disconnecting the automatic online banking updates will delete any transactions in the For Review tab.

After that, follow the steps below to disconnect the account:

1. Go to Banking on the left pane, then select Banking at the top.

2. Choose the account you want to change, and then click Edit (pencil icon).

3. Click Edit account info.

4. In the Account window, check the box next to Disconnect this account on save.

5. Hit Save and Close.

Now we are ready to reconnect. Here's how:

Here's how:

You can also check out this article for visual guide: How to use Online Banking, Connect Bank Accounts, and Review your Bank Feed in QuickBooks Online.

That should do it. Please let me know if you have any questions or concerns about this process. Take care!

Hi Tori, thank you! I disconnected and reconnected the account. Unfortunately there is no change. Is there any way to "match" the QB transaction to the one that came through from Navy Federal? When I select "Find Match" under Categorize nothing comes up but I'm hoping there is a way that the DD can be linked to this transaction.

Hi there, alishah1.

Thank you for coming back to the thread to add further details about your transactions. With this, I'll be sharing details on how matching transactions works in QuickBooks Online. Then, ensure you'll achieve this matter.

QuickBooks uses amounts, transaction dates, and bank account posted when looking for a match on the Banking page. Since the direct deposits made through QBO are not listed as the ones that came through from your bank, it could be they have different details. To confirm this one, I suggest going to the Bank register page and review your transactions being recorded. That way, you're able to verify if the downloaded entry has the same information as the direct deposit made through QBO. Then, make any changes if necessary so you're able to match and make your account accurate.

Here's how:

To see additional information, you can click this article: Find, review, and edit transactions in account registers.

Once everything is fixed and correct, you can now start matching your entries to avoid duplicate transactions in the system.

Additionally, you can refer to this article to see detailed steps on how you can reconcile your accounts so they always match your bank and credit card statements to avoid discrepancies: Reconcile an account in QuickBooks Online.

Please know you can always leave a message through this post if you need further concerns about your transactions. I'll keep my notifications open. Take care!

I think I see what is going on. The DD was done from a bank account that is now inactive in our QB. It was a duplicate of our checking account that was already in QB. I would like to fix the DD so it attaches to the active checking account but it won't let me. Can I fix this issue?

Good afternoon, @alishah1.

Thanks for reaching back out and adding some clarification to the subject.

When your payroll transactions are recorded in the wrong bank register, there are two processes that must be followed, correction and prevention.

2. Prevention: Keep future payroll transactions from being recorded under the incorrect register by updating the Accounting Preferences and changing where the future bank register's entries are recorded.

It's that easy, then you can change your payroll bank account to the new on if need be by using this link.

Let me know if this helps. I'm only a post away if you need me. Have a wonderful day!

There was clearly an update and now DD are not creating a matchable split transaction to link wage expenses to the DD. Support seems to not understand this - continue to tell us to unmatch transactions - but then reconciliation will be off by the bank tranactions. Super frustrating.

Hi kegelsinn,

I understand that some changes have caused some issues with the Direct Deposit (DD) transactions not creating matchable split transactions to link wage expenses, and the support team's suggestions haven't resolved the issue. I understand how you feel about it.

I know that you've already been in touch with our QBO Payroll team. However, I suggest reaching out to them again. They can thoroughly investigate this matter and provide the assistance needed to resolve the issue.

Thank you for bringing this to our attention, and we appreciate your patience as we work to address this issue.

You can always go back to this thread if you have other questions in mind.

This now happening to a few our transactions so the system is still glitching. has anyone found a solution

Hi there, @BPE. Let me share more information about matching bank transactions.

To learn how to set up bank rules in QBO, refer to this article: Set up bank rules to categorize online banking transactions in QuickBooks Online.

Let me know if you still have questions about your bank transactions. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here